We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

PPI Reclaiming discussion Part III

Comments

-

marshallka wrote: »Evening Boo. Have you got your figures for Turbo to look over...??

Hi marsh.

EEERRRR if i posted what i know,do you think he could give me some rough calcs?:j Let him who be deceived ,be deceived:j0 -

I've got

a)4,736 refund for Pymts + 8% if fixed rate

b)4,906 refund if assumtions made on interest rates rising

c) + around £11,250-ish written off the overall loan

Will post up details tomorrow

This is my take on this Nick

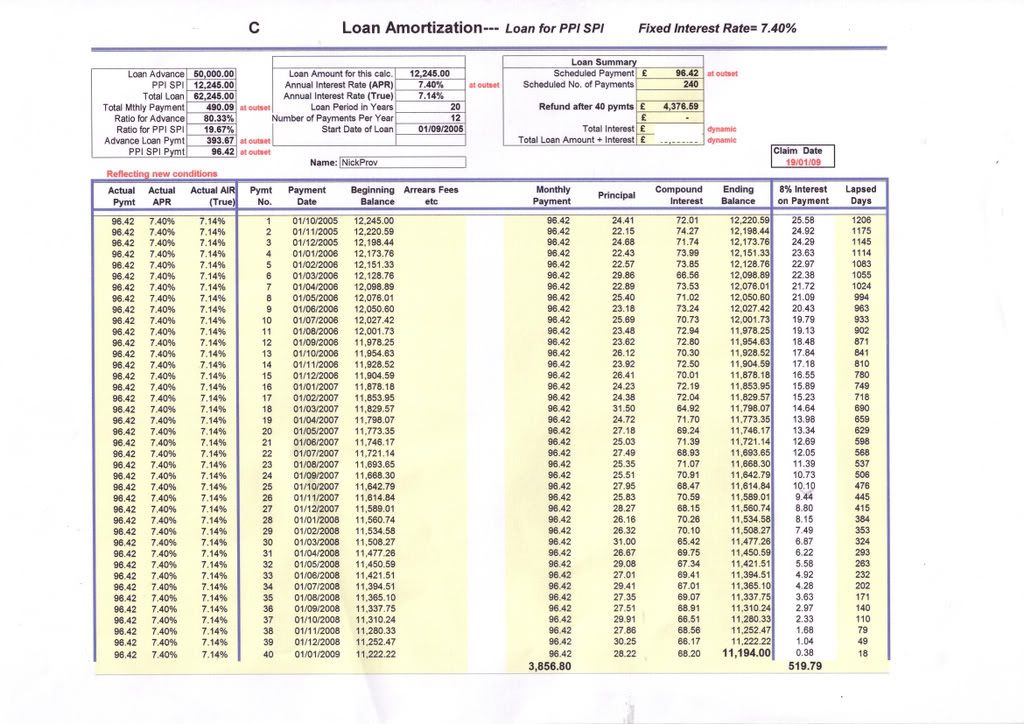

If we assume fixed interest at 7.4% we have £3,856 in paid PPI premiums in my sheet at line 40 (like Marshallka) and as at todays date 8% would be £519.79 making £4,376.59.

Looking at the left 2 cols, you can see my model can change the interst rate & paymt.

Using your revised premium of £615 (x 19.67% = £120.97) I have assumed that rate for all of 2008.

Also, a gradual raising of the rate before then in line with my own experiences.

This resulted in revised PPI paid of £4,348 + 8% of £557 = £4,905---.

So, you will also see that there is an outstanding balance at line 40 of £11,200-ish. This is the amount that must be written off, so reducing the total balance owed-and all trace of PPI SPI has been removed.

As there are several ways of calculating potential settlement figure (paid-up loans), I always talk about the outstanding balance on the remaining Advances Account and if you were to succeed in the mis-selling argument, your outstanding balance would be (if 7.4%) would be in the order of £45,703. (again from my model for a £50,000 loan).

This would attract an additional penalty if you were to ask for a settlement figure (based on different criteria for different firms)--note that some of the earlier penaltys were originally (& some still are) based on assuming you actually still owed the whole lot - then a rebate calculated.

But-that's not the issue here, I detail it to avoid future mis-understanding on terminology.

You say that you have been offered £2,721 which is unusual as they either give you the lot or say Get Lost.

Check your letter again Nick and Be absolutely sure that they arenot pushing you into "Cancellation" --rather than accepting it was mis-sold& this is a derisory refund--yet not refunding the full original PPI (on which you would pay interest for 200 more months)

This is the last time I will post up these Images(hard work without PDF attachments) as I think I have explained how I work now--I merely enter the figures & its done--so in future will just reply by summarising in text within the message

Turboaka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

Hi marsh.

EEERRRR if i posted what i know,do you think he could give me some rough calcs?

Fire away if its just mis-selling question on a current loanaka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

Ok turboman here goes,

This is all the chick at hfc told me,

I took the loan out in dec 2006

Initial loan £8000 + insurance :rolleyes:

I pay £45.88 p/m ppi:eek:

My total monthly payments are £258.00

Total charge fr credit £2325.78:eek: :eek: :eek:

Apr 13.9%:mad:

I took the loan over 4 yrs :eek:

If you can do some rough calcs,i wont hold you to the figures:j Let him who be deceived ,be deceived:j0 -

Oh fingers crossed for you Bathgate, I passed mine to them in June 08 - never mind more interest for me if I win!

So, we must be at around roughly the same stage? Have your lenders put any account you have on hold at the moment as Sainsburys have refused to do that for me. During the course of the dispute, they have added just under £200 worth of interest to my account, which combined with the PPI premiums and 8% interest I'm reclaiming, means that the remaining balance of my credit card is all related to PPI! :eek:

I did write to the OFT to ask for their take on the fact that Sainsburys have not put this account on hold pending outcome of the Adjudication (breaching their own Guidance Note), so perhaps the call was about that? Or maybe the chap calling was the Adjudicator? Who knows! This is going to really annoy me until I speak to them!Almost debt-free, but certainly even with the Banks!0 -

Hi

A couple of months ago after writing my first letter to Natwest I got a response off them stating that they were rejecting my claim based upon the fact that their staff are trained and would not have told me I needed PPI on my loan which was to consolidate other Natwest debt. I then wrote back and heard nothing so I have recently complained to the F.O. However they have told me that they need the letter that Natwest sent in order to investigate further. Does anybody know what the chances are of Natwest sending me another copy of the letter?

Thanks

Teapotty0 -

The missing figure--amount of PPI SPI--£2000 ish perhaps??? or £1416 ??Ok turboman here goes,

This is all the chick at hfc told me,

I took the loan out in dec 2006

Initial loan £8000 + insurance :rolleyes:

I pay £45.88 p/m ppi:eek:

My total monthly payments are £258.00

Total charge fr credit £2325.78:eek: :eek: :eek:

Apr 13.9%:mad:

I took the loan over 4 yrs :eek:

If you can do some rough calcs,i wont hold you to the figuresaka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

They should be ok about it and send you another copy. Did Natwest confirm that it is their full and final decision on your case? Also, the onus is on them to prove that it was not mis-sold and if the best they can come up with is 'our staff wouldn't do such a thing' then they may have difficulties satisfying the FOS!

(P.S - I'm not sure where the burden of proof being on them comes from. Anyone?)Almost debt-free, but certainly even with the Banks!0 -

The missing figure--amount of PPI SPI--£2000 ish perhaps??? or £1416 ??

Hi turbo,

up to press ive paid £1099.68 ppi including the bit of interest on it,

So over the loan period i would have paid £2199.36 which i guess you would of worked out,

All im trying to roughly find out is

If i cancel ppi what should i get back if i claim it?

And if poss what my new loan agreement should look like Because i wouldnt have the remaining 2 yrs ppi on it + interest

Does this help you?:j Let him who be deceived ,be deceived:j0 -

Ok turboman here goes,

This is all the chick at hfc told me,

I took the loan out in dec 2006

Initial loan £8000 + insurance :rolleyes:

I pay £45.88 p/m ppi:eek:

My total monthly payments are £258.00

Total charge fr credit £2325.78:eek: :eek: :eek:

Apr 13.9%:mad:

I took the loan over 4 yrs :eek:

If you can do some rough calcs,i wont hold you to the figures

Assuming PPI SPI is £1,475 (check) & premiums CONSTANT

Premiums paid = 25 mths = £1,020 + 8% of £86 = £1106 AND a WITEOFF OF REMAINDER OF £768 ishaka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards