We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

BITCOIN

Comments

-

The discussion becomes the dialogue of the deaf when another person is arguing a lot, talking a lot of bla bla bla (like Gretha Thurnberg has decribed it); start accusing another person is making it up, liying but he does not do his own homework.bugbyte_2 said:WHO?

WHO apart from your good self keeps posting about WB and CM? is there a MoneySavingExpert Buffett appreciation thread I have completely missed? Has Munger done something unspeakably bad to your cat for you to keep bringing his name up? Every other post you mention them, plus the hordes of non existent posters who apparently keep bringing them up.

Secondly, whats your point? Lets name a couple of companies that have been successful whilst completely ignoring the literally thousands of other companies that also didn't make a profit in the early days and guess what? they never made a profit and then popped out of existence. What can I say? I personally lent Mark Zuckerberg his seed money? about as probable as saying I put my life savings on Bitcoin in 2015 - wasn't I clever?It took me sometimes to find it out but you have got do something preventing people might call you a liar. Just imagine when the original poster has deleted his original post. I will remain as a liar in this thread

The second point is another dialogue of the deaf. I will just throw out these buzzwords.

Bitcoin vs Shitcoin

OTC Penny stocks P&D vs Blockbuster IPOs of high growth stocks

Nikola Vs Tesla

Real time information vs Hard copies of Newspapers delivered by snailmail in the past

DDsRisk vs RewardsYou take that decision in every aspect of your life. You took that decision when you choose between Investing vs Saving, LT investing vs Short Term Investing. Put your money into saving nothing wrong with it as long as you are not complaining when you get <1% interest per annum, while some people might get that in less than a week.

I am not saying everyone could figure it out. But the final phrase is that “Fortune favours the brave” like this video clip featured with Matt Damon.

0 -

I know right.darren232002 said:

This will not age wellHexane said:That was on 13th April 2021. Six months down the line, BTC seems to be at around $59,000

So it's gone basically nowhere in that time, other than down a lot and back up again.

Need another "few months"?

So in April it was going to US$100,000 in "a few months", in October it was around $59,000 ... and now it's around $60,000

we need a few months more I guess7.25 kWp PV system (4.1kW WSW & 3.15kW ENE), Solis inverter, myenergi eddi & harvi for energy diversion to immersion heater. myenergi hub for Virtual Power Plant demand-side response trial.1 -

adindas said:What probably some people are not aware of because they keep living in their own compound is that there are REASONABLE number of active retail investors constantly get 30%+ year after year. So expecting to get the return of 30%+ is not like expecting people to make you living forever. Thanks to major cryptos, good high growth stock, near zero fee platform for trading and investing such as eToro, Trading 212, Robinhood, Freetrade, WeBull, Stake, MooMoo, etc.If you can find enough bros who think it's reasonable to lose a sum equivalent to a third of your hodlings every year, year in year out, solely so that you can get rich quick, then all power to you. Punters' money in == punters' money out.FAOD, if you can invest a mere £10,000 at age 30 and cash out just shy of £2 million at 50, or just under £100 million at 65, that = getting rich quick.MATT DAMON!1

-

Every single person who has held bitcoin for four years has made money, often significant sums of money. Those who panic sold in the inevitable cycle dips usually lost money.0

-

Again, market timing and selecting a specific time period with an extremely endpoint sensitive asset.Zola. said:Every single person who has held bitcoin for four years has made money, often significant sums of money. Those who panic sold in the inevitable cycle dips usually lost money.0 -

No marketing timing about it, quite the opposite actually. You could buy the top of any cycle, and thus far as long as you have held for 4 years, you are in profit.0

-

Likewise for you.0

-

Why don't you re read what bugbyte said, he said who keeps posting about wb?

I did say adindas you took my comment out of context in a later post as you kept banging on about WB, for the record I'm not everyone I'm one person.

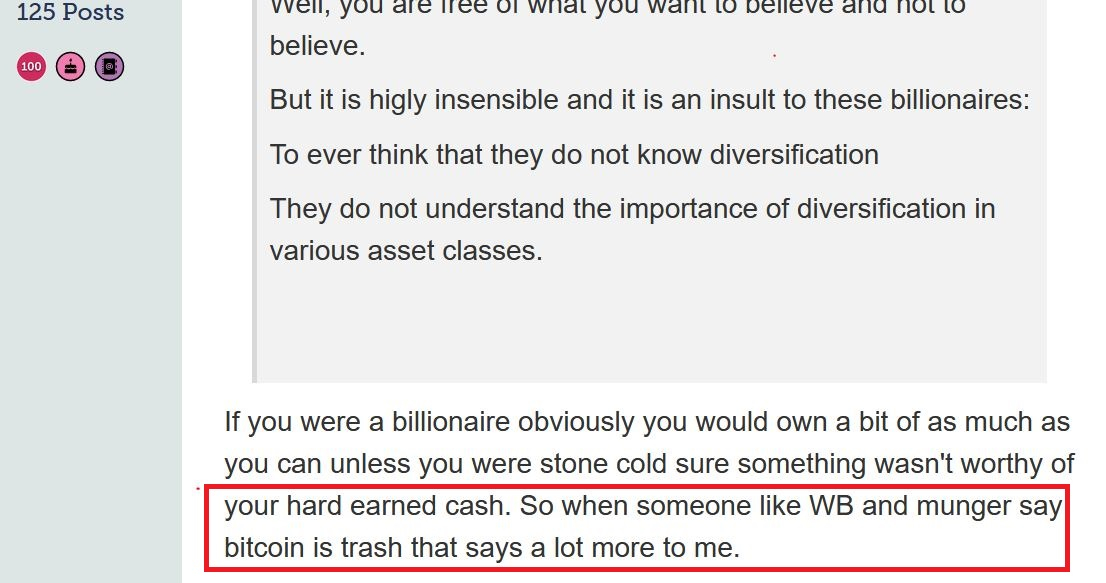

I don't follow WB but i have obviously seen some stuff of his and I've watched some stuff from CM as well, i didn't make a decision to not get involved in BTC because of WB, the point was you was talking about michael saylor and other billionaires and i made a point regarding WB comment who is also a billionaire.

You and others keep posting about 200% gains and 1k into 220k in 5 years, those are past returns your not going to turn 1k into 220k.

You keep talking about 1% interest and then say don't complain, no one is complaining only you taking the !!!!!! out of others. I don't care for measly rates or bonds either but some people do, some don't need to take much risk because either they don't want to or they don't have to.

.

0 -

200x in 5 years does seem far too good to be true / rather unrealistic, but it has happened before, so who knows? I do believe in the law of diminishing returns...

What if someone said you could potentially 5x, 10x your return in 5 years? Would you take it? Worth a hedge? I think so. Remember this isn't a tiny "bro asset" as some of the clowns here like to keep inferring. It is growing on a daily basis and changing real businesses from small shops, to multinational public companies.

You only have to look back at some of the slightly older bitcoin threads to see how utterly wrong people have been thus far.

Either way, I hope this thread is still going in five years' time, to review results.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=9hBC5TVdYT8

https://www.youtube.com/watch?v=9hBC5TVdYT8