We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

My house has been on the market for a month and i have no viewing.

Comments

-

dazleeds1978 wrote: »Me and i have two friends selling 2 bed houses. they just not selling at all.

Because they are priced too high!dazleeds1978 wrote: »If you read the posts. I had 3 EAs valued and bank because i want to re-mortgage. I put the price cheaper than all their valuation

The value of a house is not what an estate agent or bank says, but what somebody will actually pay for it. All houses will sell, including 2 bedroomed houses, if the price is right. If you lower your price it will sell, it's as simple as that.0 -

Because they are priced too high!

The value of a house is not what an estate agent or bank says, but what somebody will actually pay for it. All houses will sell, including 2 bedroomed houses, if the price is right. If you lower your price it will sell, it's as simple as that.

Its not that simple. my friend reduced 25% and still not selling. house prices didnt go down from 2006 25% down.0 -

dazleeds1978 wrote: »Its not that simple. my friend reduced 25% and still not selling. house prices didnt go down from 2006 25% down.

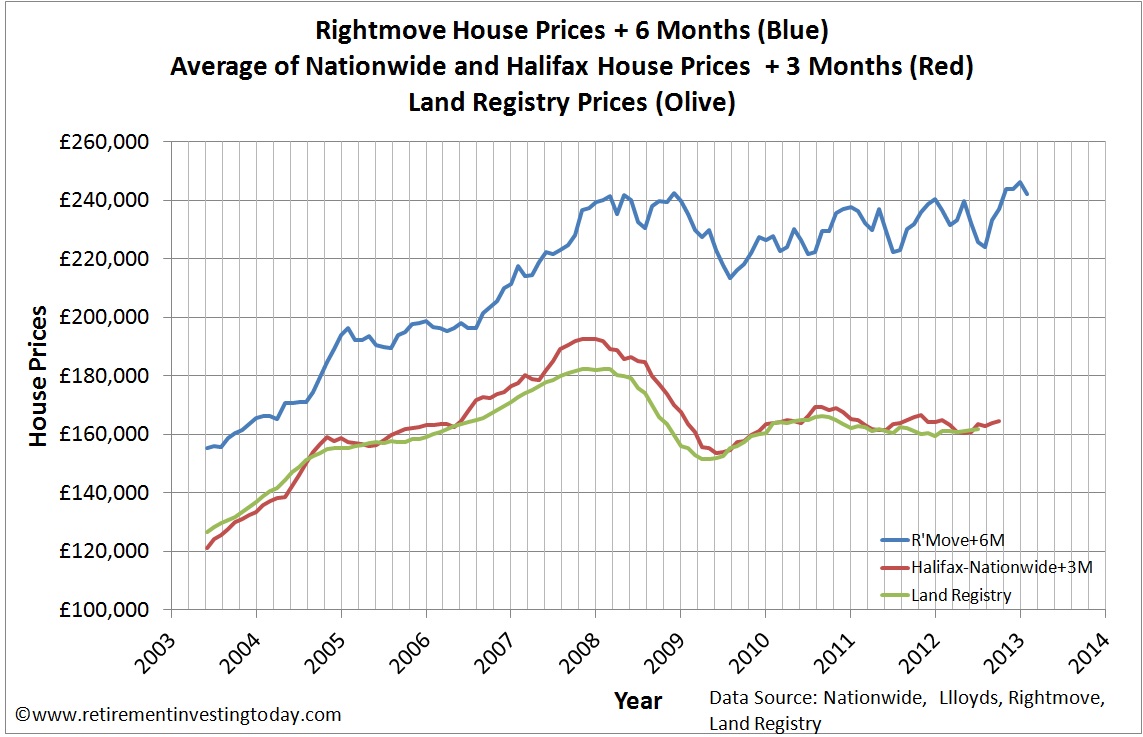

It is that simple. A home will sell if it is priced right, the graph below shows sellers are becoming increasingly delusional on price. :exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

dazleeds1978 wrote: »Its not that simple. my friend reduced 25% and still not selling. house prices didnt go down from 2006 25% down.

It is that simple! If you reduce it enough it will sell. '2 bedroomed houses don't sell' is nonsense - they do sell, just to a different market. If it was a lot cheaper I could buy it myself and rent it out, but that isn't a viable option at the current price. The fact remains that any house will sell if it is priced correctly.0 -

It is that simple! If you reduce it enough it will sell. '2 bedroomed houses don't sell' is nonsense - they do sell, just to a different market.

I agree there is a lot of interest in 2 bed houses, I for one are looking at 2-3 bed houses. The big market for 2 bed houses are FTBs and Buy to Let.

If the price is not right you will not attract any of these 2 groups. FTBs need to get deposits and mortgages up to that value and Landlords need to buy at a price where they can get +5% rent. If you do your calculations with both those in mind you can find a better price to sell at.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

It is that simple! If you reduce it enough it will sell. '2 bedroomed houses don't sell' is nonsense - they do sell, just to a different market. If it was a lot cheaper I could buy it myself and rent it out, but that isn't a viable option at the current price. The fact remains that any house will sell if it is priced correctly.

I could rent i too. and i will do that if doesnt sell at 95-96k because i am not willing to loose anymore. so i will invest instead sell it with loose and in time they will get in price again.0 -

-

The house prices Halifax nation wide price index it shows

A property located in Yorkshire & Humberside which was valued at £108,500 in Q1 of 2008 would be worth approximately £96,059 in Q2 of 2012. This is equivalent to a change of -11.47%.

And it shows current index is 11.4 drop since i bought it not 25%.

http://www.nationwide.co.uk/hpi/calculator/calculator.htm0 -

dazleeds1978 wrote: »I wend to house prices Halifax nation wide price index.

A property located in Yorkshire & Humberside which was valued at £108,500 in Q1 of 2008 would be worth approximately £96,059 in Q2 of 2012. This is equivalent to a change of -11.47%.

And it shows current index is 11.4 drop since i bought it not 25%.

http://www.nationwide.co.uk/hpi/calculator/calculator.htm

Now why would a building society website show that houses are worth more than they actually are? What motive could they have for doing that? Property is not the cash cow it once was Daz due to over indebtedness from the crazy years and a correction of house prices which at the very best will stagnate at current levels for many years to come. Low wages and high inflation over the last few years has led to people tightening their belts and people wont pay over the odds.

Until everybody realises this then the housing market continues to stagnate as it is. People cant get on the ladder for high prices, people cant move up the ladder as they have their equity trapped in a house they think is worth more than it is. If everybody got real then the housing market would pick up which would aid the economy no end...0 -

dazleeds1978 wrote: »The house prices Halifax nation wide price index it shows

A property located in Yorkshire & Humberside which was valued at £108,500 in Q1 of 2008 would be worth approximately £96,059 in Q2 of 2012. This is equivalent to a change of -11.47%.

And it shows current index is 11.4 drop since i bought it not 25%.

http://www.nationwide.co.uk/hpi/calculator/calculator.htm

Rightmove shows 8 pages of 2 bed houses priced cheaper, most far cheaper. There are a lot for £50-£60k compared to your £98k. So I doubt you would get either the Buy to Let or FTB crowd.

It's your right to rent it out instead if you have the 25% equity for the buy to let mortgage and the rest of the equity can be used for your new deposit say 25%.

Have you 50% in equity?

Sorry to be harsh but I believe you need to be more realistic, the property market is only going to get worse from here on in.

:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards