We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Would you quote the part of their e-mail about closing the account and withdrawals up to and after 20 April pse. Thanks - my e-mail has disappeared.where_are_we said:YBS announced a reduction of monthly saver interest rates on 18/3/20 with new interest rates from 5/4/20 - MS 2% down to1.5%, MS2 2.5% down to 2% and MS3 2.1% down to 1.6%. Their email today has a link giving MS interest rates with no mention of the above reduction happening on 5/4/20 and gives the impression that the MS 2%, MS2 2.5% and MS3 2.1% interest rates apply until 20/4/20. A double reduction announcement in interest rates in less than a fortnight is not a good way to treat customers, especially not by giving correct up to date information .0 -

My HSBC RS account has reached its 12month maturity today, am I free to withdraw the money back to my current account?

I have already been credited with the interest.

Sorted now."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

I was the same, no details set up previously and was able to transfer the funds to whatever account details I provided when I clicked the close option. Money arrived in my account the next day.typistretired said:

I can only speak from my own experience. I clicked on close I was asked where I wanted the money sent, I put the name, sort code and account of the bank account and it arrived late the following afternoon in my accountglider3560 said:

Unless you already hold an account with YBS that you want the money transferred to, you still need to set the account details up in advance. Took just over a day before I was able to withdraw to (or close and transfer to) my non-YBS bank account.1 -

Does this helpschiff said:

Would you quote the part of their e-mail about closing the account and withdrawals up to and after 20 April pse. Thanks - my e-mail has disappeared.YBS sent an email to me on 31/03/2020 this informs of further reductions to those advised on 18/03/2020 email.

“After an initial decrease to the Bank of England base rate earlier on in the month, on 19 March 2020 a further reduction to 0.10% was announced. This means that we’ll be further reducing the interest rates on some of our variable** rate savings products on 20 April 2020.

You don’t need to do anything as a result of the changes we’re making. However, we’ll be lifting any withdrawal restrictions on affected accounts until 20 May 2020 so if you’d like to, you can move your money into a different account that suits your needs better, subject to the account terms and conditions. While restrictions are lifted you also have the option to close your account without notice or loss of interest.”

"Look after your pennies and your pounds will look after themselves"1 -

My Monmouthshire Building Society Celebration Regular Saver Bond is about to mature. I have received a Bond Maturity Options form in the post. I wish to send the funds to my external account. I have to provide proof of ownership but I do not have any bank statements for this account because I bank online. They give an alternative - a paying in slip. I assume this is the slip at the back of my cheque book with "bank giro credit" at the top and I presume I don`t fill in any of it. This is a new one on me!

0 -

There is also an option of a cheque.where_are_we said:My Monmouthshire Building Society Celebration Regular Saver Bond is about to mature. I have received a Bond Maturity Options form in the post. I wish to send the funds to my external account. I have to provide proof of ownership but I do not have any bank statements for this account because I bank online. They give an alternative - a paying in slip. I assume this is the slip at the back of my cheque book with "bank giro credit" at the top and I presume I don`t fill in any of it. This is a new one on me!

Check two thirds of the way down the form (section B )0 -

A cheque in the post is not my preferred option (thanks for suggesting it) - it would mean a trip to the bank - not good in lockdown. I was wondering if anyone has presented a blank paying in slip as proof of ownership before.veryintrigued said:

There is also an option of a cheque.where_are_we said:My Monmouthshire Building Society Celebration Regular Saver Bond is about to mature. I have received a Bond Maturity Options form in the post. I wish to send the funds to my external account. I have to provide proof of ownership but I do not have any bank statements for this account because I bank online. They give an alternative - a paying in slip. I assume this is the slip at the back of my cheque book with "bank giro credit" at the top and I presume I don`t fill in any of it. This is a new one on me!

Check two thirds of the way down the form (section B )

0 -

If you are self-isolating you will not be able to go the post office. Send them a secure message"Look after your pennies and your pounds will look after themselves"0

-

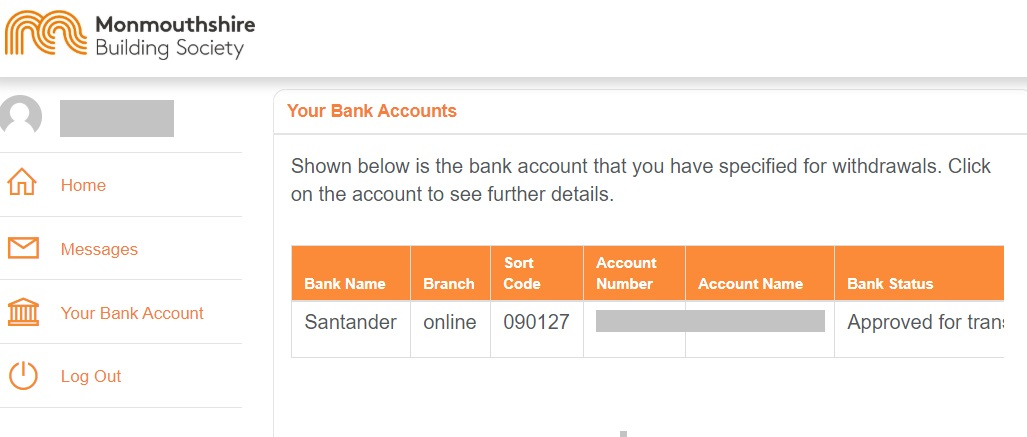

I asked Monmonth about this previously if you have a bank account registered for widthdrawls on their online portal. They said for that case you don't need to provide proof. However when I tried they sent back a letter asking for proof, so I messaged them through the website and they said sorry and actioned the transfer. So this time I will add a post-it note to form saying "NOTE: this is my registered account for withdrawls" or something like that.where_are_we said:My Monmouthshire Building Society Celebration Regular Saver Bond is about to mature. I have received a Bond Maturity Options form in the post. I wish to send the funds to my external account. I have to provide proof of ownership but I do not have any bank statements for this account because I bank online. They give an alternative - a paying in slip. I assume this is the slip at the back of my cheque book with "bank giro credit" at the top and I presume I don`t fill in any of it. This is a new one on me!

0 -

What does it say under "Your Bank Account" for you in your online banking? IIRC, I sent them a cheque when I opened my first account with them, and they used that account as the account to which all my matured balances were transferred.

if you haven't got one of those already set up, you could probably open an instant access account and send them a £1 cheque as an opening deposit. Worth having such an account sitting there if you plan further accounts with them and want to keep your online access alive. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards