We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Just for information, Skipton state the following on my regular saver:RG2015 said:

re:Skipton RSBigwheels1111 said:RG2015 said:bristolleedsfan said:I recall some months ago it was not possible to transfer between Skipton accounts on a Saturday.This appears to be correct.My RS matured yesterday but the funds were only visible today in another Skipton account. I have just opened a new RS with funds from that account. I chose today for the transfer but the next screen said “We can only complete transactions on working days, we will process your request on 03 June 2024.”Make a manual payment today, I did 50 mins ago.From another bank.

Thanks, this worked.

It’s crazy that an external deposit at the weekend is accepted but an internal transfer has to wait for the next working day.

"Please note payment transactions made to this account on a non-working day will start earning interest from the next working day."

Hence I will be losing 2 days interest on £250 in my feeder account (VM 4.76%).

£250 x 4.76% x 2 / 365 = £0.076 -

I opened my first Saffron BS account on the 1st of June 23 (due to recommendation on the forum to do so, for possible future loyalty products); the Members' Month Loyalty Saver was showing when I logged in this morning, and account now opened successfully.soulsaver said:

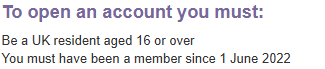

Cut off date showed June 2022 in my application.Bridlington1 said:

Saffron BS Members Month Loyalty Saver at 8% now live:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

https://www.saffronbs.co.uk/savings/regular-savings-accounts/members-month-loyalty-saver

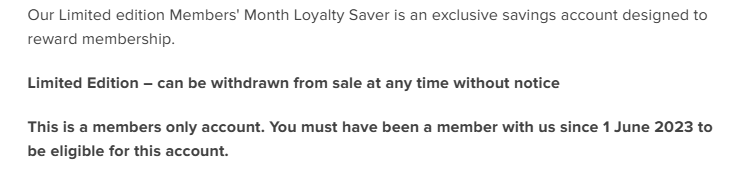

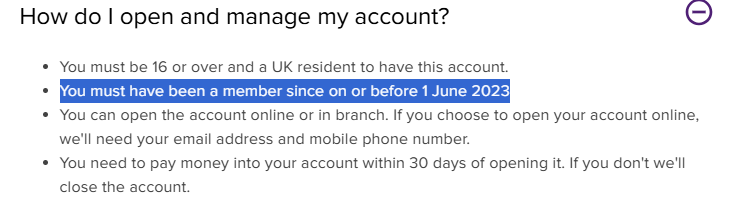

In addition it's worth noting the eligibility cut off date is now 1st June 2023, rather than 1st June 2022 as was stated in one of my earlier posts so it seems I was given incorrect information, all other details seem to be correct though. I'll find the offending post and amend it for accuracy shortly, apologies for the misinformation.

ETA: No prob for me, been a member before that. Note also, my account hasn't opened immediately.3 -

Regarding the 8% Saffron RS:

I asked them to convert my maturing 9% RS into a new 8% RS over the phone a while back, this hasn't been done yet. For those who are in this position don't try applying for a new one now.

I've just spoken to them after a rather lengthy hold (for Saffron BS anyway) and they've said the reason for the delay was because they're having to process each of the maturity instructions manually and there's rather a lot of them, applying for a new account now will only increase their workload and thus cause further delays.

With regards to the cut off date the application form is saying this:

whereas the website is saying this:

[...]

They have confirmed that the application form is incorrectly showing the cut off date for last year's RS and that the main page of their website is indeed showing the correct cut off date of 1st June 2023.4 -

I think it's really poor that this new 8% account wasn't an option last week in the 'maturity manager' (MM) and we have to resort to sending messages. Plenty of people with maturing accounts who don't follow these threads wouldn't have been aware of this and taken the relatively poor 5.75% option shown in the MM.simonsmithsays said:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

A little patience required

Saffron are fantastic

100% confident that they'll follow the manual instructions and be a new account showing on the app funded with £50 by, at the latest, COP Monday backdated to today

Edit - I've now received an email saying the balance (+ interest - £50) is winging its way to my nominated account

And now £50 is showing in a 8% account with the same account number and sort code as previously.

Brilliant service0 -

Not sure I see the hardship, surely you could just open a new Members Month now?wmb194 said:

I think it's really poor that this new 8% account wasn't an option last week in the 'maturity manager' (MM) and we have to resort to sending messages. Plenty of people with maturing accounts who don't follow these threads wouldn't have been aware of this and taken the relatively poor 5.75% option shown in the MM.simonsmithsays said:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

A little patience required

Saffron are fantastic

100% confident that they'll follow the manual instructions and be a new account showing on the app funded with £50 by, at the latest, COP Monday backdated to today

Edit - I've now received an email saying the balance (+ interest - £50) is winging its way to my nominated account

And now £50 is showing in a 8% account with the same account number and sort code as previously.

Brilliant service3 -

SaffronWillPS said:

Not sure I see the hardship, surely you could just open a new Members Month now?wmb194 said:

I think it's really poor that this new 8% account wasn't an option last week in the 'maturity manager' (MM) and we have to resort to sending messages. Plenty of people with maturing accounts who don't follow these threads wouldn't have been aware of this and taken the relatively poor 5.75% option shown in the MM.simonsmithsays said:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

A little patience required

Saffron are fantastic

100% confident that they'll follow the manual instructions and be a new account showing on the app funded with £50 by, at the latest, COP Monday backdated to today

Edit - I've now received an email saying the balance (+ interest - £50) is winging its way to my nominated account

And now £50 is showing in a 8% account with the same account number and sort code as previously.

Brilliant service

As well as the 5.75% - which lots of us will already have!

We obviously have different expectations!

Every year I'm impressed by them.1 -

The rules I follow based on my experience:SJMALBA said:With 12 month RSs that state a maximum amount that can be paid into the account, is it better to open & fund at the end of a calendar month, or the start, to maximise available interest?

1) If the account says "one payment per calendar month" then opening+making the first payment towards the end of the month, and then making subsequent payments on the first of the month will earn you more interest over the term. (Only had one account that didn't permit this - Ford Money Regular Saver back in 2017/18 , which only allowed one payment per month period - the best you could do is make a payment on day 1, and then 11 payments on the monthly "anniversary" day - so if you opened the account on the 10th of June, in subsequent months the earliest you could make the payment was on the 10th)

2) If the account states a maximum balance, then don't bother trying to make a 13th payment that will take you over that balance. (e.g. Saffron BS).

0 -

I have but it's an aggravation. It should've been a maturity option, it's not like they didn't know it was coming. Rather than having simple 'transfer' options like its other accounts the maturity instant access account can only be managed online by sending messages. I'm not singing Saffron's praises.WillPS said:

Not sure I see the hardship, surely you could just open a new Members Month now?wmb194 said:

I think it's really poor that this new 8% account wasn't an option last week in the 'maturity manager' (MM) and we have to resort to sending messages. Plenty of people with maturing accounts who don't follow these threads wouldn't have been aware of this and taken the relatively poor 5.75% option shown in the MM.simonsmithsays said:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

A little patience required

Saffron are fantastic

100% confident that they'll follow the manual instructions and be a new account showing on the app funded with £50 by, at the latest, COP Monday backdated to today

Edit - I've now received an email saying the balance (+ interest - £50) is winging its way to my nominated account

And now £50 is showing in a 8% account with the same account number and sort code as previously.

Brilliant service

2 -

Not your fault.Bridlington1 said:

Saffron BS Members Month Loyalty Saver at 8% now live:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

https://www.saffronbs.co.uk/savings/regular-savings-accounts/members-month-loyalty-saver

In addition it's worth noting the eligibility cut off date is now 1st June 2023, rather than 1st June 2022 as was stated in one of my earlier posts so it seems I was given incorrect information, all other details seem to be correct though. I'll find the offending post and amend it for accuracy shortly, apologies for the misinformation.

Just checked, Saffron have now linked to that savings page from their members month page that features on their homepage.0 -

Not sure why you expected it to be when it wasn't members month last week nor had the product officially launched.wmb194 said:

I think it's really poor that this new 8% account wasn't an option last week in the 'maturity manager' (MM) and we have to resort to sending messages. Plenty of people with maturing accounts who don't follow these threads wouldn't have been aware of this and taken the relatively poor 5.75% option shown in the MM.simonsmithsays said:jameseonline said:

The one that still isn't on their website?, hmmSpeculator said:Interest of £29.20 has been credited to my Saffron 9% Loyalty Regular Saver dated 31/5.

Hopefully, they will open my new 8% Members Month Loyalty Saver later today.

A little patience required

Saffron are fantastic

100% confident that they'll follow the manual instructions and be a new account showing on the app funded with £50 by, at the latest, COP Monday backdated to today

Edit - I've now received an email saying the balance (+ interest - £50) is winging its way to my nominated account

And now £50 is showing in a 8% account with the same account number and sort code as previously.

Brilliant service

You are no better or worse off anyway, even if you gave them instructions to transfer £50 into the new account (& rest of money elsewhere) Saffron wouldn't have done so until today at the earliest.

You can apply via their website today surely?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards