We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which banks do NOT use a card reader for online banking?

Comments

-

It might be a generational issue. Very few young people will be interested in the cute calculator-thingies their parents and grandparents got accustomed to. As one of the grandparent generation with a sizeable collection of card readers myself, but also an avid user of all kinds of apps, I have a lot of sympathy for the view that one or two intelligent gadgets is plenty.RG2015 said:I have to say that I don't quite understand the near pathological aversion to card readers. I always set up new payees at home so there is no issue of not having the card reader with me.

I just see it as a minor preference issue and having set up face recognition, I decided to cancel it and revert to card reader confirmation.0 -

Personal preference I guess. I much prefer online access as opposed to app, generally only set up new payee's at home and quite like the card reader option as mobile signal at home is patchy.Whilst I realise I'm probably in a minority I would be rather miffed if the card reader option was ever dropped.4

-

RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.0

-

How does this make the RBS system backward?[Deleted User] said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.0 -

The reason it is backwards is because RBS told me to get rid of the card reader and switch to app authentication. The only option to add Amex as a payee was using a card reader. Hence it is backwards. It is nothing to do with Amex. This was within the RBS app.RG2015 said:

How does this make the RBS system backward?Deleted_User said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.0 -

Okay. You didn't say that RBS told you to get rid of the card reader.[Deleted User] said:

The reason it is backwards is because RBS told me to get rid of the card reader and switch to app authentication. The only option to add Amex as a payee was using a card reader. Hence it is backwards. It is nothing to do with Amex. This was within the RBS app.RG2015 said:

How does this make the RBS system backward?[Deleted User] said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.0 -

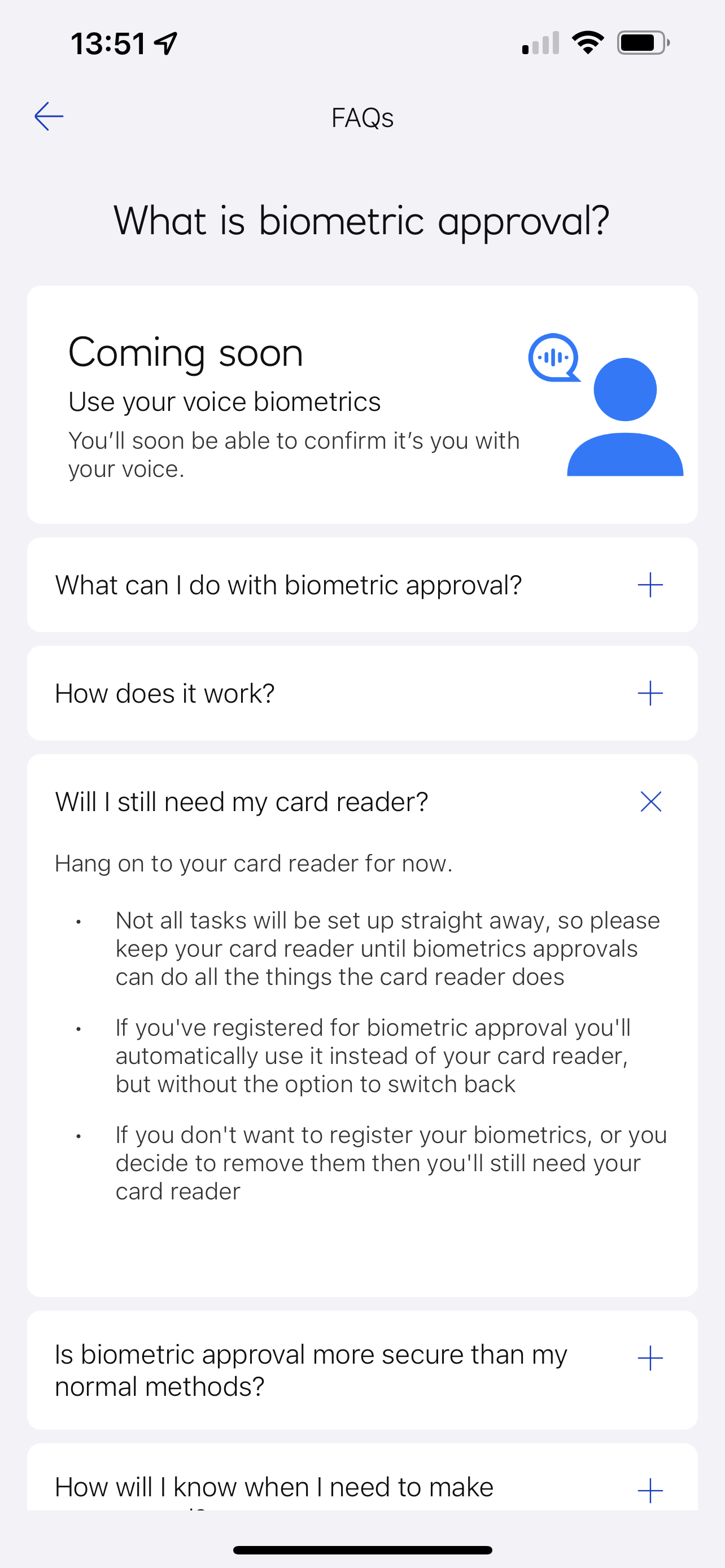

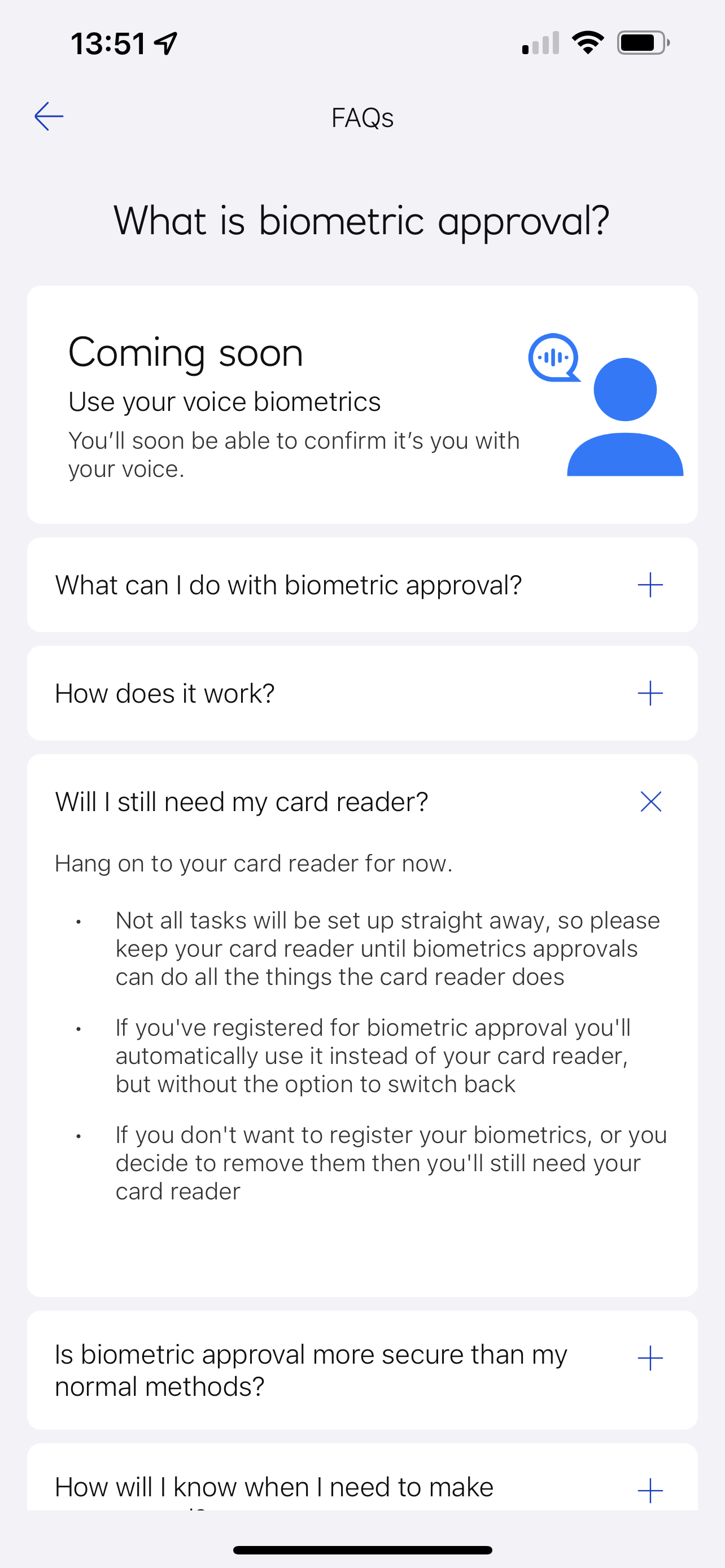

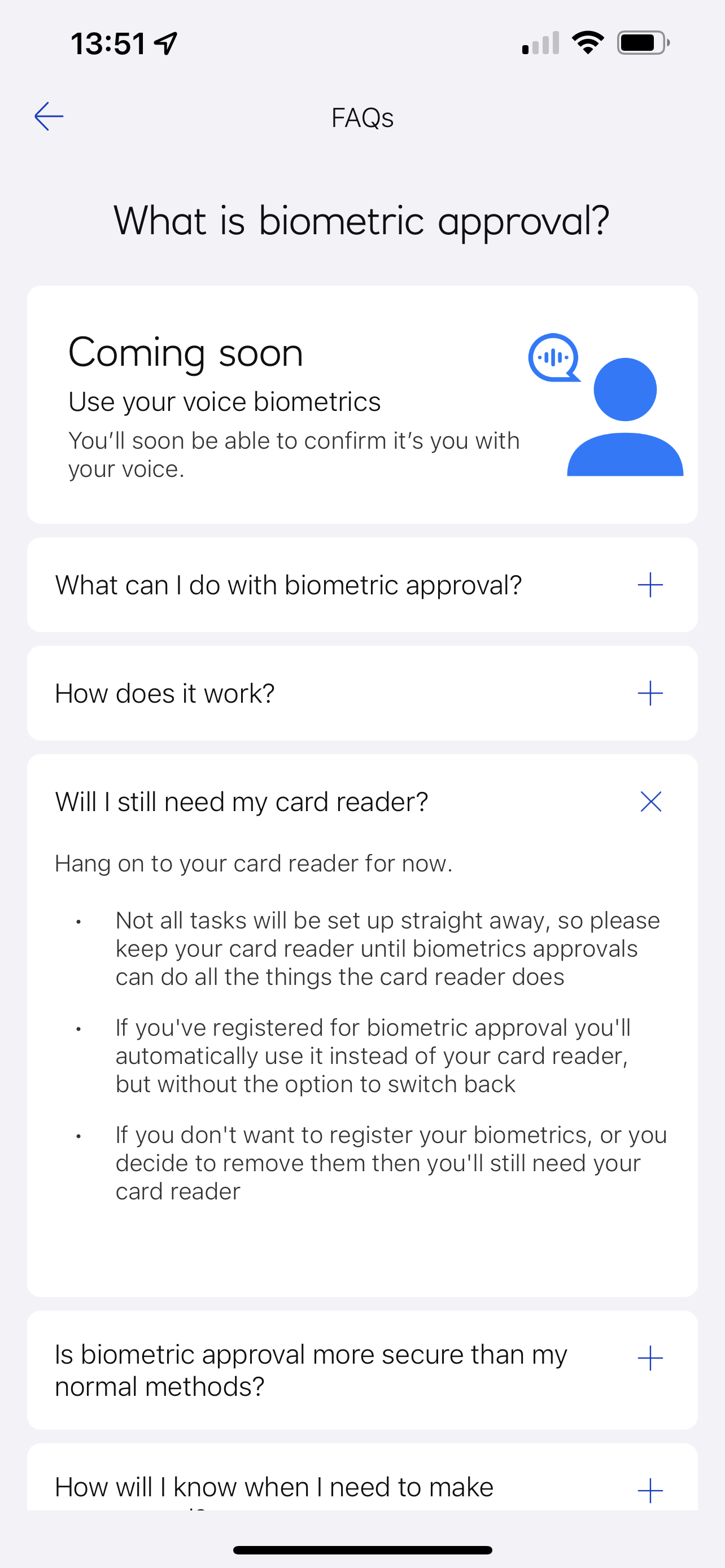

The official advice from RBS (/Natwest /Ulster) is to hang on to your card reader for now, in case you need it, or if you prefer not to use biometrics. From the biometrics FAQ in the app:RG2015 said:

Okay. You didn't say that RBS told you to get rid of the card reader.[Deleted User] said:

The reason it is backwards is because RBS told me to get rid of the card reader and switch to app authentication. The only option to add Amex as a payee was using a card reader. Hence it is backwards. It is nothing to do with Amex. This was within the RBS app.RG2015 said:

How does this make the RBS system backward?[Deleted User] said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.

1 -

Interesting thread. I hated card readers when they introduced. I remember banking with Natwest in the early 2000s and you could just login with a username and password not problem. Set up payees etc.. Then card readers were introduced and initially you needed them for everything. As someone that bought and sold a lot of items online and sent and received payments via bank transfer, a card reader was big inconvenience.

I was an early adopter of digital accounts. The user experience is on another level.

I will say one thing about card readers though, they were reliable. I never had one fail or batteries die. In fact I will have a nationwide one from 2010 that is working.0 -

This isn't the same thing as the currently alternative to the card reader (you get a prompt and press yes), which is app authentication or text message 2FA. If you turn these on the card reader is withdrawn as an option, at least it never appears as an option to use it again. Apart from when I tried to marry the Amex and RBS apps. When I ordered the card reader it said there was no need and to use the app but I ordered it anyway as at the time my phone was faulty. Hence why it doesn't make sense as some customers will not have a card reader.Daliah said:

The official advice from RBS (/Natwest /Ulster) is to hang on to your card reader for now, in case you need it, or if you prefer not to use biometrics. From the biometrics FAQ in the app:RG2015 said:

Okay. You didn't say that RBS told you to get rid of the card reader.Deleted_User said:

The reason it is backwards is because RBS told me to get rid of the card reader and switch to app authentication. The only option to add Amex as a payee was using a card reader. Hence it is backwards. It is nothing to do with Amex. This was within the RBS app.RG2015 said:

How does this make the RBS system backward?Deleted_User said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.

If you read the page:

https://www.rbs.co.uk/banking-with-royal-bank-of-scotland/how-to/card-reader.html

It is a bit you need it, but don't really need it, and it doesn't metion of the current text or app prompt option.0 -

Not sure what you mean. I don't need my card reader any longer for RBS as I can do all the approvals through the app.[Deleted User] said:

This isn't the same thing as the currently alternative to the card reader (you get a prompt and press yes), which is app authentication or text message 2FA. If you turn these on the card reader is withdrawn as an option, at least it never appears as an option to use it again. Apart from when I tried to marry the Amex and RBS apps. When I ordered the card reader it said there was no need and to use the app but I ordered it anyway as at the time my phone was faulty. Hence why it doesn't make sense as some customers will not have a card reader.Daliah said:

The official advice from RBS (/Natwest /Ulster) is to hang on to your card reader for now, in case you need it, or if you prefer not to use biometrics. From the biometrics FAQ in the app:RG2015 said:

Okay. You didn't say that RBS told you to get rid of the card reader.[Deleted User] said:

The reason it is backwards is because RBS told me to get rid of the card reader and switch to app authentication. The only option to add Amex as a payee was using a card reader. Hence it is backwards. It is nothing to do with Amex. This was within the RBS app.RG2015 said:

How does this make the RBS system backward?[Deleted User] said:RBS have a very backward system, I went into the Amex app to pay for bill, it stated you can do a direct bank transfer instead of card payment. I clicked ok and it opened the RBS app which then asked for a card reader.

The RBS security protocol requires a new payee to be authorised with a second factor, one of which is a card reader.

A direct bank transfer from RBS is a payment to a third party.

It actually sounds like Amex have a backward system.

If you read the page:

https://www.rbs.co.uk/banking-with-royal-bank-of-scotland/how-to/card-reader.html

It is a bit you need it, but don't really need it, and it doesn't metion of the current text or app prompt option.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards