We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

s71hj said:

Is the cashback on any direct debits or just your standard utilities like Santander etc pay.Stevo_safc said:

Email from them this morning.dgpur said:

Where are you seeing that? I can’t see it in the app or the website.Stevo_safc said:Is the Zopa 7.5% Regular Saver new?I think it's any direct debits.We’re currently giving cashback on up to £1,500 of Direct Debits paid from your Zopa bank account per year.

The cashback rate is fixed for a year – starting from the day you open your account – and variable after that. Cashback is calculated daily and paid monthly. You can check your rate in your bank account terms.

3 -

jameseonline said:Interesting, I've not done anything with Zopa for ages (£0 balance) so not surprised I haven't been invited.

Would only be interested in their Regular Saver as 2% savings is poor, especially when they themselves offer higher for using savings pots.I had a zero balance on my Smart Saver too, but I was invited - bank account now setup, £1 deposit to it arrived immediately - only takes a few clicks to then open the RS.you will need to get their bank account, and have a Smart Saver to get access to the regular saver.I will add that you need to identify yourself during the bank application process, e.g taking a selfie in the app and also an image of ID (passport) - they're using Mitek for this.After 12 months, the RS becomes a Smart Saver pot... then you'll be able to open a new RS pot.3 -

4 -

I've sent money yesterday (evening) and today (this afternoon) to MHBS, just have to see if anything gets returned and/or hope they sort their website out to login etc, otherwise I'll call them tomorrow or something.Kim_13 said:

Wondering the same.jameseonline said:Anyone know what Market Harborough are upto because I can't access their online services & there's nothing till 10th October scheduled.

Wanted to check if my money was credited from yesterday.I topped Melton up to £200 yesterday (within normal working hours, but later than I’d have liked due to funds not arriving from HRBS particularly promptly - but still earlier than Monmouthshire.) It is dated processed today but listed as posted yesterday, so wondering if the account is likely to accept £200 this month?

Not the best of starts for me with them, hopefully it will get better soon.

Meanwhile it's taking ages to get setup back up again with Monmouthshire due to postal system & still being in their system & having to reset things etc 😌0 -

Looks like those of us with the 31/08/25 (same rate) are ruled out:Afahmaep said:Chorley Building Society have new Regular Ssver

5.16% £300 per month max 12 monthsRegular Saver Account

Account Name

Interest Rate

Opening Balance

Type of Account

Withdrawals

You can mark products as favourites, allowing you to gather all your favourited items for a comparison.

Only one Regular Saver and one Seasonal Saver can be held in any 12 month rolling period.1 -

Zopa.janusdesign said:jameseonline said:Interesting, I've not done anything with Zopa for ages (£0 balance) so not surprised I haven't been invited.

Would only be interested in their Regular Saver as 2% savings is poor, especially when they themselves offer higher for using savings pots.I had a zero balance on my Smart Saver too, but I was invited - bank account now setup, £1 deposit to it arrived immediately - only takes a few clicks to then open the RS.you will need to get their bank account, and have a Smart Saver to get access to the regular saver.I will add that you need to identify yourself during the bank application process, e.g taking a selfie in the app and also an image of ID (passport) - they're using Mitek for this.After 12 months, the RS becomes a Smart Saver pot... then you'll be able to open a new RS pot.

I had Smart Saver too, the balance was zero for nearly 2 years. Now I opened the app, had to login from scratch, Smart Saver is no longer showing and all my pots have disappeared (I had about 8 of them).

Have they scrapped Smart Saver?0 -

Presumably they closed your account due to the zero balance and a long period of inactivity. I would imagine (like to think) there'll be a related email tucked away in your inbox somewhere. I always leave £1 in any 'save from £1' savings accounts that I stop using but wish to retain (even if they don't state a £1 minimum balance in the T&Cs) as it removes any ambiguity.allegro120 said:Zopa.

I had Smart Saver too, the balance was zero for nearly 2 years. Now I opened the app, had to login from scratch, Smart Saver is no longer showing and all my pots have disappeared (I had about 8 of them).1 -

I'm using the latest Android app, all my savings pots are showing, mind you Ive not left it 2 years to logon etcallegro120 said:

Zopa.janusdesign said:jameseonline said:Interesting, I've not done anything with Zopa for ages (£0 balance) so not surprised I haven't been invited.

Would only be interested in their Regular Saver as 2% savings is poor, especially when they themselves offer higher for using savings pots.I had a zero balance on my Smart Saver too, but I was invited - bank account now setup, £1 deposit to it arrived immediately - only takes a few clicks to then open the RS.you will need to get their bank account, and have a Smart Saver to get access to the regular saver.I will add that you need to identify yourself during the bank application process, e.g taking a selfie in the app and also an image of ID (passport) - they're using Mitek for this.After 12 months, the RS becomes a Smart Saver pot... then you'll be able to open a new RS pot.

I had Smart Saver too, the balance was zero for nearly 2 years. Now I opened the app, had to login from scratch, Smart Saver is no longer showing and all my pots have disappeared (I had about 8 of them).

Have they scrapped Smart Saver?0 -

Market Harborough

Unplanned maintenance at the moment

https://mhbs.co.uk/savings-information/technical-issues/

5 -

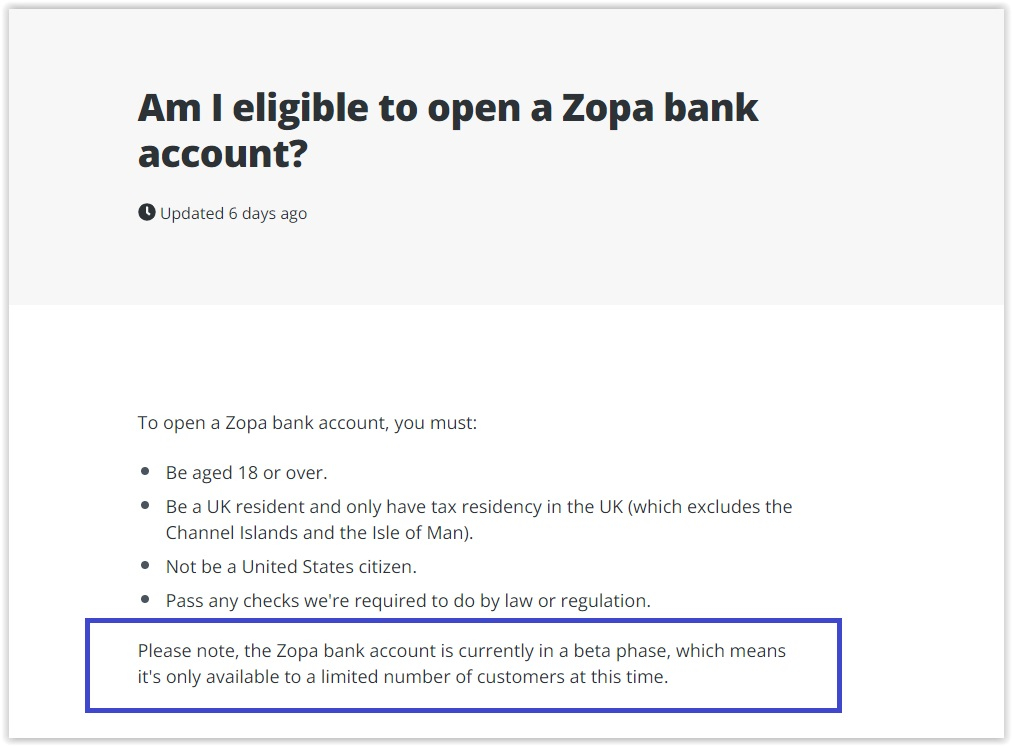

Zopa Bank account and linked Regular Saver @7.5% - I have £1 in their Smart Saver. I asked in chat about opening a Zopa Bank account and reply was that only a limited number of customers can do this at the moment but not to worry - we`ll be opening to more of you in the coming months. Notification will via the App and also through email.Good luck to those who can open the Zopa Bank account now. For the rest of us it`s a question of waiting.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards