We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

I received 'thank you' email first, 5 mins later User ID, 5 mins later again 'secure message' emailallegro120 said:

I applied about an hour ago. Received 2 e-mails almost immediately, "thank you" and "a message has been sent to you", but no ID number for login. How long did it take to receive the ID?Aidanmc said:Re Manchester BS,

I just applied for the RS as a new customer.

Received user id, but when i try to log in i get 'Site Error' message1 -

Thats strange, works fine for me tooPowerSavingMode said:

Thanks, but same blank screen, apart from the word 'savings' and huge black arrow.ForumUser7 said:

Works fine for me, but try https://manchester.co.uk/savings/all-savings-accounts then click regular saverPowerSavingMode said:

Re: Manchester Building Society — regular saver 5.50% for 24 monthsMarkFromCornwall said:

Yes. When I clicked on their link about how to fund the new (Manchester) account it sent me to a page on the Newcastly Building Society website.shirley999 said:The Newcastle Building Society then! (T/a Manchester Building Society)

Do you have the direct link, BAC? The other link under the original post (https://manchester.co.uk/savings/product/manchester-regular-saver-issue-1) shows nothing but a word (Savings) and then a big black arrow!0 -

Waiting makes no sense if you have money now. You are loosing interest - it's better for this money to earn 6.5% than to wait.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

1 -

Likewise.Aidanmc said:

I received 'thank you' email first, 5 mins later User ID, 5 mins later again 'secure message' emailallegro120 said:

I applied about an hour ago. Received 2 e-mails almost immediately, "thank you" and "a message has been sent to you", but no ID number for login. How long did it take to receive the ID?Aidanmc said:Re Manchester BS,

I just applied for the RS as a new customer.

Received user id, but when i try to log in i get 'Site Error' messageAll very prompt. Signed up and, after emails, log-in was simple.Digital Payback

The National Lottery : A tax on those who aren’t good at maths.0 -

Melton have temporarily pulled all savings accounts while they upgrade their systems, as discussed on the thread last night/this morning. We'll only know what has been withdrawn when we see what is there when it comes back.happybagger said:@Bridlington1

Melton BS RS 5

Regardless of their current "Not opening any accounts temporarily" statement, it would appear that the Melton RS 5 account (2 years, 5% var) is now a closed issue

It's in their "closed issue accounts" list, and clicking the account link states it is "discontinued"

RS5 was an open ended account in contrast to their other accounts which had fixed end dates, so no obvious reason for that to be pulled unless they no longer wish to offer an open ended RS.

1 -

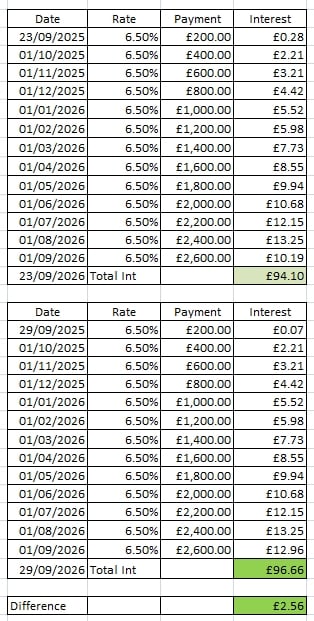

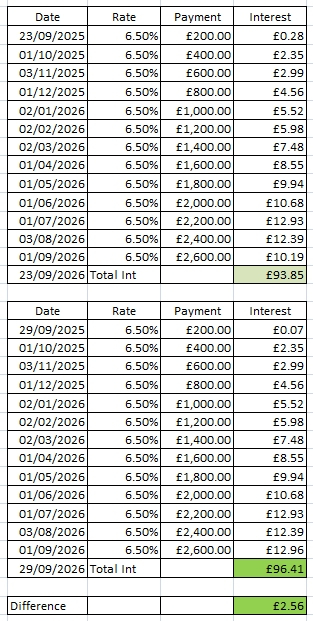

It's not just the second deposit that can be made 6 days earlier in the account year, it's the 3rd, 4th, ..., 13th. Meaning overall there's an extra 6 days gained on £2,400 worth about £2.56 minus whatever interest could be earned on the money elsewhere.rallycurve said:Bobblehat said:

A good point .... but .....Stargunner said:

Why don't you open the new RS now, so that you can be earning interest on your first deposit of £200.Bobblehat said:

I'll risk it! The NW agent I spoke to insisted on looking up the rate of the current offering when I mentioned about opening a new one later in the month (I already knew the rate). His wording was slightly worrying ... "It's still 6.5%, at the moment!". I should have asked if there was an expected drop imminent, but knew I would get a non-committal answer.friolento said:

It might not be available any longer on the 29th.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

OTOH, there might be a better offer during Savings Week, only available if you haven’t yet got the 6.5% one.

Choices, choises🤔

It's a variable account anyway, so if it did drop between now and the 29th, I'd have probably only lost pennies. I have the choice to go elsewhere if the drop is drastic or NLA ... unlikely.

You previously said that you were leaving £400 in the current account to cover the first 2 payments. How much interest are you earning on the £400?

I could shift it out to Chase Saver and back 7 days later @ 4.65% gaining £0.28p over leaving it where it is (1%)....

or, I could open the NW RS tomorrow and lose £2.56 over opening it on 29/09, (£94.10 maturing 22/09/2026 vs £96.66 maturing 28/09/2026).

So leaving the £400 where it is and not having to shift it around, and opening on 29th I'll have gained £2.56 over opening on 23rd but lost £0.28p for being a tad lazy! Do I loose an MSE point for being a tad lazy?I’d be curious to know the maths behind this. How can you earn £2.56 in 7 days on £200 in an account paying 6.5%?

0 -

Waiting majes sense if you believe you won't be able to earn 6.5% in a year's time if you were to open it nowgrumpy_codger said:

Waiting makes no sense if you have money now. You are loosing interest - it's better for this money to earn 6.5% than to wait.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.I consider myself to be a male feminist. Is that allowed?2 -

OK ..... I'm glad I kept the rough working out spreadsheet! It would be 6 days BTW, as although I could have shifted the £400 I kept back today, I can't open the new RS until tomorrow at the earliest.rallycurve said:Bobblehat said:

A good point .... but .....Stargunner said:

Why don't you open the new RS now, so that you can be earning interest on your first deposit of £200.Bobblehat said:

I'll risk it! The NW agent I spoke to insisted on looking up the rate of the current offering when I mentioned about opening a new one later in the month (I already knew the rate). His wording was slightly worrying ... "It's still 6.5%, at the moment!". I should have asked if there was an expected drop imminent, but knew I would get a non-committal answer.friolento said:

It might not be available any longer on the 29th.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

OTOH, there might be a better offer during Savings Week, only available if you haven’t yet got the 6.5% one.

Choices, choises🤔

It's a variable account anyway, so if it did drop between now and the 29th, I'd have probably only lost pennies. I have the choice to go elsewhere if the drop is drastic or NLA ... unlikely.

You previously said that you were leaving £400 in the current account to cover the first 2 payments. How much interest are you earning on the £400?

I could shift it out to Chase Saver and back 7 days later @ 4.65% gaining £0.28p over leaving it where it is (1%)....

or, I could open the NW RS tomorrow and lose £2.56 over opening it on 29/09, (£94.10 maturing 22/09/2026 vs £96.66 maturing 28/09/2026).

So leaving the £400 where it is and not having to shift it around, and opening on 29th I'll have gained £2.56 over opening on 23rd but lost £0.28p for being a tad lazy! Do I loose an MSE point for being a tad lazy?I’d be curious to know the maths behind this. How can you earn £2.56 in 7 days on £200 in an account paying 6.5%?

Here you go ... usual qualifier, if you spot an error, let me know and I'll look and correct as necessary.

And for those who insist on a more accurate table showing payment dates for SO's on Bank working days ....

I have similar tables to above but showing a rate drop to 6.00% on 01/10/2025! Did I hear a murmur of "Keep 'em to yourself"?

Edit here ... hear!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum6 -

But the second (and 3rd, 4th, etc) deposit can be made on the 1st of the month no matter if you open it 23/09 or 29/09 right?masonic said:

It's not just the second deposit that can be made 6 days earlier in the account year, it's the 3rd, 4th, ..., 13th. Meaning overall there's an extra 6 days gained on £2,400 worth about £2.56 minus whatever interest could be earned on the money elsewhere.rallycurve said:Bobblehat said:

A good point .... but .....Stargunner said:

Why don't you open the new RS now, so that you can be earning interest on your first deposit of £200.Bobblehat said:

I'll risk it! The NW agent I spoke to insisted on looking up the rate of the current offering when I mentioned about opening a new one later in the month (I already knew the rate). His wording was slightly worrying ... "It's still 6.5%, at the moment!". I should have asked if there was an expected drop imminent, but knew I would get a non-committal answer.friolento said:

It might not be available any longer on the 29th.Bigwheels1111 said:Bobblehat said:

If it's of interest(!), opened the RS 22/09/2024, funded it 22/09 & 01/10 and then by SO on 01/11 until 01/09/2025, so closing balance was £2693.67.Bigwheels1111 said:Hattie627 said:Nationwide BS Flex Regular Saver

My Issue 3 Flex RS has its maturity date today. Interest has been added (£93.46). I have moved the balance plus interest out. The account is still showing as a Flexible RS which is preventing me opening a new one (now Issue 7). I can't remember what happened last year. Has anyone any recent experience of a Flex RS maturity and can recall when the account changes to an Instant Saver?Did you make an extra £200 payment this month, ie total £2600.I did and only got £93.42.Yes interest, I'm thinking of waiting until the 29th to open a new one so I can fund on the first as well to maxInterest this year. Then open on the 30th next year to do the same. As you need to wait a day to open.

OTOH, there might be a better offer during Savings Week, only available if you haven’t yet got the 6.5% one.

Choices, choises🤔

It's a variable account anyway, so if it did drop between now and the 29th, I'd have probably only lost pennies. I have the choice to go elsewhere if the drop is drastic or NLA ... unlikely.

You previously said that you were leaving £400 in the current account to cover the first 2 payments. How much interest are you earning on the £400?

I could shift it out to Chase Saver and back 7 days later @ 4.65% gaining £0.28p over leaving it where it is (1%)....

or, I could open the NW RS tomorrow and lose £2.56 over opening it on 29/09, (£94.10 maturing 22/09/2026 vs £96.66 maturing 28/09/2026).

So leaving the £400 where it is and not having to shift it around, and opening on 29th I'll have gained £2.56 over opening on 23rd but lost £0.28p for being a tad lazy! Do I loose an MSE point for being a tad lazy?I’d be curious to know the maths behind this. How can you earn £2.56 in 7 days on £200 in an account paying 6.5%?

0 -

Manchester BS Regular Saver 1

I waited over an hour for the User Id and didn't get it, so I went to their website to do a for "Forgotten your User ID?" on the login page, and got the User Id that way.6

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards