We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

LBG closing all my accounts on 18th May

Comments

-

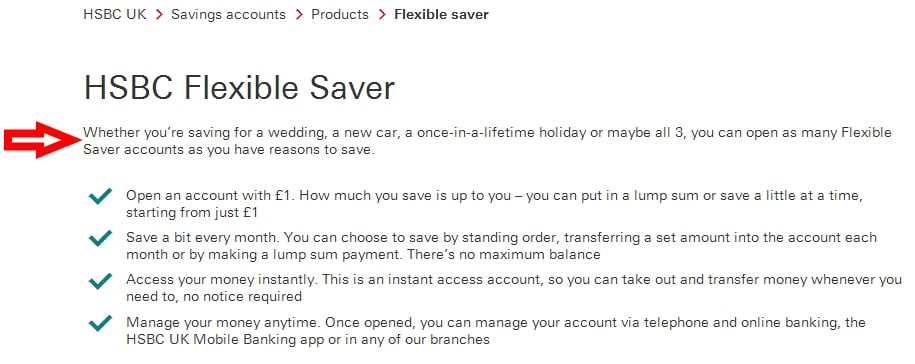

***And regular savers...datz said:It's been a couple of days since I checked back here. To elaborate on one of my earlier points, the following is a screenshot from HSBC. So if savings account applications are, in fact, triggering problems for people, then banks have some very differing policies on the matter... from open encouragement of an "all you can eat" buffet to just throwing you under the bus with no questions asked. And what makes it harder for people to distinguish, is that the latter do not expressly prohibit it in their literature. Or where they do stipulate an account limit, they then (apparently?) aggressively act to enforce before people even exceed any stated limits. In LBG's case, they allow you to have 5 of each (savings) account type, or at least that is what the respective product terms say.

So if savings account applications are, in fact, triggering problems for people, then banks have some very differing policies on the matter... from open encouragement of an "all you can eat" buffet to just throwing you under the bus with no questions asked. And what makes it harder for people to distinguish, is that the latter do not expressly prohibit it in their literature. Or where they do stipulate an account limit, they then (apparently?) aggressively act to enforce before people even exceed any stated limits. In LBG's case, they allow you to have 5 of each (savings) account type, or at least that is what the respective product terms say.

Those that like to push the boundaries just hope their actions disappear into the background noise. You will always get looked at more closely when you trip (the ever more restrictive) algorithms that run these platforms. It's always going to be a gamble when behaviour is far outside that of normal customers.pecunianonolet said:That we all try to milk the system, use loopholes and bribes is normal, we wouldn't be here otherwise. That many people are desperate for extra cash, especially if it can be obtained fairly easy with next to now effort, in times when many people suffer is just natural too.

At the end not every fight is worth fighting and I have to choose my battles wisely.

For example, since we are talking specifically about LBG here, you still have people that are abusing the multi-profile loophole to create and run multiple sets of halifax reward accounts***... each profile paying out £15 per month, and each able to take advantage of switching incentives. That alone is more "abusive" than anything I have read in this thread, but they get away with it because I can only guess that no one has gone looking for it.2 -

I can't see where Halifax state that you are allowed 3 reward accounts. When I opened one a couple of years ago, I expected to be able to open 3, but they told me over the phone that the limit was one, having been reduced from 3, and I later found this limit on their website.

Have they upped the limit again?0 -

I seem to recall they upped the limit in their Ts&Cs in November. They have been letting people open 3 for a while before that though, indeed when I opened my reward accounts you could only officially open 1 sole and one joint yet their systems allowed me to open 3.gwapenut said:I can't see where Halifax state that you are allowed 3 reward accounts. When I opened one a couple of years ago, I expected to be able to open 3, but they told me over the phone that the limit was one, having been reduced from 3, and I later found this limit on their website.

Have they upped the limit again?2 -

Bridlington1 said:

I seem to recall they upped the limit in their Ts&Cs in November. They have been letting people open 3 for a while before that though, indeed when I opened my reward accounts you could only officially open 1 sole and one joint yet their systems allowed me to open 3.gwapenut said:I can't see where Halifax state that you are allowed 3 reward accounts. When I opened one a couple of years ago, I expected to be able to open 3, but they told me over the phone that the limit was one, having been reduced from 3, and I later found this limit on their website.

Have they upped the limit again?

Yes, the system only ever enforced the 3 account limit which existed with the old format Rewards account (the one where you had to have 2 DDs to qualify).

2 -

The loophole of having various customer profiles is interesting and I wonder how people deliberately take advantage of it. one thing for sure I am not planning on doing anyway. My name is the same in every application, so is my address from the database and that is checked against the credit and fraud files. You can change email and phone number should you happen to have several of each and that might trigger it to be a "new" application and a new account I think this is more by chance rather than by calculation.2

-

pecunianonolet said:The loophole of having various customer profiles is interesting and I wonder how people deliberately take advantage of it. one thing for sure I am not planning on doing anyway. My name is the same in every application, so is my address from the database and that is checked against the credit and fraud files. You can change email and phone number should you happen to have several of each and that might trigger it to be a "new" application and a new account I think this is more by chance rather than by calculation.

Another sure fire way of having your accounts closed if reviewed.

9 -

Tag: @pecunianonolet

... don't you risk your name being considered suspicious?pecunianonolet said:The loophole of having various customer profiles is interesting and I wonder how people deliberately take advantage of it. one thing for sure I am not planning on doing anyway. My name is the same in every application, so is my address from the database and that is checked against the credit and fraud files. You can change email and phone number should you happen to have several of each and that might trigger it to be a "new" application and a new account I think this is more by chance rather than by calculation.

0 -

I am not dyslexic so I can type my name into the field in the same format but I get what you meandealyboy said:Tag: @pecunianonolet

... don't you risk your name being considered suspicious?pecunianonolet said:The loophole of having various customer profiles is interesting and I wonder how people deliberately take advantage of it. one thing for sure I am not planning on doing anyway. My name is the same in every application, so is my address from the database and that is checked against the credit and fraud files. You can change email and phone number should you happen to have several of each and that might trigger it to be a "new" application and a new account I think this is more by chance rather than by calculation.

0

0 -

I have more than one profile, but it isn't deliberate and a side effect of opening some Vantage accounts with BoS years ago. When I set up the new profile I started using it across all brands, but have one legacy account opened under the old profile. It is an annoyance and I wish they'd merge the profiles.pecunianonolet said:The loophole of having various customer profiles is interesting and I wonder how people deliberately take advantage of it. one thing for sure I am not planning on doing anyway. My name is the same in every application, so is my address from the database and that is checked against the credit and fraud files. You can change email and phone number should you happen to have several of each and that might trigger it to be a "new" application and a new account I think this is more by chance rather than by calculation.

2 -

Tags: @Bridlington1, @pecunianonolet

From Lloyds Bank Personal Banking T&Cs and Banking Charges:

"Section M – When can we close an account or stop or suspend a service, benefit or package of benefits you provide? When can you close your account?

This agreement will last until you or we cancel it.You can end this agreement for any reason and you don't have to tell us in advance.If we end the agreement we will act reasonably and reduce any inconvenience to you.We can end this agreement (or account, benefit or benefits package or service) without telling you in advance if we reasonably think that:• there is or may be illegal or fraudulent activity connected to the account;• you are or may be behaving improperly. This includes being abusive or threatening to our staff or including abusive or threatening messages in payment instructions;• a regulator or Government may take action against us (or another Lloyds Banking Group company) unless we end it;• we may break the law or regulatory requirement if we don't end it; or• you have broken the agreement in a serious wayIf we want to end the agreement for any other reason, we must tell you at least 2 months in advance.We may stop or suspend a service if we think you don't want it any more. This could be because you have not used it for 12 months or you aren't eligible for it any more. We will tell you at least two months before we do this.We can also end this agreement if you have not used your account for 15 years (or another period set out in law) and we can't contact you. If this happens we will transfer your money to the UK's Reclaim Fund for unclaimed assets.We will always try to contact you before we do this.When this agreement ends you must:• repay any money you owe us;• pay any charges up to the date the agreement ends;• return anything that belongs to us if we have asked for it back including debit cards and unused cheques; or• cancel any payments into and out of your accountIf someone makes a payment to you after your account closes we'll try to send it back to them.Legal rights and obligations that arise under the agreement will continue after it ends. This includes our right to take money from your account to pay back amounts you owe us. If we need to do so, we can continue to hold and use your personal data.When the agreement ends we will pay any money in your account or that we owe you to you or anyone you tell us to.We may take off any money you owe us or money to cover any losses we have suffered.If you die before this agreement ends we may need to see formal documents before we release your money to anyone dealing with your estate.

"

... so what do I get from this:

- they don't think there has been any illegal or fraudulent activity

- you haven't behaved improperly

- you haven't broken the agreement in a serious way

They think you don't want the service anymore!2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards