We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

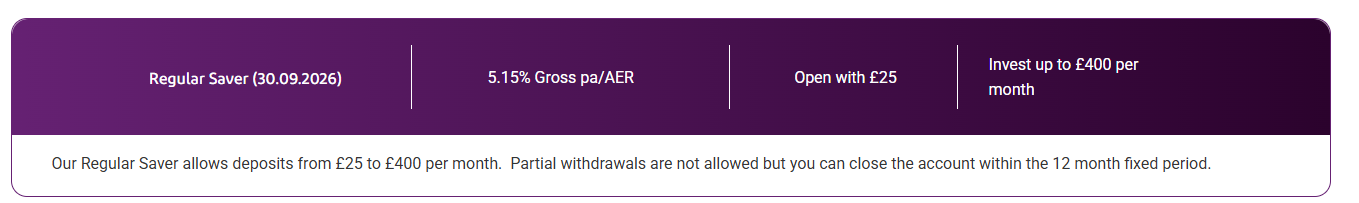

CHORLEY RS 5.15%v

Iv'e read their T&Cs and still cant make out if you can withdraw or close account... A) because you just wish to and if they reduce the rate TIA 0

if they reduce the rate TIA 0 -

there is a line on the RS page that says....castle96 said:CHORLEY RS 5.15%v

Iv'e read their T&Cs and still cant make out if you can withdraw or close account... A) because you just wish to and if they reduce the rate TIAOur Regular Saver allows deposits from £25 to £400 per month. Partial withdrawals are not allowed but you can close the account within the 12 month fixed period.

if they reduce the rate TIAOur Regular Saver allows deposits from £25 to £400 per month. Partial withdrawals are not allowed but you can close the account within the 12 month fixed period. I was looking at the account at the weekend (both Chorley RS accounts in fact), and I don't recall there being an "if the rate drops, you can close" clause in the terms - though the fact there is a closure option, probably negates the need for it. 0

I was looking at the account at the weekend (both Chorley RS accounts in fact), and I don't recall there being an "if the rate drops, you can close" clause in the terms - though the fact there is a closure option, probably negates the need for it. 0 -

"You cannot make a partial withdrawal from our Regular Saver Account during the 12-month period, but if you need access to your money, you can close the account"castle96 said:CHORLEY RS 5.15%v

Iv'e read their T&Cs and still cant make out if you can withdraw or close account... A) because you just wish to and if they reduce the rate TIA

if they reduce the rate TIA

https://www.chorleybs.co.uk/savings/regular-saver-accounts/regular-saver-300920260 -

But at least TSB allow closure and don’t hold £1 hostage. Allowing the closure and saying no new account until the anniversary would make more sense than ending up with £1 in the accounts of annoyed customers, surely?jaypers said:Progressive…..my thoughts……I’ve read some bad things about them but decided to open the RS account yesterday. All went without a hitch and the ID check thing also worked well. All now funded with £300 so happy so far.

With regards to the Issue 3 interest rate Vs Issue 4, it’s pretty common on their stand here. Even the likes of TSB won’t let you close and reopen their RS until the year has passed by. I too would be annoyed but I guess it’s a fact of life and it’s just their policy.

TSB’s rate is fixed, so it’s somewhat fairer to say you can’t open another. Progressive’s approach is within their T and C though, so they haven’t done anything wrong. I doubt the ombudsman would find their terms unfair since no one is forced to keep a material balance at a rate that isn’t what it was when they applied.1 -

West Brom Reglar Saver issue 7

Maturity letter just says it will convert to a EA. Says can get passbook updated in branch. How is best to access the money (avoiding going to a branch)

0 -

Still worth doing even if you exceed your savings allowance - its 20p on each pound over. Mostly HMRC will just adjust your tax code to pay any outstanding tax and send you a letter so mostly its not worth worrying about until your interest exceeds £4KTheQuaker said:

Usually it's better to think about maximising your gains after tax rather than always avoiding paying tax e.g., 7% is 5.6% net of 20% tax and is still better than most Isa accounts, 6% is 4.8% net at 20%.

Very true. Thanks for that. Makes me think having money in cash ISAs is not worth it if playing this game.

“Create all the happiness you are able to create; remove all the misery you are able to remove. Every day will allow you, --will invite you to add something to the pleasure of others, --or to diminish something of their pains.”2 -

Got mine out online when it matured, but no replacement account unless you go to a branch.liamcov said:West Brom Reglar Saver issue 7

Maturity letter just says it will convert to a EA. Says can get passbook updated in branch. How is best to access the money (avoiding going to a branch)0 -

Another progressive 5.5 here, I ll keep funding as its still a good deal, it's just not as good as the 7.

Well done anyone getting the 7, must be near the top of current leader board of rs es.

Just culled my sub 5.0% ones, some I ve been with for ages but theres no sentiment in this...good luck all.0 -

Do you have online access to WestBrom? They do seem to distinguish between online and branch versions of the same product so do you know what type of EA you have?liamcov said:West Brom Reglar Saver issue 7

Maturity letter just says it will convert to a EA. Says can get passbook updated in branch. How is best to access the money (avoiding going to a branch)0 -

What’s the significance of £4K? I was aware of the tax return at £10K, but is £4K the point at which HMRC send a bill for the unpaid tax rather than adjusting the tax code to recover it? If so, some would prefer that.mhoc said:

Still worth doing even if you exceed your savings allowance - its 20p on each pound over. Mostly HMRC will just adjust your tax code to pay any outstanding tax and send you a letter so mostly its not worth worrying about until your interest exceeds £4KTheQuaker said:

Usually it's better to think about maximising your gains after tax rather than always avoiding paying tax e.g., 7% is 5.6% net of 20% tax and is still better than most Isa accounts, 6% is 4.8% net at 20%.

Very true. Thanks for that. Makes me think having money in cash ISAs is not worth it if playing this game.

Less than £4K can also be a problem - if someone’s earning £50K, less than £300 taxable interest will turn them into a higher rate taxpayer and lose half of their PSA.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards