We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

OK, will do.friolento said:

@bob2000 you just need to look at page 1 of this threadBob2000 said:

OK, I'll keeping looking for a higher rate.Stargunner said:

Plenty of higher paying RS accounts available, unless you already have them all.Bob2000 said: Was looking at this account earlier with maybe putting £500 (max allowed) in for first two months thereafter £100.

Was looking at this account earlier with maybe putting £500 (max allowed) in for first two months thereafter £100.

Any thoughts?

I won’t open/fund any RS unless it pays over 5%

Merry Christmas.0 -

Yes, l noticed the rate difference when l looked.ForumUser7 said:

It’s closed issue. The 4.8% @flaneur@flaneurs_lobster mentioned is the current issue.Bob2000 said:

I'm not sure if l can open the account . I'll take a look later. Thank you.wiseonesomeofthetime said:

For an extra 12 months I have access to Coventry's First Home Saver Issue 1 at 5.10% variable which allows £1000, though I haven't added anything to that for 11 months as been feeding 7, 7.5, 8, and 10% RS accounts instead.Bob2000 said:

But are there any letting you pay in £500 per month so l can get in £1000 sooner rather then later?Stargunner said:

Plenty of higher paying RS accounts available, unless you already have them all.Bob2000 said: Was looking at this account earlier with maybe putting £500 (max allowed) in for first two months thereafter £100.

Was looking at this account earlier with maybe putting £500 (max allowed) in for first two months thereafter £100.

Any thoughts?

I won’t open/fund any RS unless it pays over 5%

I know l could put in a fixed rate with the Grand but l want to add extra over the term of the account.

Some may still have access to that.

Thanks anyway for telling me.

Merry Christmas.1 -

Those are indeed the T&C as published.where_are_we said:MHBS RS Issue 2 - So they are not enforcing their T&C`s?"Customers may only have two Fixed Term Regular Saver accounts open at a time, either solely or jointly, with a combined maximum deposit of £250 per month not exceeding the maximum balance of £3,750.00"My reading of the above implies you cannot pay in two lots of £250 each month.

I think it's very hit n miss to follow in the footsteps of those people who report having 'got away' with funding more than £250 in total. Their experience could be due to the building society computerised system simply not picking it up; perhaps the customer has more than a single customer record, perhaps there is manual involvement in checking and personnel are deployed on other duties, perhaps they don't allocate time to look at more than a few such discrepancies per month. Perhaps their newly-launched amended website goes alongside increased computer programming in the background to pick up such discrepancies earlier in future.

So perhaps the building society will attempt to 'undo' the extra funded accounts at some indeterminate time, with the risk of interest paid being reduced to their flexible-access rate. Who knows!

There are other firms offering good rates, so personally I just keep to their T&Cs for a simpler life, split 'spare' money across them, nab any new accounts as they appear from other firms, whilst of course keeping 6 months as easy-ish access as per always advised, and mixing with some cash ISAs & other things. Where there is a willing spouse in a trusting relationship, money can be shared between you; we open an account each to 'double' the money in good rate accounts. We're both saving aggressively because we want to move home, so both of us are on the same page as regards saving.15 -

Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second deposit on the first January?0 -

I'd be inclined to open and fund it on 31/12/24 and make your second deposit on 1/1/25 to give you the highest average balance over the account term and thus the most interest overall. Plus it means the account matures at the end of a month, which is more convenient if you have other regular savers that need funding on 1st of the month.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?2 -

I’d fund it today and again on 1st January.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?1 -

Thanks for quick reply.Bridlington1 said:

I'd be inclined to open and fund it on 31/12/24 and make your second deposit on 1/1/25 to give you the highest average balance over the account term and thus the most interest overall. Plus it means the account matures at the end of a month, which is more convenient if you have other regular savers that need funding on 1st of the month.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?

Another question, please.

If l do open the account today I'll still be OK under the terms to fund it on 31st?0 -

So no real advantage then to open and fund on the 31st?allegro120 said:

I’d fund it today and again on 1st January.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?0 -

You have 5 days from the day the account is opened to fund the account, otherwise the account gets closed, if you open the account today you'll have till 31/12/24 to fund it.Bob2000 said:

Thanks for quick reply.Bridlington1 said:

I'd be inclined to open and fund it on 31/12/24 and make your second deposit on 1/1/25 to give you the highest average balance over the account term and thus the most interest overall. Plus it means the account matures at the end of a month, which is more convenient if you have other regular savers that need funding on 1st of the month.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?

Another question, please.

If l do open the account today I'll still be OK under the terms to fund it on 31st?

The advantage of opening and funding it on 31st rather than today would be that you'd be effectively swapping having 5 days of the account sitting with a £200 balance earning 8% in December for an extra 5 days of having the account sat at a £1.2k balance earning 8% in June. In other words you get more interest opening/funding the account on 31/12/24 as opposed to opening/funding the account today.Bob2000 said:

So no real advantage then to open and fund on the 31st?allegro120 said:

I’d fund it today and again on 1st January.Bob2000 said:Re: Principality 6 month RS

So if l opened this account today, if possible, being boxing day. Does anyone suggest funding today or leaving until Tuesday 31st then second on the first January?

2 -

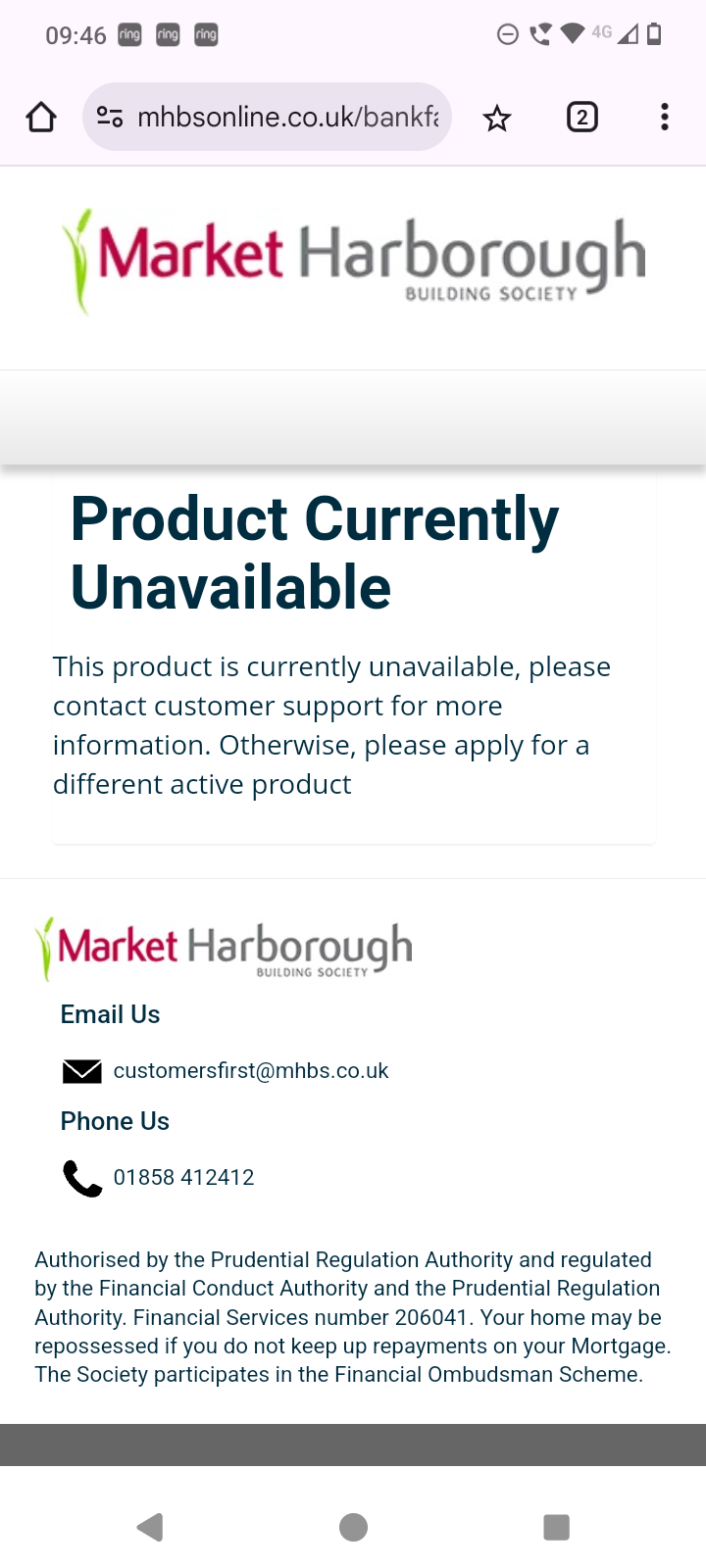

Looks like the MHBS RS link has been taken downBridlington1 said:

The application link still seems to be livesimonsmithsays said:

It was visible three hours ago under Regular Savers.Bobblehat said:

Yep! Not visible for me when logged in! Watch this space I suppose!dcs34 said:Market Harborough Fixed Term Regular Saver (31.03.2026)

For those that have applied online, would you mind confirming the process? I've logged in and gone to 'Apply' > 'Regular' and then checked all the other types, but can't see it on the system at all.

Possible that MHBS have spotted some issues (i.e. people opening both issues and funding, it was supposed to remain branch only, etc.) and have withdrawn from the online system?

It's now, no longer, an option.

They've simply removed it from online applications.

https://mhbsonline.co.uk/bankfastApply/apply?code=1yr02

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards