We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

RBS & NatWest Rewards

Comments

-

Rewards take 35 days to become payable which can sometimes, depending on dates, result in two months rewards still being pending before one months rewards becomes payable.

As a new account it will definitely have two months in pending before anything becomes payable.

Logging in online rather than the app shows far more detail including the account to which the reward is attributed.2 -

Thanks for info

0

0 -

You can now access the Reward account details from the app which takes you into your Rewards account via your browser.kaMelo said:Rewards take 35 days to become payable which can sometimes, depending on dates, result in two months rewards still being pending before one months rewards becomes payable.

As a new account it will definitely have two months in pending before anything becomes payable.

Logging in online rather than the app shows far more detail including the account to which the reward is attributed.0 -

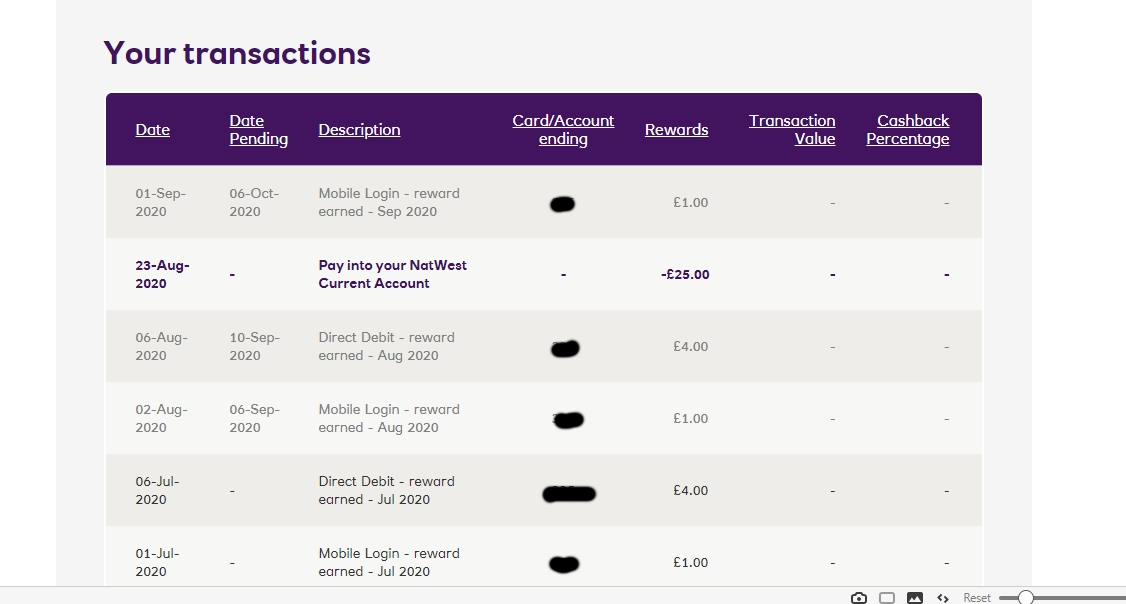

It does, however it's not as detailed. Online access also has columns for "Transaction Value" and "Percentage" which obviously refer back to the original rewards terms.RG2015 said:

You can now access the Reward account details from the app which takes you into your Rewards account via your browser.kaMelo said:Rewards take 35 days to become payable which can sometimes, depending on dates, result in two months rewards still being pending before one months rewards becomes payable.

As a new account it will definitely have two months in pending before anything becomes payable.

Logging in online rather than the app shows far more detail including the account to which the reward is attributed.

The updated app which allows you to login to rewards came about after the reward offer changed so I can only think that, as transaction value and percentage are no longer relevant, they were not added.2 -

Thank you @kaMelo. I am used to using the app on a tablet and this does show the full details including the account number.kaMelo said:

It does, however it's not as detailed. Via the app/mobile browser it doesn't show account no whereas online it does.RG2015 said:

You can now access the Reward account details from the app which takes you into your Rewards account via your browser.kaMelo said:Rewards take 35 days to become payable which can sometimes, depending on dates, result in two months rewards still being pending before one months rewards becomes payable.

As a new account it will definitely have two months in pending before anything becomes payable.

Logging in online rather than the app shows far more detail including the account to which the reward is attributed.

I assumed the smartphone would be the same but even in landscape the details shown are limited, as you say.0 -

I think it's easier to post an image. The app is far more detailed than I last remembered it however and this is the only thing I can see different, probably because the columns still available online are not actually relevant with the current offer. The account number would be nice though on the mobile app.

2

2 -

Thanks, kaMelo. It didn't even occur to me that online would show more info than the app. In any case, though, they "are unable" to register my for MyRewards, so I will just continue to guess. It's easy enough to figure out what's what, so not a problem.0

-

You do realise, rather than paying the money into your account, you can earn more rewards by getting an ecard? So that £25 would have earnt you another £1 if you'd got a Morrisons ecard, for example?kaMelo said:I think it's easier to post an image. The app is far more detailed than I last remembered it however and this is the only thing I can see different, probably because the columns still available online are not actually relevant with the current offer. The account number would be nice though on the mobile app.

I normally save mine up until I need something from Argos, where you get an extra 5%I consider myself to be a male feminist. Is that allowed?2 -

Yes, and I generally do a similar thing. I could go on a long winded explanation but to cut a long story short, basically I made a bad choice and screwed up. It was the first time I've ever converted rewards for cash and it will be the last for sure..surreysaver said:

You do realise, rather than paying the money into your account, you can earn more rewards by getting an ecard? So that £25 would have earnt you another £1 if you'd got a Morrisons ecard, for example?kaMelo said:I think it's easier to post an image. The app is far more detailed than I last remembered it however and this is the only thing I can see different, probably because the columns still available online are not actually relevant with the current offer. The account number would be nice though on the mobile app.

I normally save mine up until I need something from Argos, where you get an extra 5%

If I'd shown a little more in the list it would have listed the Currys/PC World vouchers which are always available and very good value, with 11% (ish) uplift and once every six months a £10 voucher for £7.50 rewards. (about 33% uplift)

To follow on from my earlier point about the columns account no, transaction value and percentage being redundant now, upon further thinkng this is not actually true. DD's and mobile login generate flat reward values however debit card/credit card spending also generate rewards based on a percentage of qualifying transactions so the columns are still relevant after all. I've only just realised this after using the RBS rewards credit card after Asda/Creation ditched me. All the more reason for these columns to be included in the app.1 -

Account no is useful even if you don't hold their credit card / don't use your debit card for reward purchaseskaMelo said:To follow on from my earlier point about the columns account no, transaction value and percentage being redundant now, upon further thinkng this is not actually true. ......<snip>

I absolutely don't understand why they don't show these columns in the phone app, as there is easily enough space for them in landscape mode.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards