We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The New Top Easy Access Savings Discussion Area

Comments

-

For those who held a monument account on 22nd Oct they are offering a cash bonus on top of the interest.

I withdrew almost all of it when they dropped the rate to 4% in August (and am

ineligible for new customer rates) but if you increase your balance before 31st Dec and hold it in the account until end of Feb 2026 then you get a cash bonus of £25 for £10k increases £50 for £20k etc up to £200 for a £50k increase. If you increase by the optimal amount this works out at between 0.25% and 0.4% boost. BUT this boost is only for holding it there for two months so on an AER basis it’s approximately 6x this.I think if you are eligible and can put £50k in, you’d get the 4% plus £200 which a bit of back of envelope maths is over 6% annualised. Obviously if they cut the rate in the mean time it would reduce and you only get the boost for two months. Might also work out better for those that pay tax as the £200 bonus *might not* be classed as interest (and therefore not subject to tax), but that depends a bit on Monument.1 -

I already had a Monument account with a zero balance, but opened a 4.47% one-year fix on 17 Nov and stuck £100k in it on 29 Nov. I am not usually that lucky but reckon I'll be good for the £200 cash bonus in March.cwep2 said:For those who held a monument account on 22nd Oct they are offering a cash bonus on top of the interest.

I withdrew almost all of it when they dropped the rate to 4% in August (and am

ineligible for new customer rates) but if you increase your balance before 31st Dec and hold it in the account until end of Feb 2026 then you get a cash bonus of £25 for £10k increases £50 for £20k etc up to £200 for a £50k increase. If you increase by the optimal amount this works out at between 0.25% and 0.4% boost. BUT this boost is only for holding it there for two months so on an AER basis it’s approximately 6x this.I think if you are eligible and can put £50k in, you’d get the 4% plus £200 which a bit of back of envelope maths is over 6% annualised. Obviously if they cut the rate in the mean time it would reduce and you only get the boost for two months. Might also work out better for those that pay tax as the £200 bonus *might not* be classed as interest (and therefore not subject to tax), but that depends a bit on Monument.

It's the wrong thread but they're still offering a 6 month fix at 4.31%. I sent a referral link to my sister so I should get another £50 bonus for that! (Edit: I just checked and the referral bonus has been reduced to £30!)0 -

A reminder if you have the United Trust Bank Personal Easy Access Account, the interest rate dropped today from 4.3% to 4.05%. Closure and funds transfer to my current account was under two hours, so no complaints there.0

-

When I received the email I set a reminder to pay into my Monument account, currently with zero balance, just before the end of the year. By my calcs, if you pay in £50k and leave it there for the two months needed, you lose out on about £12-£20 per month depending on tax vs roughly the 4.5% you can earn on the best paying easy access account. So, max £40 loss of interest at today's rates to earn £200 bonus. No brainer if you've got the money.cwep2 said:For those who held a monument account on 22nd Oct they are offering a cash bonus on top of the interest.

I withdrew almost all of it when they dropped the rate to 4% in August (and am

ineligible for new customer rates) but if you increase your balance before 31st Dec and hold it in the account until end of Feb 2026 then you get a cash bonus of £25 for £10k increases £50 for £20k etc up to £200 for a £50k increase. If you increase by the optimal amount this works out at between 0.25% and 0.4% boost. BUT this boost is only for holding it there for two months so on an AER basis it’s approximately 6x this.I think if you are eligible and can put £50k in, you’d get the 4% plus £200 which a bit of back of envelope maths is over 6% annualised. Obviously if they cut the rate in the mean time it would reduce and you only get the boost for two months. Might also work out better for those that pay tax as the £200 bonus *might not* be classed as interest (and therefore not subject to tax), but that depends a bit on Monument.5 -

I haven't heard of Monument bank before and am looking at investing in their savings account which is giving a rate of 4.51%.

There are some stories on google reviews of difficulty withdrawing funds but I guess people tend to post negative reviews when they are disgruntled.

Looking for opinions on whether to open an account with them or if not any other recommendations would be so helpful. I have c£53K, most of which is in a current account at the moment!!!!0 -

I've been using them since March and have experienced no difficulties with running the account including withdrawals. Their app works well also.Jogster said:I haven't heard of Monument bank before and am looking at investing in their savings account which is giving a rate of 4.51%.

There are some stories on google reviews of difficulty withdrawing funds but I guess people tend to post negative reviews when they are disgruntled.

Looking for opinions on whether to open an account with them or if not any other recommendations would be so helpful. I have c£53K, most of which is in a current account at the moment!!!!

As an existing customer the 4.51% rate isn't available to me, but I would jump at the chance if available. I now have a couple of their fixed rate accounts. See if you can find a friend or family member with a Monument account, as they could make a referral and you would get £30 each as a reward!

1 -

I've got nothing against Monument, but I would go with a Cahoot Simple Saver instead. It's paying slight less (4.40%) but they give 2 months notice of a rate reduction so if the base rate decreases as expected on 18th Dec, then it could actually end up paying more than Monument for a while, plus the minimum balance is only £1. You can also open a Sunny Day Saver to get 5% on up to £3k.Jogster said:I haven't heard of Monument bank before and am looking at investing in their savings account which is giving a rate of 4.51%.

There are some stories on google reviews of difficulty withdrawing funds but I guess people tend to post negative reviews when they are disgruntled.

Looking for opinions on whether to open an account with them or if not any other recommendations would be so helpful. I have c£53K, most of which is in a current account at the moment!!!!

In case you're not familiar with Cahoot, they're owned by Santander, transfers in and out are instant and, although they don't have their own app (so it's online banking via a browser), you can apparently use the Santander banking app if you're not already using it for Santander (although functionality may be limited).

You can also currently get £25 cashback for opening a Simple Saver (and another £25 for the Sunny Day Saver) via TopCashback, which is how I applied recently.

Chase at 4.5% is another option if you'd be a new customer, although that requires opening a current account with them too.3 -

I've not received my Chase saver statement yet, due 2'nd of the month. Is it just me please ?0

-

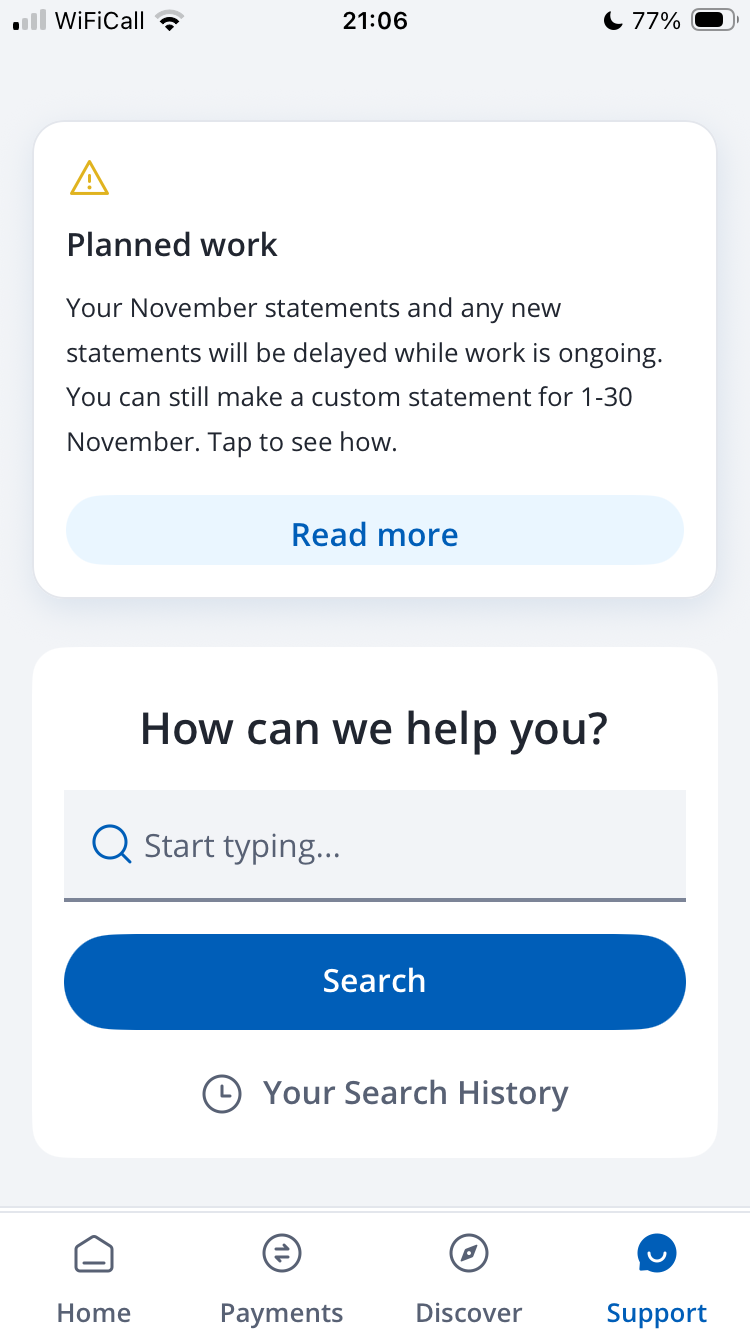

No. See the app

2 -

Thanks, never thought to look at the support page, lesson learnt.BreakingGlass said:No. See the app0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards