We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pay ALL Your Debt Off By Xmas 2026!

Comments

-

@BlueJ94 Personally I would, just to make life easier though check the % is decent. I did consider this myself as well, though my CCs are 0% until May and July this year, I just thought it will be easier if I've had one payment instead of two, currently it's two direct debits, overpayments to two cards, roundups to two cards, etc, adds a lot of entries to my budget. Do make sure you don't add to your debt though and don't stay in debt for longer than it's absolutely neccessary, ie if you were originally planning to clear it by end of 2026 but you're taking a 3 year loan, etc. I actually follow Tori Dunlap and her New Year challenge includes listing your debts, APRs, etc and applying for a more affordable consolidation loan.

Mortgage: £173,700 Sep 22 £158,000 Jan 26

MF Date: Sep 52 Mar 52

CC Debt: £15,250 Nov 25 £11,600 Jan 26

2026 Challenges:

MFiT-T7 #5

DFbyXMAS #7

Sealed Pot Challenge #022

January 2026 Grocery Challenge: £51.06/£200

1 -

Id consolidate, one payment and one lot of interest and your monthly payment seems more manageable 👍#no 3 Debts off by Xmas 2026 £633.58/£15,250

NSD Jan 17/20

#no 13 365 days 1p challenge 2026

£17.70/£667.95 paid 59/365

#no 2 £2 coin savers challenge 2026 £12

#no 11 SPC 19 £44 banked restart £19.66

2026 PAD challenge £660

1% challenge = 5%

#cc1 200/4100 29%

#cc2 NatWest 210/3400 29%

#cc3 Halifax 60/2150 26%

#cc4. MBNA 80 /5600 0% runs out soon

#loan1 /14000 7.2%

#loan2 /11000 13%

#family loan /3000 0%#solicitors /35002 -

£50.04 paid off the credit card today 💪🏻 all with the help of NSD and living frugally. I’m getting my hope back#no 3 Debts off by Xmas 2026 £633.58/£15,250

NSD Jan 17/20

#no 13 365 days 1p challenge 2026

£17.70/£667.95 paid 59/365

#no 2 £2 coin savers challenge 2026 £12

#no 11 SPC 19 £44 banked restart £19.66

2026 PAD challenge £660

1% challenge = 5%

#cc1 200/4100 29%

#cc2 NatWest 210/3400 29%

#cc3 Halifax 60/2150 26%

#cc4. MBNA 80 /5600 0% runs out soon

#loan1 /14000 7.2%

#loan2 /11000 13%

#family loan /3000 0%#solicitors /35001 -

How much longer/more will it cost you in the long run? And can you cut up the cards, consolidate and then be absolutely certain you wont borrow any more (not that I've ever done the same 😂)BlueJ94 said:Right my fellow internet friends! I need your honest help and advice!

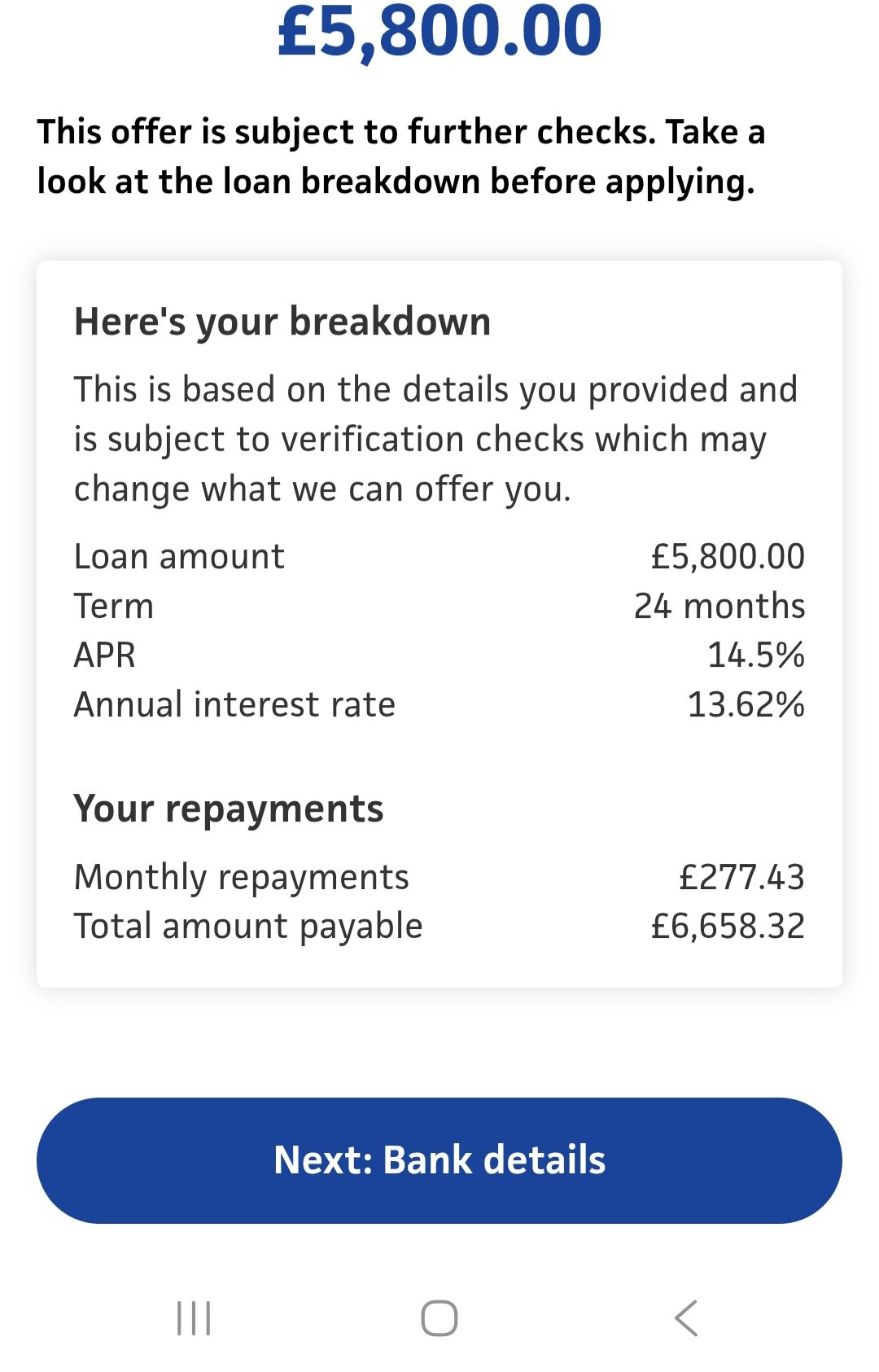

I can take a consolidation loan out for £5,800 to clear all my loan debts and combining them into one payment and paying £276 each month. Does anyone agree or disagree etc?

Im just looking currently so wanting help and/or advice!Jan 18 Joint debts 35,213

Mortgage Jan 18- 77224 Jan 26- just under 64k

June 25 Debts in my name were £5170. Now 5178 (Jan 26)

DH debts ?? at a guess £15k1 -

Im not sure im gonna double check in a bit, i need to sit down and work it out properly because I was surprised I could even get offered a consolidation loan!NeverendingDMP said:

How much longer/more will it cost you in the long run? And can you cut up the cards, consolidate and then be absolutely certain you wont borrow any more (not that I've ever done the same 😂)BlueJ94 said:Right my fellow internet friends! I need your honest help and advice!

I can take a consolidation loan out for £5,800 to clear all my loan debts and combining them into one payment and paying £276 each month. Does anyone agree or disagree etc?

Im just looking currently so wanting help and/or advice!I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001 -

This is my first offer, over 24 months!I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001 -

BlueJ94. I did this and it worked for me but you have to be strong. My friend did it and then ran up more debts on her cc so ended up with the loan plus more. I'd only do it if you are strong and cut up your cards and live within your means. Also make sure that if you want to pay the loan off quicker which you might do if you are debt busting that you can. Some won't let you and the interest is fixed over a period of time, interest rates are going down so you don't want to be locked in.Total debt £18,000 at the start of DFW Journey. 2018 14TH JULY 2021 DEBT FREE / 2026 struggling

NUMBER 14 1p a day challenge 2026 £3.95 / £667.95 NUMBER 15 Pay my debts in 2026 £273/£10,0003 -

Thanks BlueJ94 I need a lucky number?Total debt £18,000 at the start of DFW Journey. 2018 14TH JULY 2021 DEBT FREE / 2026 struggling

NUMBER 14 1p a day challenge 2026 £3.95 / £667.95 NUMBER 15 Pay my debts in 2026 £273/£10,0002 -

@BlueJ94 I'd say no to this and continue paying what you have right now and overpay what's possible. I thought the APR will be maybe 5-7%.

https://www.moneysavingexpert.com/loans/cheap-personal-loans/#7.5k

Mortgage: £173,700 Sep 22 £158,000 Jan 26

MF Date: Sep 52 Mar 52

CC Debt: £15,250 Nov 25 £11,600 Jan 26

2026 Challenges:

MFiT-T7 #5

DFbyXMAS #7

Sealed Pot Challenge #022

January 2026 Grocery Challenge: £51.06/£200

1 -

The link you sent is for a standard loan I believe? I looked into consolidation ones not sure what the difference is?RedLipstick said:@BlueJ94 I'd say no to this and continue paying what you have right now and overpay what's possible. I thought the APR will be maybe 5-7%.

https://www.moneysavingexpert.com/loans/cheap-personal-loans/#7.5kI’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards