We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

It's time to start digging up those Squirrelled Nuts!!!!

Comments

-

I won't try and give you investment advice but don't forget the option of spending it on something you couldn't have afforded otherwise as opposed to worrying about how much you can grow it. There are definitely things I'm going to treat myself to to make up for the going out and holidaying I won't be doing.

1

1 -

Spend it...?? What is this "spending" you refer too?

Seriously though, if we could think of anything we needed or wanted at the moment we probably would...but as most of our plans of spending was going to be from being "away" what else is there?

New TV, fibre broadband, streaming subscriptions etc...don't appeal.

A heated swimming pool would be nice, but £2k isn't going to cut it!! (and we don't have room!)

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)1 -

A fancy holiday when this is all over?

If you really can't think of anything to spend it on then reinvesting is the best use of it... and personally I'd invest into the more equities heavy fund at the moment. There will be a point where you have to either spend it or give it away though. Do you have any longer term plans for spending your investments down or giving them away? Forgive me if I'm wrong but I seem to remember you don't have children?1 -

I just view it as an offset against the value that your investments has declined. May not be extra money in the strictest sense. Buy some premium bonds and support the UK's funding requirement. Proposed reduction in NSI returns has been cancelled. The Treasury needs every £ it can raise.0

-

I've just read that elsewhere. My everyday savings account has just announced that it is cutting its interest rates and I've been considering purchasing some premium bonds myself. The cancelled reduction in prize pay outs may just tip me into opening an account.Thrugelmir said:I just view it as an offset against the value that your investments has declined. May not be extra money in the strictest sense. Buy some premium bonds and support the UK's funding requirement. Proposed reduction in NSI returns has been cancelled. The Treasury needs every £ it can raise.0 -

Just read that Marcus are reducing their rates, so i'll be only getting 1.35% on the money until my bonus expires in August.

Another reason not to keep it in cash. We've also got 2 full Monmouthshire Celebration Reg Savers maturing at the end of the month, and with everything else filled and topped up, that's where it will sit.

mmm, Premium Bonds. DH has a whopping £21 worth, from when he was in short pants. I'm not sure another "small" amount would win us much.

As for the long term plan, we might give some away to the N&Ns, but, yes, as we don't have children, there are lots of things that we're going to have to do (and pay for) ourselves as we get older, as we won't have "helping hands" to ask, especially if the N&Ns end up not living local. They'll get what's left, eventually.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)1 -

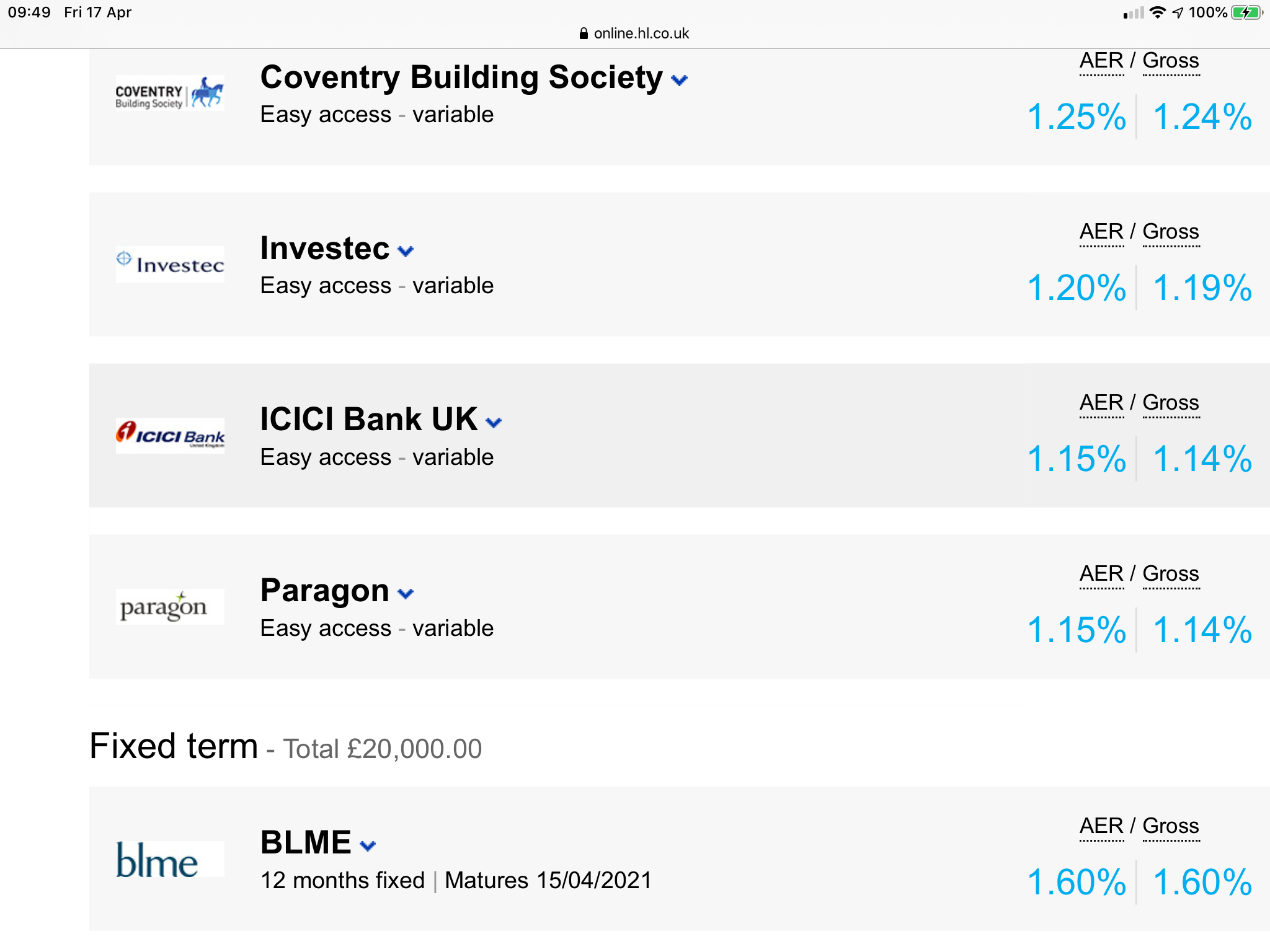

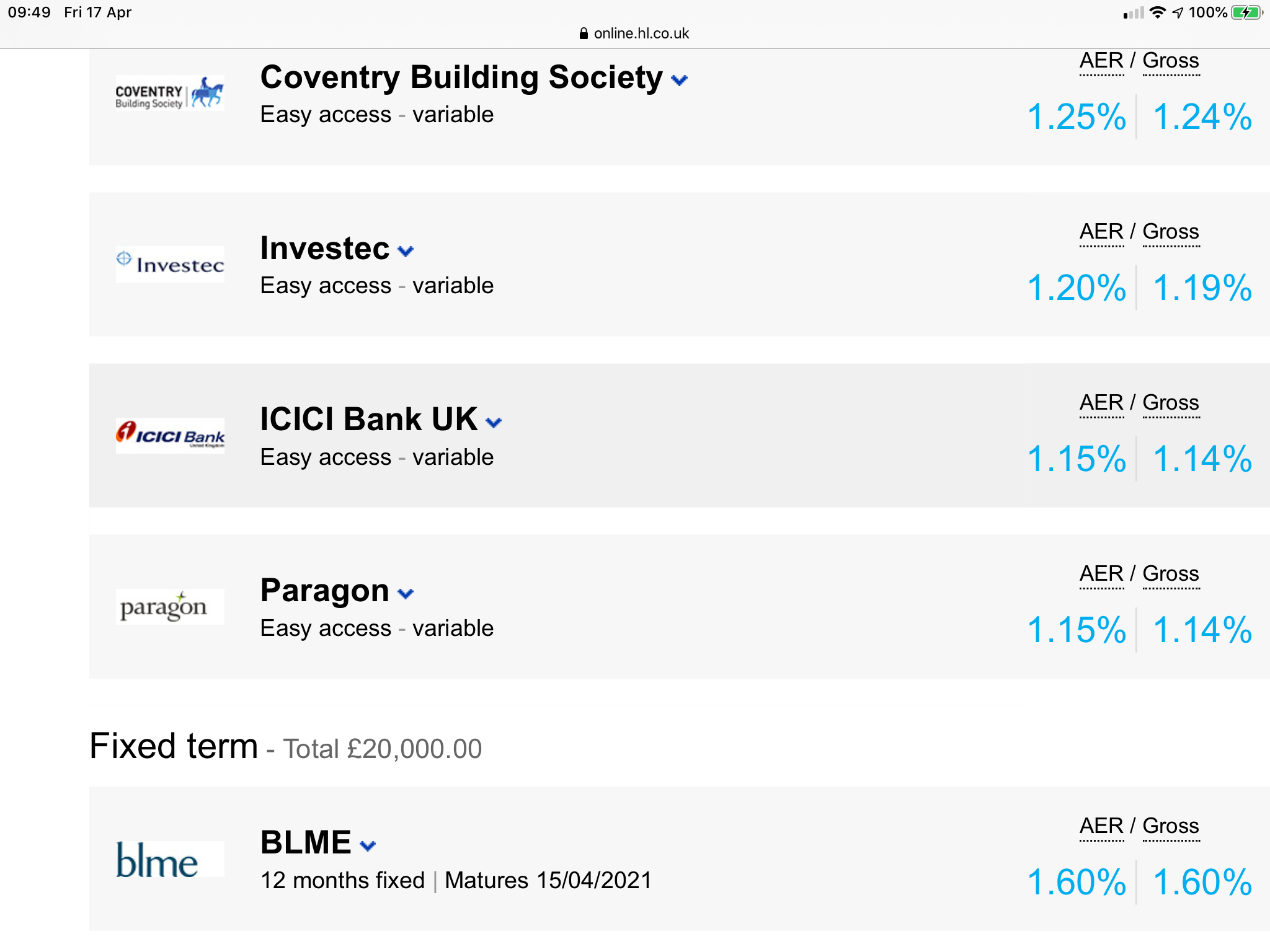

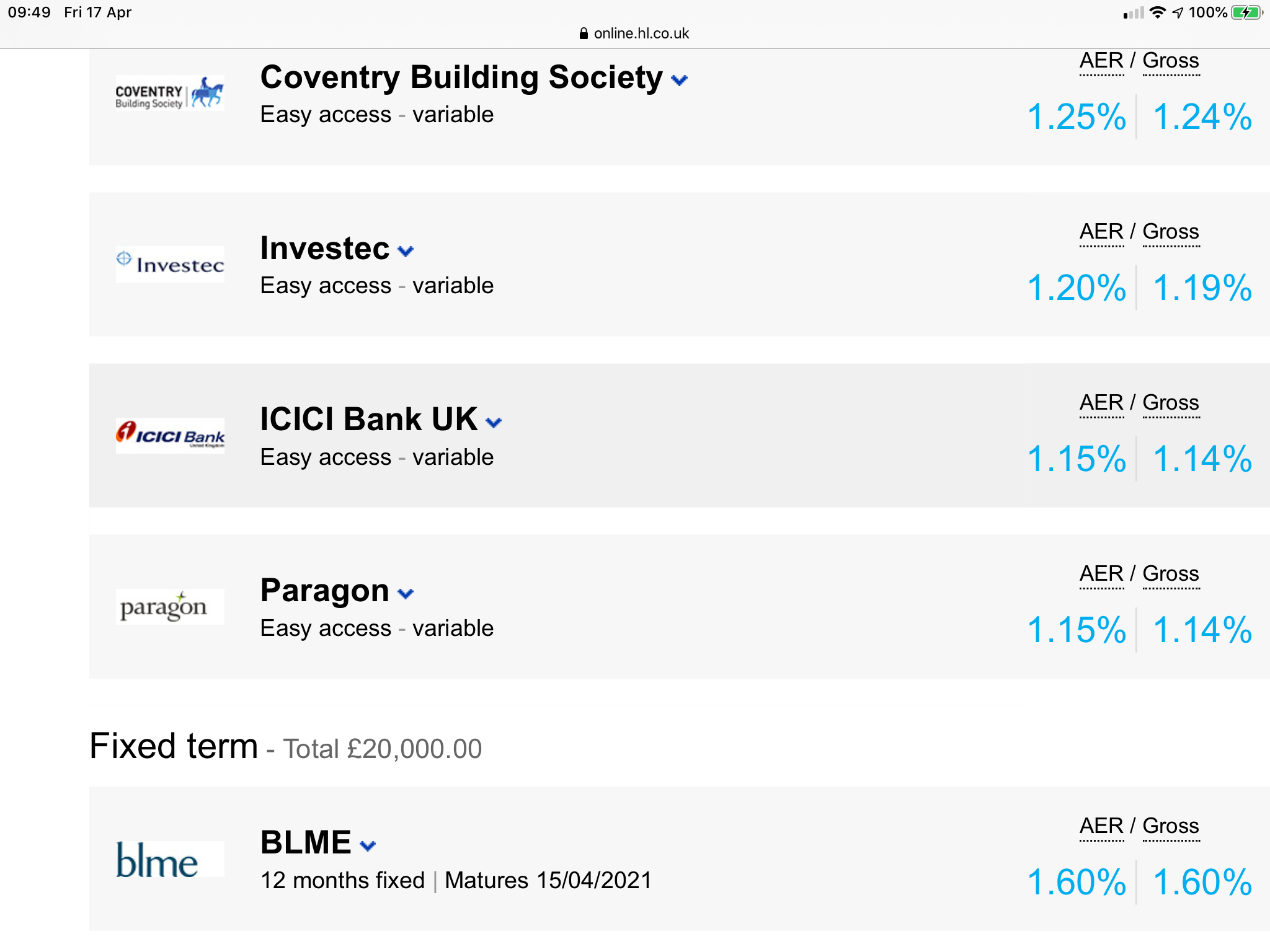

Thats annoying about NSI having shifted all income bond funds (1.15% supposed to drop to 0.7%) into Hargreaves Active savings. However rates are quite good there at the moment...

2

2 -

ffacoffipawb said:Thats annoying about NSI having shifted all income bond funds (1.15% supposed to drop to 0.7%) into Hargreaves Active savings. However rates are quite good there at the moment...

Yes, I have a 1 year fixed at 2% coming to the end in July. I'm also shifting my Emergency Fund to the Investec offering. Popping it into HL means it's out of sight out of mind!

If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.0 -

BLME have a 2% 5 year fix at HL active savings at the moment. Seems low for such a long term fix with no access though. May stick a few quid of my 5 year cash spends fund into it.Bravepants said:ffacoffipawb said:Thats annoying about NSI having shifted all income bond funds (1.15% supposed to drop to 0.7%) into Hargreaves Active savings. However rates are quite good there at the moment...

Yes, I have a 1 year fixed at 2% coming to the end in July. I'm also shifting my Emergency Fund to the Investec offering. Popping it into HL means it's out of sight out of mind! 0

0 -

Well.....since our family ski trip was halted before we got away......we had a similar sum unspent.Sea_Shell said:Spend it...?? What is this "spending" you refer too?

Seriously though, if we could think of anything we needed or wanted at the moment we probably would...but as most of our plans of spending was going to be from being "away" what else is there?

New TV, fibre broadband, streaming subscriptions etc...don't appeal.

A heated swimming pool would be nice, but £2k isn't going to cut it!! (and we don't have room!)

Perhaps no pool......but I can confirm that £400 gets a great inflatable hot tub+chemicals (Aldi) - money well spent!

Yes, there is also an electricity cost, but for the current time, our "Quarantine Tubatino" has been a box office hit here!!

The rest? I'd personally be happy ISA'ing it in a relatively high-risk fund, but then I'm a high risk kind of person....yes, I'd risk that things could get worse, but my feeling is things will be back up within 2+ years. YMMV Plan for tomorrow, enjoy today!4

Plan for tomorrow, enjoy today!4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards