We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

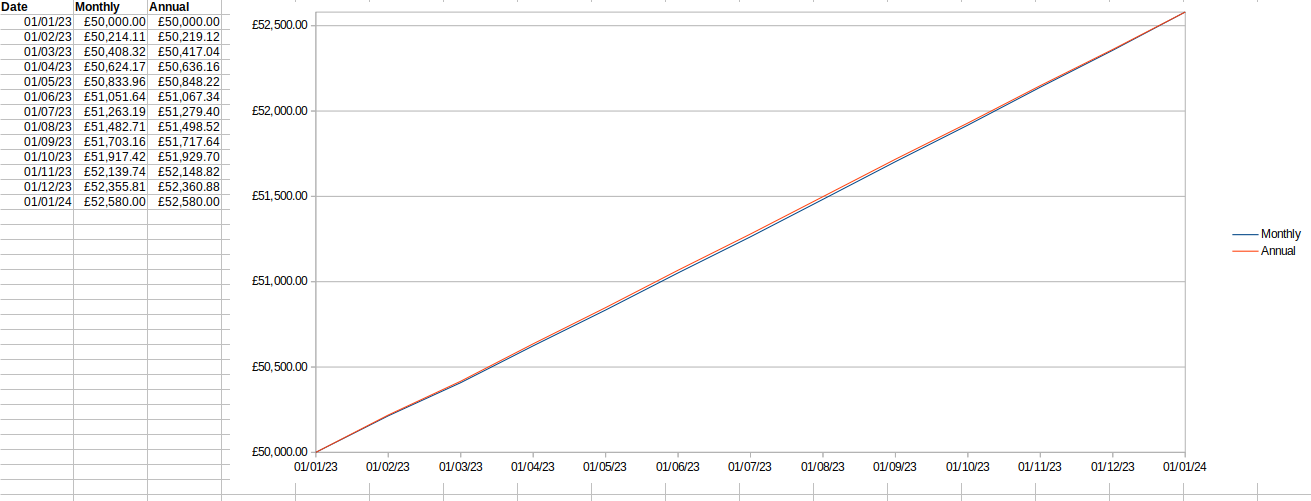

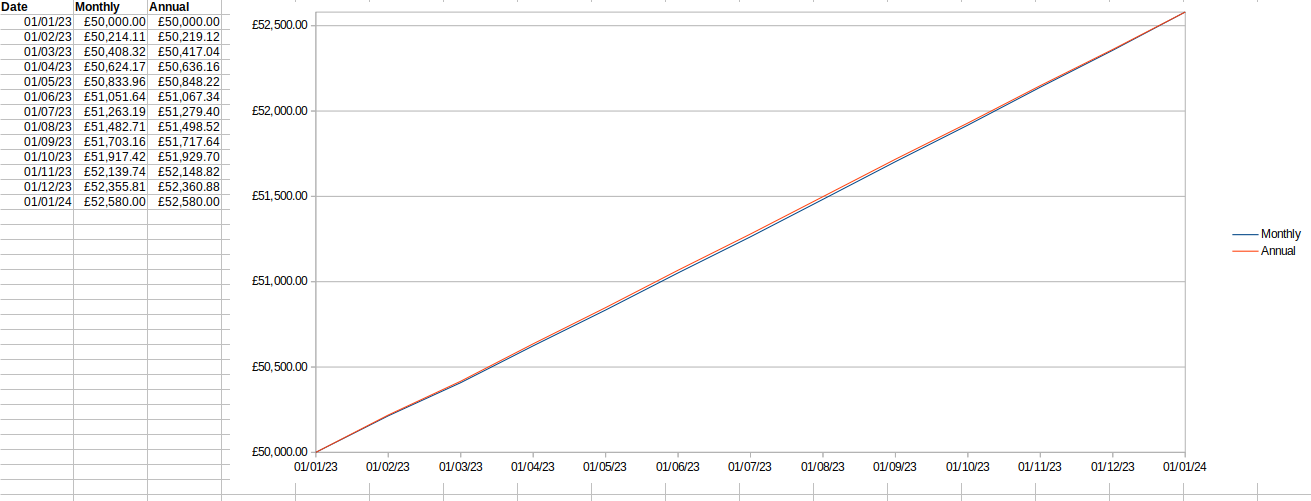

May be worth plotting only the difference between the 2 columns, would show the proper U-curvemasonic said:Here's a table and plot of the relative outcomes when closing the respective accounts on the first of each month (based on Paragon double access 5.16%), you can only just see the gap between the lower blue curve and upper red line in the plot: 4

4 -

intalex said:

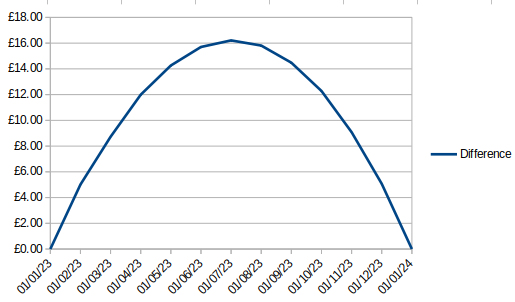

May be worth plotting only the difference between the 2 columns, would show the proper U-curvemasonic said:Here's a table and plot of the relative outcomes when closing the respective accounts on the first of each month (based on Paragon double access 5.16%), you can only just see the gap between the lower blue curve and upper red line in the plot: Good idea, and indeed it does:

Good idea, and indeed it does: 5

5 -

And to clarify, the maximum mid-point % difference that I quoted of 0.0305% corresponds to a 5% AER, so it's not a fixed % and actually varies with the AER.intalex said:

Only if you keep the funds in there for the full 12 months, if you were to "exit" i.e. close down the account and have the accrued interest paid, then the annual option would yield a tiny bit more than the monthly option.allegro120 said:

It works out the same.invuk said:Thanks guys really appreciate the time and effort for all the responses Just one last question, if you choose monthly over 12-month interest does it always work out the same or do you get more if you choose the annual option?

Just one last question, if you choose monthly over 12-month interest does it always work out the same or do you get more if you choose the annual option?

To give you an idea of how tiny, by my workings, a maximum possible difference of 0.0305% of the principal would be yielded if "exiting" at exactly the mid-point of the 12-month period. At a principal equal to the £85k FSCS limit this would be a maximum possible difference of £25.89.

So unless you need the monthly interest to be accessible (e.g. as a supplementary income, to feed a regular saver, etc), it might be slightly better to go with annual interest on an easy access account, and then:

- "exiting" immediately if a better interest rate comes along, and then re-apply the same logic with a new account

- "exiting" at the precise 6-month point if the same interest rate is available in a new account

- keeping the account going if the interest rate remains better than anything else available in the market

4 -

I already have the account too. Thanks for the tip though!soulsaver said:

Using the same 'hack' you may get 95 day 5.60% at RCI.. 'available to existing customers'.sta0612 said:

Apologies. In my haste, after a long night shift, I misread it as 5.60% 😅. You are correct, it is still 4.60%. Thanks for pointing that out. I believe their Easy Access ISA is currently chart topping though.soulsaver said:

Have they changed the notice account rate? 4.60% for 95 days is worse than poor EAs and surely cant be 'table topping'?sta0612 said:Gatehouse 5.23% EPR can, however, be opened by "existing" customers.

Having noticed they are also topping the Easy Access ISA and Notice Account charts, I just opened these accounts as a new customer. I was then able to open the Easy Access Account in a matter of seconds.

95 day notice savings account | Gatehouse Bank | Gatehouse Bank plc

I already hold the account so can't test it.

95 Day Notice Account | RCI Bank0 -

Currently I have a Kent Reliance Easy Access issue 65 account paying 5.01%. I note that they have closed this issue and opened issue 66 paying a slightly better 5.06%. Does anyone have experience of being transferred to newer issues automatically or is it only done on request?

0 -

I can confirm the 'hack' works for RCI. Having never previously used RCI before I applied for one of their Freedom Savings accounts at 4.75% at around 10am this morning, received my user ID about 30 minutes later and have now opened their 95 day notice account at 5.6%. I never funded the EA account so will just let them close it at a later date but the notice account will absorb a large chunk of the money I currently have in 5.25% regular savers quite nicely for a few months.soulsaver said:

Using the same 'hack' you may get 95 day 5.60% at RCI.. 'available to existing customers'.sta0612 said:

Apologies. In my haste, after a long night shift, I misread it as 5.60% 😅. You are correct, it is still 4.60%. Thanks for pointing that out. I believe their Easy Access ISA is currently chart topping though.soulsaver said:

Have they changed the notice account rate? 4.60% for 95 days is worse than poor EAs and surely cant be 'table topping'?sta0612 said:Gatehouse 5.23% EPR can, however, be opened by "existing" customers.

Having noticed they are also topping the Easy Access ISA and Notice Account charts, I just opened these accounts as a new customer. I was then able to open the Easy Access Account in a matter of seconds.

95 day notice savings account | Gatehouse Bank | Gatehouse Bank plc

I already hold the account so can't test it.

95 Day Notice Account | RCI Bank3 -

On request. Log in, open new issue. I transfer balance leaving £1 in old account then send secure message requesting closure and transfer of capital and interest to latest account. Usually takes a few days.chineplate said:Currently I have a Kent Reliance Easy Access issue 65 account paying 5.01%. I note that they have closed this issue and opened issue 66 paying a slightly better 5.06%. Does anyone have experience of being transferred to newer issues automatically or is it only done on request?

1 -

Reminds self not to automatically send message to upgrade to latest issueBridlington1 said:@soulsaver

Shawbrook EA Issue 36 at 5.11% is now NLA and has been replaced by Issue 37 at 5%.

EDIT:

Paragon Double Access Issue 3 at 5.25% is also NLA and has been replaced by Issue 4 at 5.16%.1 -

Have interest rates peaked and are we begining to see them drop?0

-

Easy access rates are very close to the base rate now, so a lot of banks are raising their rates temporarily to generate funds, then reducing those rates to new customers once the funds have been raised (but honouring the higher rate for those that have already signed up). Rates may or may not have peaked but there is no obvious drop in sight, at least for the next couple of months.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards