We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Economy crash =/= stock market crash?

Comments

-

GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investing.That is a good strategy. That is what is the so called DCA (Dollar Cost Averaging). DCA is a well-known strategy used in the bear market. I have passed numerous authoritative information about this in the past, and that information not come from random people on the internet.

In the past, especially early 2022 a few people were suggesting that if you had a lumpsum say £100k, £300k threw that all in one go in lieu of DCAing. There is no evidence those who were suggesting other people to threw £100k, £300k have done that by themselves. When you have a different opinion, you would be fiercely attacked by the same group of people cheering up each other. Just see what happen to the people now who threw £100k, £300k in early 2022.I personally used "enhanced" version of DCA using various technical indicators, mood in the market tools as well as regularly follow the news of the stock market. Certainly, Fundamental Analysys and valuation is a must to know the basic of financial information of the companies you are investing adn to know whether the particular assets are undervalued or overvalued. Sofar it works well for me.

0 -

Most people are not choosing to do DCA - its the default option. They get paid monthly, their pension contribution is monthly, and they invest it immediately and automatically.adindas said:GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investing.That is a good strategy. That is what is the so called DCA (Dollar Cost Averaging). DCA is a well-known strategy used in the bear market. I have passed numerous authoritative information about this in the past, and that information not come from random people on the internet.

In the past, especially early 2022 a few people were suggesting that if you had a lumpsum say £100k, £300k threw that all in one go in lieu of DCAing. There is no evidence those who were suggesting other people to threw £100k, £300k have done that by themselves. When you have a different opinion, you would be fiercely attacked by the same group of people cheering up each other. Just see what happen to the people now who threw £100k, £300k in early 2022.I personally used "enhanced" version of DCA using various technical indicators, mood in the market tools as well as regularly follow the news of the stock market. Certainly, Fundamental Analysys and valuation is a must to know the basic of financial information of the companies you are investing adn to know whether the particular assets are undervalued or overvalued. Sofar it works well for me.

Using an ISA might be a little different but it usually boils down to when the funds arrive. Contribute monthly or if you get a bonus from work maybe throw it in.

Only rarely will you get people with a decision to make. Maybe they have just done a pension transfer and it has arrived in cash. Maybe they have been left a lump sum. Maybe a house downsizing. In those situations, since it is very difficult to read a market (including determining a future bear vs bull), it it generally best to invest it all at once rather than hanging around for some unknown time in the future.3 -

Absolutely. But in the past especailly early 2022, there were a few threads people were asking regarding wether to throw lumpsum, a few hundred thousands pounds or dripfeeding (non technical term for DCA) some people were suggesting threw that all in one go, as if you hold it it will mean timing the market. They were very vocal.Prism said:

Most people are not choosing to do DCA - its the default option. They get paid monthly, their pension contribution is monthly, and they invest it immediately and automatically.adindas said:GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investing.That is a good strategy. That is what is the so called DCA (Dollar Cost Averaging). DCA is a well-known strategy used in the bear market. I have passed numerous authoritative information about this in the past, and that information not come from random people on the internet.

In the past, especially early 2022 a few people were suggesting that if you had a lumpsum say £100k, £300k threw that all in one go in lieu of DCAing. There is no evidence those who were suggesting other people to threw £100k, £300k have done that by themselves. When you have a different opinion, you would be fiercely attacked by the same group of people cheering up each other. Just see what happen to the people now who threw £100k, £300k in early 2022.I personally used "enhanced" version of DCA using various technical indicators, mood in the market tools as well as regularly follow the news of the stock market. Certainly, Fundamental Analysys and valuation is a must to know the basic of financial information of the companies you are investing adn to know whether the particular assets are undervalued or overvalued. Sofar it works well for me.

Using an ISA might be a little different but it usually boils down to when the funds arrive. Contribute monthly or if you get a bonus from work maybe throw it in.

When you raised a different opinion, you would be fiercely attacked by the same group of people cheering up each other.

Keep in mind for people who have lumpsum and you are doing DCAs, your money is not sitting iddle doing nothing as there is high interest RSAs, easy access high interest saving accounts and/or high interest current account which are currently paying interest higher than Bonds and risk free waiting allocation for DCA.

Not in the bear/ declining market. Bear market take months sometimes years. That is at least what the strategistst authoritatve sources have been saying. Those who were suggesting that have you done that yourself early last year when people were asking Lumpsum a few hundred pounds vs dripfeeding??. If not why not ?? Just see what happen to the people now who threw £100k, £300k in early 2022. Do you think you know better than these strategists.

Prism said:Only rarely will you get people with a decision to make. Maybe they have just done a pension transfer and it has arrived in cash. Maybe they have been left a lump sum. Maybe a house downsizing. In those situations, since it is very difficult to read a market (including determining a future bear vs bull), it it generally best to invest it all at once rather than hanging around for some unknown time in the future.

https://www.nerdwallet.com/article/investing/dollar cost averaging 2

https://www.investopedia.com/terms/b/bearmarket.asp What Is a Bear Market?

https://www.investopedia.com/8-ways-to-survive-a-market-downturn-4773417 Smart Strategies for a Bear Market By The Investopedia Team May 30, 2022 Reviewed by Robert C. Kelly Fact checked by Diane Costagliola

https://www.capitalgroup.com/pcs/insights/articles/benefits of dollar cost averaging spring 2020.html A simple approach can help limit the downside during a bear market

https://www.fool.com/investing/stock market/basics/dollar cost averaging/

Generally speaking, dollar cost averaging works best in bear markets and with securities that have dramatic price swings up and down. It is those times, and those types of investments, where reducing investor anxiety and fear of missing out tend to be the most important.

https://www.investors.com/etfs and funds/mutual funds/dollar cost averaging is good for a falling market/ Dollar Cost Averaging Good In A Falling Market

1 -

adindas said:

Absolutely. But in the past especailly early 2022, there were a few threads people were asking regarding wether to throw lumpsum, a few hundred thousands pounds or dripfeeding (non technical term for DCA) some people were suggesting threw that all in one go, as if you hold it it will mean timing the market. They were very vocal.Prism said:

Most people are not choosing to do DCA - its the default option. They get paid monthly, their pension contribution is monthly, and they invest it immediately and automatically.adindas said:GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investing.That is a good strategy. That is what is the so called DCA (Dollar Cost Averaging). DCA is a well-known strategy used in the bear market. I have passed numerous authoritative information about this in the past, and that information not come from random people on the internet.

In the past, especially early 2022 a few people were suggesting that if you had a lumpsum say £100k, £300k threw that all in one go in lieu of DCAing. There is no evidence those who were suggesting other people to threw £100k, £300k have done that by themselves. When you have a different opinion, you would be fiercely attacked by the same group of people cheering up each other. Just see what happen to the people now who threw £100k, £300k in early 2022.I personally used "enhanced" version of DCA using various technical indicators, mood in the market tools as well as regularly follow the news of the stock market. Certainly, Fundamental Analysys and valuation is a must to know the basic of financial information of the companies you are investing adn to know whether the particular assets are undervalued or overvalued. Sofar it works well for me.

Using an ISA might be a little different but it usually boils down to when the funds arrive. Contribute monthly or if you get a bonus from work maybe throw it in.

When you raised a different opinion, you would be fiercely attacked by the same group of people cheering up each other.

Keep in mind for people who have lumpsum and you are doing DCAs, your money is not sitting iddle doing nothing as there is high interest RSAs, easy access high interest saving accounts and/or high interest current account which are currently paying interest higher than Bonds and risk free waiting allocation for DCA.

Not in the bear/ declining market. Bear market take months sometimes years. That is at least what the strategistst authoritatve sources have been saying. Those who were suggesting that have you done that yourself early last year when people were asking Lumpsum a few hundred pounds vs dripfeeding??. If not why not ??

Prism said:Only rarely will you get people with a decision to make. Maybe they have just done a pension transfer and it has arrived in cash. Maybe they have been left a lump sum. Maybe a house downsizing. In those situations, since it is very difficult to read a market (including determining a future bear vs bull), it it generally best to invest it all at once rather than hanging around for some unknown time in the future.

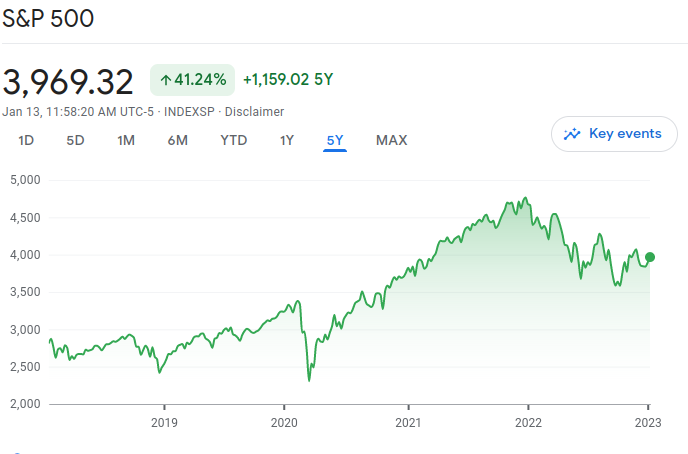

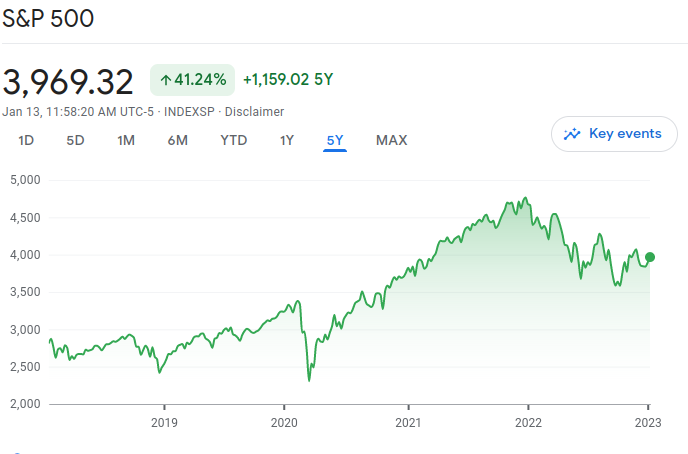

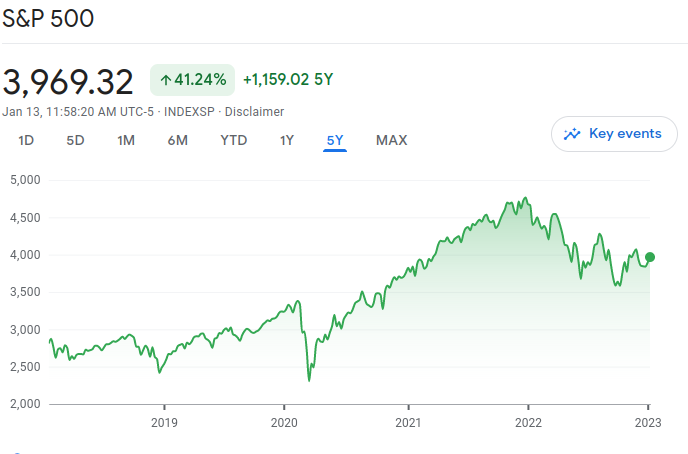

When you look at the actual data, you can see how flawed and backward this argument is. If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.0

If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.0 -

masonic said:adindas said:Prism said:adindas said:GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investingWhen you look at the actual data, you can see how flawed and backward this argument is. If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.

If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.That is what happen when people think they are better than strategists. Please find any link from authoritative sources CNBC, yahoo finance, Bloomberg, Reuters, CNN finance, etc other authoritative source any single strategist, even the most bullish one ever tell people to throw lump sum in one go since the beginning of January 2022 to this date. Most of them (if not all) have warned people not to throw ALL of their money in the bear market.

Also I understand those who were suggesting people to throw a few hundred thousand early January 2022, even in the middle of last year have never done that themselves. At least they have not shown any print screen as evidence. Just see what happen to the people now who threw £100k, £300k in early 2022 ?

There are many strategists, news on CNBC, yahoo finance, Bloomberg, Reuters will be able to tell other people where we were last year now bear or bull. There is numerous information regarding inflation, the interest rates hikes and its impact, the FED, war in Ukraine, supply chain problem. If people don’t pay attention to the that and that is another story. If you have crystal ball, where you could call the bottom of course you will always be better off with lump-sum.

0 -

adindas said:

That is what is actually happen when people think they are better than strategists. Also I understand those who were suggesting that early janury 2022, have never done that themselve. at least they have not shown any printscree as evidence. There are many strategist on CNBC, yahoo finance, Bloomberg wil be able to tell other people where we were last year and are now bear or bull.masonic said:adindas said:

Absolutely. But in the past especailly early 2022, there were a few threads people were asking regarding wether to throw lumpsum, a few hundred thousands pounds or dripfeeding (non technical term for DCA) some people were suggesting threw that all in one go, as if you hold it it will mean timing the market. They were very vocal.Prism said:

Most people are not choosing to do DCA - its the default option. They get paid monthly, their pension contribution is monthly, and they invest it immediately and automatically.adindas said:GazzaBloom said:

Same here, I increased my pension salary sacrifice significantly in February last year and have been buying the same 100% stocks index fund each month and remain 100% invested in the stocks index.Prism said:I have been fully invested all the way through last year so it makes no difference to me. I'd prefer more of a downturn but what will happen, will happen

I read many comments where people sit with cash waiting to deploy fearing further market falls. That's market timing and a sure fire way to lower than average returns if used as a strategy over a lifetime of investing.That is a good strategy. That is what is the so called DCA (Dollar Cost Averaging). DCA is a well-known strategy used in the bear market. I have passed numerous authoritative information about this in the past, and that information not come from random people on the internet.

In the past, especially early 2022 a few people were suggesting that if you had a lumpsum say £100k, £300k threw that all in one go in lieu of DCAing. There is no evidence those who were suggesting other people to threw £100k, £300k have done that by themselves. When you have a different opinion, you would be fiercely attacked by the same group of people cheering up each other. Just see what happen to the people now who threw £100k, £300k in early 2022.I personally used "enhanced" version of DCA using various technical indicators, mood in the market tools as well as regularly follow the news of the stock market. Certainly, Fundamental Analysys and valuation is a must to know the basic of financial information of the companies you are investing adn to know whether the particular assets are undervalued or overvalued. Sofar it works well for me.

Using an ISA might be a little different but it usually boils down to when the funds arrive. Contribute monthly or if you get a bonus from work maybe throw it in.

When you raised a different opinion, you would be fiercely attacked by the same group of people cheering up each other.

Keep in mind for people who have lumpsum and you are doing DCAs, your money is not sitting iddle doing nothing as there is high interest RSAs, easy access high interest saving accounts and/or high interest current account which are currently paying interest higher than Bonds and risk free waiting allocation for DCA.

Not in the bear/ declining market. Bear market take months sometimes years. That is at least what the strategistst authoritatve sources have been saying. Those who were suggesting that have you done that yourself early last year when people were asking Lumpsum a few hundred pounds vs dripfeeding??. If not why not ??

Prism said:Only rarely will you get people with a decision to make. Maybe they have just done a pension transfer and it has arrived in cash. Maybe they have been left a lump sum. Maybe a house downsizing. In those situations, since it is very difficult to read a market (including determining a future bear vs bull), it it generally best to invest it all at once rather than hanging around for some unknown time in the future.

When you look at the actual data, you can see how flawed and backward this argument is. If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.If the strategist in question was saying people should DCA when we're in a bear market, but invest lump sums at other times, then people actually would be better than that strategist and the market data shows that. I doubt any strategist would say something like that though.It's obviously your perogative to disbelieve anyone has ever invested a lump sum, and there doesn't seem to be any evidence on this forum of people pressuring anyone to throw in large sums of money into the market or fiercely attacking people who disagreed, but perhaps such overt rule-breaking behaviour led to the thread being deleted and action taken against the rule-breaking individuals. The overriding factor is always someone's risk tolerance and ability to sleep at night. Most people should prioritise this above what is the highest return option because selling everything in a downturn (either permanently, or to then DCA it) is suboptimal to say the least.Bloomberg is no doubt wonderful for analysis, but it doesn't see into the future. The market spends much of its time at an all-time high, which can either continue (as it did through 2021), or descend into a bear market (as it did through 2022). Anyone who designs an accurate predictive model to differentiate those two outcomes can be king of the world.

If you try to DCA only "in the bear market" and lump sum invest at other times, you'll tend to do worse than always investing what you can at the first opportunity, which is what most people do.In mid February 2020, the S&P500 was in a bull market, but this would have been a bad time to invest a lump sum.In mid March 2020, the S&P500 entered a bear market, but it would have been better to add a lump sum around this time rather than DCA, because every month since then, the index has been higher.On 31st December 2021, the S&P500 was back in a bull market, yet it would have been much better to DCA over subsequent monthsIn mid June 2022, the S&P500 entered a bear market, but DCA over the next 6 months would again have led to a slightly worse outcome given the index averaged above that level subsequently.The idea that you can change your strategy based on market conditions is a nice fairy tale, but in practice it is impractical for two reasons:1) You need to know and take action several months in advance of a bear market coming2) Once you're in that decline to a bear market, you need to know if it's going to be a deep and prolonged one, vs a short sharp one, because only the former has the potential to give a better outcomeIn fact, the further the market has already fallen, the more the odds are in your favour that average prices in the future will be higher than the current price.If the strategist in question was saying people should DCA when we're in a bear market, but invest lump sums at other times, then people actually would be better than that strategist and the market data shows that. I doubt any strategist would say something like that though.It's obviously your perogative to disbelieve anyone has ever invested a lump sum, and there doesn't seem to be any evidence on this forum of people pressuring anyone to throw in large sums of money into the market or fiercely attacking people who disagreed, but perhaps such overt rule-breaking behaviour led to the thread being deleted and action taken against the rule-breaking individuals. The overriding factor is always someone's risk tolerance and ability to sleep at night. Most people should prioritise this above what is the highest return option because selling everything in a downturn (either permanently, or to then DCA it) is suboptimal to say the least.Bloomberg is no doubt wonderful for analysis, but it doesn't see into the future. The market spends much of its time at an all-time high, which can either continue (as it did through 2021), or descend into a bear market (as it did through 2022). Anyone who designs an accurate predictive model to differentiate those two outcomes can be king of the world.

In early 2022, we were not in a bear market, so that is the point I am making. Waiting until a bear market to start DCA, if you're inclined to DCA at all, is not a good idea. It's when there has been a bull market run that risk starts to build.adindas said:Just see what happen to the people now who threw £100k, £300k in early 2022 ?

I doubt any of those publications would ever tell anyone to throw in a lump sum in one go ever. That doesn't mean it has never been the highest return outcome. It means that they know they can't predict the markets and that it goes against many people's psychology to do such a thing.adindas said:Please post any link from authoritative sources CNBC, yahoo finance, Bloomberg, Reuters that ever tell people to throw lumpsum in one go since the beginning of January 2022 to this date

0 -

Vanguard have studied the 2 strategies here:

https://static.twentyoverten.com/5980d16bbfb1c93238ad9c24/rJpQmY8o7/Dollar-Cost-Averaging-Just-Means-Taking-Risk-Later-Vanguard.pdf"We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets

as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use."

and a study with 3 examples here comparing lump sum at the top of the market just before a crash vs DCA:

https://seekingalpha.com/article/4471728-getting-in-at-the-worst-timeConclusion

"Based on history, it pays (quite literally) to begin investing ASAP, and to keep investing in the market as often as possible... even in the worst case scenario where the market crashes right after you start to invest. History shows that by investing early, you do ~10.3% better on average than you'd do if you saved your money and only started to invest from the lowest month of the past three bear markets. On the other hand, flawless market timing (Scenario 3 in my example) only earns ~3.1% more money than the investor who starts investing right before the crash. Although investors may be wary because markets are at all-time highs, history has shown that investing early and often is generally the best approach - even if you start right in front of a bear market."

As mentioned above I DCA monthly as that is how I get paid but will lump sum a chunk from an annual bonus payment each year.

3 -

GazzaBloom said:Vanguard have studied the 2 strategies here:

https://static.twentyoverten.com/5980d16bbfb1c93238ad9c24/rJpQmY8o7/Dollar-Cost-Averaging-Just-Means-Taking-Risk-Later-Vanguard.pdf"We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets

as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use."

and a study with 3 examples here comparing lump sum at the top of the market just before a crash vs DCA:

https://seekingalpha.com/article/4471728-getting-in-at-the-worst-timeConclusion

"Based on history, it pays (quite literally) to begin investing ASAP, and to keep investing in the market as often as possible... even in the worst case scenario where the market crashes right after you start to invest. History shows that by investing early, you do ~10.3% better on average than you'd do if you saved your money and only started to invest from the lowest month of the past three bear markets. On the other hand, flawless market timing (Scenario 3 in my example) only earns ~3.1% more money than the investor who starts investing right before the crash. Although investors may be wary because markets are at all-time highs, history has shown that investing early and often is generally the best approach - even if you start right in front of a bear market."

As mentioned above I DCA monthly as that is how I get paid but will lump sum a chunk from an annual bonus payment each year.

Well, keep in mind we are talking about investing lump-sum vs DCA in the bear / declining market. Is that case above particularly referring to bear / declining market??

Also does the study take into consideration the fact that if you have lumpsum and intend to DCAs, the sensible people, retailer investors will put part of their money into high interest saving accounts, RSAs, current accounts currently paying interest rate higher than the market return while waiting allocation for DCA, not sitting idle doing nothing ? Do people need a research to find out that in the short run +4% (say) in saving is better than -15% (say), where people could easily see that +4% is higher than -15%.

The default is that the Bull market run much longer than the bear market.

0 -

If you know the market is going to decline then of course you don't lump sum at the start, you lump sum at the endadindas said:GazzaBloom said:Vanguard have studied the 2 strategies here:

https://static.twentyoverten.com/5980d16bbfb1c93238ad9c24/rJpQmY8o7/Dollar-Cost-Averaging-Just-Means-Taking-Risk-Later-Vanguard.pdf"We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets

as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use."

and a study with 3 examples here comparing lump sum at the top of the market just before a crash vs DCA:

https://seekingalpha.com/article/4471728-getting-in-at-the-worst-timeConclusion

"Based on history, it pays (quite literally) to begin investing ASAP, and to keep investing in the market as often as possible... even in the worst case scenario where the market crashes right after you start to invest. History shows that by investing early, you do ~10.3% better on average than you'd do if you saved your money and only started to invest from the lowest month of the past three bear markets. On the other hand, flawless market timing (Scenario 3 in my example) only earns ~3.1% more money than the investor who starts investing right before the crash. Although investors may be wary because markets are at all-time highs, history has shown that investing early and often is generally the best approach - even if you start right in front of a bear market."

As mentioned above I DCA monthly as that is how I get paid but will lump sum a chunk from an annual bonus payment each year.

Well, keep in mind we are talking about investing lumpsum vs DCA in the bear / declining market. Is that case above particularly referring to bear / declining market??

Also does the study include the option where retailer investor put their money in high interest saving account, RSA, current account currently paying higher interest rate than the market return waiting allocation for DCA ?

The default is that the Bull market run much longer than the bear market.

4 -

InvesterJones said:

If you know the market is going to decline then of course you don't lump sum at the start, you lump sum at the endadindas said:GazzaBloom said:Vanguard have studied the 2 strategies here:

https://static.twentyoverten.com/5980d16bbfb1c93238ad9c24/rJpQmY8o7/Dollar-Cost-Averaging-Just-Means-Taking-Risk-Later-Vanguard.pdf"We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets

as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use."

and a study with 3 examples here comparing lump sum at the top of the market just before a crash vs DCA:

https://seekingalpha.com/article/4471728-getting-in-at-the-worst-timeConclusion

"Based on history, it pays (quite literally) to begin investing ASAP, and to keep investing in the market as often as possible... even in the worst case scenario where the market crashes right after you start to invest. History shows that by investing early, you do ~10.3% better on average than you'd do if you saved your money and only started to invest from the lowest month of the past three bear markets. On the other hand, flawless market timing (Scenario 3 in my example) only earns ~3.1% more money than the investor who starts investing right before the crash. Although investors may be wary because markets are at all-time highs, history has shown that investing early and often is generally the best approach - even if you start right in front of a bear market."

As mentioned above I DCA monthly as that is how I get paid but will lump sum a chunk from an annual bonus payment each year.

Well, keep in mind we are talking about investing lumpsum vs DCA in the bear / declining market. Is that case above particularly referring to bear / declining market??

Also does the study include the option where retailer investor put their money in high interest saving account, RSA, current account currently paying higher interest rate than the market return waiting allocation for DCA ?

The default is that the Bull market run much longer than the bear market.

Also similarly, if people had a crystal ball Lump-sum always beat DCAs do not they ??Do not you know that in the bear market it does not mean the stock market will keep declining, falling all the time. In the bear market the stock market going up but down again like yoyo, typical within a channel before sometimes falling again reaching a new low. There is what is the so called bull trap, dead cat bounce. If it keep declining all the time it is going to zero. This is common sense.Because you do not know where the bottom is (unless you have a crystal ball), imo you will have a higher probability to make a better decision by doing DCAs as in the bear market as the stock fall more than it raises. Also mainly because part of your lumsump money are sitting in high interest Saving accounts, RSAs waiting allocation for DCAs. As I mentioned before, people could easily see that at the moment 4% (say) in saving is better than -15% (say) with stock market return, no research is needed to see that +4% is higher than -15%.What are the data, the analysts / strategists the news have been saying ? Are we in the bull or bear market ?? Does any authoritative sources, any single wall street analyst even the most bullish one has ever said we are now in the bull market ?Also what are they suggesting the people to do during the bear market ?Knowing the bear market is not about knowing the exact flipping point as bear market is a period of a few months and sometimes years.0

Also similarly, if people had a crystal ball Lump-sum always beat DCAs do not they ??Do not you know that in the bear market it does not mean the stock market will keep declining, falling all the time. In the bear market the stock market going up but down again like yoyo, typical within a channel before sometimes falling again reaching a new low. There is what is the so called bull trap, dead cat bounce. If it keep declining all the time it is going to zero. This is common sense.Because you do not know where the bottom is (unless you have a crystal ball), imo you will have a higher probability to make a better decision by doing DCAs as in the bear market as the stock fall more than it raises. Also mainly because part of your lumsump money are sitting in high interest Saving accounts, RSAs waiting allocation for DCAs. As I mentioned before, people could easily see that at the moment 4% (say) in saving is better than -15% (say) with stock market return, no research is needed to see that +4% is higher than -15%.What are the data, the analysts / strategists the news have been saying ? Are we in the bull or bear market ?? Does any authoritative sources, any single wall street analyst even the most bullish one has ever said we are now in the bull market ?Also what are they suggesting the people to do during the bear market ?Knowing the bear market is not about knowing the exact flipping point as bear market is a period of a few months and sometimes years.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards