We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

Zola. said:

Maybe because the markets haven't actually dropped that much at all eitherThere is a stronger correlation now thats for sure, probably because Wall Street and big institutions have began accumulating etc. Agreed that we could be in for a bumpy few years in all markets.

Overall my S&S ISA hasn't dropped that much yet at all though, given its mostly global trackers.

0 -

Well, I did see that the bigger weighted companies in most indexes, like Microsoft (down 14% in the last month), Apple (-11%), Amazon (-15%), Tesla (-15%), etc.... I had expected an automatic cascade down through the various indexes... was surprised to see it hadn't affected my ISA balance that much... still time I suppose

1

1 -

There are winners and losers.

Have not been seeing as much buy the dip nowadays.

I have never gotten involved but ever so often excitement and dread around.0 -

I wonder how much money that would previously have been pumped into Bitcoin after a 50% dump can't be this time, because it's already been spunked on NFT clip art.

3 -

We can't reasonably expect the huge upswings without having to sit through the downswings, the current dip is a normal occurrence for Bitcoin and something I am happy comfortable with.2

-

We have unlimited ammo to load as we're in ponzi liquidity pools with 700% APYMalthusian said:I wonder how much money that would previously have been pumped into Bitcoin after a 50% dump can't be this time, because it's already been spunked on NFT clip art.1 -

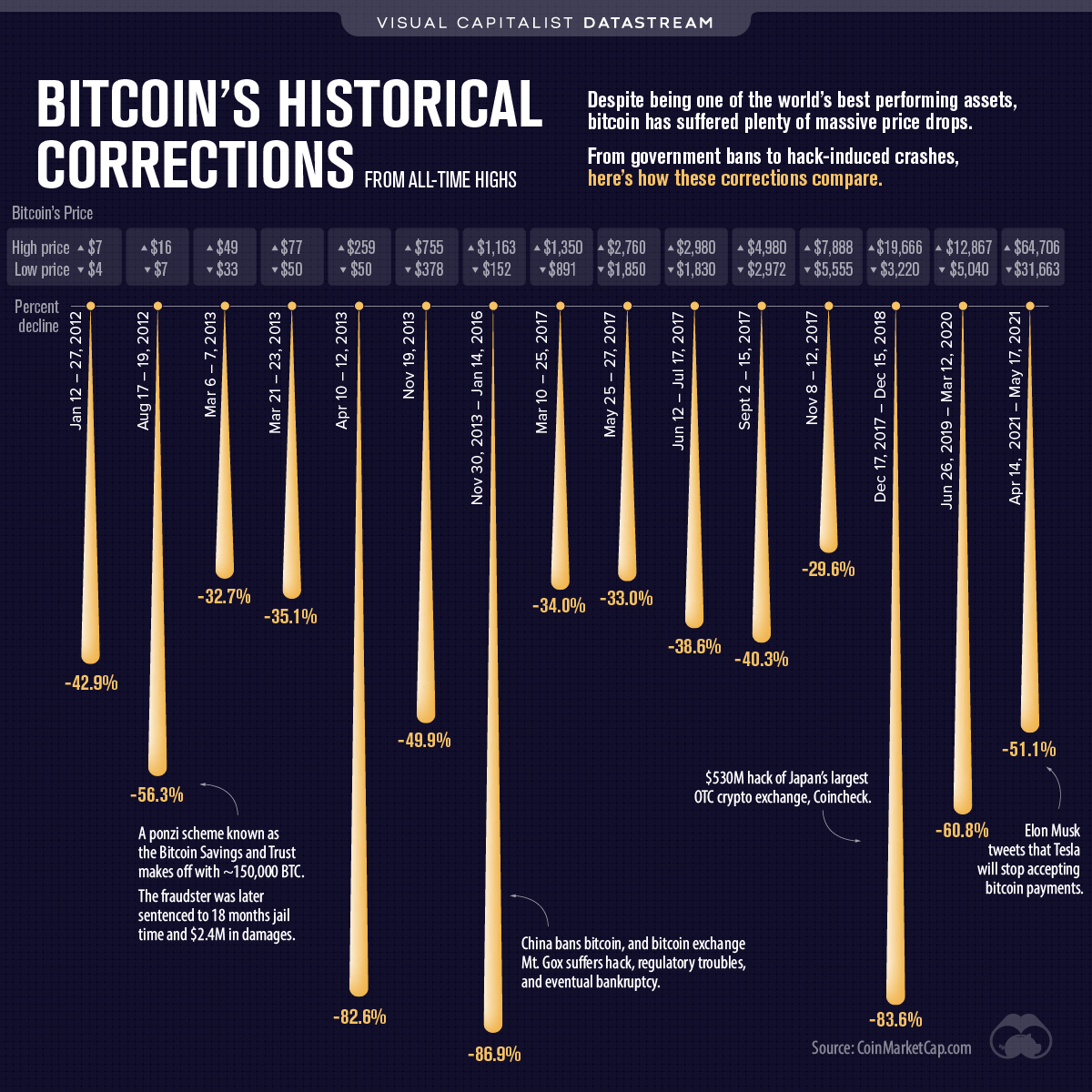

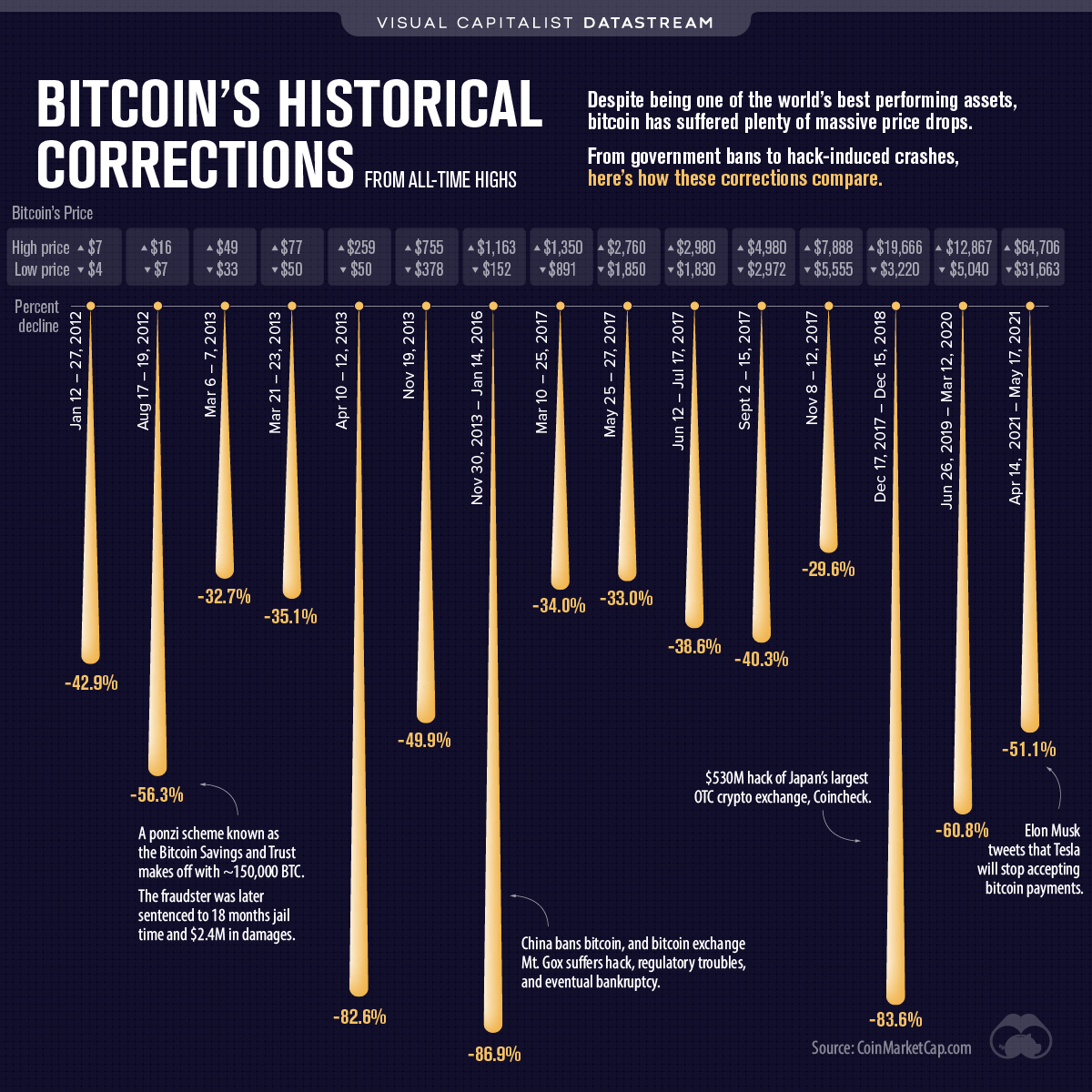

Looking at the Bitcoin all time price chart, maybe not so normal?Adyinvestment said:We can't reasonably expect the huge upswings without having to sit through the downswings, the current dip is a normal occurrence for Bitcoin and something I am happy comfortable with.0 -

lozzy1965 said:

Looking at the Bitcoin all time price chart, maybe not so normal?Adyinvestment said:We can't reasonably expect the huge upswings without having to sit through the downswings, the current dip is a normal occurrence for Bitcoin and something I am happy comfortable with.

Looking at the highs and low prices, its clear... don't buy Bitcoin, because you can be sure its gonna crash! 3

3 -

Ha ha, point taken. I was just looking at the upy downy (technical term) one for all time and the recent months looked a bit different. Obviously I'm not saying that means it's doomed - could go up, could go down from here.Zola. said:lozzy1965 said:

Looking at the Bitcoin all time price chart, maybe not so normal?Adyinvestment said:We can't reasonably expect the huge upswings without having to sit through the downswings, the current dip is a normal occurrence for Bitcoin and something I am happy comfortable with.

Looking at the highs and low prices, its clear... don't buy Bitcoin, because you can be sure its gonna crash! 1

1 -

I love you guys/gals/whatevers. Your money means a lot. At $50 and at hundreds of thousands of you, you really help hold the coin floor. I know this may be a lot of money for many of you. I have been there. In my early 20’s $50 was like $5,000 for me. What I can say is you are doin right by investing at such a young age. These things can take time to develop and when they do they can become the next DOGE. But that took a long time. Be patient with the process. When all you see is RED, buy if you can or tune out if you can’t. SHIB will be around a long time with all the holders and a strong community. We will see some action again soon. Remember, you only lose if you sell, you still own the same SHIB even if it is worth less USD right now. So keep your little $50 in there and God willing it will be a “little $1,000,000” one day. Ignore the angry folks here and the arrogant ones too. Any time you need advice feel free to ping me. I’m no expert, but I know a thing or two. I also know your money is better off in the market than in a bank. Go SHIB!-4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards