We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

I would like to open an ISA with T212. My fixed rate ISA with Lloyds comes to an end today. I have maxed out my ISA allowance. I see some ISA providers want an opening balance, I can’t transfer any money as I have maxed out my allowance, am I still able to open a T212 ISA without an initial deposit? Thanks0

-

FluffyKatzen said:I would like to open an ISA with T212. My fixed rate ISA with Lloyds comes to an end today. I have maxed out my ISA allowance. I see some ISA providers want an opening balance, I can’t transfer any money as I have maxed out my allowance, am I still able to open a T212 ISA without an initial deposit? Thanks

Transferring existing subscriptions doesn't count towards your annual ISA allowance, so you can transfer your balance from Lloyds to another provider of choice when it matures. Just make sure to use the ISA transfer process (typically involves filling out a form with your new provider) rather then withdrawing and redepositing the money yourself.0 -

Charter have pulled their 1yr fix ISA paying 4.5% today.1

-

Am I being overly optimistic here......

Are there usually many new or boosted ISA offers come the new tax year?

I've almost maxed out this years allowance but as rates fall I may (well I probably will) prioritise the regular savings I have unless I see some better ISA rates.

0 -

Looks like the United Trust Bank Cash ISA 1 Year Bond has dropped to 4.35% :'(0

-

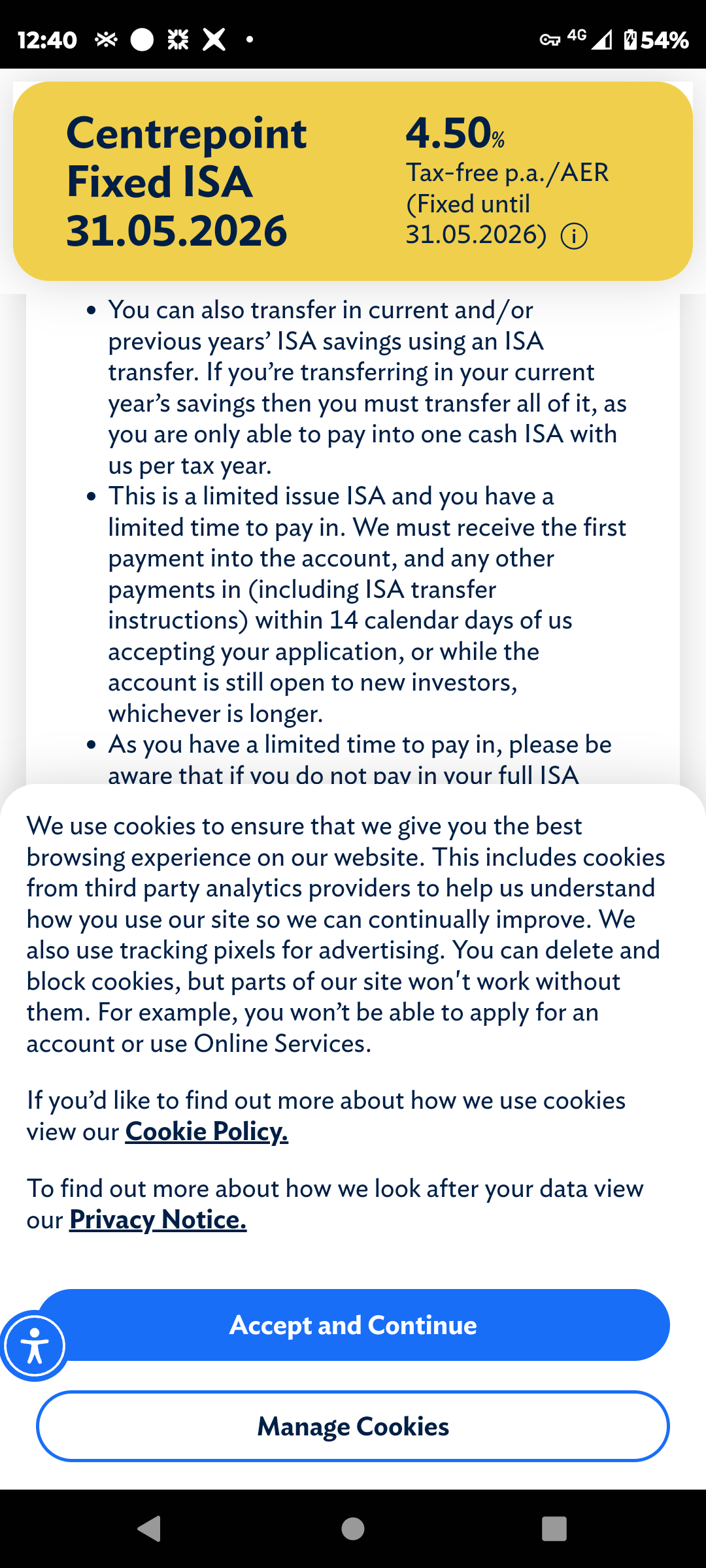

You can still get 4.5% with Coventry BS for a slightly longer FRISA which matures 31 May 26 https://www.coventrybuildingsociety.co.uk/member/product/savings/cash_isa/centrepoint-fixed-isa-31-05-2026.html

3 -

I note that partial transfers in are not allowed (unless there are no current year subscriptions within it?) but the reason given is completely nonsensical!silvermum said:You can still get 4.5% with Coventry BS for a slightly longer FRISA which matures 31 May 26 https://www.coventrybuildingsociety.co.uk/member/product/savings/cash_isa/centrepoint-fixed-isa-31-05-2026.html

I'm thinking of transferring in my long-term YBS cash ISA which I think is paying 4.3%.

Also, you cannot proceed online without accepting advertising cookies.

3 -

yesnottsphil said:

Also, you cannot proceed online without accepting advertising cookies. (Coventry BSoc)

Cookies are an annoying feature of almost all website use

- I particularly don't like those tracking which websites I have been to before using the particular financial institution where I have accounts, and the cookies tracking where I go to next

- therefore I actively delete cookies before and after my account visit, even for those websites where I then have to use the full log-in process. Feels safer.

I use a desktop computer, it's easy to delete cookies & browsing history and doesn't mess up my other functions; not sure it's as easy on smartphones? I haven't got one, so I'm not sure if I'm suggesting something which messes up other things on the phone.2 -

Coventry Centrepoint ISA

I decided to lock in FR @ 4.5% & xfer from a Virgin Money variable rate @ 4.51%Opened Coventry ISA & requested xfer in OLB Sat 8/2. Slightly concerned at no acknowledgement, but transfer completed today 11/2.Exactly how it should work but doesn’t always.1 -

Two working days? Very impressive.badger09 said:Coventry Centrepoint ISA

I decided to lock in FR @ 4.5% & xfer from a Virgin Money variable rate @ 4.51%Opened Coventry ISA & requested xfer in OLB Sat 8/2. Slightly concerned at no acknowledgement, but transfer completed today 11/2.Exactly how it should work but doesn’t always.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards