We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Economy crash =/= stock market crash?

Comments

-

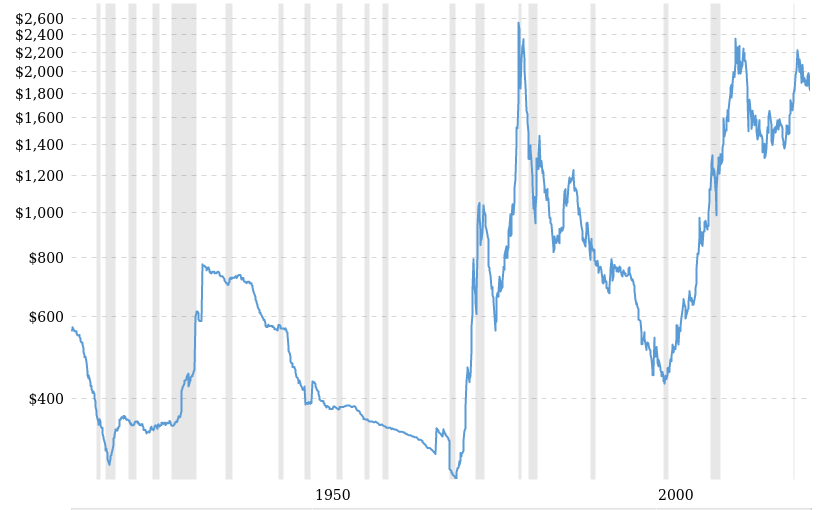

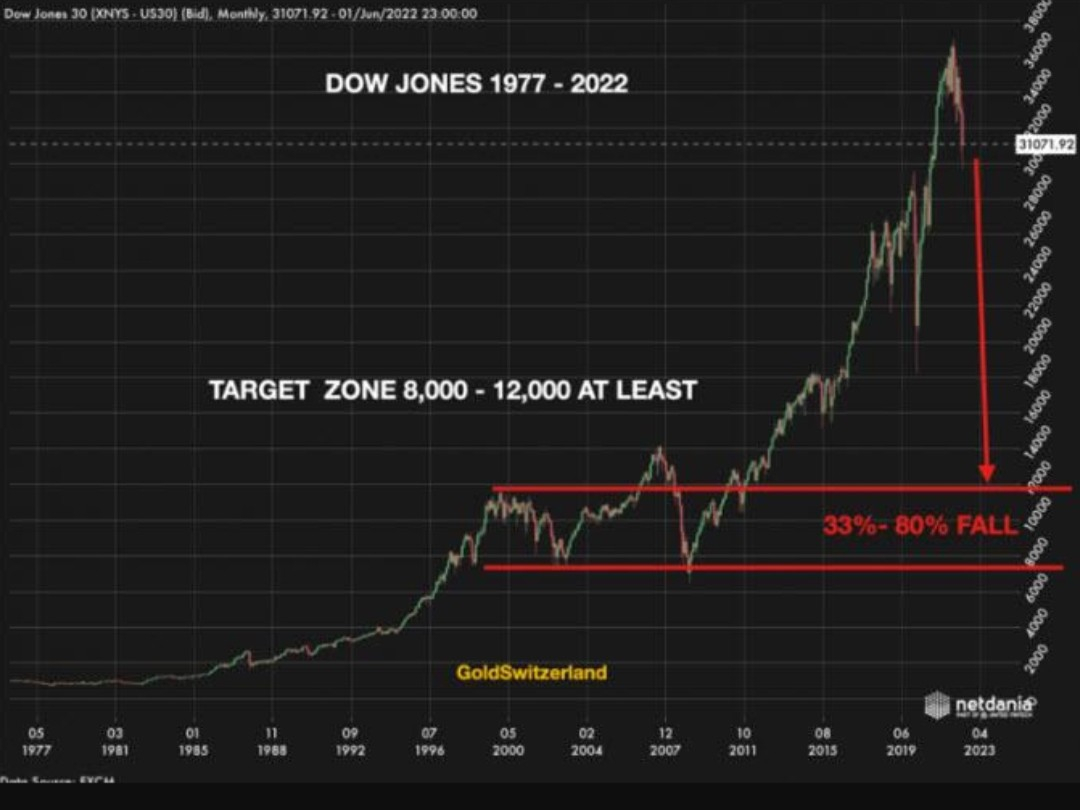

Their graph is about the Dow, not gold?masonic said:Type_45 said:This graph by Gold Switzerland is... interesting...I don't know who GoldSwitzerland is, but if you wanted to give them some feedback, you could tell them to plot that graph with a log scale on the y-axis and inflation adjust the price. You then end up with something like this: The May 2000 "peak" is no longer a peak (it's at $469 in today's money), and the 2003 "bottom" is higher in real terms than the supposed "peak". However, the point that gold is relatively expensive at this time is evident from the fact that it is close to $1800 in today's money, whereas the 100 year geometric mean (just by eye) is somewhere around $500 in today's money.1

The May 2000 "peak" is no longer a peak (it's at $469 in today's money), and the 2003 "bottom" is higher in real terms than the supposed "peak". However, the point that gold is relatively expensive at this time is evident from the fact that it is close to $1800 in today's money, whereas the 100 year geometric mean (just by eye) is somewhere around $500 in today's money.1 -

Type_45 said:

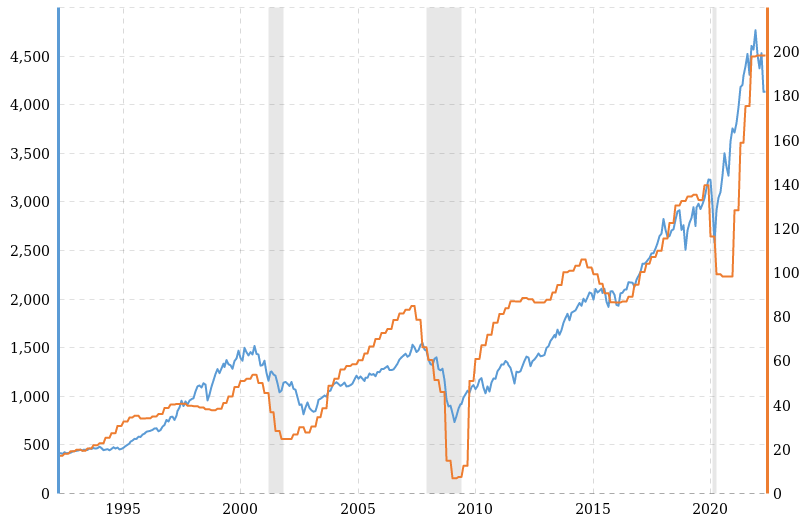

Their graph is about the Dow, not gold?masonic said:Type_45 said:This graph by Gold Switzerland is... interesting...I don't know who GoldSwitzerland is, but if you wanted to give them some feedback, you could tell them to plot that graph with a log scale on the y-axis and inflation adjust the price. You then end up with something like this:The May 2000 "peak" is no longer a peak (it's at $469 in today's money), and the 2003 "bottom" is higher in real terms than the supposed "peak". However, the point that gold is relatively expensive at this time is evident from the fact that it is close to $1800 in today's money, whereas the 100 year geometric mean (just by eye) is somewhere around $500 in today's money.Sorry, missed that! Why is someone called "GoldSwitzerland" not talking about gold?!! Perhaps he should stick to gold as he has applied a truth about gold (that it is an unproductive asset that has no real growth) to an equities index (which has experience significant earnings growth over the last two decades). His red lines should therefore slope/curve upwards.To understand this with a chart, we'd have to switch from the Dow to the S&P500. Here is a plot of price (blue) and earnings per share (orange) over the last 30 years:

Perhaps he should stick to gold as he has applied a truth about gold (that it is an unproductive asset that has no real growth) to an equities index (which has experience significant earnings growth over the last two decades). His red lines should therefore slope/curve upwards.To understand this with a chart, we'd have to switch from the Dow to the S&P500. Here is a plot of price (blue) and earnings per share (orange) over the last 30 years: The data goes out to May 2022. Earnings can certainly drop considerably, as they did in 2002, 2007 and 2020, but there is no sign of this happening yet, and the forward P/E puts the market at fair value. The minimum P/E based on this historic data is 13 (in Sep 2011), though it has gone as low as 8 in the 1980s. So GoldSwitzerland's analysis, applied to the S&P500, would put the lower bound drop at about 2600 (about a 32% drop from where we are), and the upper bound drop at about 4000, which is above where we are today, so up to 32% more based on today's earnings. If earnings collapse, you can see from the chart that a larger drop is possible, but equally, P/E can go quite high, as in 2009 (P/E = 108 at the bottom of the crash). At a P/E of 108, earnings could drop to 35 (an 80% drop) and still be capable of supporting today's price.In short, the historic data can't tell you very much because there is too much variance in P/E and earnings per share.1

The data goes out to May 2022. Earnings can certainly drop considerably, as they did in 2002, 2007 and 2020, but there is no sign of this happening yet, and the forward P/E puts the market at fair value. The minimum P/E based on this historic data is 13 (in Sep 2011), though it has gone as low as 8 in the 1980s. So GoldSwitzerland's analysis, applied to the S&P500, would put the lower bound drop at about 2600 (about a 32% drop from where we are), and the upper bound drop at about 4000, which is above where we are today, so up to 32% more based on today's earnings. If earnings collapse, you can see from the chart that a larger drop is possible, but equally, P/E can go quite high, as in 2009 (P/E = 108 at the bottom of the crash). At a P/E of 108, earnings could drop to 35 (an 80% drop) and still be capable of supporting today's price.In short, the historic data can't tell you very much because there is too much variance in P/E and earnings per share.1 -

The only interesting thing I see is that GoldSwitzerland can't actually calculate a 33% drop and/or put some misleading red lines on a graphType_45 said:This graph by Gold Switzerland is... interesting... 2

2 -

It shows it's value compared to other currencies, which is the applicable measure when one is talking about which currencies are being held globally as a reserve.masonic said:The US dollar index shows the value of the dollar relative to a basket of other currencies. It does not mean that the dollar is increasing in intrinsic value.

0 -

I think the Dow will see 22,000 before it sees 40,000.

And it will see a long way further down than that.0 -

Type_45 said:I think the Dow will see 22,000 before it sees 40,000.

And it will see a long way further down than that.

I was going to say, that's only a 40% drop. Have you changed your mind? Or are you still predicting an 80% drop - in which case telling us you're also predicting 40, 41, 42, 43 etc. % drops is already implied.

0 -

If the dude throws out enough numbers, one is bound to eventually be correct, sufficient to "claim victory" which is basically what this entire thread is about.

Apropos of nothing, my 5 year old demonstrates the same approach to solving basic multiplication problems.

5 -

FTSE 100 down 2% right now.0

-

"Drax powered ahead after JPMorgan Cazenove put the shares on "positive catalyst watch" and said it expects the company to upgrade guidance at its interim results"

FTSE 250 - Risers

Drax Group (DRX) 660.00p 1.93%

"He seems to have an eye for a good investment"

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=anIOV6HmuBs

https://www.youtube.com/watch?v=anIOV6HmuBs