We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

Apologies for my slow reply, despite my poorly chosen username I am not all that frequently here.darren232002 said:

How about we move this forward a little....

...What does it do to the theory that 'Tether is a crock' if it manages to sustain the peg and maintain redemptions throughout this kind of market volatility?

What does it do? Well, not a lot really. Just as I'm sure they did in the USA many times in days of yore, wildcat banks can survive occasional crises, which doesn't make them a great idea and certainly doesn't mean they'll survive the next one.

I know it's dreadfully tedious for me to keep just referring to FT articles, but there's another timely article this weekend on this very topic.

The thing that would hands-down falsify my view on Tether for me personally would be if they released a complete audit (not attestation) of their assets, which as per the article they point blank refuse to do, despite the fact that they have been one of the direct and explicity stated reasons for the US authorities denying permission for a spot Bitcoin fund.

Until then, what you have is a very large cog in the crypto infrastructure which can't back up its claims and is very susceptible to a run. Not to mention the various misdoings and very peculiar total public absence of the people in charge of it (do you not find that a tadge odd?), or indeed the mystery of how a figure as large as $80bn can be allocated in safe assets with very little evidence of where or what those assets are from anyone outside of Tether.

That's as far as I and I think anyone without insider knowledge can really go, I think. Whilst I suppose it's technically possible they're acting in good faith, it smells incredibly rotten and no-one can really identify any good reasons for the highly suspicious way they behave.

0 -

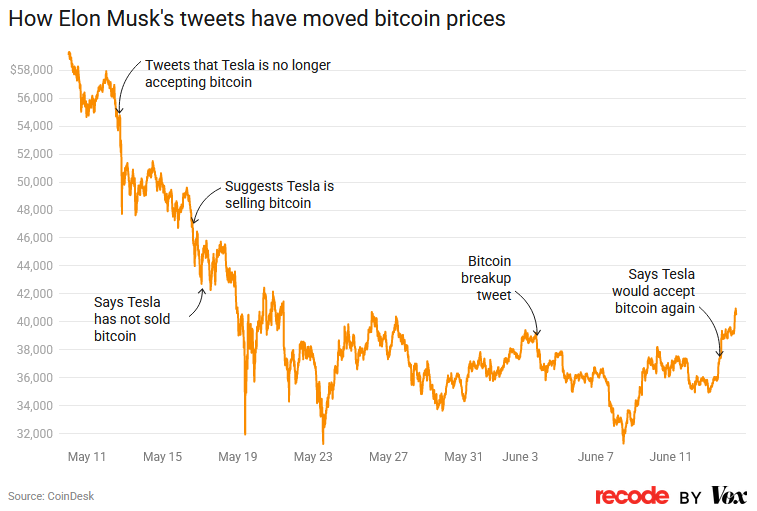

darren232002 said:To take just one point. Elon Musk brought into Bitcoin because he could manipulate the price with one tweet and make shedloads of (real) money. To think otherwise IMHO is very naive.

Bitcon trades billions every day and as we seem to point out repeatedly even Elon can't move such a market by meaningful percentages. (source with more detail)Presumably a 12% dump isn't a "meaningful percentage" to people who are hodling for returns of 200%pa.1

(source with more detail)Presumably a 12% dump isn't a "meaningful percentage" to people who are hodling for returns of 200%pa.1 -

Nothing temporary. This is is the start of the reset. With Central Banks losing control ofinflation. Pouring fuel on the fire by printing money is no longer an option. A return to normality for interest rates which will result in repricing of assets of all classes. Non income generating assets by default will be the ones to suffer the most.darren232002 said:

Everything, including Bitcoin, will be down only for at least a few months more. But the punch bowl is being temporarily removed to be refilled, not taken away.Another dip would hardly be a surprise. Given the far broader clouds hanging over almost every asset class. The great reset will continue for some considerable time. A new era for investors. With the punch bowl of cheap money taken away.0 -

So you're saying bitcoin is dead @Thrugelmir? 🤣0

-

The fad is passing in terms of being an investment.Zola. said:So you're saying bitcoin is dead @Thrugelmir? 🤣0 -

Doesn't generate value? What do you call building wind turbines in Gambia?

https://mobile.twitter.com/farzad23864527/status/1451430597944020994?lang=en-GB

I think some people in here got lost on the way to their boomer stocks threads 0

0 -

A good idea. My portfolio is stocked up with renewable investment. From battery storage, wind, solar, hydro, forestry, charging points etc etc. I don't need to buy a crypto currency to own a share of them though. Just adds an unneccesary layer of risk.mooneysaver said:What do you call building wind turbines in Gambia?1 -

Ah so when you said "no value" you meant "too risky". Careful those goalposts are heavy, you might do yourself some damage if you keep shifting them around so much.0

-

Thrugelmir said:

A good idea. My portfolio is stocked up with renewable investment. From battery storage, wind, solar, hydro, forestry, charging points etc etc. I don't need to buy a crypto currency to own a share of them though. Just adds an unneccesary layer of risk.mooneysaver said:What do you call building wind turbines in Gambia?It always baffles me when people claim that the "revolutionary" feature of crypto is that some of the projects do things like build renewable sites and jointly own them. My portfolio also has plenty of renewable energy investments, and the collective way in which such sites are owned is via a company, so I own shares in that company. Those shares are then valued depending on how much someone is willing to pay for a piece of the overall assets and income. Anyone can buy or sell those shares pretty much instantly using an exchange, and some of the investment vehicles have been around for decades. The difference is that a) my ownership of the shares confers a legal right to income and assets in the event of wind-up and b) the value of such shares is essentially based on the profitability of the underlying asset with various factors influencing whether there is a premium or discount to the net asset value of the underlying holdings. This type of structure is an investment trust, and these have been going as an asset type for over a century.Or, apparently, I could take ownership by buying an asset type where the price is determined almost exclusively by sentiment and influencers, with no real bearing on the actual value of the assets that are owned by the token as a whole. On top of that, it's genuinely questionable in some cases whether owning a token actually grants ownership of anything under actual law.I'll stick with investment trusts!I am a Chartered Financial Planner

Anything I say on the forum is for discussion purposes only and should not be construed as personal financial advice. It is vitally important to do your own research before acting on information gathered from any users on this forum.0 -

If my maths are correct, Safemoon is now worth 1.3% of what it was worth a year ago. Someone will come along in a minute to tell me this is actually a brilliant thing. Never say never, its logo is a rocket after all!, and looking at the tweet threads, Safemoonarmy do appear to have their very own hand gesture. That's not weird in any way.mooneysaver said:Doesn't generate value? What do you call building wind turbines in Gambia?

https://mobile.twitter.com/farzad23864527/status/1451430597944020994?lang=en-GB

I think some people in here got lost on the way to their boomer stocks threads

Re: the wind turbines. Any further details such as where? when? who is financing it? who is going to own it? what % take is going to go towards burning tokens? Let me know when it actually happens please.Edible geranium1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards