We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Cash ISAs: The Best Currently Available List

Comments

-

akh43 said:

Is there a calculator where I can check correct interest given on matured Barclays ISA where initial balance increased 2 further times within first month as I am not sure it is correct? I only know calculators for the whole year and its giving much more interest so want to double check first.

If it was a fixed rate, the interest should approximately be composed of:

(11/12) * Rate * Balance (after second increase)

+

(1/12) * Rate * Balance (after first increase)0 -

AmityNeon said:akh43 said:

Is there a calculator where I can check correct interest given on matured Barclays ISA where initial balance increased 2 further times within first month as I am not sure it is correct? I only know calculators for the whole year and its giving much more interest so want to double check first.

If it was a fixed rate, the interest should approximately be composed of:

(11/12) * Rate * Balance (after second increase)

+

(1/12) * Rate * Balance (after first increase)

Sorry I have no idea what that means

0 -

akh43 said:AmityNeon said:akh43 said:

Is there a calculator where I can check correct interest given on matured Barclays ISA where initial balance increased 2 further times within first month as I am not sure it is correct? I only know calculators for the whole year and its giving much more interest so want to double check first.

If it was a fixed rate, the interest should approximately be composed of:

(11/12) * Rate * Balance (after second increase)

+

(1/12) * Rate * Balance (after first increase)Sorry I have no idea what that means

Interest is calculated daily. Take the account balance each day, multiply it by the gross interest rate, and then divide the result by 365 to calculate the interest for each day. The total interest paid at maturity is the sum of the daily interest accrued over the term of the account.

If you'd like, someone here can calculate it if you provide the interest rate, the account start/maturity dates, and the dates of the three deposits and their corresponding amounts. For example:

- Interest rate: 4.60%

- Start date: 10 Jan 2023

- First deposit date/amount: 10 Jan 2023; £5,000

- Second deposit date/amount: 15 Jan 2023; £5,000 (balance £10,000)

- Third deposit date/amount: 25 Jan 2023; £5,000 (balance £15,000)

- Maturity date: 10 Jan 2024

In this example, there are:

- 5 days at £5,000 = £5,000 * (4.60% / 365) * 5 = £3.15

- 10 days at £10,000 = £10,000 * (4.60% / 365) * 10 = £12.60

- 350 days at £15,000 = £15,000 * (4.60% / 365) * 350 = £661.64

- Total interest after 365 days = £677.40 (after rounding)

2 -

Thanks for the offer hopefully all the information is below.Barclays 4% flexible ISA opened 13 Jan 2317 Jan first 2 deposits/transfers on same day £11,827.13 & £20,691.76 = £32,518.8913 Feb further deposit/transfer £20,158.18 = £52,677.0717 Feb further deposit/transfer £126.49 = £52,803.56Account matured 12/1/24 but as it was a Friday interest was not added until 15/1/24 of £2,028.92 = £54,832.48Although transfer requested on 31/12/23 it was moved to a much lower rate ISA of 1.20%/1.21% AER interest until it finally transferred on 17/1/24 to new ISA and £54,840.05 was transferred.The interest was only compounded once at the end of term on checking the key facts of the ISAI tried to work out the best I could and got more interest than they gave me, but not sure on my working out and have raised it for them to check.

0 -

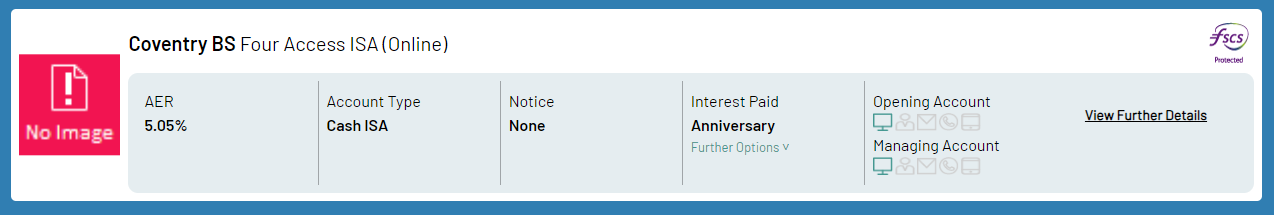

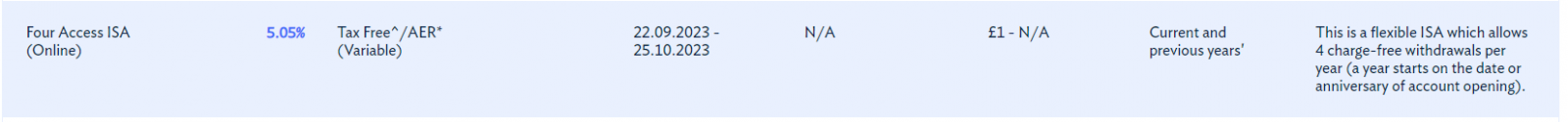

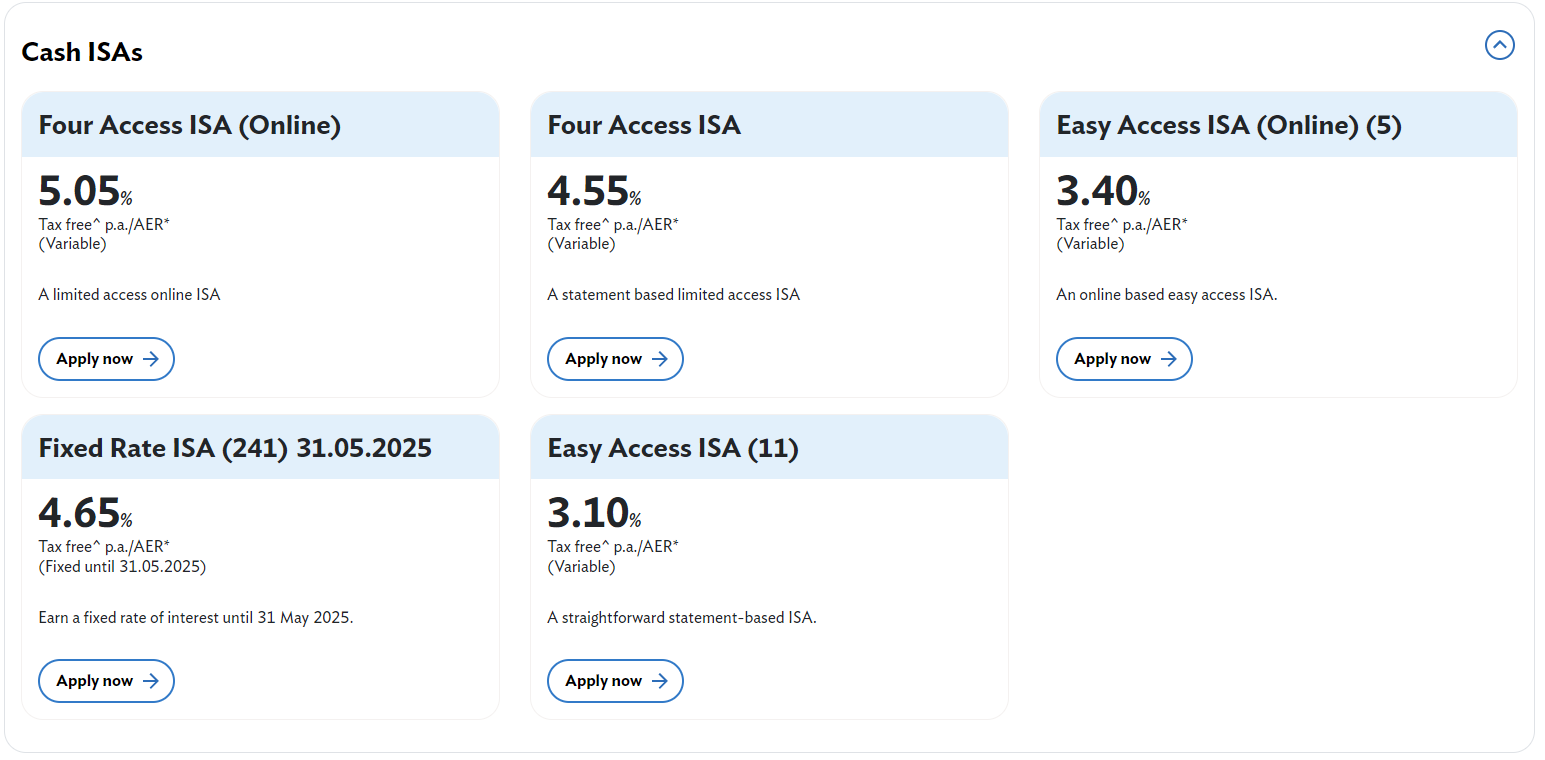

Coventry BS 4 access ISA at 5.05% The ISA is flexible.

Source: Moneyfacts

The ISA was available last between 22.09.2023 - 25.10.2023

Source: https://www.coventrybuildingsociety.co.uk/member/savings/closed-accounts.html

Edit:

Just checked and available to apply when logged in.

4 -

akh43 said:

Thanks for the offer hopefully all the information is below.

Barclays 4% flexible ISA opened 13 Jan 23

17 Jan first 2 deposits/transfers on same day £11,827.13 & £20,691.76 = £32,518.89

13 Feb further deposit/transfer £20,158.18 = £52,677.07

17 Feb further deposit/transfer £126.49 = £52,803.56Account matured 12/1/24 but as it was a Friday interest was not added until 15/1/24 of £2,028.92 = £54,832.48

Although transfer requested on 31/12/23 it was moved to a much lower rate ISA of 1.20%/1.21% AER interest until it finally transferred on 17/1/24 to new ISA and £54,840.05 was transferred.

The interest was only compounded once at the end of term on checking the key facts of the ISA

I tried to work out the best I could and got more interest than they gave me, but not sure on my working out and have raised it for them to check.

Interest of £2,028.92 is correct for the 365-day period from 13 Jan 2023 to 12 Jan 2024.

(£0 × 4 days) + (£32,518.89 × 27 days) + (£52,677.07 × 4 days) + (£52,803.56 × 330 days)

Divide that monstrously large product by 365 to calculate the average annual balance, and then multiply by 4%:

18,513,893.11 ÷ 365 = 50,722.994822

50,722.994822 × 4% = £2,028.922 -

An update that may be of interest to those that either experienced problems with their Metro Bank transfer, or are unsure if the interest has been backdated.

After a delay beyond the 15 day window for the transfer to complete, I made a complaint (which itself was a bit of an ordeal as there is no official way to provide a written complaint except for snail mail). That also has taken rather a long time to resolve - even accounting for the Christmas break - but today I got a Final Response Letter.

As a goodwill gesture they've provided a cheque of £125. I also asked for confirmation that the 5.11% interest had been backdated to at least the point it left the previous provider. They confirmed that it has been backdated to the date the ISA transfer form was signed.

So overall a satisfactory outcome (although I'd be wary of Metro in the future given the hassle) - others may wish to make a similar complaint (and also may be reassured re. the interest).0 -

Thanks for that information.

I opened a 1 year fixed rate ISA (5.71%) with Metro at the end of November. I was told that the Metro interest rate would be paid from the date that the transfer was signed in the branch. Nowhere on any paperwork I've been provided with is that date shown but at the end of the fixed term I know how much interest will be due and that's exactly what I expect to recieve. If not, I will be persuing them for what I'm due.0 -

AmityNeon said:akh43 said:

Thanks for the offer hopefully all the information is below.

Barclays 4% flexible ISA opened 13 Jan 23

17 Jan first 2 deposits/transfers on same day £11,827.13 & £20,691.76 = £32,518.89

13 Feb further deposit/transfer £20,158.18 = £52,677.07

17 Feb further deposit/transfer £126.49 = £52,803.56Account matured 12/1/24 but as it was a Friday interest was not added until 15/1/24 of £2,028.92 = £54,832.48

Although transfer requested on 31/12/23 it was moved to a much lower rate ISA of 1.20%/1.21% AER interest until it finally transferred on 17/1/24 to new ISA and £54,840.05 was transferred.

The interest was only compounded once at the end of term on checking the key facts of the ISA

I tried to work out the best I could and got more interest than they gave me, but not sure on my working out and have raised it for them to check.

Interest of £2,028.92 is correct for the 365-day period from 13 Jan 2023 to 12 Jan 2024.

(£0 × 4 days) + (£32,518.89 × 27 days) + (£52,677.07 × 4 days) + (£52,803.56 × 330 days)

Divide that monstrously large product by 365 to calculate the average annual balance, and then multiply by 4%:

18,513,893.11 ÷ 365 = 50,722.994822

50,722.994822 × 4% = £2,028.92

Thanks for explaining in a way I can understand and now I know the formula going forward 👍I have done a test on my Shawbrook one which has several additions too. I assume x by 366 for this years calculation?

0 -

akh43 said:AmityNeon said:akh43 said:

Thanks for the offer hopefully all the information is below.

Barclays 4% flexible ISA opened 13 Jan 23

17 Jan first 2 deposits/transfers on same day £11,827.13 & £20,691.76 = £32,518.89

13 Feb further deposit/transfer £20,158.18 = £52,677.07

17 Feb further deposit/transfer £126.49 = £52,803.56Account matured 12/1/24 but as it was a Friday interest was not added until 15/1/24 of £2,028.92 = £54,832.48

Although transfer requested on 31/12/23 it was moved to a much lower rate ISA of 1.20%/1.21% AER interest until it finally transferred on 17/1/24 to new ISA and £54,840.05 was transferred.

The interest was only compounded once at the end of term on checking the key facts of the ISA

I tried to work out the best I could and got more interest than they gave me, but not sure on my working out and have raised it for them to check.

Interest of £2,028.92 is correct for the 365-day period from 13 Jan 2023 to 12 Jan 2024.

(£0 × 4 days) + (£32,518.89 × 27 days) + (£52,677.07 × 4 days) + (£52,803.56 × 330 days)

Divide that monstrously large product by 365 to calculate the average annual balance, and then multiply by 4%:

18,513,893.11 ÷ 365 = 50,722.994822

50,722.994822 × 4% = £2,028.92Thanks for explaining in a way I can understand and now I know the formula going forward 👍I have done a test on my Shawbrook one which has several additions too. I assume x by 366 for this years calculation?

There isn't an industry standard for the treatment of leap year interest, but Shawbrook's general T&Cs heavily imply that daily interest for periods that include 29 February is calculated at 1/366 of the annual rate.

10.2 Where an interest payment period incorporates the leap year day of 29 February, the daily interest rate will be calculated to reflect that extra day. This means that the interest rate accrued on a daily basis may be different.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards