We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum's text editor will shortly be getting an update, adding a bunch of handy new features to use when creating new posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

doodlector said:

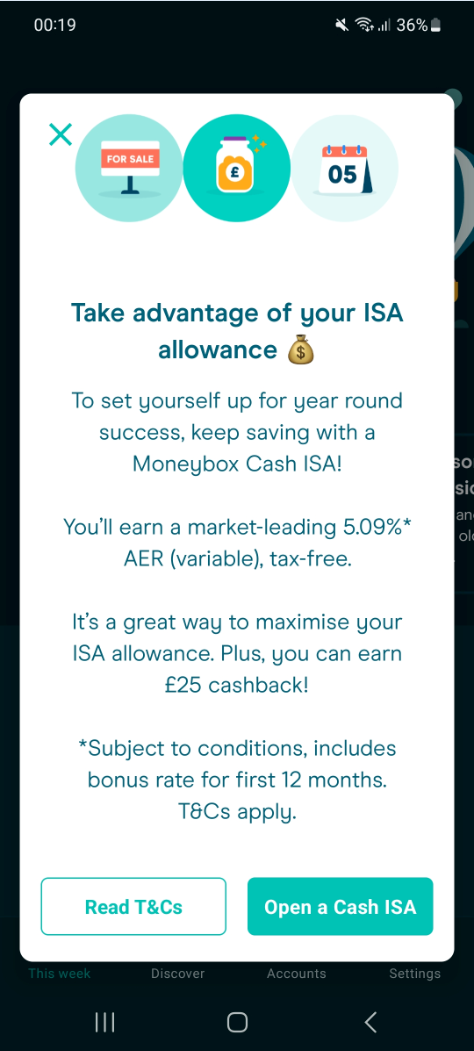

This may just be for existing customers? I just signed on to the app and I have the option to open a cash ISA but no mention of cashback.pecunianonolet said:

Yes, it's in the app and also the whole terms. The below is what I get straight after log in.drphila said:pecunianonolet said:Just seen in the app Moneybox offers £25 cashback for opening an ISA (Cash or Stocks and Shares ISA) and paying or transferring in at least £500 by 31st January. They say you get £50 if you open both types. An in progress transfer counts.

Debating to transfer some funds from the 5.05% Cash ISA with Coventry to get the £25 cashback and it's a higher rate too with 5.09%, although the interest difference hardly makes a difference, even on 20k

Anyone done it or has experience with Moneybox ISA and transfer? Worth the hassle?

Just had a quick look on the website and no mention of this offer so presumably I have to download and open the app to see it Yes it's by invitation according to this but thanks for the initial heads-up @pecunianonolet

Yes it's by invitation according to this but thanks for the initial heads-up @pecunianonolet

2 -

My Virgin 1 Year Fixed Rate Cash ISA Exclusive Issue 4 matured yesterday. It has now been switched to the Easy Access Cash ISA Exclusive Issue 2. I had an email about this on the 16th Jan which said this ISA pays a variable interest rate of 4.76% AER.However in my app the ISA is showing a rate of just 4.25% AER (and also when I log in online on my Mac). On the Virgin Money website the ISA is still advertised as 4.76% so I'm wondering what gives. I'll contact them in the morning, but has anyone else had this problem?0

-

YeSirHugo said:

Yes this has happened to me too. I already had an Easy access ISA issue 2 which shows a rate of 4.76%. However, my fixed rate ISA was transferred to a new easy access ISA issue 2 and that has the rate of 4.25%.My Virgin 1 Year Fixed Rate Cash ISA Exclusive Issue 4 matured yesterday. It has now been switched to the Easy Access Cash ISA Exclusive Issue 2. I had an email about this on the 16th Jan which said this ISA pays a variable interest rate of 4.76% AER.However in my app the ISA is showing a rate of just 4.25% AER (and also when I log in online on my Mac). On Virgin Money website the ISA is still advertised as 4.76% so I'm wondering what gives. I'll contact them in the morning, but has anyone else had this problem?

Will be interested in what explanation VM will give you.1 -

Mine is also showing 4.25% but Virgin Money are often slow in updating their sites. I am expecting the correct rate to show tomorrow.1

-

Regarding the VM ISA, the current rate is 4.76% and their terms say they will give at least 2 months notice if they reduce the rate.1

-

im in the same boat.SirHugo said:My Virgin 1 Year Fixed Rate Cash ISA Exclusive Issue 4 matured yesterday. It has now been switched to the Easy Access Cash ISA Exclusive Issue 2. I had an email about this on the 16th Jan which said this ISA pays a variable interest rate of 4.76% AER.However in my app the ISA is showing a rate of just 4.25% AER (and also when I log in online on my Mac). On Virgin Money website the ISA is still advertised as 4.76% so I'm wondering what gives. I'll contact them in the morning, but has anyone else had this problem?

Apart from the rate disparity- 4.25% vs 4.76% I have another concern here.

Will VM automatically transfer matured ISA proceeds into ISA Issue 10? or do we have to do it?

Mind you, I already placed request for the ISA transfer, while opening the new issue.

0 -

I have the Exclusive Cash ISA issue 2, although unfunded as you could open it with a 0 balance, and it still shows in the app the 4.76% interest.

I wonder where my 4.25% 1y Exclusive fix will go in 8 weeks.1 -

SirHugo said:My Virgin 1 Year Fixed Rate Cash ISA Exclusive Issue 4 matured yesterday. It has now been switched to the Easy Access Cash ISA Exclusive Issue 2. I had an email about this on the 16th Jan which said this ISA pays a variable interest rate of 4.76% AER.However in my app the ISA is showing a rate of just 4.25% AER (and also when I log in online on my Mac). On Virgin Money website the ISA is still advertised as 4.76% so I'm wondering what gives. I'll contact them in the morning, but has anyone else had this problem?

The same happened to me too and I was going to raise it, but before I could I received a message from UTB that the transfer had been received in my new 2 year fixed ISA which was surprisingly quick for virgin, especially as when I did the last transfer between the 2 different parts of virgin in December it took 5 days and for 2 of those days it didn't show in either account 🙄

0 -

The 4.25% is likely a holdover from the Fixed Issue 4, and it hasn't updated to the correct rate of 4.76%.1

-

Their maturity process is to convert a fixed ISA into a flexible easy access ISA. I had this for an earlier version and also for this one (Issue 4) today. Hence I now have two easy access issue 2 ISAs.ChewyyBacca said:

im in the same boat.SirHugo said:My Virgin 1 Year Fixed Rate Cash ISA Exclusive Issue 4 matured yesterday. It has now been switched to the Easy Access Cash ISA Exclusive Issue 2. I had an email about this on the 16th Jan which said this ISA pays a variable interest rate of 4.76% AER.However in my app the ISA is showing a rate of just 4.25% AER (and also when I log in online on my Mac). On Virgin Money website the ISA is still advertised as 4.76% so I'm wondering what gives. I'll contact them in the morning, but has anyone else had this problem?

Apart from the rate disparity- 4.25% vs 4.76% I have another concern here.

Will VM automatically transfer matured ISA proceeds into ISA Issue 10? or do we have to do it?

Mind you, I already placed request for the ISA transfer, while opening the new issue.

There is no part of the maturity that involves a new fixed ISA, which is what I assume you mean by the current Issue 10.

PS: In my opinion it makes more sense to convert into an easy access account rather than locking it into a fixed term account.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards