We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Martin Lewis: Working from home due to coronavirus, even for a day? Claim TWO years' worth of tax re

Comments

-

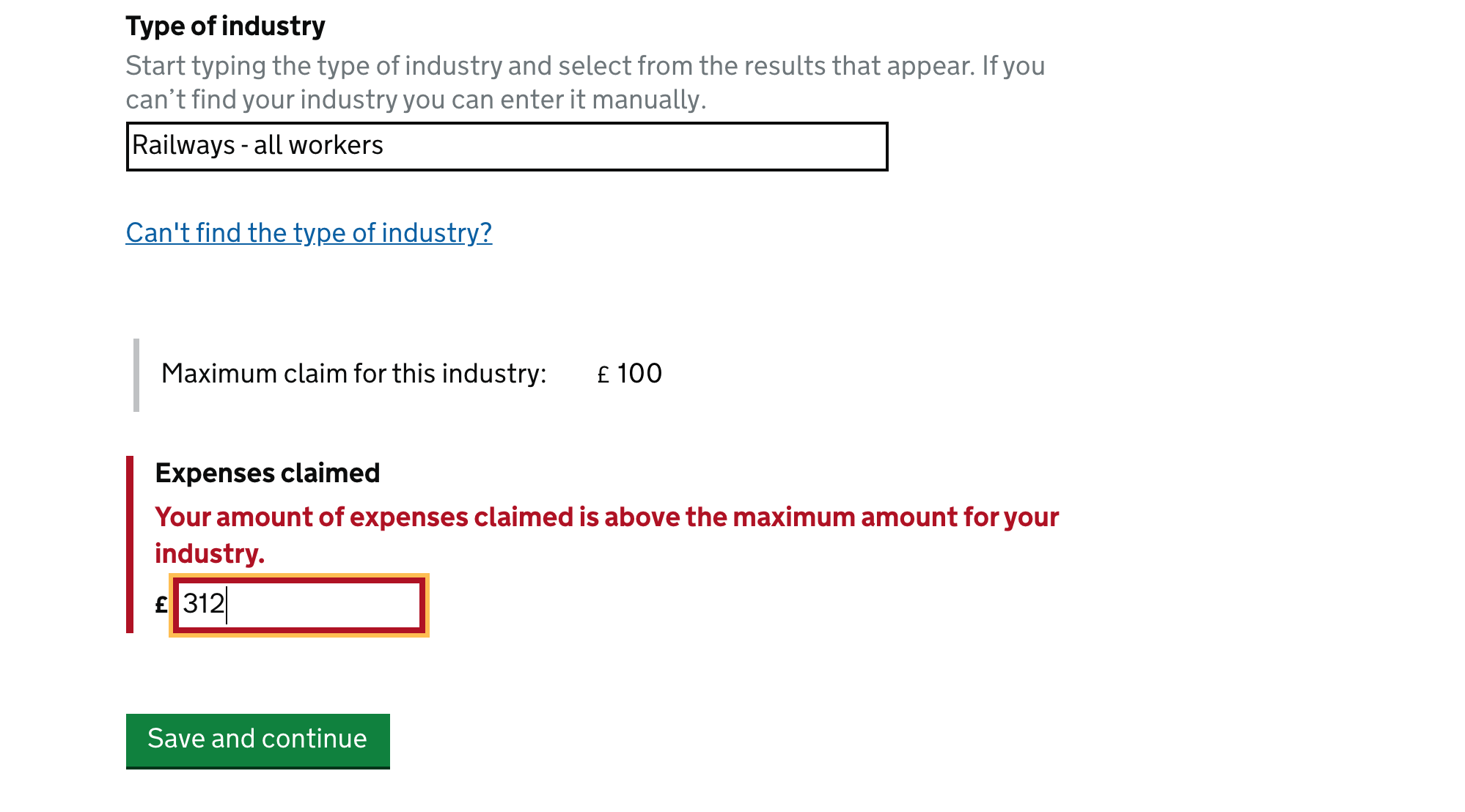

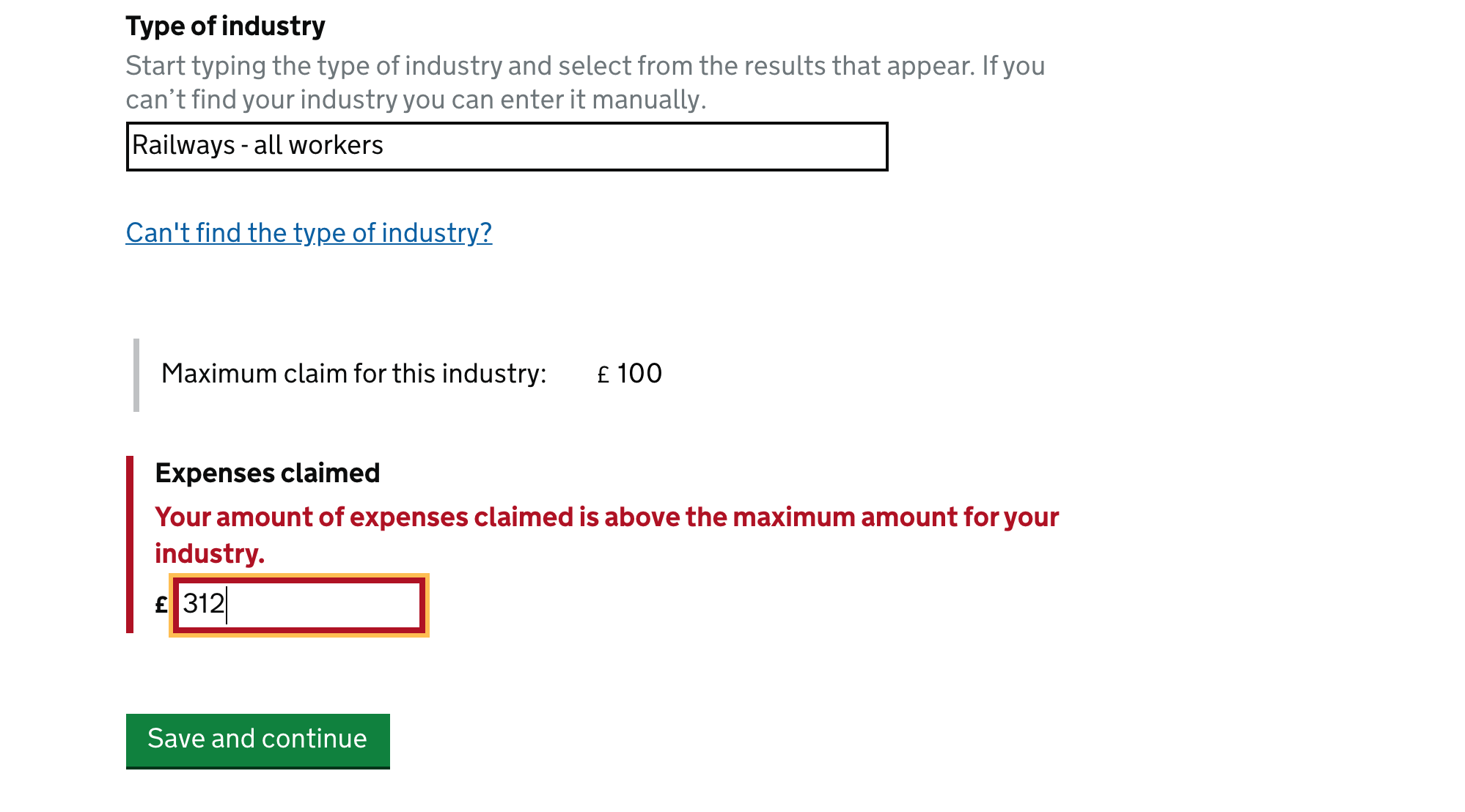

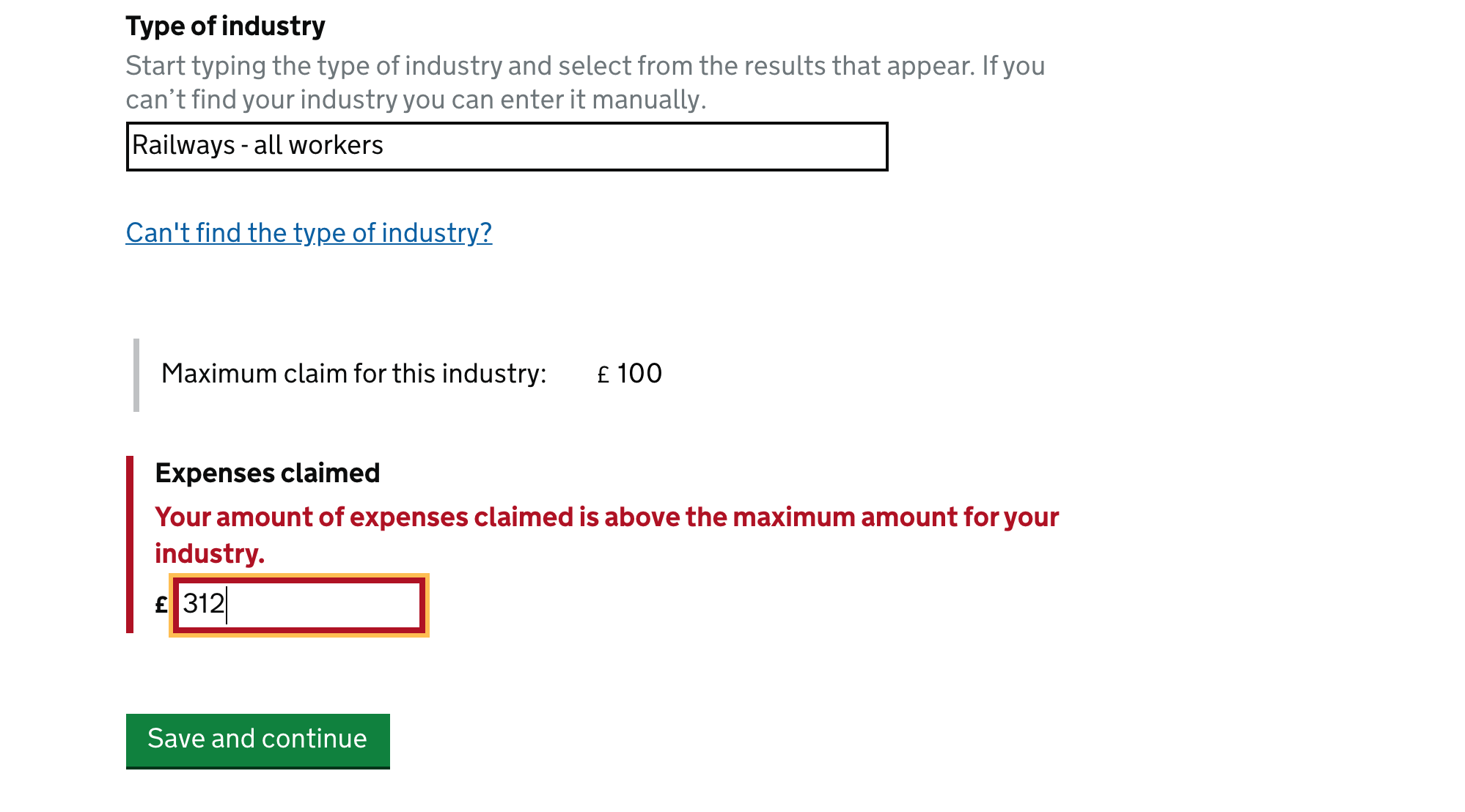

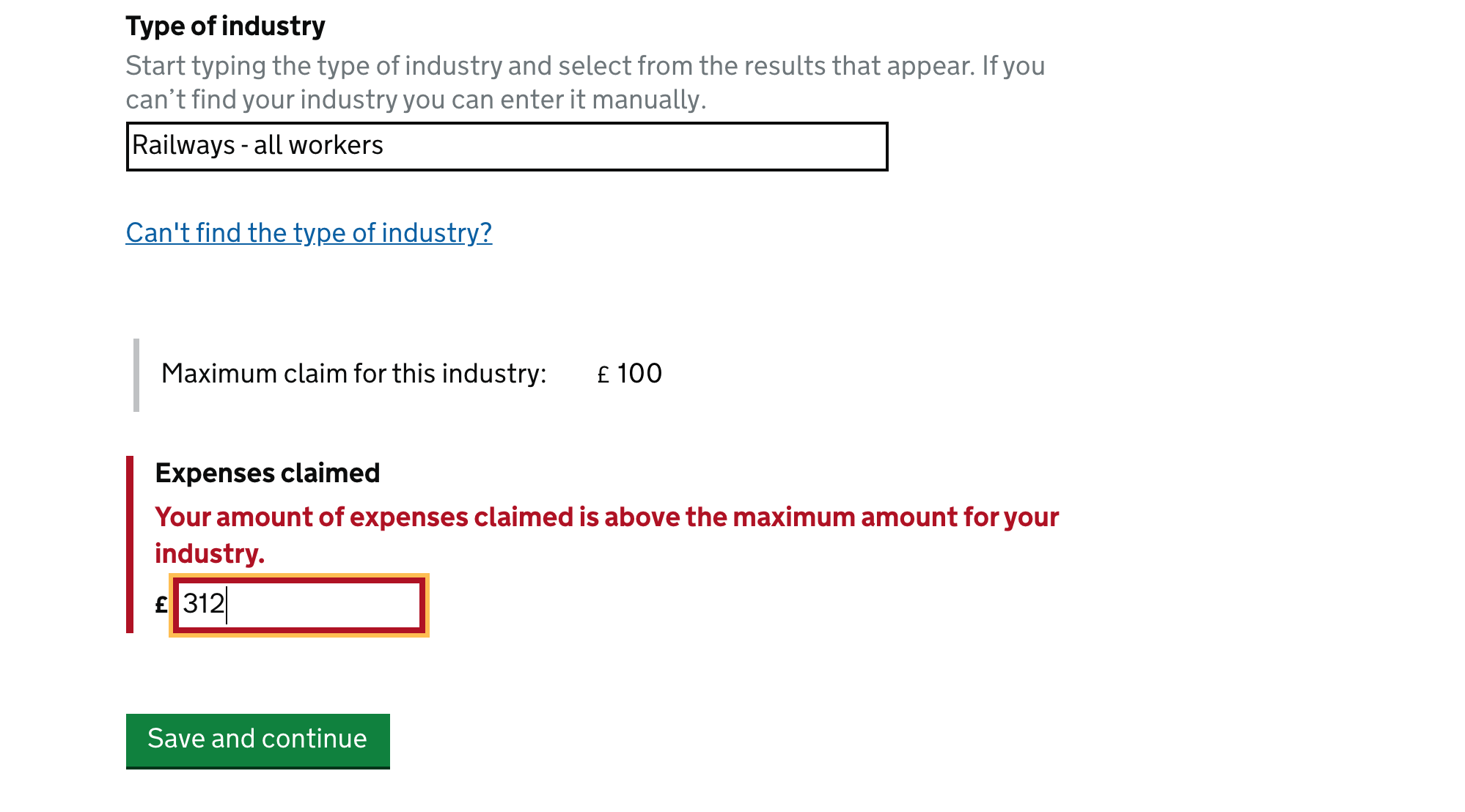

This is driving me nuts can anyone please help. Followed the instructions but get following message which prevents me from completing the process ! I am presuming that claiming for 2020/2021 is correct ? Thank you.

0 -

rstmart said:This is driving me nuts can anyone please help. Followed the instructions but get following message which prevents me from completing the process ! I am presuming that claiming for 2020/2021 is correct ? Thank you.

You appear to be trying to claim fixed rate expenses which are industry related and absolutely nothing to do with working from home expenses (the £312).

Maybe you should find the correct part of gov.uk first.0 -

Hi everyone! First post here, hope someone can help me - I've looked through the thread but can't see an answer on this.

As I read it, I can either claim tax relief, or get a home working allowance from my employer. My employer has just announced they're going to be paying out a homeworking allowance (of £16 per month) but only from October. So I don't know whether I can claim the relief from April-September, or if getting anything this financial year from my employer ticks that box, effectively. And the amount from my employer is less than £6 per week, I'm guessing that the remainder is just struck off basically? Any ideas?0 -

IYou can genuinely answer the question (today!) which asks have you received anything from your employer and say NO. So claim for now. All the taxman will do is adjust your tax code later for the period it paid you at the same time as your employer once it gets informed. If your employer isn't paying you expenses for period WFH since March to now then you are entitled to this flat rate payment.MorganGD said:Hi everyone! First post here, hope someone can help me - I've looked through the thread but can't see an answer on this.

As I read it, I can either claim tax relief, or get a home working allowance from my employer. My employer has just announced they're going to be paying out a homeworking allowance (of £16 per month) but only from October. So I don't know whether I can claim the relief from April-September, or if getting anything this financial year from my employer ticks that box, effectively. And the amount from my employer is less than £6 per week, I'm guessing that the remainder is just struck off basically? Any ideas?0 -

Thank you> I managed to get to the right screen eventually after answering NO to the one which asked 'do you want to claim flat rate expense' (which threw me !).Dazed_and_C0nfused said:rstmart said:This is driving me nuts can anyone please help. Followed the instructions but get following message which prevents me from completing the process ! I am presuming that claiming for 2020/2021 is correct ? Thank you.

You appear to be trying to claim fixed rate expenses which are industry related and absolutely nothing to do with working from home expenses (the £312).

Maybe you should find the correct part of gov.uk first.

Anyway have claimed for 2019/2020 as started WFH 16/3/20 but am unclear if I have to now go back in and also claim for 2020/2021 too or if tax adjustment / flat rate is automatically applied / carried over into this tax year too, having claimed for 2019/2020 already ? Thank you.0 -

That's a really good point, thank you! I haven't received anything, not least as they're paying us in January but backdating to October. And if it's flat rate for the whole year even if you've only worked from home for part of it, I guess I'd be covered for whenever *during* that year, even if I'd only worked a week in April or something. Thanks!rstmart said:

IYou can genuinely answer the question (today!) which asks have you received anything from your employer and say NO. So claim for now. All the taxman will do is adjust your tax code later for the period it paid you at the same time as your employer once it gets informed. If your employer isn't paying you expenses for period WFH since March to now then you are entitled to this flat rate payment.MorganGD said:Hi everyone! First post here, hope someone can help me - I've looked through the thread but can't see an answer on this.

As I read it, I can either claim tax relief, or get a home working allowance from my employer. My employer has just announced they're going to be paying out a homeworking allowance (of £16 per month) but only from October. So I don't know whether I can claim the relief from April-September, or if getting anything this financial year from my employer ticks that box, effectively. And the amount from my employer is less than £6 per week, I'm guessing that the remainder is just struck off basically? Any ideas?0 -

Apparently I mis-claimed as should have only claimed £12 for 19/20 tax tear period 23/03/20 - 05/04/2020 and then put in another claim for £312 for this years full claim. Have corrected now but hope my narrative above helps others. the Twitter @HMRCcustomers is very good for answering any queries.rstmart said:

Thank you> I managed to get to the right screen eventually after answering NO to the one which asked 'do you want to claim flat rate expense' (which threw me !).Dazed_and_C0nfused said:rstmart said:This is driving me nuts can anyone please help. Followed the instructions but get following message which prevents me from completing the process ! I am presuming that claiming for 2020/2021 is correct ? Thank you.

You appear to be trying to claim fixed rate expenses which are industry related and absolutely nothing to do with working from home expenses (the £312).

Maybe you should find the correct part of gov.uk first.

Anyway have claimed for 2019/2020 as started WFH 16/3/20 but am unclear if I have to now go back in and also claim for 2020/2021 too or if tax adjustment / flat rate is automatically applied / carried over into this tax year too, having claimed for 2019/2020 already ? Thank you.1 -

I'm confused by the being able to claim the full amount of £6 per week tax free with no evidence or the £6 per week as tax relief? Can anyone help please?0

-

Sure- what is the exact question they're asking you on the microsite? £6 per week tax relief is correct- but that would appear to be both the above options.Everypenny09 said:I'm confused by the being able to claim the full amount of £6 per week tax free with no evidence or the £6 per week as tax relief? Can anyone help please?May'18 DEBT FREE!

£6025 PB's: £1427 Nutmeg Pot: £51'174 Company Shares £512.09 InvestEngine £8.21 Freetrade £569.46 Stake

£2457.92 TCB.0 -

It is £6/week from your employer or tax relief on £6from HMRC.Everypenny09 said:I'm confused by the being able to claim the full amount of £6 per week tax free with no evidence or the £6 per week as tax relief? Can anyone help please?

The HMRC option will save you anywhere from £0 to £3.60/week in tax but for most people it saves £1.20 or £2.40.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards