We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

In the context I think Gohan means "small holding" rather than "small S&P companies".A quick look on Morningstar says there are a handful of ETFs tracking the S&P SmallCap 600 available in the UK.1

-

Sorry just S+P tracker, not small capsadindas said:

S&P small cap is S&P600 is it not ?? I wonder where to get S&P600 in the UK ?csgohan4 said:

You'd be surprised, there are some people I've seen do exactly that, riding on the US wave, which sadly is now on the downturnThrugelmir said:I doubt many UK investors have a portfolio that consists only of the S&P 500.

Luckily I sold my Small S+P tracker 1 year ago"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

People will hold an electic variety of investments. My comment was in the context of many. Somewhat different to having an element of exposure. If the SP500 was a popular destination it would be apparent from the posts made on the forum. I suspect SMT ranks far higher.csgohan4 said:

You'd be surprised, there are some people I've seen do exactly that, riding on the US wave, which sadly is now on the downturnThrugelmir said:I doubt many UK investors have a portfolio that consists only of the S&P 500.0 -

I too sold much of my US investments 1 year ago. Not sure I would call that lucky as the increase in S & P 500 over 12 months even now is still almost identical to the rise in FTSE 100 over the same period, The FTSE all share has performed significantly worse than both S & P and FTSE 100 in 12 monthscsgohan4 said:

You'd be surprised, there are some people I've seen do exactly that, riding on the US wave, which sadly is now on the downturnThrugelmir said:I doubt many UK investors have a portfolio that consists only of the S&P 500.

Luckily I sold my Small S+P tracker 1 year ago“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

adindas said:

Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.

Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.When they said they will not do anything in the next three week the market will response well, but when they said, they will be more aggregative to combat inflation, rising IR earlier than expected, will start offloading its bond that is where the market will tank.

The god casted his spell yesterday January, 26 2022.The market started green, good sentiment, but as soon as he casted his spell the market dropped lower than 2% in less than one hour.

How does it felll guys.:*

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.

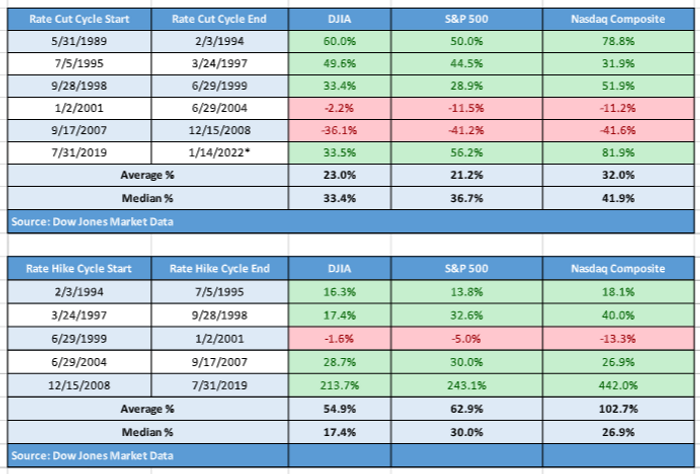

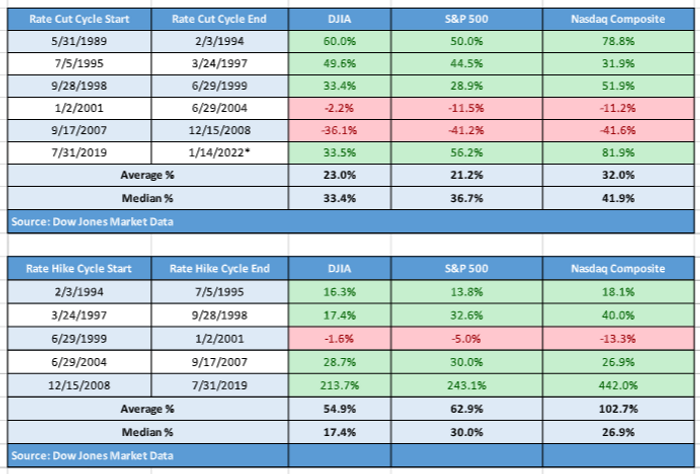

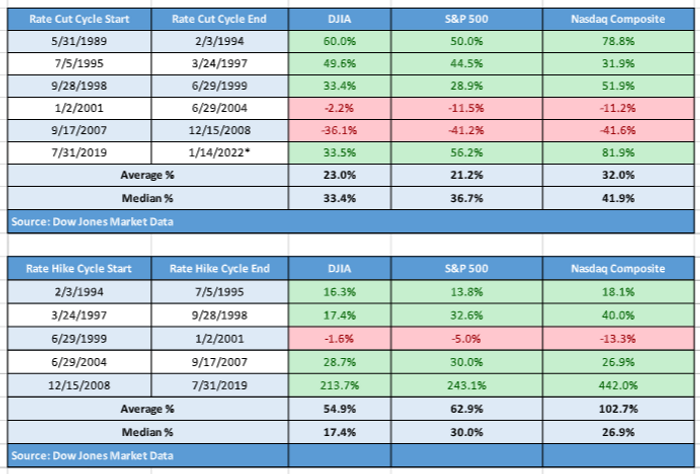

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.But here are the statistics says regarding, the relation interest rate hike and what happen to the stock market thereafter. It is actually good for the long term.

0

0 -

Amazon will publish its earning on Thursday February 3rd “after the Market close”. Like Mega caps stocks such as Apple did last week. It will dictate the direction of the high-tech stock and indexes and stock market in general markets.Amazon crash the earning given that there is no bad news to supress it, there is high probability the stock market will go green, otherwise will tank ?On Friday Morning February Friday 4rd there will also be a report about the job report. The Amazon earning result might be suppresed by the news about the job report.

Facebook (Meta Platform) reported earning yesterday, the stock tank time to get in??

Now a lot of people are talking about getting in in Alphabet (GOOG, GOOGL) after reporting beating earning and stock split 1 for 20?

I am a contrarian, so while people get in in Alphabet that will push the price further up, I will do the opposite will add FB stock while in the major discount as FB has invested billions of dollars in Metaverse. In the long run they will become one of the main players of the Metaverse along with Unity, Roblox, Microsfot, Amazon. NVidia.

Also FB (Meta Platform) missed on earnings, but beats on revenue

0 -

FB spent billions of $ buying back shares at at average price of $333. Shareholders would have been better rewarded with a dividend. FB are suffering from lower than expected advertising revenues. Perhaps the best days of growth are over for a while. Subscriber numbers have dropped for the first time on record. There are only so many people and hours in a day. Plenty of new and exciting places for the young to hang out. Facebook being for the grumpy oldies more and more.1

-

Ford (F) missed EPS and revenue Feb 3, 2022. The stock down -3.6% and another -4% after hours. Time to get in or adding position ??

https://www.youtube.com/watch?v=dddaOdJdzIk

https://www.youtube.com/watch?v=dddaOdJdzIk

Ford will be one of the biggest players in the EV industry. They just invested a lot of money for their EV division. Ford (F) is Bluechip Quality Stock and is in S&P 500 index.

0 -

You have already posted these statistics and it has already been explained to you the many issues with them (choice of date ranges, terminology, numerical errors) - it seem to me this table is a pretty clear cut case of "I have a conclusion now how can i make the stats fit it'.adindas said:adindas said: Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.

Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.When they said they will not do anything in the next three week the market will response well, but when they said, they will be more aggregative to combat inflation, rising IR earlier than expected, will start offloading its bond that is where the market will tank.

The god casted his spell yesterday January, 26 2022.The market started green, good sentiment, but as soon as he casted his spell the market dropped lower than 2% in less than one hour.

How does it felll guys.:*

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.But here are the statistics says regarding, the relation interest rate hike and what happen to the stock market thereafter. It is actually good for the long term.

3 -

grumiofoundation said:

You have already posted these statistics and it has already been explained to you the many issues with them (choice of date ranges, terminology, numerical errors) - it seem to me this table is a pretty clear cut case of "I have a conclusion now how can i make the stats fit it'.adindas said:adindas said: Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.

Both of these guys are already like god. Just watch out what they will spell out this coming Wednesday.When they said they will not do anything in the next three week the market will response well, but when they said, they will be more aggregative to combat inflation, rising IR earlier than expected, will start offloading its bond that is where the market will tank.

The god casted his spell yesterday January, 26 2022.The market started green, good sentiment, but as soon as he casted his spell the market dropped lower than 2% in less than one hour.

How does it felll guys.:*

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.

:*This CNBC article is summarising what the FED saidWe are all in the same boat. From now on good to put on the diary when the god gives an update. Normally they do it every three weeks. The spell is either "hawkish" The market will dip or "dovish" the market will response favourably. Also they will announce interest rate hike in March.But here are the statistics says regarding, the relation interest rate hike and what happen to the stock market thereafter. It is actually good for the long term.

Indeed, the sample is too small to determine a more accurate Median, i fully agree with that. But when you have very limited time and data you will need to use what you have. It is better than nothing, it is not? Keep in mind the interest rate changing a few times a year by the central bank only happen once in every few years in a history. If you have more data so we could have more accurate result please free to add it.

Even you have thousands of data, which in the above case is almost impossible people should never use the statistics in isolation in making decision as in the stock market there is also a dominant factor, e.g human behaviour, irrational exuberance that is almost impossible to model it in statistics using numbers and figures.

Ignoring the terminology. Mean/Average at least the people could see the data that has been gathered from various years ranging from 1989-2022. At least those who gather those data (not me) saves people time rather than you sourself spend time collecting that data.

I believe those who produce that table prefer to use the term "average" instead of "mean" as it is posted to general public, where people are more familiar with the term "avarage". This is not presented in the science & mathematical or financial journal. Ignoring terminology, whether it is mean or avarage you will still end up with the same figure in the above case, is it not ?

But I agree the more accurate terminology should be "mean" instead of "avarage" as it is using a sample of population, instead of the whole available set of data for the same population.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards