We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Thanks for that. I understand now, basically you get 6 extra days at the end when you have the account full and that's what makes the difference!Bobblehat said:

OK ..... I'm glad I kept the rough working out spreadsheet! It would be 6 days BTW, as although I could have shifted the £400 I kept back today, I can't open the new RS until tomorrow at the earliest.rallycurve said:Bobblehat said:

A good point .... but .....Stargunner said:

Why don't you open the new RS now, so that you can be earning interest on your first deposit of £200.Bobblehat said:

I'll risk it! The NW agent I spoke to insisted on looking up the rate of the current offering when I mentioned about opening a new one later in the month (I already knew the rate). His wording was slightly worrying ... "It's still 6.5%, at the moment!". I should have asked if there was an expected drop imminent, but knew I would get a non-committal answer.friolento said:

It might not be available any longer on the 29th.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

OTOH, there might be a better offer during Savings Week, only available if you haven’t yet got the 6.5% one.

Choices, choises🤔

It's a variable account anyway, so if it did drop between now and the 29th, I'd have probably only lost pennies. I have the choice to go elsewhere if the drop is drastic or NLA ... unlikely.

You previously said that you were leaving £400 in the current account to cover the first 2 payments. How much interest are you earning on the £400?

I could shift it out to Chase Saver and back 7 days later @ 4.65% gaining £0.28p over leaving it where it is (1%)....

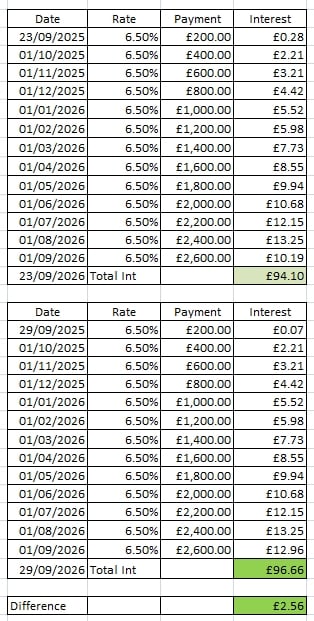

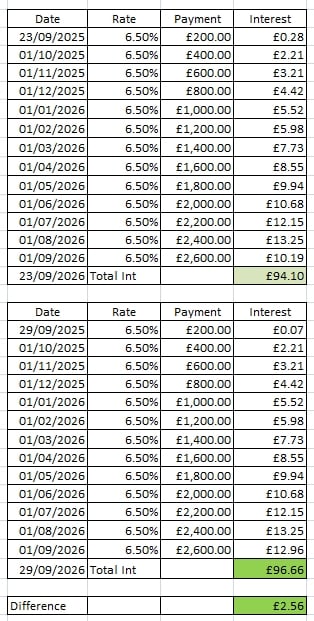

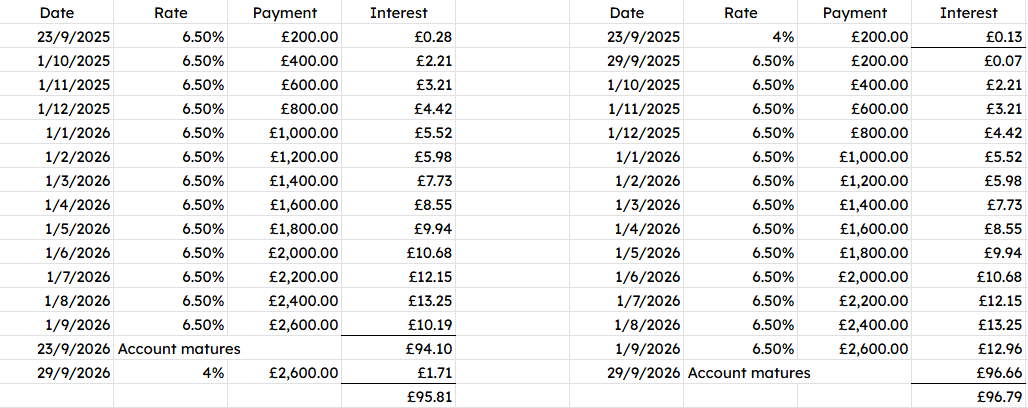

or, I could open the NW RS tomorrow and lose £2.56 over opening it on 29/09, (£94.10 maturing 22/09/2026 vs £96.66 maturing 28/09/2026).

So leaving the £400 where it is and not having to shift it around, and opening on 29th I'll have gained £2.56 over opening on 23rd but lost £0.28p for being a tad lazy! Do I loose an MSE point for being a tad lazy?I’d be curious to know the maths behind this. How can you earn £2.56 in 7 days on £200 in an account paying 6.5%?

Here you go ... usual qualifier, if you spot an error, let me know and I'll look and correct as necessary.

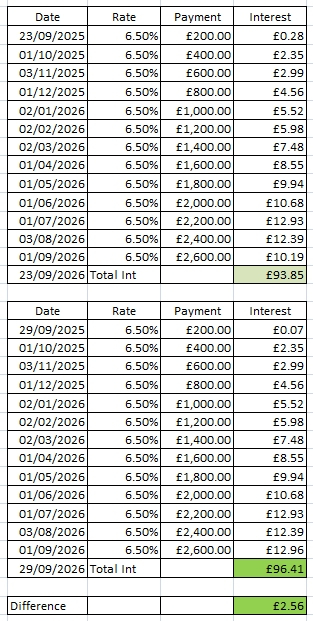

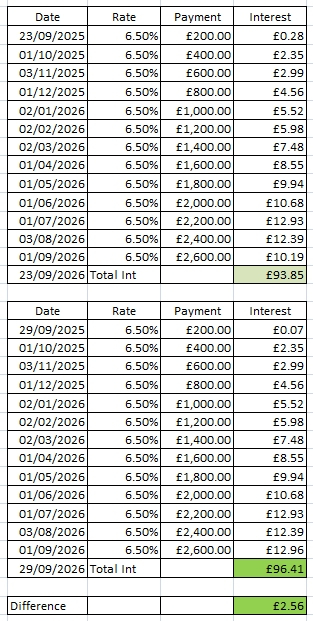

And for those who insist on a more accurate table showing payment dates for SO's on Bank working days ....

I have similar tables to above but showing a rate drop to 6.00% on 01/10/2025! Did I here a murmur of "Keep 'em to yourself"? 1

1 -

Easiest to think of the benefits by considering the difference between making the first payment on the first on the month Vs last day of the month. If you make the first payment on 1st then for the first month you are getting interest on £200 for the whole of the first month. At the end of the term you have only£2400. If you make a first payment on the last day and your second payment on the 1st of the following month, you are earning interest on £400 for the more or less the whole month. At the end of the term you get interest on £2600 for moreorless the whole month.grumpy_codger said:

Waiting makes no sense if you have money now. You are loosing interest - it's better for this money to earn 6.5% than to wait.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.1 -

I've always been a bit sceptical of the "open at the end of the month" thing, and have generally followed the rule of "open now if you have the money". But now Bobblehat's spreadsheet is making me doubt myself...

It's not worth overthinking these things though - for example when my last Coop RS matured, it took 5 days for my new account to open, so this could tip you over into the next month. Others like Principality are more predictable (if your maturity instructions are accepted, of course...)2 -

You got it! The first and last deposit rows of the two tables says it all!rallycurve said:

Thanks for that. I understand now, basically you get 6 extra days at the end when you have the account full and that's what makes the difference!Bobblehat said:

OK ..... I'm glad I kept the rough working out spreadsheet! It would be 6 days BTW, as although I could have shifted the £400 I kept back today, I can't open the new RS until tomorrow at the earliest.rallycurve said:Bobblehat said:

A good point .... but .....Stargunner said:

Why don't you open the new RS now, so that you can be earning interest on your first deposit of £200.Bobblehat said:

I'll risk it! The NW agent I spoke to insisted on looking up the rate of the current offering when I mentioned about opening a new one later in the month (I already knew the rate). His wording was slightly worrying ... "It's still 6.5%, at the moment!". I should have asked if there was an expected drop imminent, but knew I would get a non-committal answer.friolento said:

It might not be available any longer on the 29th.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

OTOH, there might be a better offer during Savings Week, only available if you haven’t yet got the 6.5% one.

Choices, choises🤔

It's a variable account anyway, so if it did drop between now and the 29th, I'd have probably only lost pennies. I have the choice to go elsewhere if the drop is drastic or NLA ... unlikely.

You previously said that you were leaving £400 in the current account to cover the first 2 payments. How much interest are you earning on the £400?

I could shift it out to Chase Saver and back 7 days later @ 4.65% gaining £0.28p over leaving it where it is (1%)....

or, I could open the NW RS tomorrow and lose £2.56 over opening it on 29/09, (£94.10 maturing 22/09/2026 vs £96.66 maturing 28/09/2026).

So leaving the £400 where it is and not having to shift it around, and opening on 29th I'll have gained £2.56 over opening on 23rd but lost £0.28p for being a tad lazy! Do I loose an MSE point for being a tad lazy?I’d be curious to know the maths behind this. How can you earn £2.56 in 7 days on £200 in an account paying 6.5%?

Here you go ... usual qualifier, if you spot an error, let me know and I'll look and correct as necessary.

And for those who insist on a more accurate table showing payment dates for SO's on Bank working days ....

I have similar tables to above but showing a rate drop to 6.00% on 01/10/2025! Did I here a murmur of "Keep 'em to yourself"?

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

Also worth noting that in many cases there's the option of ``Fund now, refresh at the end of the month if it's still available".clairec666 said:I've always been a bit sceptical of the "open at the end of the month" thing, and have generally followed the rule of "open now if you have the money". But now Bobblehat's spreadsheet is making me doubt myself...

It's not worth overthinking these things though - for example when my last Coop RS matured, it took 5 days for my new account to open, so this could tip you over into the next month. Others like Principality are more predictable (if your maturity instructions are accepted, of course...)

5 -

The best compromise for both those that like early and those that like late!Bridlington1 said:

Also worth noting that in many cases there's the option of ``Fund now, refresh at the end of the month if it's still available".clairec666 said:I've always been a bit sceptical of the "open at the end of the month" thing, and have generally followed the rule of "open now if you have the money". But now Bobblehat's spreadsheet is making me doubt myself...

It's not worth overthinking these things though - for example when my last Coop RS matured, it took 5 days for my new account to open, so this could tip you over into the next month. Others like Principality are more predictable (if your maturity instructions are accepted, of course...)Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

Many thanks for this! It worked, saved me a hassle calling them tomorrow.AndyTh_2 said:Manchester BS Regular Saver 1

I waited over an hour for the User Id and didn't get it, so I went to their website to do a for "Forgotten your User ID?" on the login page, and got the User Id that way.0 -

Slight alteration to your fabulous spreadsheet @Bobblehat - assuming you've got £200 ready to fund the account on 23/9, and will have each subsequent £200 available on the 1st of each month. Consider the total interest earned between 23/9/2025 and 29/9/2026. If you open and fund on the 23rd, then you will have a spare 6 days after maturity where your money can earn interest elsewhere (I've used 4% as an example). If you're opening on the 29th then the spare 6 days will be at the beginning, and the 4% will only apply to £200.

If you compare the two methods over 371 days, then the 29th is still the winner, but not by quite such a large margin.

Edit: the 4% from 23/9 to 29/9 should apply to the £2600 plus interest, which would gain an extra 6p overall.3 -

Savings Week

Very disappointing upto now

Here's Progressive's contribution

UK Savings Week 2025 Branch Competition

It’s UK Savings Week! Helping to ease the burden of the dreaded grocery shop bill (leaving you with a little extra in your pocket to save!), we’re offering you the chance to WIN £250 Tesco voucher! Enter by visiting your local Progressive branch for your chance to win. T&Cs apply.

Competition T&Cs3 -

lol, excludes their England based customerssaverkev said:Savings Week

Very disappointing upto now

Here's Progressive's contribution

UK Savings Week 2025 Branch Competition

It’s UK Savings Week! Helping to ease the burden of the dreaded grocery shop bill (leaving you with a little extra in your pocket to save!), we’re offering you the chance to WIN £250 Tesco voucher! Enter by visiting your local Progressive branch for your chance to win. T&Cs apply.

Competition T&Cs If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards