We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Suggestions for a speculative punt?

Comments

-

Thrugelmir said:Current plan. Do very little. As I totally realigned my portfolio earlier in the year. Top slice the outperformers. Cull the disappointing underperformers . Sit on the cash generated and wait for buying opportunities (individual shares) to materialise. There's some companies/sectors that I'm more than happy to leave to the speculators.From what I have learned from previous lockdown, people have been advised to focus more on Megacap companies such as Amazon, Google, Apple, Microsoft, when the stock marke is already aound the bottom as these companies are likely to recover much quicker than other companies.Alternatively, for current investment I might be adding my chinese stocks such as Nio, Niu, Tencent, DouYu, Xpeng mas it seems their stock are not effected by the spike of infection in europe.0

-

I've sold some of my Tencent yesterday (my largest individual company equity holding) to free up some cash for a potential buy into Ant Group once the shares are on the secondary market at the end of next week.adindas said:Alternatively, for current investment I might be adding my chinese stocks such as Nio, Niu, Tencent, DouYu, Xpeng mas it seems their stock are not effected by the spike of infection in europe.

However as it's not possible to get in on the IPO itself (which was oversubscribed), and the price will no doubt go crazy once it starts trading late next week (huge retail interest), it may be that it ends up at a ridiculous price before it's possible to buy in from the UK, so I may not end up going ahead until the excitement dies down. At the moment it's pretty difficult to figure out what I think a not-ridiculous price would look like, so I may end up just putting less into it and crossing my fingers on it working out OK in the long term despite a high entry multiple. I do have some exposure to it through Alibaba and SMT anyway, so may see sense and scrap the idea

2 -

Yeah $3 trillion of retail investor money that tried to get in on the IPO is likely to make it pretty volatile for a while.bowlhead99 said:

I've sold some of my Tencent yesterday (my largest individual company equity holding) to free up some cash for a potential buy into Ant Group once the shares are on the secondary market at the end of next week.adindas said:Alternatively, for current investment I might be adding my chinese stocks such as Nio, Niu, Tencent, DouYu, Xpeng mas it seems their stock are not effected by the spike of infection in europe.

However as it's not possible to get in on the IPO itself (which was oversubscribed), and the price will no doubt go crazy once it starts trading late next week (huge retail interest), it may be that it ends up at a ridiculous price before it's possible to buy in from the UK, so I may not end up going ahead until the excitement dies down. At the moment it's pretty difficult to figure out what I think a not-ridiculous price would look like, so I may end up just putting less into it and crossing my fingers on it working out OK in the long term despite a high entry multiple. I do have some exposure to it through Alibaba and SMT anyway, so may see sense and scrap the idea 0

0 -

I had my spring clean when the first lockdown was announced mid -March-----a lot of hospitality and travel stock was removed at reasonable prices ( which are now abysmal prices ). Since then, I have mainly done as you have done, but not culled very much , other than the most vulnerable sectors as mentioned above. Tempted to take large profits on part of my Astra Zeneca stock but finally decided to leave all 4,000 shares in my portfolio, in spite of advisors' views to the contrary. I wonder if they will win the vaccine race ? Whether or not, I don't see any major effect.Thrugelmir said:Current plan. Do very little. As I totally realigned my portfolio earlier in the year. Top slice the outperformers. Cull the disappointing underperformers . Sit on the cash generated and wait for buying opportunities (individual shares) to materialise. There's some companies/sectors that I'm more than happy to leave to the speculators.

But my reason for writing on this thread today, which I usually avoid, is to celebrate my shares in McCarthy & Stone which have risen by 40% on the back of news of agreed takeover. I never thought my old M&Stone shares would ever amount to much----and I never expected a takeover; such is the sheer luck of the markets.

That success helps to outweigh the slight concerns I have about my "favourite" shares ( Ocado) , the number of which I have increased enormously during this year though I have held shares since floatation in 2010. Now Ocado is facing a threat from a Norwegian company claiming patent infringement on some of its robotics tech. Ocado has been my biggest ever success, rising 90% in 2020----the highest riser in the FTSE 100. I now have the tricky decision as to whether to cash in part of my holdings or wait out the current hiccup ( assuming it IS a hiccup----I think so). With Ocado having over 200 separate patents, I am minded to stay firm but if anyone has any views I would be grateful to hear them please.

0 -

In the market crash like this is one of the most important phrase I will always remember in the stock marker lesson:"Don’t try to catch a falling knife”“Wait for the price to bottom out before buying it.”

0 -

The bottom will have been and gone before you realise it.adindas said:In the market crash like this is one of the most important phrase I will always remember in the stock marker lesson:"Don’t try to catch a falling knife”“Wait for the price to bottom out before buying it.” 3

3 -

Thrugelmir said:

The bottom will have been and gone before you realise it.adindas said:In the market crash like this is one of the most important phrase I will always remember in the stock marker lesson:"Don’t try to catch a falling knife”“Wait for the price to bottom out before buying it.”

True but the bottom does not mean at the very bottom, around the bottom is already acceptable. I know the anaylysts are using technical indicators such as moving avarage to estimate it. Additionally, when they start moving sideways.

0 -

Research Akero Therapeutics Inc

0

0 -

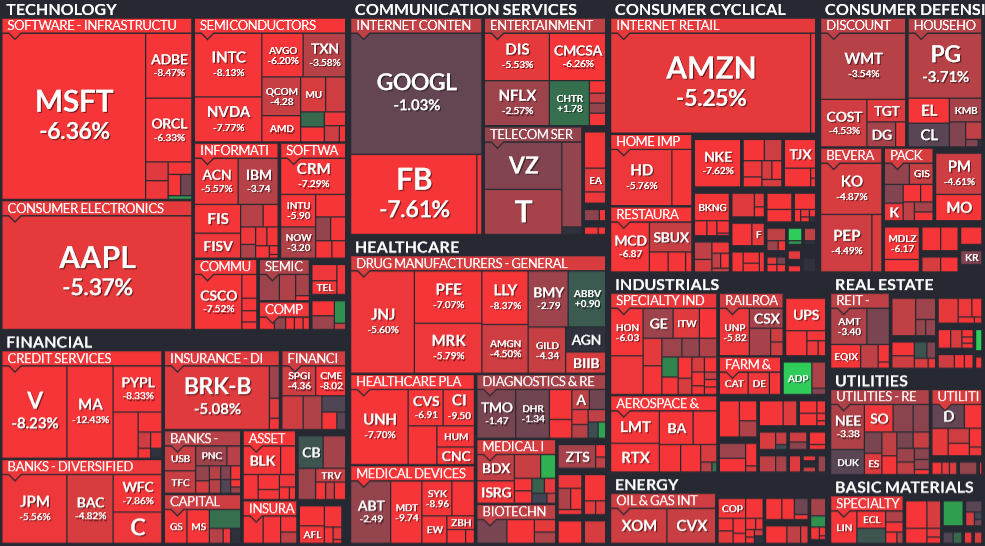

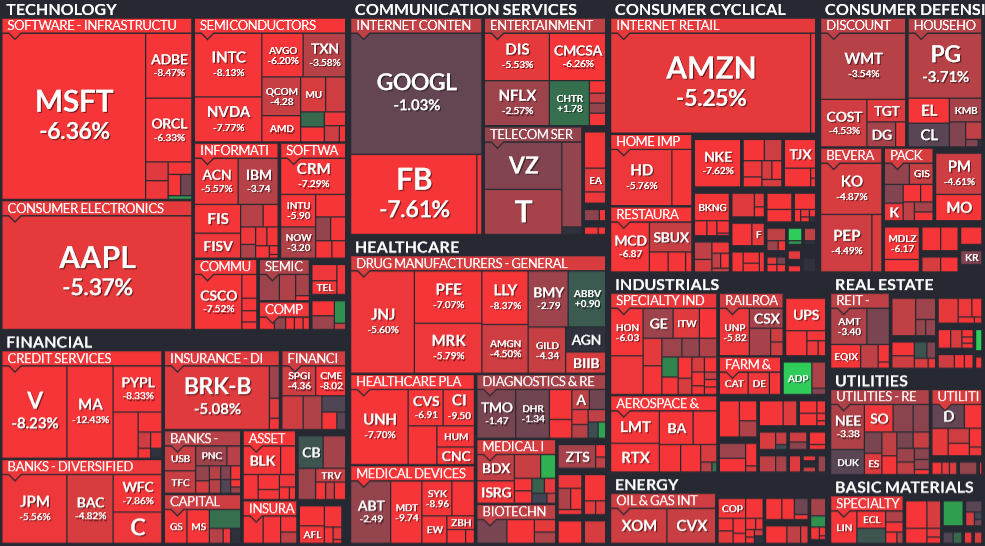

Heat Map of S&P 500 Performance for the whole week last week. The quotation from contrarian investing strategy :Baron Rothschild "the time to buy is when there's blood in the streets"John D. Rockefeller "The way to make money is to buy when blood is running in the streets"Warren Buffett "Be fearful when others are greedy, and greedy when others are fearful,"

0 -

Uh huh.adindas said:Heat Map of S&P 500 Performance for the whole week last week. The quotation from contrarian investing such as Baron Rothschild "the time to buy is when there's blood in the streets"

Better pile into RCP then. They can't do worse than the last 12 months.

https://forums.moneysavingexpert.com/discussion/6037441/zingpowzing-v-bowlhead-challenge#latest

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards