We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

BITCOIN

Comments

-

Fair, but only Reddit kids or people with insane risk tolerance would do it that way. Most people would try to diversify through various types of assets at least. There’s still people holding half of their NW in crypto who laugh in disbelief as some 18 year old kid turns 20k into 10m on dog money.Agree, there are no right or wrong answers. But a large number of people would consider investing most of your portfolio in one share, coin etc as 'gambling'.

You might have 100% conviction on the 4.20 at Aintree, but others will call it gambling.

I guess the beauty of it is the pro crypto people are generally sub 40 so don’t care if they blow up their accounts a few time. Horses for courses1 -

Agreedadindas said:

US$ 66k+ now.Hopefully not, but you might get attacked by the people on this thread who do not like it, who have missed the boat that will shout; you are a scammer, a pumper, a gambler because Charlie Munger and Warren Buffet said so.Zola. said:New all time high

BoomSimilarly, to TESLA – TSLA (or similar high growth) stock when they were still below $1,000 before the stock split last year.

Once you mention Tesla here on MSE, you would get attacked by the same sort of people who only know about Vanguard Lifestrategy or saving account, because you have touched their comfort zone. Now Tesla are already $865+, e.g., equivalent to $4,325 before the stock split.

If you blindly listen to these sort of people without doing my own DD, you would have missed a lot of opportunities in the market.

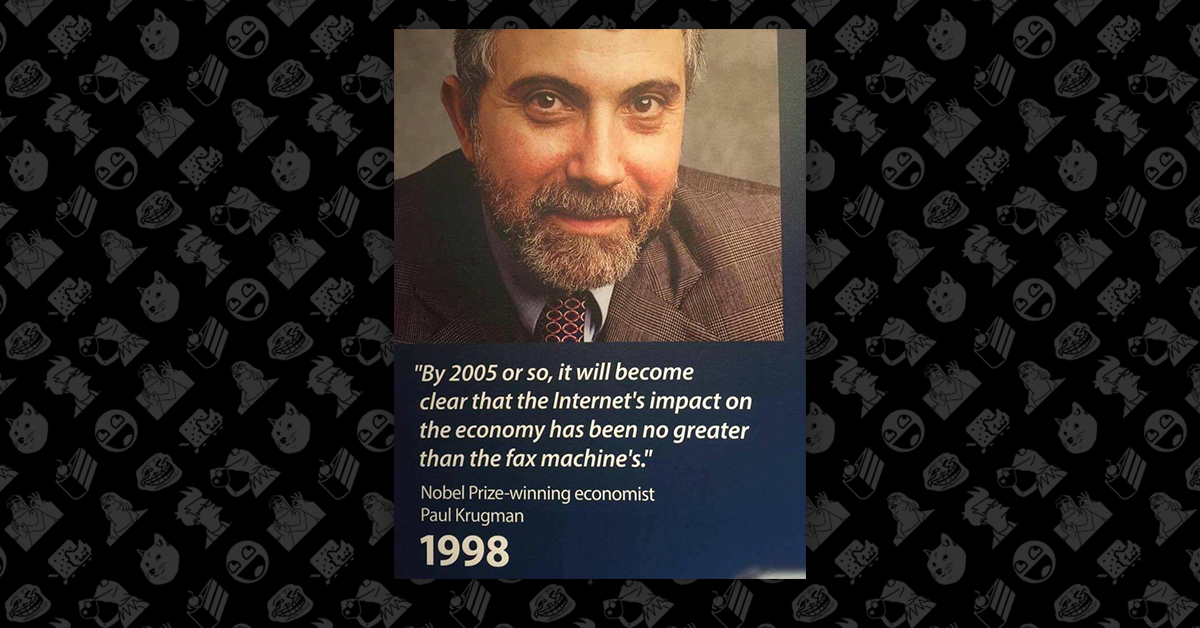

I like the quotation of this famous person.

Also, this one is worth sharing.

1 -

0

-

Scottex99 said:

Fair, but only Reddit kids or people with insane risk tolerance would do it that way. Most people would try to diversify through various types of assets at least. There’s still people holding half of their NW in crypto who laugh in disbelief as some 18 year old kid turns 20k into 10m on dog money.Agree, there are no right or wrong answers. But a large number of people would consider investing most of your portfolio in one share, coin etc as 'gambling'.

You might have 100% conviction on the 4.20 at Aintree, but others will call it gambling.

I guess the beauty of it is the pro crypto people are generally sub 40 so don’t care if they blow up their accounts a few time. Horses for coursesWell, this is really the point of taking a calculated risk (Risk vs Reward) in investment is it not? And any investment will always involve some level of risk.

If after his own DD he believes that this asset could turn US$20k into US$10m (say like the above example) and he is using the money he could effort to lose, then he should gives it ago. RISK he might lose US$20k, REWARD he might turn the investment into US$10m.

Nowayds there are a lot of analytical tools, probabilistic model, info / online news in real time, analyst prediction that might help in making conviction.

The best stock picker in the world now is "Nancy Pelocy"

https://www.thesun.co.uk/news/15549573/pelosis-husband-5m-11m-big-tech-stocks-insider-trading/

NANCY CASHING IN? Pelosi’s husband rakes in $5M profit after buying $11M in big tech stocks as critics accuse couple of ‘insider trading’

If you could get info in real time, insider information of what Nancy Pelocy (or her husband) was buying that it might be worthy to follow her.

Some people might call it gambling but this person makes this decsion after doing his own DD and he has made his own conviction.

Keep in mind people has a difference risk tolerance. No one rational will take unnecessary risk for nothing.

0 -

Let's not get confused between a long term investment in Bitcoin, and kids on Reddit putting money into Safemoon.

These kids have only a few dollars to put in. Even an asset that goes up 100% in a year is no good to them.

They are looking for their $100 gamble to turn into a life changing amount.

It's a bit like them putting their money into Gamestop or AMC.

Just because those "meme" stocks are listed on the stock exchange doesn't mean the whole of the stock market is a scam.

And just because you have people gambling on s**tcoins does not mean that Bitcoin is a scam.

3 -

There's bitcoin, then there are shitcoins.1

-

This is key. As this is a Savings and Investment forum the comments I make are purely on the basis of using crypto as a sensible way of changing one's life - "serious" investing. If it's done for fun with money whose loss would not change your life then you are in a different ballgame. As a hobby, I can see quite a few advantages of crypto beyond simple fun and excitement, particularly educational ones. A basic understandiing of finance is becoming essential for many people by the time they reach the age of 40.Scottex99 said:

Fair, but only Reddit kids or people with insane risk tolerance would do it that way. Most people would try to diversify through various types of assets at least. There’s still people holding half of their NW in crypto who laugh in disbelief as some 18 year old kid turns 20k into 10m on dog money.Agree, there are no right or wrong answers. But a large number of people would consider investing most of your portfolio in one share, coin etc as 'gambling'.

You might have 100% conviction on the 4.20 at Aintree, but others will call it gambling.

I guess the beauty of it is the pro crypto people are generally sub 40 so don’t care if they blow up their accounts a few time. Horses for courses4 -

Yep, agreed.

I started with $200 each in about 5 coins that were listed on eToro in Dec 17.

Was just a fun punt back then but it’s also completely changed my life now, both financially and what I do for a living1 -

Pretty big week for Bitcoin news

The 2nd US Bitcoin ETF launches today

US RIA's (I think the US equivalent of our IFA's) can now offer their clients crypto

The world's largest retailer Walmart is putting Bitcoin ATMs in their shops

Being able to have Bitcoin in their pensions and seeing Bitcoin machines when you do your grocery shopping feels a very long way away for the UK, but from an American point of view Bitcoin has got to be getting to the point that it is considered mainstream.0 -

Today's news (stolen from Coin Bureau newsletter):American supermarket giant, Walmart has announced plans to install a full 8,000 Bitcoin ATMs in its stores and has recently completed the introduction of an initial 200, as a pilot project.These ATMs will allow customers to purchase and claim BTC via a redemption code but will not, for the time being, facilitate the withdrawal of BTC based funds.Although some users have voiced concern over the transaction fees involved in utilizing these ATMs, I see this as a great step toward mass adoption. Even those who spend little-to-no time on the web, will now be exposed to cryptocurrency…0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards