We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Cash ISAs: The Best Currently Available List

Comments

-

From memory, I think the minimum operating balance for Vida Cash ISA is £5.Ch1ll1Phlakes said:

Just a heads up. In case you haven't met the minimum balance, Vida may close the ISA. See quote for both easy access and defined access ISAs.Zaul22 said:I saw that but they also have a minimum balance which I forgot about and didn't meet. It looks like they still pay on the anniversary of the first payment even if it was below the minimum balance, as long as you are now over it.

The minimum initial investment for this account is £500. A deposit or transfer request of at least this amount has to be made within 21 days of your application request, or the account will be closed.

EDIT: Further note if they do close your account you'll still earn interest.

From the T&Cs: The Special Conditions will tell you if there's a Minimum Account Balance that you must maintain in the Account. If the Account Balance falls below this amount, we’ll close your Account and return the Account Balance, along with any outstanding interest, to your Nominated Bank Account.0 -

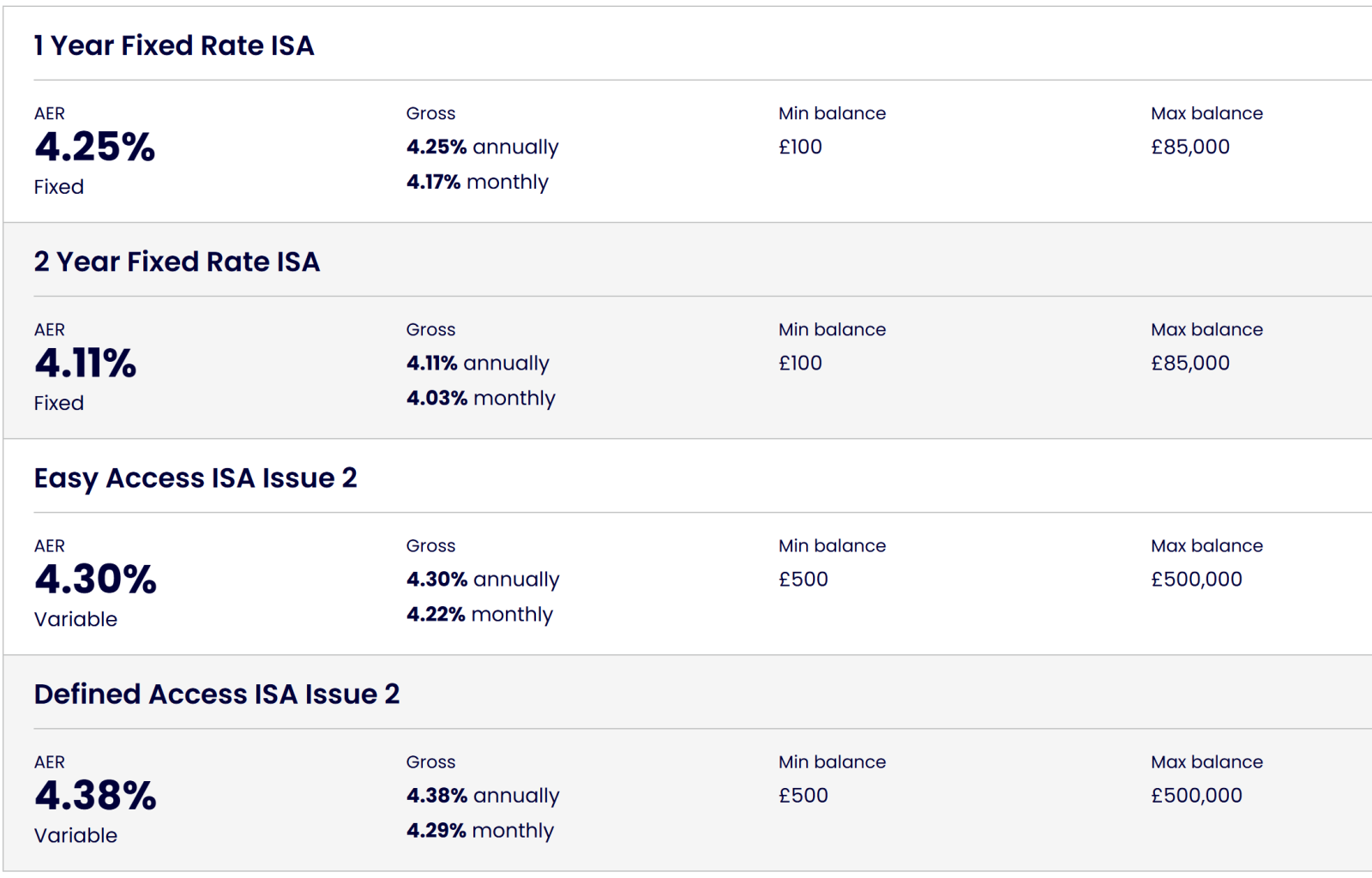

I saw no mention of a minimum operating balance in their T&Cs with the quotes previous taken from their website and T&Cs. If you can find where this was at please drop it in. Below I've provided a screenshot of Vida's ISA page for their currently available accounts. The minimum value for other accounts is lower than some of these.10_66 said:

From memory, I think the minimum operating balance for Vida Cash ISA is £5.Ch1ll1Phlakes said:

Just a heads up. In case you haven't met the minimum balance, Vida may close the ISA. See quote for both easy access and defined access ISAs.Zaul22 said:I saw that but they also have a minimum balance which I forgot about and didn't meet. It looks like they still pay on the anniversary of the first payment even if it was below the minimum balance, as long as you are now over it.

The minimum initial investment for this account is £500. A deposit or transfer request of at least this amount has to be made within 21 days of your application request, or the account will be closed.

EDIT: Further note if they do close your account you'll still earn interest.

From the T&Cs: The Special Conditions will tell you if there's a Minimum Account Balance that you must maintain in the Account. If the Account Balance falls below this amount, we’ll close your Account and return the Account Balance, along with any outstanding interest, to your Nominated Bank Account. 0

0 -

Ch1ll1Phlakes said:

I saw no mention of a minimum operating balance in their T&Cs with the quotes previous taken from their website and T&Cs. If you can find where this was at please drop it in. Below I've provided a screenshot of Vida's ISA page for their currently available accounts. The minimum value for other accounts is lower than some of these.10_66 said:

From memory, I think the minimum operating balance for Vida Cash ISA is £5.Ch1ll1Phlakes said:

Just a heads up. In case you haven't met the minimum balance, Vida may close the ISA. See quote for both easy access and defined access ISAs.Zaul22 said:I saw that but they also have a minimum balance which I forgot about and didn't meet. It looks like they still pay on the anniversary of the first payment even if it was below the minimum balance, as long as you are now over it.

The minimum initial investment for this account is £500. A deposit or transfer request of at least this amount has to be made within 21 days of your application request, or the account will be closed.

EDIT: Further note if they do close your account you'll still earn interest.

From the T&Cs: The Special Conditions will tell you if there's a Minimum Account Balance that you must maintain in the Account. If the Account Balance falls below this amount, we’ll close your Account and return the Account Balance, along with any outstanding interest, to your Nominated Bank Account.

For the Defined Access ISA Issue 1 (I appreciate the issue you show above is 2); it's shown as item 3 under Special Conditions on the Key Product Information page that was provided by them:"Balances: You must maintain a balance of between £5 and £85,000 (not including any interest) at all times in your Defined Access ISA. If your balance falls below this level, we’ll close your account and return any funds to your Nominated Bank Account. We’ll also return excess funds if your balance exceeds the maximum permitted, except if this is because of interest added to the account"1 -

Perfect. Thanks for finding that. I've amended my initial post about minimum balances to highlight this.10_66 said:Ch1ll1Phlakes said:

I saw no mention of a minimum operating balance in their T&Cs with the quotes previous taken from their website and T&Cs. If you can find where this was at please drop it in. Below I've provided a screenshot of Vida's ISA page for their currently available accounts. The minimum value for other accounts is lower than some of these.10_66 said:

From memory, I think the minimum operating balance for Vida Cash ISA is £5.Ch1ll1Phlakes said:

Just a heads up. In case you haven't met the minimum balance, Vida may close the ISA. See quote for both easy access and defined access ISAs.Zaul22 said:I saw that but they also have a minimum balance which I forgot about and didn't meet. It looks like they still pay on the anniversary of the first payment even if it was below the minimum balance, as long as you are now over it.

The minimum initial investment for this account is £500. A deposit or transfer request of at least this amount has to be made within 21 days of your application request, or the account will be closed.

EDIT: Further note if they do close your account you'll still earn interest.

From the T&Cs: The Special Conditions will tell you if there's a Minimum Account Balance that you must maintain in the Account. If the Account Balance falls below this amount, we’ll close your Account and return the Account Balance, along with any outstanding interest, to your Nominated Bank Account.

For the Defined Access ISA Issue 1 (I appreciate the issue you show above is 2); it's shown as item 3 under Special Conditions on the Key Product Information page that was provided by them:"Balances: You must maintain a balance of between £5 and £85,000 (not including any interest) at all times in your Defined Access ISA. If your balance falls below this level, we’ll close your account and return any funds to your Nominated Bank Account. We’ll also return excess funds if your balance exceeds the maximum permitted, except if this is because of interest added to the account"1 -

Do you do the ISA Transfer during the application process or after?SnowMan said:A reminder that Kent Reliance easy access ISA (issue 55) reduces from 4.56% AER to 4.21% AER today (24th July).You can open a Kent Reliance easy access ISA (issue 59) which pays 4.38% AER and do an ISA transfer of your issue 55 account into the issue 59.

tia

sx0 -

Just to add there was no loss of interest with this transfer either.Gambler said:I've been with Chip for 3 months but now the bonus has expired I've moved to Tembo.

Shame as I liked the app etc but the rate is no longer competitive.

Opened Tembo account Tuesday night and the funds have just been transferred so 48 hours on total which is superb.

Zopa to Chip took about 3 weeks.

I was going to open a Tembo fix but it's for new money only.2 -

sparkiemalarkie said:

Do you do the ISA Transfer during the application process or after?SnowMan said:A reminder that Kent Reliance easy access ISA (issue 55) reduces from 4.56% AER to 4.21% AER today (24th July).You can open a Kent Reliance easy access ISA (issue 59) which pays 4.38% AER and do an ISA transfer of your issue 55 account into the issue 59.

tia

sxYes I think you can arrange the transfer when opening during the application process.I opened my Kent Reliance easy access ISA issue 59 a number of days before I arranged the transfer. So I instead had to ring them up to arrange the internal transfer from the issue 55. It takes them a few days to process it but they backdate the transfer to the date you ring up once they do process it.I came, I saw, I melted1 -

Thank you. I think I might do it your way. I got very confused during the 'transfer during opening' process and abandoned it - A phone call seems much safer.SnowMan said:sparkiemalarkie said:

Do you do the ISA Transfer during the application process or after?SnowMan said:A reminder that Kent Reliance easy access ISA (issue 55) reduces from 4.56% AER to 4.21% AER today (24th July).You can open a Kent Reliance easy access ISA (issue 59) which pays 4.38% AER and do an ISA transfer of your issue 55 account into the issue 59.

tia

sxYes I think you can arrange the transfer when opening during the application process.I opened my Kent Reliance easy access ISA issue 59 a number of days before I arranged the transfer. So I instead had to ring them up to arrange the internal transfer from the issue 55. It takes them a few days to process it but they backdate the transfer to the date you ring up once they do process it.

sx1 -

Ford Money Flexible Cash ISA dropping from 4.35% to 4.18% on 11th August.Mortgage free

Vocational freedom has arrived1 -

Transfer now complete.Ch1ll1Phlakes said:I've just started a transfer from Moneybox to Chip. Anyone else transferred into Chip and how long did it take?

Form sent on 23rd at 8pm. Deposits in Moneybox frozen 25-7. Transfer received in Chip around 12:30 on 28-7.

Given I sent the form after 5pm and the weekend fell on the 26th and 27th that's two working days to complete the transfer. And can't complain about Moneybox or Chip as both sent emails for each stage of the process.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards