We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Halifax £100 switch incentive

Comments

-

The current offer is quite clear that it needs to be a new rewards account. I wouldn't even risk trying to switch into an existing account - at the bare minimum I'd downgrade my existing account and open a brand new one.Ghostcrawler said:I have a query..I have got switching bonus from Halifax in Oct 2019 and since then hold 1 rewards account for £5 monthly cash. As per this switching terms I think I am eligible but do I have to switch to existing Halifax account or create a new rewards account and then switch to new one? Or should I just downgrade my current one to basic and then create a new rewards account and then switch to it? I don't want to miss this opportunity.

The T&Cs are also quite clear that in theory you are only supposed to be allowed a max of two reward accounts - 1 sole and 1 joint. In practice it seems their IT systems aren't quite set up right however and are allowing a second application to go through - which many on here seem to be doing. I probably would be doing the same if I wasn't temporarily blocked from opening new LBG bank accounts for other reasons - multiple reward accounts gaining £10 per month for little effort would be very silly not to pass on.

1 -

Well if the T&Cs allow it, then your good to do as many as you like. Just read the T&Cs again to be sure.alandaniel132 said:I opened Halifax Reward and close my old TSB account and get £100 last 3 days.

Can I open another Halifax Reward and close another old account and get another £100?

They seemed did not mention 1 customer per 1 switch offer.0 -

You won’t qualify for the £100 offer if:

- You are switching to a Halifax Current Account, Basic Account, Student Account, Youth Account

- You are switching into any existing current account

- You’ve received cashback for switching to us since April 2020. We’re sorry but you won’t get it again

4 -

I had a text from Halifax this morning suggesting my switch would start in 3 working days, I set my switch date as 3rd May so I guess that makes sense (7 days switch process)

But there is a slight spanner in the works as I'm switching a Nationwide account which I'm due my final 5% FlexDirect interest payment on my £2500 balance on the last day of this month! (30th April)...am I still likely to receive that now?0 -

I think you'll still get it.

Good planning btw.

Scrounger1 -

Thanks for sharing0

-

I opened a new account on Monday night and selected the earliest date for the switch to complete (next Wednesday). Today, only 3 days later and with the switch not even completed, I have received the £100 incentive. Pretty quick! Well done Halifax.

0 -

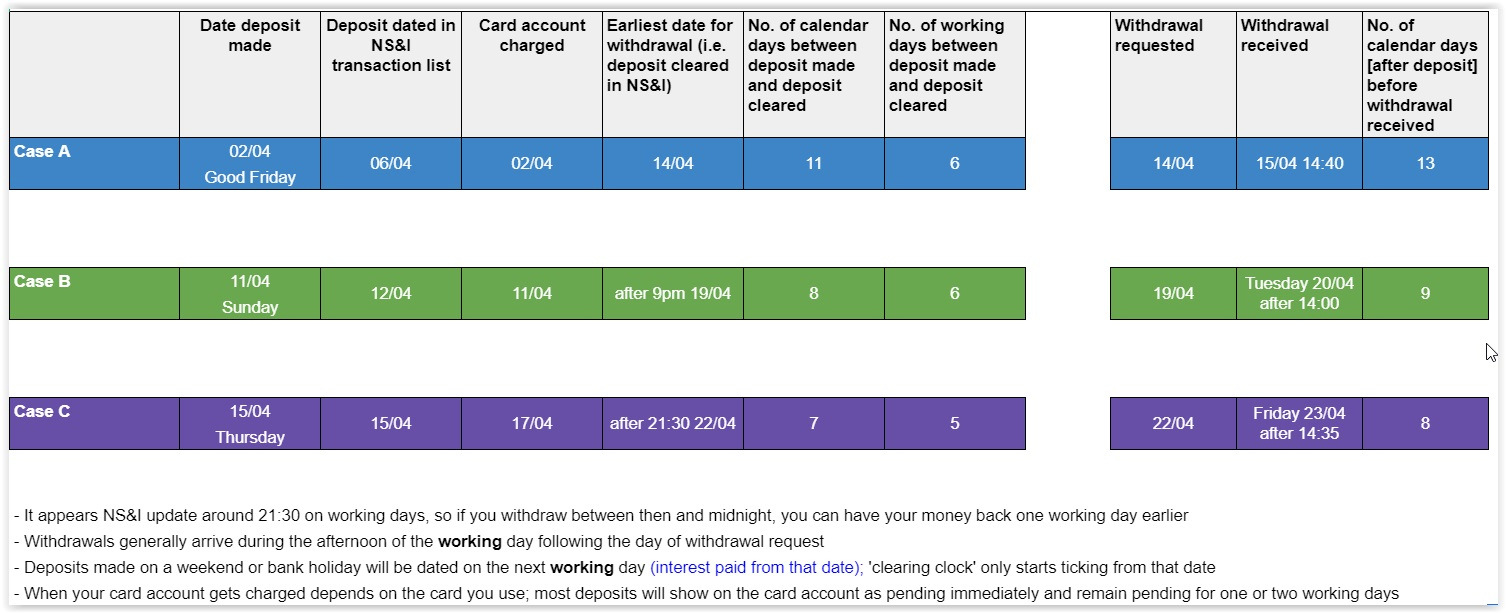

I have now completed my tests and they confirm what I thought was the case - the very earliest you can request a withdrawal of money deposited by debit card into the NS&I Direct Saver is 7 calendar days after deposit. As they are paying withdrawals on the next working day, calendar day 8 is the very earliest you can expect your money back. More likely it's 9-10 calendar days normally, as weekends might interfere, and even longer if bank holidays are involved, too. It's possible in theory that it used to work faster in the past, but I somehow doubt it ever did.Shedman said:

Isn't that just if you deposit at the very end of a month or the beginning of a month as they don't update until 5th for some obscure reason. I'm pretty sure that I've been able to withdraw after 2 or 3 days max if deposited after the 5th. But with NSI nothing seems certain.....colsten said:

Earliest you can take it out is 7 days later.Shedman said:Why NSI Premium Bonds...why not the NSI Direct Saver. Put £501 in, take out £500 a couple of days later

2 -

Sorry if i'm being thick but my intention is to put £5k into the new Reward Account and keep it there, thus getting the £5 per month reward as a form of savings interest.

Will i still have to fund the account with £1500 per month on top to avoid the £3 charge (if so i'll set up a weekly £500 bounce to/from another bank account elsewhere.0 -

Yes - you still need to fund the account monthly to avoid the fee/meet the reward criteriaharz99 said:Sorry if i'm being thick but my intention is to put £5k into the new Reward Account and keep it there, thus getting the £5 per month reward as a form of savings interest.

Will i still have to fund the account with £1500 per month on top to avoid the £3 charge (if so i'll set up a weekly £500 bounce to/from another bank account elsewhere.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards