We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

don't know why moneyfacts don't have a column to show if accounts are fixed or variable.Aidanmc said:checkly said:

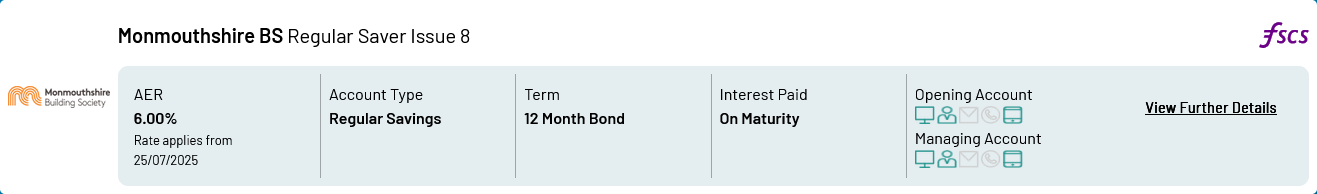

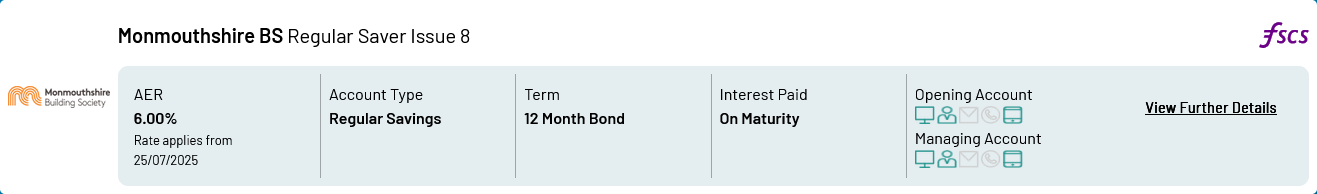

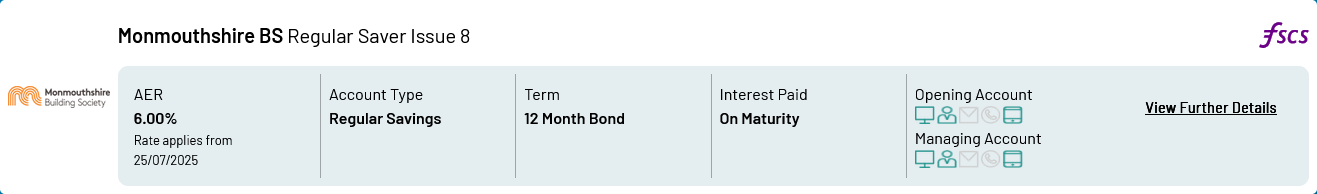

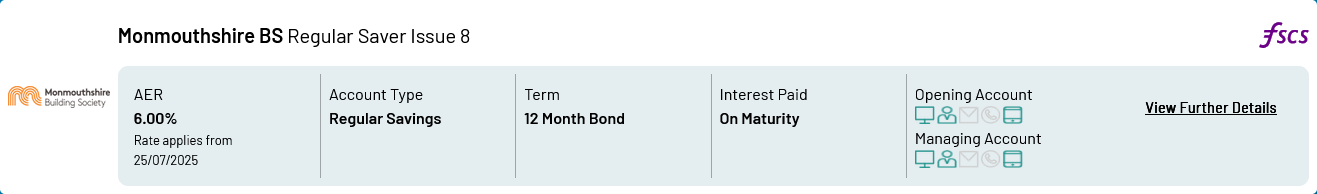

Fixed or variable? Is there a link?Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account. Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales1

Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales1 -

My guess is it's gonna be variable.0

-

Variable rate. It's visible in the app but application does not go through. Probably will be activated tomorrow.Aidanmc said:checkly said:

Fixed or variable? Is there a link?Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account. Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales4

Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales4 -

kamkop said:

Variable rate. It's visible in the app but application does not go through. Probably will be activated tomorrow.Aidanmc said:checkly said:

Fixed or variable? Is there a link?Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account. Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and WalesMonmouthshire doesn't seem to offer accounts to NI residents for some reason.Thats me out for this one.2

Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and WalesMonmouthshire doesn't seem to offer accounts to NI residents for some reason.Thats me out for this one.2 -

Can’t see it in the app - but maybe that’s because I’m not a member (yet - will be tomorrow!)kamkop said:

Variable rate. It's visible in the app but application does not go through. Probably will be activated tomorrow.Aidanmc said:checkly said:

Fixed or variable? Is there a link?Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account. Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales

Doesnt specifically say fixed or variable.In additional info it says restricted to those living in England, Scotland and Wales

Learn from the mistakes of others - you won't live long enough to make them all yourself.0 -

Unlimited access means you can access the money. Not necessarily put it backshirley999 said:

I’m about to hit the £5k imminently. You say unlimited instant access. Are you suggesting you can eg, spend £4k and replace it two months later?allegro120 said:

RBS/Natwests71hj said:

I think this account is part of their overall headline offering in their marketing, so I'm pretty confident the last rate reduction was just bowing to the inevitable after a number of rate cuts and they will not be especially reactive to all future rate cuts. My plan is to get it and the RBS equivelant to £5000 via a strategy of aggressive £1.01 debit card payments for roundups and then maintain them as savings accounts with what hopefully will remain a market leading rate for a relatively easy access account.TheBanker said:

Natwest Regular SaverForumUser7 said:

You can fill it up quickly using 'round ups'.UndergroundSaxClub said:

Thanks again. I think I'll follow your method. New to regular savers, but not regular saving. Seems a bit odd to wait almost 3 years to hit the currently advertised interest rate, or am I misunderstanding? 150x33months for 5.5% seems rough.Bridlington1 said:

I typically pay into whichever accounts give me the highest rate of interest for my money, if I pay the maximum into the top regular saver and still have money leftover I fill up the second best regular saver, then the third best one etc. You'll likely find many on this forum have a few dozen or more regular savers on the go at any one time (my peak was over 60 regular savers).UndergroundSaxClub said:

Thanks, guess it never hurts to have a backup. Currently have a Santander Edge saver at 5.84% for a year (I think) with 4k, and everything else in their Easy Access Saver, due to drop to 3% in AugustPRAISETHESUN said:UndergroundSaxClub said:Hopefully an easy one.Recently completed a switch to RBS for the £125 incentive, now opening a DRS for the extra £50. Is using this account as advertised "pointless" if I have a lump sum, or can save around 800pcm rather than 150? I'm not great with numbers, but I think I would get a better return just sticking a big lump into an easy-access savings account rather than top this up for X amount of years.

The higher interest rate will always be the better place to save your money, even with the deposit restrictions for RS accounts. Best way to maximise your return is to whack your lump sum into a high interest easy access savings account and drip feed it each month into the even higher interest DRS account (or any of the other RS accounts discussed in this thread).

To do this, you turn on 5x round ups from your debit card in the NatWest app, and then you can make loads of £1.01 payments into accounts that accept debit card deposits, or just as you spend normally let it fill up.

Agree it is tedious though, and takes a while to fill

If you have the Natwest Rewards current account you can also pay your cashback into the Regular Saver which doesn't seem to count towards your limit. Interest is paid monthly on the Regular Saver which also does not count towards your limit, so it is certainly possible to get to £5k quicker.

I like this account - although it's not as competitive as it was, and there are other accounts paying more, iit's very convenient for me as my main current account is with Natwest. Although Natwest have reduced the interest rate, it doesn't feel like they've been as aggressive in cutting it as some other providers, and you don't have to go through the annual close and re-open cycle. My Digital Regular Saver is my longest-standing savings account.

The rate changes were slow historically, so I'm of the same thought that 5.5% is going to be there for a long time.

I've had both accounts since Sept 2020 and the rates were always on a competitive side. I've used £1.01 method using NS&I direct saver, but not aggressively. It helps, but the process is very tedious. Fivers from reward scheme also helped at the end. Now I just collect monthly interest. £10k with unlimited instant access earning 5.5% is a good deal, I think.I consider myself to be a male feminist. Is that allowed?1 -

It changed quite a while ago (maybe a year?)TheBanker said:

Natwests71hj said:

I think this account is part of their overall headline offering in their marketing, so I'm pretty confident the last rate reduction was just bowing to the inevitable after a number of rate cuts and they will not be especially reactive to all future rate cuts. My plan is to get it and the RBS equivelant to £5000 via a strategy of aggressive £1.01 debit card payments for roundups and then maintain them as savings accounts with what hopefully will remain a market leading rate for a relatively easy access account.TheBanker said:

Natwest Regular SaverForumUser7 said:

You can fill it up quickly using 'round ups'.UndergroundSaxClub said:

Thanks again. I think I'll follow your method. New to regular savers, but not regular saving. Seems a bit odd to wait almost 3 years to hit the currently advertised interest rate, or am I misunderstanding? 150x33months for 5.5% seems rough.Bridlington1 said:

I typically pay into whichever accounts give me the highest rate of interest for my money, if I pay the maximum into the top regular saver and still have money leftover I fill up the second best regular saver, then the third best one etc. You'll likely find many on this forum have a few dozen or more regular savers on the go at any one time (my peak was over 60 regular savers).UndergroundSaxClub said:

Thanks, guess it never hurts to have a backup. Currently have a Santander Edge saver at 5.84% for a year (I think) with 4k, and everything else in their Easy Access Saver, due to drop to 3% in AugustPRAISETHESUN said:UndergroundSaxClub said:Hopefully an easy one.Recently completed a switch to RBS for the £125 incentive, now opening a DRS for the extra £50. Is using this account as advertised "pointless" if I have a lump sum, or can save around 800pcm rather than 150? I'm not great with numbers, but I think I would get a better return just sticking a big lump into an easy-access savings account rather than top this up for X amount of years.

The higher interest rate will always be the better place to save your money, even with the deposit restrictions for RS accounts. Best way to maximise your return is to whack your lump sum into a high interest easy access savings account and drip feed it each month into the even higher interest DRS account (or any of the other RS accounts discussed in this thread).

To do this, you turn on 5x round ups from your debit card in the NatWest app, and then you can make loads of £1.01 payments into accounts that accept debit card deposits, or just as you spend normally let it fill up.

Agree it is tedious though, and takes a while to fill

If you have the Natwest Rewards current account you can also pay your cashback into the Regular Saver which doesn't seem to count towards your limit. Interest is paid monthly on the Regular Saver which also does not count towards your limit, so it is certainly possible to get to £5k quicker.

I like this account - although it's not as competitive as it was, and there are other accounts paying more, iit's very convenient for me as my main current account is with Natwest. Although Natwest have reduced the interest rate, it doesn't feel like they've been as aggressive in cutting it as some other providers, and you don't have to go through the annual close and re-open cycle. My Digital Regular Saver is my longest-standing savings account.

For those who haven't noticed, my Natwest app now gives me the option to switch on 5x Round Ups. So I assume a £1.01 purchase would sent £4.95 to my savings account. If you use the debit card for day to day spend you'd need to be careful as your current account could rapidly become empty, but this would be a good way of building your savings balance. Not sure if this is for everyone but the option is there in my app.I consider myself to be a male feminist. Is that allowed?1 -

Interesting, not sure if I've got the funds to start one though🤣Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account.

Maybe in September if it's still going🤔1 -

It's worth noting with Monmouthshire that they class the account opening as the date of first deposit rather than date of application and IIRC you've 30 days to fund so even if you applied tomorrow you could push the start date of the account well into August.jameseonline said:

Interesting, not sure if I've got the funds to start one though🤣Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account.

Maybe in September if it's still going🤔

I plan to apply tomorrow, if they can get it opened before the end of the month I'll fund at the end of the month, if they don't open it till August I'll hold out till the end of that month before funding.9 -

Same here, I'm struggling to fund all of my regular savers at the moment, and none are maturing until mid-September. Hopefully this one will be on offer for a while.jameseonline said:

Interesting, not sure if I've got the funds to start one though🤣Kim_13 said:Looking at Moneyfacts, Monmouthshire appear to be launching a Regular Saver Issue 8 tomorrow paying 6%, £500 per month and unlimited withdrawals.

I cannot see an equivalent Exclusive account.

Maybe in September if it's still going🤔2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards