We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Ultimate Hard and Fast debt clearing mission

Dinah93

Posts: 11,466 Forumite

Three and a half years ago my new boyfriend set me a challenge – clear your debt and I’ll move from Ireland to England to be with you when it’s all gone. So began a manic year in which I eventually cleared £16,456 of debt in 250 days (or £65.82 a day if you want to be precise). He moved to England, we got engaged, we bought a house, we got married, we spent the first year of married life living in the barely habitable house, and we’ve just passed our first anniversary.

Now we’ve stopped and taken stock. To be honest it’s not a pretty picture in some respects. We’re back in debt. Not a little bit back in debt, but a lot back in debt. Doing up the house cost more than we thought, the wedding cost more than we thought, I had an injury and was off work for 8 months and lost quite a bit of wages, my wages have decreased and prices have increased, we stopped watching the pennies and the pounds didn’t take care of themselves, there are a lot of reasons for it but basically it’s here and we don’t want it to be.

But we're very happy together, we've had a great first year, it's just the money worries are starting to niggle me again.

The first time we wanted to clear the debt it was mine (well mostly my ex’s I was left with but that’s a whole other can of worms), I managed to cut my outgoings hugely by moving back in with my parents, and I was living on my own so could spend every spare hour on ebay, surveys, mystery shopping etc. Now life is more messy, I’m doing a MA, we have a house to take care of, I’m starting my own business, we both work 40 hours a week. So for the last year we took it easy, thinking the debts would pay themselves off, but they haven’t, they’ve grown.

We’d love to start a family, but we couldn’t afford maternity leave at the moment, let alone childcare, so we need to clear the debt so we can think about creating a little Dinah-NIM hybrid.

So a new tack is called for. No more taking it easy, we’re going old school hard and fast. Once we can reverse the growth and start laying into them it’ll get easier and easier as things speed up, but it’s turning that corner that is keeping me awake at the moment.

I’ve been here a long time, I know the drill, so a recent SOA is below. Last time I did this the comments were really helpful, and I’ve made big changes since then, so lets see if there is anything we’ve missed.

Oh yeah, and we want to clear the debt by our second wedding anniversary, 11 months away – did I forget that little nugget? Ooops.

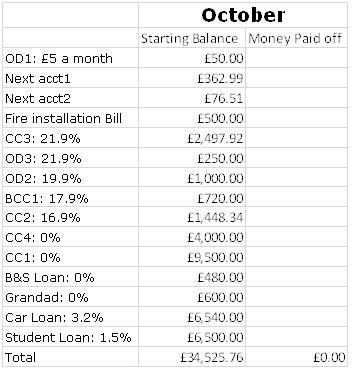

Debts as of 10th October

CC1 0% £9500

CC2 16.9% £1448.34

CC3 21.9% £2497.92

CC4: 0% £4000

BCC1: 17.9% £720

OD1: £5 a month £50

OD2: 19.9% £1000

OD3: 21.9% £250

Fire installation Bill: £500

Next acct1: £362.99

Next aact2: £76.51

B&S Loan 0% £480

Grandad 0% £600

Car Loan: 3.2% £6540

Student Loan: 1.5% £6500 (estimate)

Total 10th October 2011: £34,425.76 and 329 days to do it in…. £104.64 a day is the target.

A link to the first diary and all the subsequent ones are found below.

The Diaries

Diary 1: The Ultimate Incentive to get debt free, can I do it by New Years?

How I cleared £16,456 of debt in 250 days (£65.82 that works out at!), leading to my DFD of the 24th April 2009. My Ultimate Incentive to clear the debt was that my boyfriend (known here as NIM, Naked Irish Man, poor fella was nicknamed by the girlies on my thread and it kind of stuck, he's not always naked, honest!) told me he would move to England from Ireland when I cleared my debt. I actually cleared more debt than I had take home pay in the same period, through doing a lot of little extra income earners mostly online. If you're fighting for ideas on how to clear your debt, this diary is chock full of suggestions.

Diary 2: The Ultimate Incentive worked! Now onto phase two...

My second diary, where NIM has just moved to England, and we start to save up for a house

Diary 3: The Ultimate Incentive proposed! Buying a house, wedding and staying debt free

My third diary, after NIM has proposed and we're faced with the task of saving for a house and a wedding, in the space of a year, and staying debt free.

Diary 4: The Ultimate Incentive proposed! Time for an ultimate challenge...

My fourth diary, where I set myself a challenge I failed miserably at and never really got started due to lack of time. Moving swiftly on from this one!

Diary 5: The Ultimate Incentive to have an amazing 2010

Where we started out with the best of intentions, underestimated the cost of our wedding and renovating the house and ended up solidly back in debt - but had an amazing wedding in the process

Diary 6: The Ultimate Incentive to get debt free...Dinah & NIM go head to head.

Our first year of married life, where we've nattered a lot but not really made any progress whatsoever on clearing the debt. We never did go head to head, we work much better as a team.

Diary 7: The Ultimate Incentive Threadies go all out

Bit of a Girls Gone Wild title, but this was a challenge where we all tried to clear/save £1000 over what we normally would, and the very lucky Cinny thrashed us all into submission. This was part of NIM & I's first year of marriage where we did things his way and tried to have balance... our debt grew.

Now we’ve stopped and taken stock. To be honest it’s not a pretty picture in some respects. We’re back in debt. Not a little bit back in debt, but a lot back in debt. Doing up the house cost more than we thought, the wedding cost more than we thought, I had an injury and was off work for 8 months and lost quite a bit of wages, my wages have decreased and prices have increased, we stopped watching the pennies and the pounds didn’t take care of themselves, there are a lot of reasons for it but basically it’s here and we don’t want it to be.

But we're very happy together, we've had a great first year, it's just the money worries are starting to niggle me again.

The first time we wanted to clear the debt it was mine (well mostly my ex’s I was left with but that’s a whole other can of worms), I managed to cut my outgoings hugely by moving back in with my parents, and I was living on my own so could spend every spare hour on ebay, surveys, mystery shopping etc. Now life is more messy, I’m doing a MA, we have a house to take care of, I’m starting my own business, we both work 40 hours a week. So for the last year we took it easy, thinking the debts would pay themselves off, but they haven’t, they’ve grown.

We’d love to start a family, but we couldn’t afford maternity leave at the moment, let alone childcare, so we need to clear the debt so we can think about creating a little Dinah-NIM hybrid.

So a new tack is called for. No more taking it easy, we’re going old school hard and fast. Once we can reverse the growth and start laying into them it’ll get easier and easier as things speed up, but it’s turning that corner that is keeping me awake at the moment.

I’ve been here a long time, I know the drill, so a recent SOA is below. Last time I did this the comments were really helpful, and I’ve made big changes since then, so lets see if there is anything we’ve missed.

Oh yeah, and we want to clear the debt by our second wedding anniversary, 11 months away – did I forget that little nugget? Ooops.

Debts as of 10th October

CC1 0% £9500

CC2 16.9% £1448.34

CC3 21.9% £2497.92

CC4: 0% £4000

BCC1: 17.9% £720

OD1: £5 a month £50

OD2: 19.9% £1000

OD3: 21.9% £250

Fire installation Bill: £500

Next acct1: £362.99

Next aact2: £76.51

B&S Loan 0% £480

Grandad 0% £600

Car Loan: 3.2% £6540

Student Loan: 1.5% £6500 (estimate)

Total 10th October 2011: £34,425.76 and 329 days to do it in…. £104.64 a day is the target.

A link to the first diary and all the subsequent ones are found below.

The Diaries

Diary 1: The Ultimate Incentive to get debt free, can I do it by New Years?

How I cleared £16,456 of debt in 250 days (£65.82 that works out at!), leading to my DFD of the 24th April 2009. My Ultimate Incentive to clear the debt was that my boyfriend (known here as NIM, Naked Irish Man, poor fella was nicknamed by the girlies on my thread and it kind of stuck, he's not always naked, honest!) told me he would move to England from Ireland when I cleared my debt. I actually cleared more debt than I had take home pay in the same period, through doing a lot of little extra income earners mostly online. If you're fighting for ideas on how to clear your debt, this diary is chock full of suggestions.

Diary 2: The Ultimate Incentive worked! Now onto phase two...

My second diary, where NIM has just moved to England, and we start to save up for a house

Diary 3: The Ultimate Incentive proposed! Buying a house, wedding and staying debt free

My third diary, after NIM has proposed and we're faced with the task of saving for a house and a wedding, in the space of a year, and staying debt free.

Diary 4: The Ultimate Incentive proposed! Time for an ultimate challenge...

My fourth diary, where I set myself a challenge I failed miserably at and never really got started due to lack of time. Moving swiftly on from this one!

Diary 5: The Ultimate Incentive to have an amazing 2010

Where we started out with the best of intentions, underestimated the cost of our wedding and renovating the house and ended up solidly back in debt - but had an amazing wedding in the process

Diary 6: The Ultimate Incentive to get debt free...Dinah & NIM go head to head.

Our first year of married life, where we've nattered a lot but not really made any progress whatsoever on clearing the debt. We never did go head to head, we work much better as a team.

Diary 7: The Ultimate Incentive Threadies go all out

Bit of a Girls Gone Wild title, but this was a challenge where we all tried to clear/save £1000 over what we normally would, and the very lucky Cinny thrashed us all into submission. This was part of NIM & I's first year of marriage where we did things his way and tried to have balance... our debt grew.

Debt January 1st 2018 £96,999.81

Debt September 20th 2022 £2991.68- 96.92% paid off

Met NIM 23/06/2008Debt September 20th 2022 £2991.68- 96.92% paid off

0

Comments

-

The Snowball list

OD1: £5 a month £50

Next acct1: £362.99

Next acct2: £76.51

Fire installation Bill: £500

CC3 21.9% £2497.92

OD3: 21.9% £250

OD2: 19.9% £1000

BCC1: 17.9% £720

CC2 16.9% £1448.34

CC4: 0% £4000

CC1 0% £9500

B&S Loan 0% £480

Grandad 0% £600

Car Loan: 3.2% 6540

Student Loan: 1.5% 6500 (estimate)

The Graph

The Chart

NIM will be doing the Graph and Chart for me tomorrow - lots of pretty pictures to see how we're doing.

We're not going to do a current sig total - we're going to update once a month on the first of the month but I will post each time we pay something off so you know we're actually doing something - please cheer or nag all the way.Debt January 1st 2018 £96,999.81Met NIM 23/06/2008

Debt September 20th 2022 £2991.68- 96.92% paid off0 -

October Goals

For the threadies. Let me know what your aims are each month - please pm me for October.

Tete - October

- Lose 5lbs

- Bring packed lunch for 16 remaining work days (1/16)

- Get to payday without dipping into my savings account

- Finish crocheting 2 baby blankets (currently at about 40% and 7% finished)

- Get my 5k PB under 35 minutes (current 35.04 so sounds easy but I don't think it will be!)

Starnac - October

- make 3 Christmas presents

- have nursery finished for when baby is born

- compare and switch gas and electric

- earn £4 from VO to qualify for next voucher (am saving my amaz*n vouchers to buy DH a kindle for his birthday)

- save extra £100 on top of regular payment to savings account.

Birdie - October

- Make 4 Christmas Presents

- Make 4 Christmas cards

- Lose 4lbs

- Write 4 reviews and try to get back onto the voucher-earning bandwagon!

Shrimpy

- Lose 7lbs

- Get xmas voucher stash up to £100 (£50/£100 so far)

- Book first two AAT exams

- Do £10 a day challenge

- Find another 20 ebay items

- Get to payout on dooyoo

- Be ready to pass driving test (check for cancellations to bring forward)

- End month with debt under £3k

Wendz

- do £15 a week of surveys

- get to end of month without going into savings

- lose 3lb

DippyKitty

- Get to redemption for vouchers on DooYoo finally - currently on £15.44 so £4.56 to go!

- Get through the rest of the month without buying unnecessary crap

Lara

- Make sausages!!

- Take lunches to the library

- Cycle to the library a few times a week

- Finish kitchen spring cleaning

- Plant rocket salad leaves

- Tackle the junk cupboard (wash duvets, buy vac pac storage boxes)

- Ebay the junk in the junk cupboard (or at least some of it)

- Make pencil case (am a very inexperienced seamstress!)

- Make own bread again

- Visit financial advisor

- Make at least another £20 vouchers for Christmas

- Complete at least 1 of sig savings goals

- Reduce food shopping costs (build storecupboard, possibly veg. box)

CMD

- Move from Scotland to Ireland (I know I have done this but it was a biggie and 3 weeks after Evie was born!)

- Book church for christening

- Find venue for afters of the christening

- Register family with the GP

- Book my 6 weeks postnatal check and baby's check

- Attend mother & toddler group every Monday

- Make an appointment with a mortgage consultantDebt January 1st 2018 £96,999.81Met NIM 23/06/2008

Debt September 20th 2022 £2991.68- 96.92% paid off0 -

Mystery shops this weekend were pretty good overall, got a present for D I was going to give her for Christmas but due to being a pure sap I folded and gave it to her yesterday. Set of Pandora earrings, so anyone got any super MS ideas of something I can give the worlds greatest gift getter for Christmas?This was 6 months out of date so I've changed it.:j:j:j:j0

-

Aww NIM you've got some brill MS! I think I'm going to get OH looking into that soon because those kind of shops sound amazing!

Dinah my goals are not in very SMART (hehe) formats so I might need to think about them and then send them to you perhaps.

Cinny - thanks for the shred link, is this really jumpy or do you think I could do it in a flat without distrubing people on the floor below? (we have carpet..)

Dinah also I didn't realise you had included the student loan..! If I include me and OH's we're on -£44000 ish!! yikes! I've only paid off about £30 net so far and OH has paid £0 which is so depressing but i dont think we'll ever pay them off! Need to get OH's overdraft sorted next though!! He kind of needs a job for that though!! we can't really have a carboot sale because we've just moved and only bought essential things with us!

we can't really have a carboot sale because we've just moved and only bought essential things with us!

Cinny also well done on the OH casino winning! I'm very impressed that he managed to save it as it can be so tempting to just keep playing. Good on him

CMD I'm so glad you're home and happy I know you have the little ones but maybe now being away from some of your stuff will make you realise you don't need it all! and you could build up an ebay stash!!

I know you have the little ones but maybe now being away from some of your stuff will make you realise you don't need it all! and you could build up an ebay stash!!

Wendz I'm glad the wedding was lovely I've get addicted to don't tell the bride again recently and its made me a bit wedding-broody (if that makes sense!)

I've get addicted to don't tell the bride again recently and its made me a bit wedding-broody (if that makes sense!)

Finally birdie I am so glad you had an amazing time and I would love to see photos!! The magic kingdom is one of my favourites and I would love to go to harry potter world! Holidays are kind of on hold for a while now though while I have a few tough years at work and find my feet and we get ourselves financially stable (I didnt think we were really in debt until I thought about student loans! - really its just student overdrafts and then building up some long term savings!).

Lara - how did the phd review go?!?!? I'm sure you're work was fab but I always get embarrassed about people reading my written academic work and i hate hearing feedback (even though it helps and is usually mostly positive..!)

Dinah and NIM - when's cc3 going to be paid off then? End of november? (I assume it's one of the first targets? or are you psycological-smallest-balances-first type clearers?)0 -

ok - just realised the snowball list is in order! oops I just picked out the highest apr! so are there timelines which go against that list or is it just ASAP??0

-

So what have I done today to prepare for the new hard and fast way of life in my last few days of taking it 'easy' (as anyone who has followed these diaries knows my easy is not the same as anyone else's)?

- I've applied for a 0% card to try to shift some other balances to

- I've complained to Asda (useless) Tesco (no response) and Sainsburys (no response) about poor quality products I bought in the hope of getting a refund

- NIM has been mystery shopping

- I've applied for a £200 cashback account to move the bills to

- I've finally found out all our totals and APRs to make a real snowball

- I've made soup from a load of reduced price veg. Oh so much soup.

(Yes, that's 11 varieties and around 90 portions of soup. That equals a heck of a lot of pureed veg)

The ongoing and badly numbered to do list:

20. Finally sort out trapped bingo money

24. Order props for photoshoot

25. Return trousers and boots to Next

27. Write engagement card

32. Contact medicash about lack of apology

33. Apply to TNS MS

34. Do design for glass class.

37. Work out £10 a day totals for sig

39. Put in Medicash claim

41. Email York friend

42. Book in for a new tyre

43. Order speakers and wireless network card for desktop

50. Read £10 a day thread for money ideas.

57. Question past tax codes for both of us see if we're due anything back

61. Get NIM to call car garages re fixing the scratches from the egit who keyed the car

63. Order stained glass pieces

66. Do driving licence renewal

74. Put all MS dates in diary

78. Get passport photos

79. Sort out where our life insurance has gone since it appears NIM managed to cancel the application.Debt January 1st 2018 £96,999.81Met NIM 23/06/2008

Debt September 20th 2022 £2991.68- 96.92% paid off0 -

There will be timelines, but not until tomorrow when NIM makes the chart/graph. As a vague clue though this is what we're aiming for on November 1st:ok - just realised the snowball list is in order! oops I just picked out the highest apr! so are there timelines which go against that list or is it just ASAP??

[STRIKE]OD1: £5 a month £50 [/STRIKE]

[STRIKE]Next acct1: £362.99[/STRIKE]

[STRIKE]Next acct2: £76.51[/STRIKE]

[STRIKE]Fire installation Bill: £500[/STRIKE]

CC3 21.9% [STRIKE]£2497.92[/STRIKE] £2154.42

OD3: 21.9% £250

OD2: 19.9% £1000

BCC1: 17.9% [STRIKE]£720[/STRIKE] £695

CC2 16.9% [STRIKE]£1448.34 [/STRIKE] £1408.34

CC4: 0% £4000

CC1 0% [STRIKE]£9500[/STRIKE] £9290

[STRIKE]B&S Loan 0% £480[/STRIKE]

Grandad 0% £600

Car Loan: 3.2% [STRIKE]6540[/STRIKE] £6400

Student Loan: 1.5% [STRIKE]£6500[/STRIKE] (estimate) £6400

New total (projected): £32,197.76.....Debt January 1st 2018 £96,999.81Met NIM 23/06/2008

Debt September 20th 2022 £2991.68- 96.92% paid off0 -

Just spent the last five minutes humming the tetris theme to myself stacking said 90 tubs in the chest freezer, nearly couldnt close it...eep. Problem is I cant say no to a 10p bag of veg which could do me a weeks soup for lunch.This was 6 months out of date so I've changed it.:j:j:j:j0

-

Good morning, happy new thread - let's see if I can keep up with this one a bit better, I miss you girls and boys. Off to make a cuppa and have a look at your SOA and to do list! x

PS does this mean the Ultimate Challenge thing is over and I can erase my paltry effort from my sig?! Weightloss: 14.5/65lb0

Weightloss: 14.5/65lb0 -

Just spent the last five minutes humming the tetris theme to myself stacking said 90 tubs in the chest freezer

:rotfl:Loving the soup, totally going to follow your lead (not to the same extent!!) as I'm craving soup these days - I think it's the dark mornings (then I don't see daylight in my little windowless cupboard so my brain thinks it's still dark).

OK well I've had a look and anything I was going to suggest you've planned to have rid of by next month anyway. Good Luck!

What are the October Goals - anything we like? I'll have a think - need to check my banks and get my monies in order. Normally do stuff like that at work but with being so busy it's got neglected a bit and I don't really know where I am :eek:

Hope everyone else is well Weightloss: 14.5/65lb0

Weightloss: 14.5/65lb0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards