We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Possible £100 Halifax switch offer starting 4/8/20

Comments

-

To spell out my understanding for Point 2, from what I've seen of it in action initially you select a reward which runs for a 12 month period as you've stated - once you've picked one you are locked in and can't change until the 12 month period finishes. To subsequently qualify for each of the monthly rewards within that 12 month period, then the qualifying period is that particular calendar month (ie. you need to make your debit card spend so it clears within that particular month). Once you qualify for the monthly reward, then it is subsequently paid out around the 12th of the following month. By the same token there's nothing to stop you getting a reward for the first month when you open the account, so long as you can meet the requirements by the end of the month in question (which is a good reason why you should open your account towards the start of the month!). I believe the question was asked as some banks (eg. Tesco) have a statement/reward period starting on the monthly anniversary of when the account was opened.masonic said:Deleted_User said:I just spoke to Halifax. Sorry if this has already been covered but

1) The bonus is being paid within 7 days AFTER the switch is completed, not as it states on the main site as 7 days after you've started the switching process.

2) It's a calendar month so if you opened the account with £5000 on August 2nd and kept it there until the end of August you are not entitled to the £5 reward.The person you spoke to at Halifax got it wrong on both counts...Point 1 is covered in the T&Cs of the switching offer, which states "The offer will be paid directly into your account by the time your switch has completed and will appear as a cash credit. The offer is not available to employees of Lloyds Banking Group, or if the employee is named on any bank account held in joint names."Point 2 is covered in the post above yours, the T&Cs state: "The Offer starts on the day you select it and lasts for a minimum of 12 full months. For example, if you select the Offer on 10th November 2020, it will end on 30th November 2021. If you keep a balance of £5,000 or more in your account from 10th – 30th November 2020, you will receive the Offer for that month."See https://www.halifax.co.uk/assets/pdf/bankaccounts/banking-offers-guide.pdf0 -

My switch completed earlier today. No £100 in my account yet.Update - 21.45 - It is now.

0

0 -

Just had my bonus paid in after switch completed today.0

-

Switch complete today. No dosh for me yet. Dont want to mess with the £500/£5000 business, or incur a fee. Can I change/downgrade to another account? Cant see any online options. Must it be a phone call?0

-

You can change accounts online easily. On the left hand side once logged in there is "current account options" under which is "change account type."castle96 said:Switch complete today. No dosh for me yet. Dont want to mess with the £500/£5000 business, or incur a fee. Can I change/downgrade to another account? Cant see any online options. Must it be a phone call?

I would personally wait until you have the switch money before doing anything though. The fee is only payable if you don't pay in £1500 this calendar month so you've plenty of time to either do that or change the account after you've received the switch bonus.0 -

My £100 now arrived - a little late, but appreciated nevertheless.

Now just have to decide which Reward option to go for, though it's really a no brainer I think: the £500 debit card spend is better value than 5k in the account. I can earn money on 5k elsewhere.3 -

Absolutely, it's per calendar month, but if you add or renew Reward Extras part way through the month, then you only need to meet the minimum balance requirement for the part of the month Reward Extras was active. The response from Halifax that "It's a calendar month so if you opened the account with £5000 on August 2nd and kept it there until the end of August you are not entitled to the £5 reward", is wrong. Assuming you added Reward Extras on the same day you opened the account (2nd August) and had £5000 in the account from the end of that day, you would qualify for the £5 reward in August. If you added Reward Extras on a later date in August, then you wouldn't even need to have the £5000 in your account from 2nd August to qualify, provided it was there by the end of the day in which you added Reward Extras.PRAISETHESUN said:

To spell out my understanding for Point 2, from what I've seen of it in action initially you select a reward which runs for a 12 month period as you've stated - once you've picked one you are locked in and can't change until the 12 month period finishes. To subsequently qualify for each of the monthly rewards within that 12 month period, then the qualifying period is that particular calendar month (ie. you need to make your debit card spend so it clears within that particular month). Once you qualify for the monthly reward, then it is subsequently paid out around the 12th of the following month. By the same token there's nothing to stop you getting a reward for the first month when you open the account, so long as you can meet the requirements by the end of the month in question (which is a good reason why you should open your account towards the start of the month!). I believe the question was asked as some banks (eg. Tesco) have a statement/reward period starting on the monthly anniversary of when the account was opened.masonic said:Deleted_User said:I just spoke to Halifax. Sorry if this has already been covered but

1) The bonus is being paid within 7 days AFTER the switch is completed, not as it states on the main site as 7 days after you've started the switching process.

2) It's a calendar month so if you opened the account with £5000 on August 2nd and kept it there until the end of August you are not entitled to the £5 reward.The person you spoke to at Halifax got it wrong on both counts...Point 1 is covered in the T&Cs of the switching offer, which states "The offer will be paid directly into your account by the time your switch has completed and will appear as a cash credit. The offer is not available to employees of Lloyds Banking Group, or if the employee is named on any bank account held in joint names."Point 2 is covered in the post above yours, the T&Cs state: "The Offer starts on the day you select it and lasts for a minimum of 12 full months. For example, if you select the Offer on 10th November 2020, it will end on 30th November 2021. If you keep a balance of £5,000 or more in your account from 10th – 30th November 2020, you will receive the Offer for that month."See https://www.halifax.co.uk/assets/pdf/bankaccounts/banking-offers-guide.pdf

1 -

Switch confirmed and £100 in this pm.0

-

My switch completes tomorrow but I've already picked the £5/m reward and paid in £1500 but since have opened a Post Office saver and done 2 x £250 payments using the new Hfx card. Both show as pending under transactions.Zanderman said:My £100 now arrived - a little late, but appreciated nevertheless.

Now just have to decide which Reward option to go for, though it's really a no brainer I think: the £500 debit card spend is better value than 5k in the account. I can earn money on 5k elsewhere.Once the switch completes and stuff I'll move the grand back to my other pot and then take the £500 from PO in a week or two once I get all paperwork etc for that.Seems a real easy process, like 5 mins work to get the fiver. Suits me.0 -

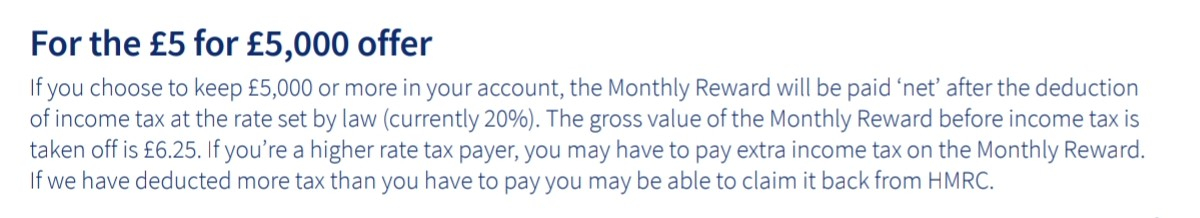

Anyone know if you choose the £5 for £500 debit card option if this still applys

Typically confused and asking for advice0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards