We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Nationwide Soft-Search

Comments

-

Antony I think this is dependant on how you run the account, how much you have on the card against it's current limit and how you manage your payments. i.e. do you pay more than the minimum payment, are you constantly maxed out, or do you clear the entire balance each month?0

-

The soft-check is just that, soft. Basically confirms who you are, your age, your income and your address.

It'll only fully search the CRA when you click the apply now button.

The default from 2008, until it comes off your record, will be the reason why - though I'm not trying to state the obvious.

The only difference between a soft and full credit search is the record of the soft search is only visible to you.

Once you go ahead and give the permission for a full search this is visible to all lenders.

If what you say is true? why would Nationwide be able to offer you a credit card/Loan with a APR and Credit limit based on the information you believe they obtain from a soft search?0 -

Antony I think this is dependant on how you run the account, how much you have on the card against it's current limit and how you manage your payments. i.e. do you pay more than the minimum payment, are you constantly maxed out, or do you clear the entire balance each month?

I currently have a credit limit of £2000 but don't go anywhere near the limit, I've just checked my Internet Banking and it said I can increase my limit to £2600 the thing is I currently have a balance at the moment of £500 which I intend to pay off on Monday, do you think it would be best to ask for the increase after that to maximize any possible increase?0 -

The only difference between a soft and full credit search is the record of the soft search is only visible to you.

Once you go ahead and give the permission for a full search this is visible to all lenders.

If what you say is true? why would Nationwide be able to offer you a credit card/Loan with a APR and Credit limit based on the information you believe they obtain from a soft search?

I'm not sure what you want me to say here. They only do a full search after you click apply now and only then will they see if you have stuff on your credit file like CCJ's or missed payments / defaults.

The beginning bit you are confirming age, address, salary etc and they give you a rough estimate based on that. It even says if you click apply now they will then do a full credit search after you receive your provisional offer.0 -

I'm not sure what you want me to say here. They only do a full search after you click apply now and only then will they see if you have stuff on your credit file like CCJ's or missed payments / defaults.

The beginning bit you are confirming age, address, salary etc and they give you a rough estimate based on that. It even says if you click apply now they will then do a full credit search after you receive your provisional offer.

Rich they see all of the above with the soft search.

It's not a rough estimate it's the APR and credit limit that you will be given once you proceed with the application.

How would any lender be able to offer you a credit limit and APR without knowing what your current financial standing is?

From the Nationwide website.

During your application, we're able to check your credit history and give you a no-obligation quote that won't affect your credit rating.0 -

So why do they insta-decline when you click apply now?0

-

So why do they insta-decline when you click apply now?

Because they already have all the information they need from the soft search.

If they declined you after the soft search how would other lenders know that you have been applying for credit elsewhere?

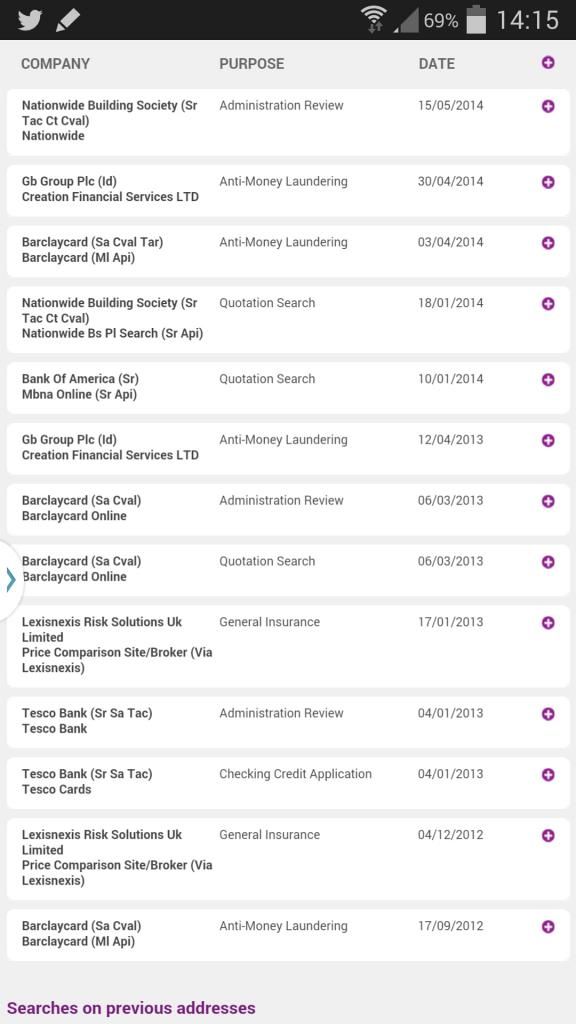

The picture above shows the Quotation searches (soft) by Barclaycard,Nationwide,MBNA.0 -

Okay, so why do they give you a limit and an APR so you think 'thats cool I'll go for that' and then they decline you?

Surely they should just come back with sorry, no offer for you.0 -

Okay, so why do they give you a limit and an APR so you think 'thats cool I'll go for that' and then they decline you?

Surely they should just come back with sorry, no offer for you.

It's all circumstantial, some lenders do this, some won't give you a decline until you fully apply. It's just like how some lenders will automatically decline anyone under a certain age (e.g. 21), but they say that anyone over 18 can apply.Credit 'Score' - Don't buy the credit 'score' that Experian, Equifax and Noddle want to sell you. It's an arbitrary number that means nothing when it comes to applying for credit.

ALWAYS HAVE A DIRECT DEBIT SET UP FOR THE MINIMUM PAYMENT ON YOUR CREDIT CARDS, REGARDLESS OF WHETHER YOU PLAN TO LOGIN AND PAY EACH MONTH.0 -

Okay, so why do they give you a limit and an APR so you think 'thats cool I'll go for that' and then they decline you?

Surely they should just come back with sorry, no offer for you.

If they did that how would other lenders know you have been making applications for credit elsewhere?

Most credit scorecard formulas will deduct points for recent searches, if someone is making 12 searches in a 3 month period it could be seen as desperation and in some cases fraud.

So whilst soft searches let you shop around without being penalised, when you go ahead and apply there needs to be a record of this.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards