We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Economy crash =/= stock market crash?

Comments

-

We are in a market which is clearly trending downwards and yet people are saying "buy the dip". We've also been told that in times of food shortages it's best not to have food in case it gets stolen... But my strategy of storing food and having cash ready to buy back when the inevitable crash happens needs a "warning" sticker... OK.

0 -

No they're not. The only recommendations I've seen have been to not let emotion change your strategy.Type_45 said:We are in a market which is clearly trending downwards and yet people are saying "buy the dip".

0 -

Don't let facts change your strategy either.0

-

Type_45 said:Don't let facts change your strategy either.Which facts are those? If the strategy is to ride out the ups and downs on the basis that crashes are temporary, then no facts are being ignored. It's still your position that the crash will not be permanent, isn't it? Markets falling 80% from their peak on or before 31st December 2022 is a prediction, not a fact. If it happens, then it will become a fact, but it will then be too late to act. Likewise for the melt-up prior to the 80% crash.Meanwhile, the Telegraph has published an article warning "We are on track for a currency crisis – and bankruptcy" due to the UK having the largest ever deficit, which again is just a prediction... one that puts cash under the same threat as equities, but not a temporary one. A rapid devaluation of the pound would give the appearance of a melt-up, as other assets hold their value rather better than your home currency. Assets won't have inflated in value, it's your cash that would be worth a lot less.

2 -

The facts we've already covered, such as this is the worst year ever so far for the NASDAQ, this is the worst year for the stock market since 1970, this is the worst year for bonds since (I can't remember, but many years).masonic said:Type_45 said:Don't let facts change your strategy either.Which facts are those? If the strategy is to ride out the ups and downs on the basis that crashes are temporary, then no facts are being ignored. It's still your position that the crash will not be permanent, isn't it? Markets falling 80% from their peak on or before 31st December 2022 is a prediction, not a fact. If it happens, then it will become a fact, but it will then be too late to act. Likewise for the melt-up prior to the 80% crash.Meanwhile, the Telegraph has published an article warning "We are on track for a currency crisis – and bankruptcy" due to the UK having the largest ever deficit, which again is just a prediction... one that puts cash under the same threat as equities, but not a temporary one. A rapid devaluation of the pound would give the appearance of a melt-up, as other assets hold their value rather better than your home currency. Assets won't have inflated in value, it's your cash that would be worth a lot less.

We have policy errors such as Biden and the EU's energy policies, we have an ongoing war featuring a major oil, gas and wheat exporter, we have Biden weaponising the USD against Russia only for it to spectacularly backfire and hasten the demise of the USD as the global reserve currency, and we have the impending devaluation/destruction of the USD and GBP which I've mentioned many times and you've now informed me is now being written about in the MSM. Meanwhile the market is clearly in a downwards trend. Now is probably the time to short this market, not keep putting money into it.

Regarding the devaluation of the GBP and the appearance of assets rising in value: gold may (as happened in Weimar) rise in real terms at the same time as the GBP devalues thus compounding the upwards valuation of gold. Is there a story of how it was possible to purchase a house with a few ounces of gold at that time? (How would SGLN do if the GBP devalues?)

0 -

January was the time to short the market. I'd rather take my chances and start to buy back in slowly at this point.Type_45 said:

Now is probably the time to short this market, not keep putting money into it.masonic said:Type_45 said:Don't let facts change your strategy either.Which facts are those? If the strategy is to ride out the ups and downs on the basis that crashes are temporary, then no facts are being ignored. It's still your position that the crash will not be permanent, isn't it? Markets falling 80% from their peak on or before 31st December 2022 is a prediction, not a fact. If it happens, then it will become a fact, but it will then be too late to act. Likewise for the melt-up prior to the 80% crash.Meanwhile, the Telegraph has published an article warning "We are on track for a currency crisis – and bankruptcy" due to the UK having the largest ever deficit, which again is just a prediction... one that puts cash under the same threat as equities, but not a temporary one. A rapid devaluation of the pound would give the appearance of a melt-up, as other assets hold their value rather better than your home currency. Assets won't have inflated in value, it's your cash that would be worth a lot less.0 -

I'd say we're about half way down with the S&P. Once around 3000 levels, I'll get interested again. Odds are we're already in a recession in the US, corporate earnings likely to disappoint in the coming quarter, so that'd be the second leg down.As for shorting, I'll stay away from such adventures. Volatility is higher in downturns than rising markets, and these bear rallies are easier to see after the fact then when being in one, on top of which, puts are really expensive, well, word's gotten out it's a bear market. Right now, keeping my delta to market as low as possible, trying to earn a bit of alpha here and there, and keeping an eye on things.0

-

What about stagflation? What about the insane amounts of non-productive spending from the US government? What about Biden's energy policy?bd10 said:I'd say we're about half way down with the S&P. Once around 3000 levels, I'll get interested again. Odds are we're already in a recession in the US, corporate earnings likely to disappoint in the coming quarter, so that'd be the second leg down.As for shorting, I'll stay away from such adventures. Volatility is higher in downturns than rising markets, and these bear rallies are easier to see after the fact then when being in one, on top of which, puts are really expensive, well, word's gotten out it's a bear market. Right now, keeping my delta to market as low as possible, trying to earn a bit of alpha here and there, and keeping an eye on things.

There are deep structural issues at play here which won't fix themselves.

0 -

Commodities appear to have topped out now.

What does that mean for inflation as a whole?0 -

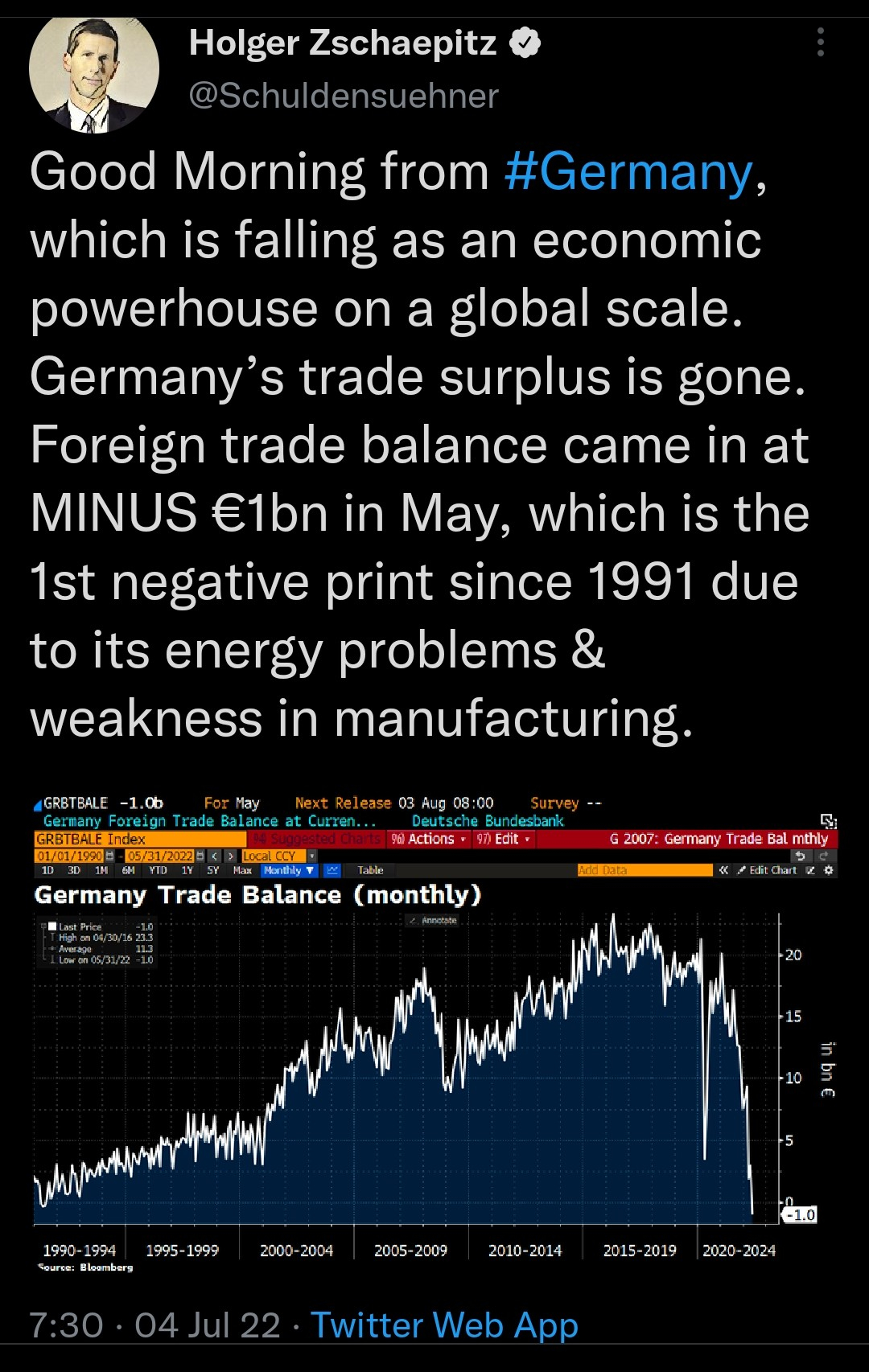

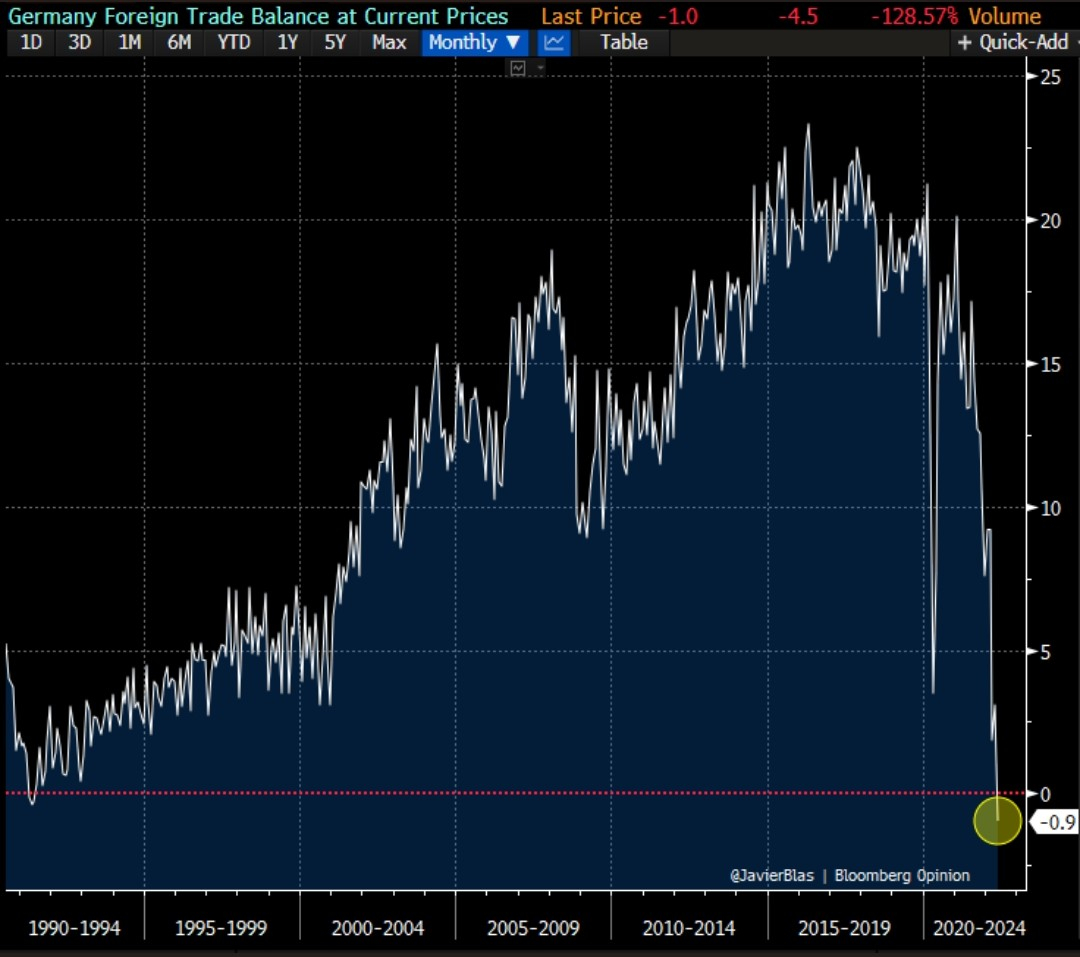

An interesting chart:

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards