We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

I can't argue about mathematical facts. For everything else, i.e. how the interest is actually calculated and credited, I can only take your word (I have to confess that I could never be bothered to check).spider42 said:

The grounds for claiming that you'd get a bit more interest by opting for annual interest if you close the account earlier are that it is a mathematical fact. With monthly interest, you'd get (1.043^(1/12))^6 times your original balance if you close after 6 months, in other words £10,212.74 per £10,000 deposited. With annual interest, you would have £10,215.00.grumbler said:

Possibly, you are right.cwep2 said:

AER has to be quoted to 2 decimal places (by law).grumbler said:

Again, I think you are mistaken. It's always calculated daily, but credited either monthly or annually.cwep2 said:

You don't earn interest on the interest until it's paid (monthly).No, I don't think so. Annual interest is calculated daily at 4.22%. After compounding it makes 4.3%:

(1+0.0422/365)^365-1 = 0.043

As simple as that.

That said, daily compounding within one month is negligible:

(1+0.0422/12)^12-1 = 0.043026

(1+0.0422/365)^365-1 = 0.043101

The same for all credit products (CCs, overdrafts, loans) - calculated daily, added monthly or annually (or on closure).

If they paid interest at 4.22% gross and it was compounding daily, then as per your own calculation the AER on the account would be 4.31% not 4.30%.

4.22% seems to be the gross 'monthly' rate calculated from the base 4.30% figure:

(1.043^(1/12)-1)*12 = 4.2175%

I still see no grounds for claiming that"The result is the same if you keep the account open for 12 months and the annual interest is paid in 12 months time. If you close earlier, you'd get a bit more interest opting for annual interest because you'd get the annual interest rate on closure. "Maybe because 4.22 > 4.2175 if they really use the former for calculations.

The sums are even easier of you look at closing after 1 month instead of 6. With monthly, you'd get 4.22%/12. With annual, you'd get 4.3%/12. Annual is obviously better in this example, without needing to consider compounding or do any calculations.

It is nothing to do with rounding of interest rates, it is just maths. .

0 -

How can you check. I opened an account a few hours ago but don't have any details to log on and view my account2010 said:

Tomorrow.tsmiggy54 said:Anyone know how long, it is before the initial deposit appears in the Newcastle account?

I transfered mine using the reference number today, but nothing yet

Thanks

I sent initial yesterday and it showed today.

I also sent more payments today and they are showing in the account now.16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j0 -

It's in the app but it only appears one day after opening the account, exactly like ford money 👍SteveG2010 said:

Not had that, but I'll give it a few days and try again. Clearly, not being able to withdraw money that I have already put in is not the normal state of affairs, but a message on screen that I can't do it, rather than just not having any visible ability to do so (no button, link, menu item at all) is an obvious improvement that their website and app desperately needs.moi said:

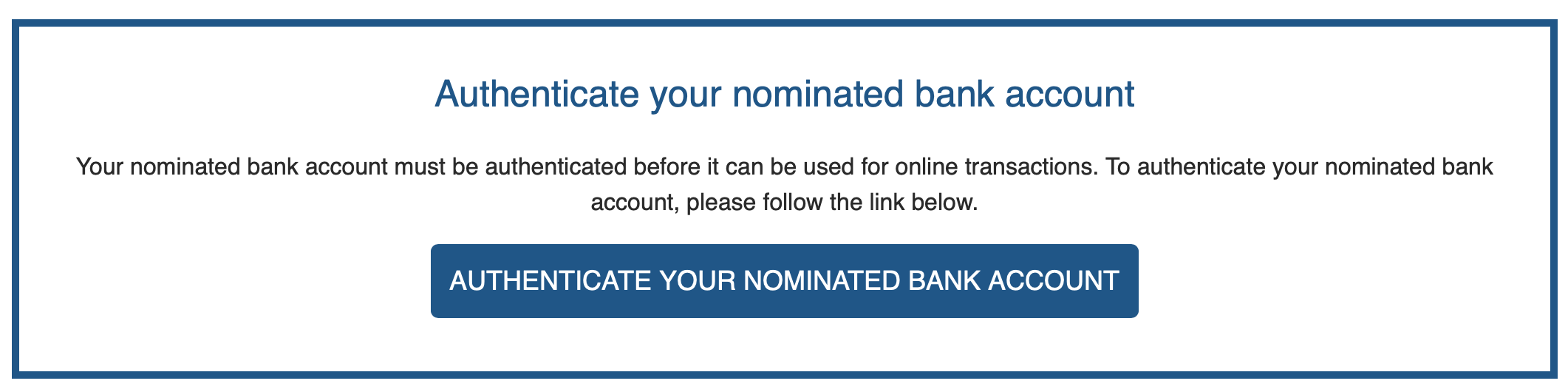

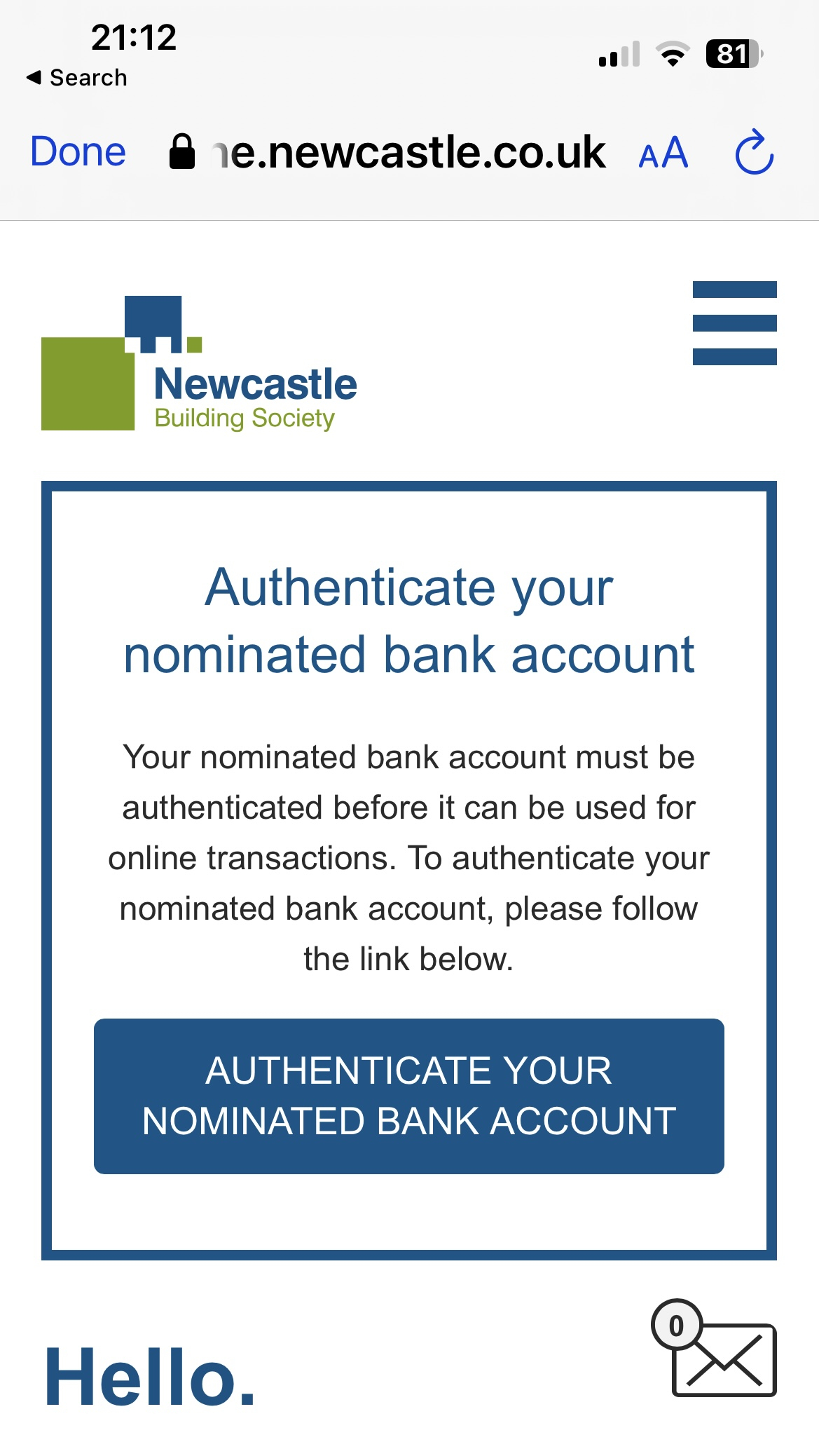

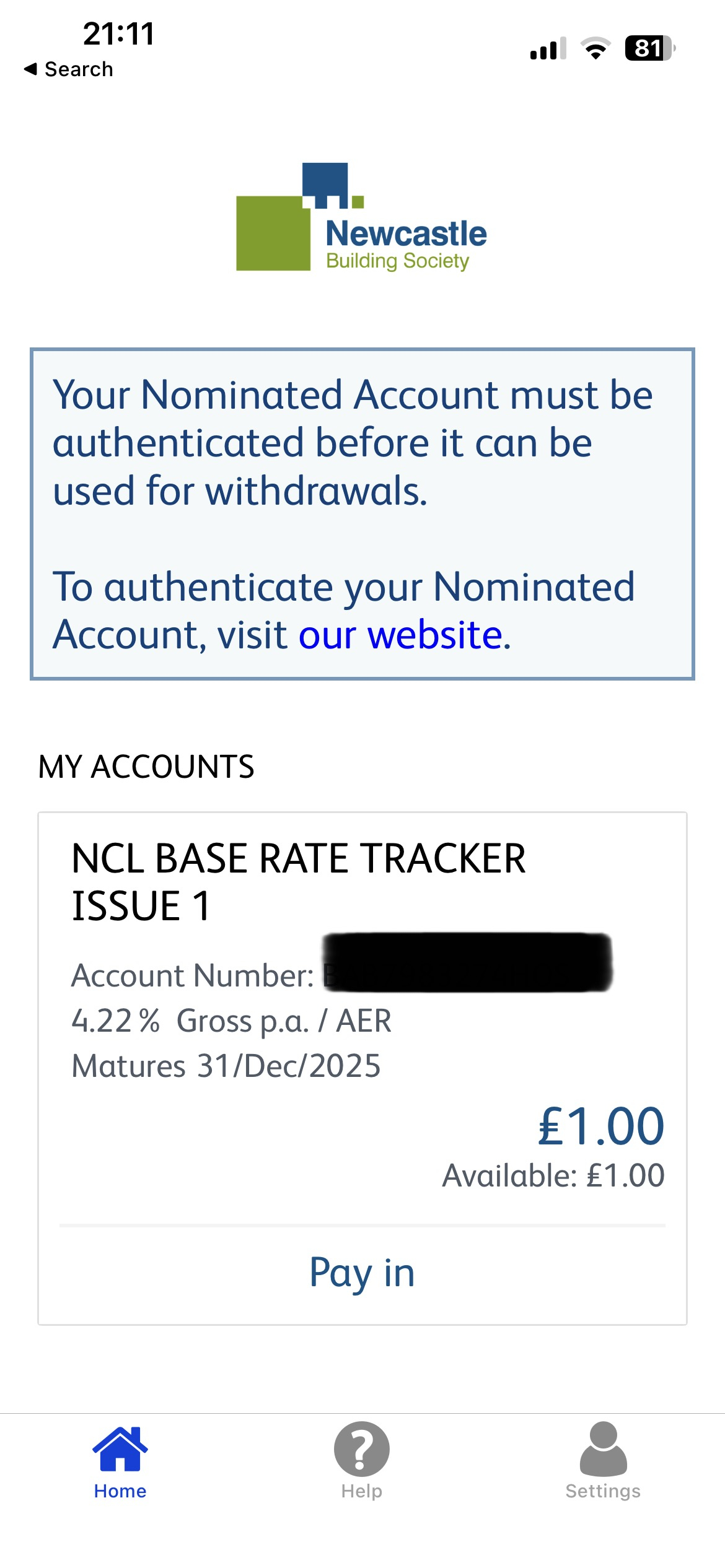

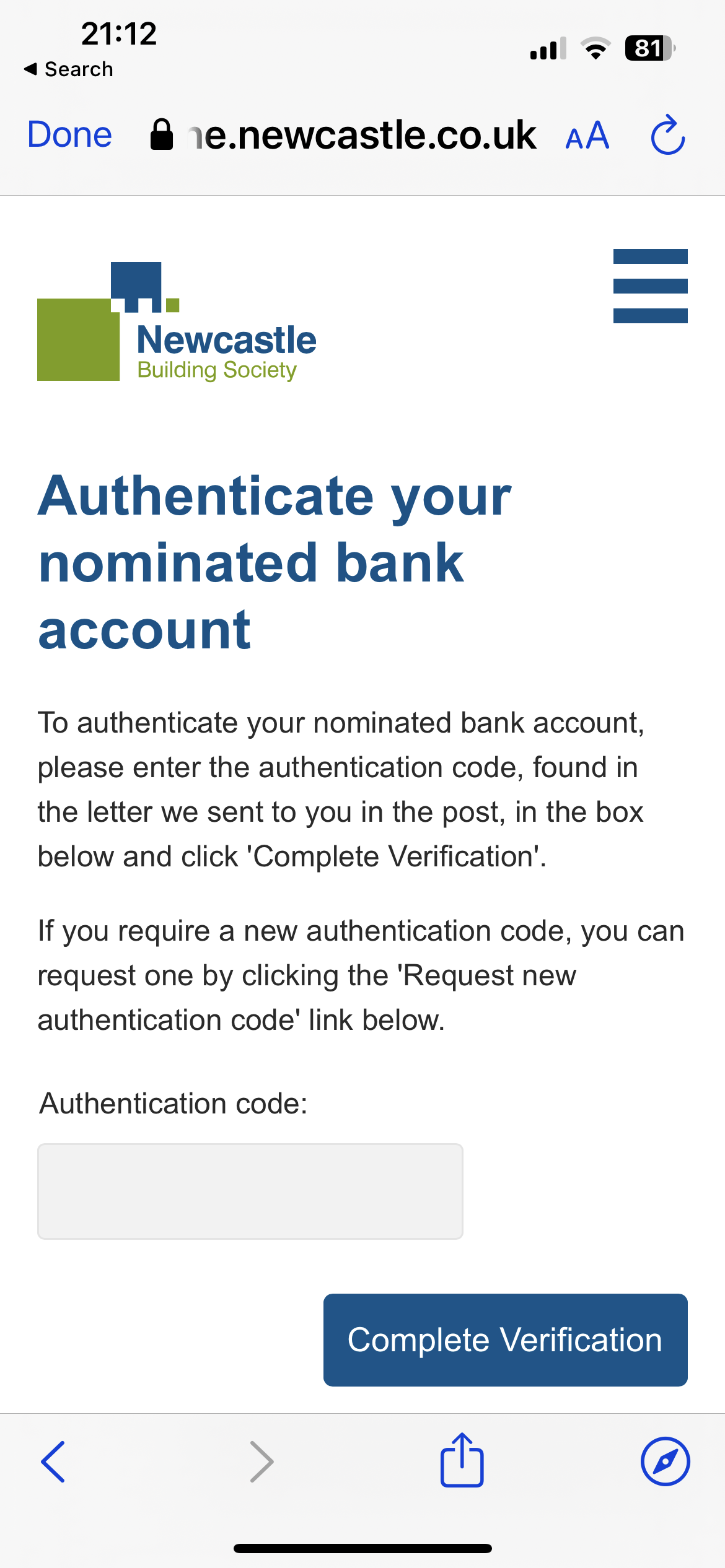

Do you not have the huge "Authenticate your nominated bank account" message? Like cymruchris said, you need the code in the post before you can withdraw to your nominated account.SteveG2010 said:I have opened a Newcastle BS Tracker online and transferred some money in. There is no way to withdraw money from the account, neither via the website nor via the Android App. There just isn't a button, link or menu item to do it. All I can do is show a statement. There's something seriously wrong with their IT. 0

0 -

You should get your ID tomorrow by email.allegro120 said:

Thank you! Did it again just now and it worked without "send us ID" message. Deposited £1, downloaded the app and now awaiting for user ID and instructions - I guess that will be sent by post.fabsaver said:

Just applied again online for the Newcastle base rate tracker, as I've noticed a few comments saying accounts successfully opened today.fabsaver said:

Same here. Very odd as I open lots of accounts and always get verified electronically.Mr._H_2 said:

Me too, which is odd because I'm usually easily verified electronically. One would imagine that if there were a means to provide the documentation electronically, they would provide those details in the application confirmation email. However, the only method provided is to post physical copies to them (how quaint!)jaceyboy said:Just applied but they are asking for additional proof of identity, has anyone managed to do this electronically rather than postal?

I can only think of one occasion in the last few years where the electronic checks failed and I was asked to provide id. However it was just a temporary blip because I'd applied in the early hours. On that occasion I reapplied during working hours and the account was opened instantly.

Unless they allow documents by email it's really not worth the effort. It's very likely the rate will be beaten soon anyway. Their loss.

It worked! All the same details as yesterday but this time account opened straight away with no id documents needed.

It seems there may have been some sort of glitch with the electronic verification yesterday. Perhaps due to the volume of account applications. For anyone else who was asked to post proof of id it's worth trying another online application.

A code to authenticate your nominated bank account comes by post.

Until you get that, you can only pay in but not withdraw.1 -

I received my user ID via email, same day as I applied for the account.allegro120 said:

Thank you! Did it again just now and it worked without "send us ID" message. Deposited £1, downloaded the app and now awaiting for user ID and instructions - I guess that will be sent by post.fabsaver said:

Just applied again online for the Newcastle base rate tracker, as I've noticed a few comments saying accounts successfully opened today.fabsaver said:

Same here. Very odd as I open lots of accounts and always get verified electronically.Mr._H_2 said:

Me too, which is odd because I'm usually easily verified electronically. One would imagine that if there were a means to provide the documentation electronically, they would provide those details in the application confirmation email. However, the only method provided is to post physical copies to them (how quaint!)jaceyboy said:Just applied but they are asking for additional proof of identity, has anyone managed to do this electronically rather than postal?

I can only think of one occasion in the last few years where the electronic checks failed and I was asked to provide id. However it was just a temporary blip because I'd applied in the early hours. On that occasion I reapplied during working hours and the account was opened instantly.

Unless they allow documents by email it's really not worth the effort. It's very likely the rate will be beaten soon anyway. Their loss.

It worked! All the same details as yesterday but this time account opened straight away with no id documents needed.

It seems there may have been some sort of glitch with the electronic verification yesterday. Perhaps due to the volume of account applications. For anyone else who was asked to post proof of id it's worth trying another online application.1 -

Ref the Newcastle building society saver - in my app tonight there’s a link to authenticate my bank account - which when you follow through brings you to inputting the code you get sent in the post. (Which of course I won’t have gotten yet as I only opened the account yesterday) so no doubt once this is received and input - deposits and withdrawals should be straightforward.

---

--- ---

--- 1

1 -

You will get your ID tomorrow by email and you already know your password and other login details.Rheumatoid said:

How can you check. I opened an account a few hours ago but don't have any details to log on and view my account2010 said:

Tomorrow.tsmiggy54 said:Anyone know how long, it is before the initial deposit appears in the Newcastle account?

I transfered mine using the reference number today, but nothing yet

Thanks

I sent initial yesterday and it showed today.

I also sent more payments today and they are showing in the account now.

You could try the following now if you can`t wait for your ID.

Go to the login page and click "forgot ID"

Answer the questions and they will send you an email with your ID.1 -

Harpenden BS - Not TOTP, but I thought perhaps account holders would want to know

The below accounts will be changing from Friday 30th June as follows:

Account name Current rate Gross PA / AER%* Variable New rate Gross PA / AER%* Variable Triple Access (3 or less withdrawals per annum) 3.50% 3.75% **Triple Access (4 or more withdrawals per annum) 1.60% 1.60% All other product rates remain the same.

The below account will be launched from Friday 30th June as follows:

Account name Current rate Gross PA / AER%* Variable New rate Gross PA / AER%* Variable Online Instant Access (Issue 1) n/a 3.84% If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

moi said:

Do you not have the huge "Authenticate your nominated bank account" message? Like cymruchris said, you need the code in the post before you can withdraw to your nominated account.SteveG2010 said:I have opened a Newcastle BS Tracker online and transferred some money in. There is no way to withdraw money from the account, neither via the website nor via the Android App. There just isn't a button, link or menu item to do it. All I can do is show a statement. There's something seriously wrong with their IT. Where do you see this message??? When I log into my new NBS account, don't see it anywhere, I've clicked around. I haven't seen anything about having to auth the nominated bank account, nothing said a letter, there was "If you are a new Newcastle Building Society customer, you will be sent a letter, as well as an email, containing your User ID. You will need this to log into your account.", but they sent me the user ID in an email.0

Where do you see this message??? When I log into my new NBS account, don't see it anywhere, I've clicked around. I haven't seen anything about having to auth the nominated bank account, nothing said a letter, there was "If you are a new Newcastle Building Society customer, you will be sent a letter, as well as an email, containing your User ID. You will need this to log into your account.", but they sent me the user ID in an email.0 -

Opened Newcastle without needing to send ID.

Good App.

Good website optimised for mobile.

Good security.

Good savings goals system.

If transfers are an acceptable speed and they don't make it NLA very soon, Chip had better watch out.

3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards