We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

Not another Santander thing🤣soulsaver said:Note Moneybox is not a UK bank, it's another aggregator.

Where your not-so 'Simple Saver' funds are apparently held, Santander International (eventually) is also not a UK Bank.

So it's not clear to me that my funds would be covered by FSCS depositor protection - never mind my usual gripe with these enterprises, 100% of the time.

Santander Edge. (Current account applied for)

Cahoot. (Applied & accepted for straight away today)

This.

Anything else Santander related I've not seen? 🤔😁0 -

Check the FCA or FSCS websites. Santander International is a trading name of Santander Financial Services plc, FCA registration number 146003. This firm is authorised and regulated by the PRA/FCA. Deposits are protected by the FSCS, if (and only if) they are held with a UK branch.soulsaver said:Note Moneybox is not a UK bank, it's another aggregator.

Where your not-so 'Simple Saver' funds are apparently held, Santander International (eventually) is also not a UK Bank.

So it's not clear to me that my funds would be covered by FSCS depositor protection - never mind my usual gripe with these enterprises, 100% of the time.

If deposits are held with their branches in Jersey or the Isle of Man then protection is provided by the local deposit protection scheme instead.

DYOR etc.

1 -

Zopa EA ISA is still showing 5.08% - I thought the rate was dropping from 6 April?0

-

6 April 2025.patpalloon said:Zopa EA ISA is still showing 5.08% - I thought the rate was dropping from 6 April?

Technically, 0.50% bonus until 6 April 2025. The underlying rate of 4.58% is variable.2 -

Thanks! I misread that.RG2015 said:

6 April 2025.patpalloon said:Zopa EA ISA is still showing 5.08% - I thought the rate was dropping from 6 April?

Technically, 0.50% bonus until 6 April 2025. The underlying rate of 4.58% is variable.0 -

I have just noticed the following on the Zopa website.RG2015 said:

6 April 2025.patpalloon said:Zopa EA ISA is still showing 5.08% - I thought the rate was dropping from 6 April?

Technically, 0.50% bonus until 6 April 2025. The underlying rate of 4.58% is variable.Earn a bonus rate on Access ISA pots!

Open a Smart ISA before 6th May 2024 to earn an extra 0.5% AER*/gross** fixed on top of the underlying 4.58% AER (4.48% gross) variable Access ISA pot rate.

This means you'll earn a total of 5.08% AER (4.96% gross) variable on Access ISA pots!

The bonus rate will run until 6th May 2025.

Just trying to get my head around whether I should update mine somehow as its 0.50% bonus expires on 6 April 2025.

0 -

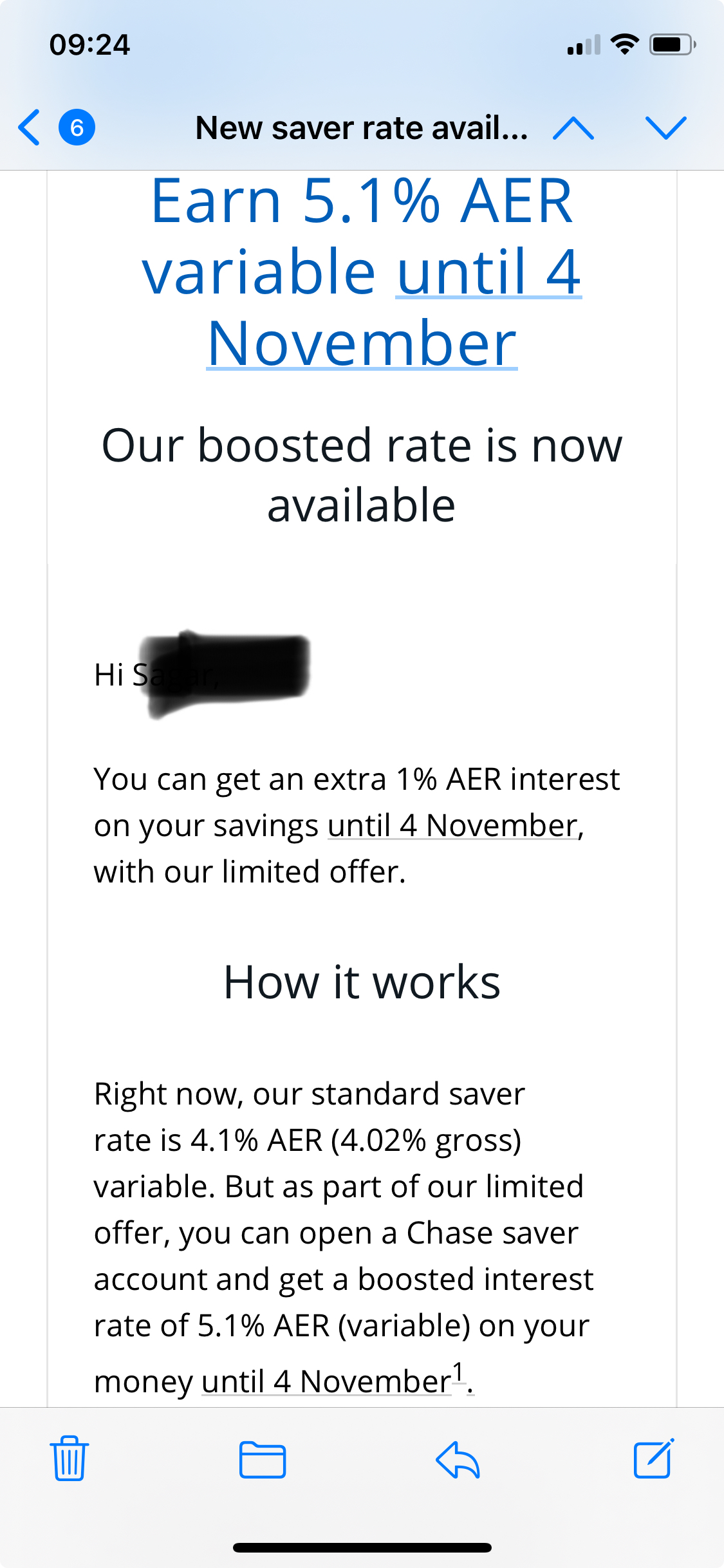

Just got a email from chase. They’ve put out a boosted easy access saver giving a total rate of 5.1% until November (1% bonus) but tracks base rate -1.15%. Decent right now but may drop. Could be a good alternative short term when the Santander 5.2% rate drops for their easy access saver10

-

How do you get this? Can’t see anything online or in the app.Sp363 said:Just got a email from chase. They’ve put out a boosted easy access saver giving a total rate of 5.1% until November (1% bonus) but tracks base rate -1.15%. Decent right now but may drop. Could be a good alternative short term when the Santander 5.2% rate drops for their easy access saver0 -

I got this email through this morning. Then there was a boosted option in the app.

0

0 -

Hmm….so are Chase only offering this to certain customers? I don’t seem to have that option.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards