We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

akh43 said:I opened my Coventry late on Thursday night and the Virgin iSA was there when I logged on next day, quickest I recall, especially from Virgin. Disappointing when checking Virgin site as no sign whatsoever of my transferred ISA so I could download a final statement.Same here, very quick transfer to T212.I contacted Virgin live chat to ask about a statement, they said once an account is closed or transferred all transaction history is gone!Then did send a letter few days later, but it only gave the total transfer amount.1

-

Unless this has changed recently, I don't think Principality are one of the providers who use the BACs ISA transfer service. I had a number of their cash ISAs a few years ago and the transfers in and out were carried out by cheque/post and took around 10-14 days to complete.1spiral said:I don't. It does beg the question though why in this day and age, there are still some antiquated methods. Apparently Principality do do electronic transfers, its just Zopa are not on their list.

Zopa, on the other hand, do do electronic transfers AFAIK although they've only started offering cash ISAs in the last year or two and don't seem to have made it onto other banks' lists of approved BACs ISA transfer providers yet.2 -

We transferred a stocks and shares ISA from Aviva to a Santander cash ISA and it began to feel like the money must have been gradually carried between their 2 offices one penny at a time before all being credited at the end1

-

Im joining the T212 club after zopa's rate drop.

I wonder how long this will take..Ex Sg27 (long forgotten log in details)Massive thank you to those on the long since defunct Matched Betting board.0 -

West Brom BS

I've got the WeBSave 60 Day Notice ISA (Issue 2) and with the rate drop announced today I would need to move the cash. The balance is very small as I opened it a long time ago as a backup account.

If I am not mistaken, when they drop the rate you are allowed to close the account earlier without penalty so you don't have to wait until the 60 days are over.

I intend to move it to Virgin, so when I tell Virgin to wait until available, would WestBrom still apply the 60 days or will they release as soon as it is possible penalty free?

Can anyone confirm if my interpretation of the T&C's is correct?0 -

pecunianonolet said:

Final statement will come by post in the next days from Virgin.akh43 said:I opened my Coventry late on Thursday night and the Virgin iSA was there when I logged on next day, quickest I recall, especially from Virgin. Disappointing when checking Virgin site as no sign whatsoever of my transferred ISA so I could download a final statement.Just got a letter from Virgin to tell me the transfer is done and dusted and I will be getting a closing statement shortly. Why do banks waste so much money sending out numerous letters why not just send both letters together?Same with Coventry, 3 letters re 1 ISA transfer when 1 could give all the information required/needed.

3 -

pecunianonolet said:West Brom BS

I've got the WeBSave 60 Day Notice ISA (Issue 2) and with the rate drop announced today I would need to move the cash. The balance is very small as I opened it a long time ago as a backup account.

If I am not mistaken, when they drop the rate you are allowed to close the account earlier without penalty so you don't have to wait until the 60 days are over.

I intend to move it to Virgin, so when I tell Virgin to wait until available, would WestBrom still apply the 60 days or will they release as soon as it is possible penalty free?

Can anyone confirm if my interpretation of the T&C's is correct?From i understand it, you have 30 days from when they notify you of rate reduction to close or transfer your ISA penalty free, should you wish to do so. So if you've received notice you should be free to transfer ISA immediately.1 -

According to www.moneyfactscompare.co.uk, Coventry Building Society will today be pulling their Centrepoint Fixed ISA 31.05.26 paying 4.50% AER tax free and replacing it with Fixed Rate ISA (279) 31.05.26 which is paying a significantly lower interest rate of 4.32% AER tax free.

4 -

This is what it said in the email notification when they reduced the rate in December:pecunianonolet said:West Brom BS

I've got the WeBSave 60 Day Notice ISA (Issue 2) and with the rate drop announced today I would need to move the cash. The balance is very small as I opened it a long time ago as a backup account.

If I am not mistaken, when they drop the rate you are allowed to close the account earlier without penalty so you don't have to wait until the 60 days are over.

I intend to move it to Virgin, so when I tell Virgin to wait until available, would WestBrom still apply the 60 days or will they release as soon as it is possible penalty free?

Can anyone confirm if my interpretation of the T&C's is correct?

What's changing and whenWe are reducing the rate of interest paid on your WeBSave account(s) on 17 December 2024. The accounts affected and new rates can be found in the tables at the end of this email. Your account(s) affected are shown below.Account Name Account Number*WeBSave 60 Day Notice ISAMake sure your account is still right for youYou may consider moving your savings following this change. If you want to do this, we will waive any notice period or withdrawal charges that may normally apply on your account(s) for any withdrawals completed up to (and including) 2 January 2025.0 -

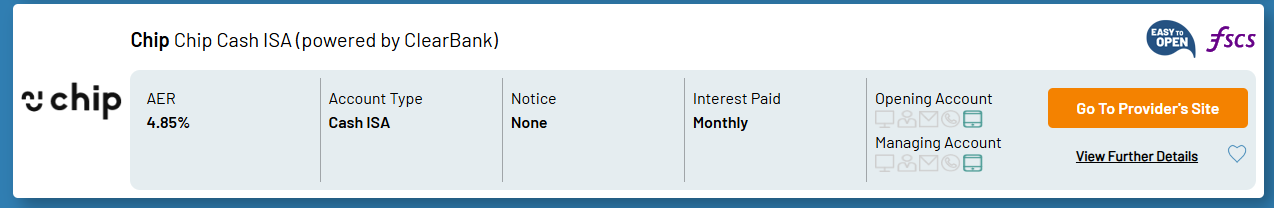

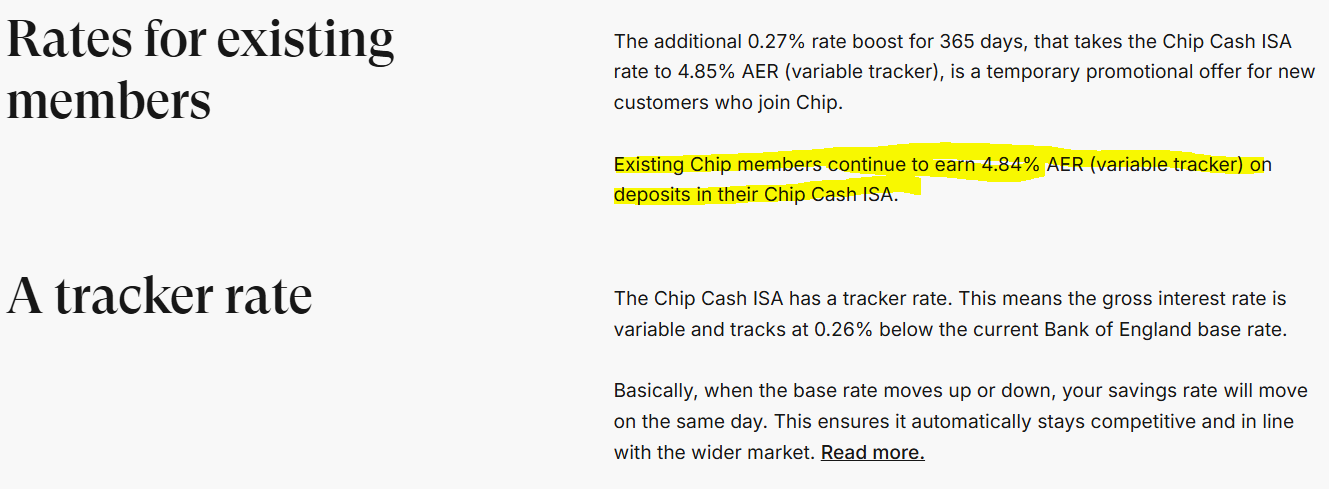

Did this ever get resolved? I am in the same position and I applied as new customer around the same time as you?pecunianonolet said:Chip Cash ISA

Anyone able to explain this or what I maybe miss here. My Chip ISA shows me a rate of 4.58% AER but on moneyfacts I see 4.85%

Checking on the Chip website, it shows me that new customers get a boosted rate. However, they also show this for existing members but say at the same time it is a tracker with 0.26% below base rate, which is at 4.75%

Is this a mistake on the website or have they actually tinkered with the rates? I suspect the former.If you want to be rich, never, ever have kids 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards