We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Refusing to refund VAT. Is this allowed?

Comments

-

I think you need to establish what ‘US VAT ‘ means. Is it UK vat or a US charge?You do not say when you received the item.Could there be Customs charges still due for importing the goods?Couriers often send the bill after delivery.0

-

Not that I can see, it has a plastic envelope on it which I don't want to pull off/damage in any way.born_again said:

Very strange thing to say.Mintsource said:They have come back with

"Sorry for the delayed response. I appreciate your patience during this time. We have not forgotten about you and are committed to providing you with the best support possible.

I regret to inform you that the VAT charged for the purchases on Zwiftshop.com is non-refundable.

Nevertheless, if you need it after you complete the purchase, we can provide you with an invoice with our VAT information so you can reclaim it with the local tax authorities. We appreciate your understanding."

Does the doc you show above have their VAT number on it?0 -

It's a documentation envelope. It's intended to be opened by the recipient.Mintsource said:

Not that I can see, it has a plastic envelope on it which I don't want to pull off/damage in any way.born_again said:

Very strange thing to say.Mintsource said:They have come back with

"Sorry for the delayed response. I appreciate your patience during this time. We have not forgotten about you and are committed to providing you with the best support possible.

I regret to inform you that the VAT charged for the purchases on Zwiftshop.com is non-refundable.

Nevertheless, if you need it after you complete the purchase, we can provide you with an invoice with our VAT information so you can reclaim it with the local tax authorities. We appreciate your understanding."

Does the doc you show above have their VAT number on it?

I'd take a knife or a pair of scissors and cut it open to access the docs inside.

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

0

-

This is likely to contain your "invoice".Mintsource said:

Not that I can see, it has a plastic envelope on it which I don't want to pull off/damage in any way.born_again said:

Very strange thing to say.Mintsource said:They have come back with

"Sorry for the delayed response. I appreciate your patience during this time. We have not forgotten about you and are committed to providing you with the best support possible.

I regret to inform you that the VAT charged for the purchases on Zwiftshop.com is non-refundable.

Nevertheless, if you need it after you complete the purchase, we can provide you with an invoice with our VAT information so you can reclaim it with the local tax authorities. We appreciate your understanding."

Does the doc you show above have their VAT number on it?0 -

Hopefully that will provide some answers...0

-

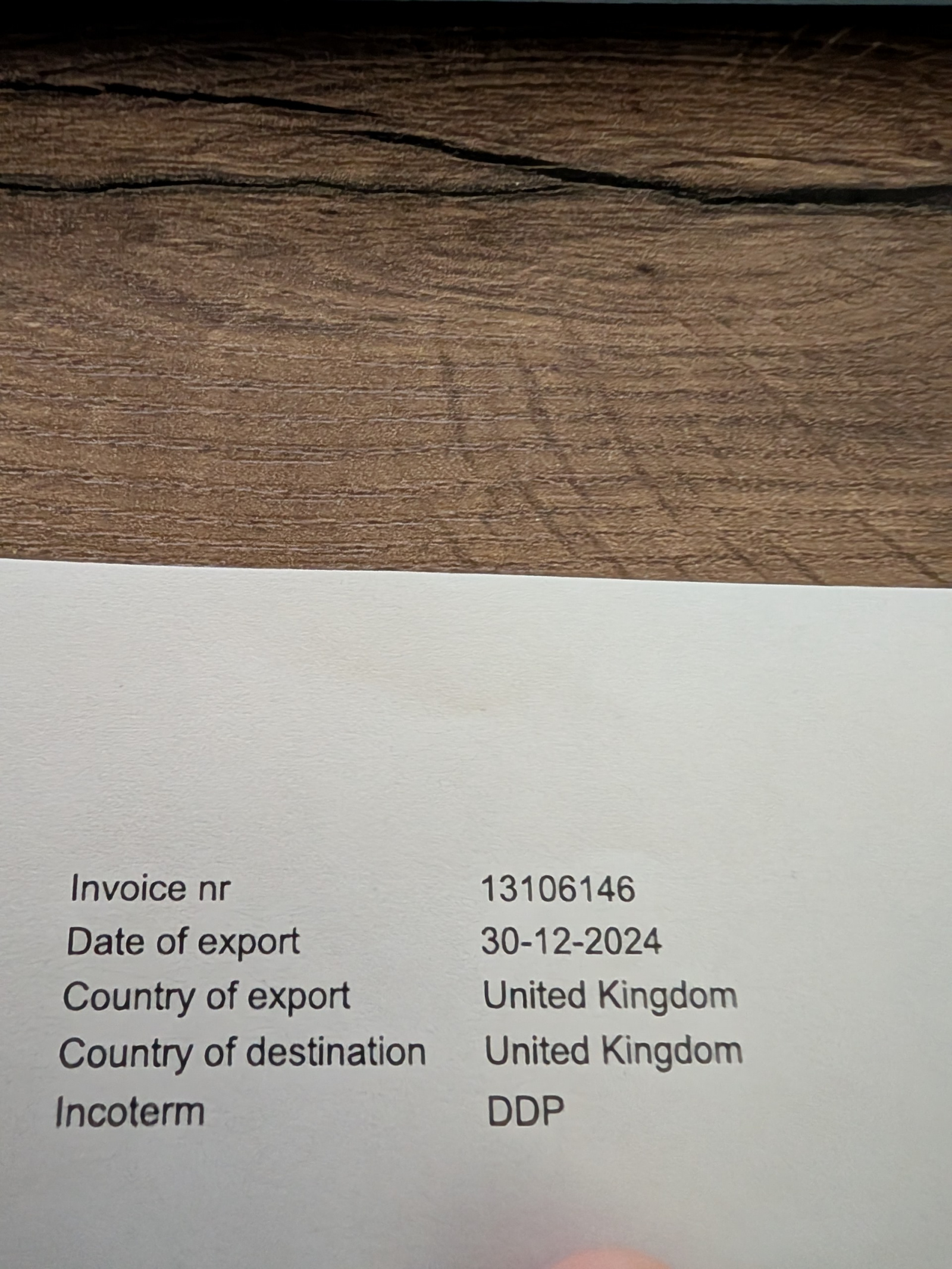

This is all that's on there apart from my address, the address already in this thread and the description of the item.

0 -

It was ordered by accident.Okell said:

I had already bought 1, the browser refreshed it bought a 2nd. I tried to cancel it but their website doesn't allow cancellations. Which they do clearly state but they do allow refunds and reimburse delivery costs as per their T&Cs.

What they don't state is that the delivery costs are refundable, the VAT is not.0 -

Did you try to contact them (ie a living human being) when you realised you had inadvertantly bought two?

I would have thought that any reasonable and responsible trader would have allowed you to cancel the second order in those circumstances rather than saying "our T&Cs don't allow cancellation.

Certainly what you can do in this country is withdraw your offer to buy before the contract is formed - and they say your contract is governed by UK law.0 -

And as I said above it also says:DullGreyGuy said:

Thats UK legislation, the T&Cs of the vendors website states California Law applies... UK government doesn't set Californian law so you won't find it on legislation.gov.ukUltimately

https://www.legislation.gov.uk/uksi/2013/3134/regulation/34

(1) The trader must reimburse all payments, other than payments for delivery, received from the consumer, subject to paragraph (10)

So if the trader was paid the VAT they need to refund it, if the VAT was paid to the courier upon import (before/on/after delivery) then obviously it's a separate matter from the trader's obligations.

However, you will benefit from any mandatory provisions of the law of your local jurisdiction, and nothing in these Terms affects your rights as a consumer to rely on such mandatory provisions of local law. You or we may bring a legal action relating to these Terms or our relationship in either the state or federal courts located in Los Angeles, California or in the courts located in your country of residence.

So they are affording your UK consumer rights under the contract.19. GOVERNING LAW AND VENUE

Any dispute, claim, or controversy between you and Zwift arising from or related to these Terms, the Zwift products, or your use of the Platform will be governed by and construed and enforced in accordance with the laws of California, except to the extent preempted by U.S. federal law, without regard to conflict of law rules or principles (whether of California or any other jurisdiction) that would cause the application of the laws of any other jurisdiction. Any dispute, claim, or controversy between the parties that is not subject to arbitration or cannot be heard in small claims court will be exclusively resolved in the state or federal courts of California and the United States, respectively, sitting in Los Angeles, California. You and Zwift waive any objection to venue in any such courts.

https://support.zwift.com/terms-of-service-HJt7VBYyH

Above is the terms of service I see on their site, cannot see where you copied that text from and Google has no trace of it on their site either

Assuming it is from some unindexed page, is the CCR "mandatory" where the seller is not UK based?

As an aside, I have to say all the normal consumer champion type websites could seriously do with some updating and consideration of international purchases which are becoming ever more common. Not a single one of CAB, Which? etc that I saw say anything about if the rules are the same or different if the merchant is outside the UK. At best they warn that a .uk domain name isnt a guarantee that the company is UK based but then dont say the consequences of it not being UK based.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards