We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

Kent RelianceI note that, depending on your type of account there are two different login systems. I am currently on the "old" system but am interested in the EA account which means having a login for the "new" system.Currently my login process is simple - password and memorable word.My question is does the "new" system have any additional security stages, (OTP, landline call, text,email)?I'm keen to avoid any more OTP's as I have difficulty receiving them at my location.0

-

on the new system, it's username / password, then an OTP (text by default, but can select email).. and then you're in.StayinAlive said:Kent RelianceI note that, depending on your type of account there are two different login systems. I am currently on the "old" system but am interested in the EA account which means having a login for the "new" system.Currently my login process is simple - password and memorable word.My question is does the "new" system have any additional security stages, (OTP, landline call, text,email)?I'm keen to avoid any more OTP's as I have difficulty receiving them at my location.1 -

As janusd says, on their new system logging on is simple. I use email code which comes instantly. Deposits and withdrawals are as instant as you could ever get. I have the easy access account and am extremely impressed with themStayinAlive said:Kent RelianceI note that, depending on your type of account there are two different login systems. I am currently on the "old" system but am interested in the EA account which means having a login for the "new" system.Currently my login process is simple - password and memorable word.My question is does the "new" system have any additional security stages, (OTP, landline call, text,email)?I'm keen to avoid any more OTP's as I have difficulty receiving them at my location.

As I understand they are moving all accounts to the new online system over time (this year I think)1 -

DRS1 said:

Those are rates as at 01/09/25. What you want is this pagedosh37 said:DRS1 said:

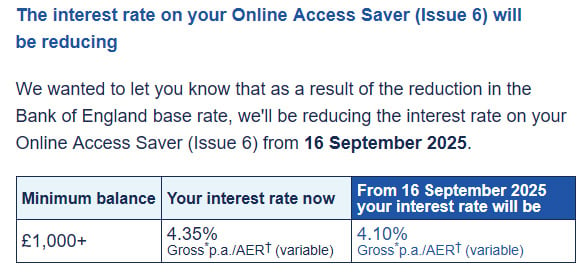

Down to 4.1% from 16 September 2025. Might as well leave it in Coventry.dosh37 said:1spiral said:

That's interesting. Just checked my issue 90 and that says the same. My mum has this account with several thousand in (opened on 1/8 which was only 2 days after it was launched.) Having just checked with her, she has received no such email regarding a rate reduction. I would be interested to know from anyone that received the email as to what date it arrived on. In the meantime I'll keep an eye on the historical rate document.SnowMan said:1spiral said:Have Cynergy announced any rate cuts to existing accounts since the last BR cut? I don't recall seeing any mentioned here.As they haven't updated their historic interest rates document (choose the historic interest rates tab and then you can download it) then it's a bit of a guess but I think the answer is yes they have reduced rates.I've only got £1 in an online easy access account (issue 90) and the rate is showing when I log in as 4.19% AER so it has clearly been reduced from 4.45% AER at some point. As they don't inform you of interest rate cuts if you only have £1 in your account, I've no way of knowing when the reduction took place.I am in a similar situation...I opened an Iss 90 account on 1st Aug and transferred in around 1.7K from an existing Iss 80 account.The Iss 80 account was then closed.I thought the Iss 90 rate was 2.26% variable + 2.19% bonus = 4.45%.Hence today I intended to transfer savings from a Coventry 4 Access Saver (Rate reduced to from 4.5% to 4.2%).It was only when I checked the Iss 90 rate that I discovered it has dropped to 4.19%.I received no rate reduction notification emal from Cynergy.Instead, I looked into transferring into an existing Leeds Online Access Saver Iss 6 (4.35%) but was unable to login to the Leeds website (IT problems at their end).I get the error:-Error 504 - Gateway Timeout

F5 site: tn2-lonIt is still broken.I wouldn't be surprised if their rate also drops in the next few days.All this effort just to save a few £££. Is it worth it when you also have to pay tax on savings interest.Incorrect. Leeds Online Access Saver Iss 6 (no longer available) is still showing 4.35%.

Changes to our savings accounts | Leeds Building SocietyYou are right.When I phoned Leeds BS yesterday to complain about the website not working, I also confimed the existing interest rate. I was told 4.35%. I also specifically asked if the rate was likely to drop soon.One day later and I have just received the email:- Just as well I didn't bother to transfer my Coventry BS savings.4.1% is one of the lowest in my portfolio - almost as bad as Chetwood (4.04%) or Marcus (3.75%).I could transfer to Charter Savings Iss 62 (4.36%) but I expect they will also be reducing their rate before long.If you have to pay savings tax, 4.1% equates to about 3.3%.Inflation is currently around 3.8% so savers are losing money in real terms.Maybe I should give up on saving and just spend it on something enjoyable like real ale.1

Just as well I didn't bother to transfer my Coventry BS savings.4.1% is one of the lowest in my portfolio - almost as bad as Chetwood (4.04%) or Marcus (3.75%).I could transfer to Charter Savings Iss 62 (4.36%) but I expect they will also be reducing their rate before long.If you have to pay savings tax, 4.1% equates to about 3.3%.Inflation is currently around 3.8% so savers are losing money in real terms.Maybe I should give up on saving and just spend it on something enjoyable like real ale.1 -

I'm pleased to have opened up the cahoot 4.55% and family bs 4.60% accounts while they were available

With cahoot giving 60 days notice of reduction at least there is some insulation there1 -

happybagger said:I'm pleased to have opened up the cahoot 4.55% and family bs 4.60% accounts while they were available

With cahoot giving 60 days notice of reduction at least there is some insulation thereI also have a Family BS account (4.6%).That currently tops the interest rate list. I am fully expecting the rate to plummet in the next few days.I also have two Cahoot sunny day accounts (5%).No doubt they will follow.0 -

Can anyone tell me if Hampshire Trust has announced an upcoming rate reduction to their NLA EA accounts?

Having shifted funds from Cynergy due to their unannounced reduction to 4.19% (still no response to secure message, today is third working day they aim to respond by) to HTB EA Issue 30 at 4.4%, it occurs to me that having had just £1 in there previously they may have communicated an imminent rate reduction but only to those with >£100. Current HTB EA offering is Issue 32 at 4.0%.0 -

Skipton

I've got a clear note that the interest rate on the Bonus Saver (Issue 12) was due to be reduced to 4.25% on 1/9.

Yet it's still showing 4.50% when I log in and all the other Skipton reductions on 1/9 have occurred as expected.

Comments?2 -

Mine too. Now let's delete these posts in 5...4...3....schiff said:Skipton

I've got a clear note that the interest rate on the Bonus Saver (Issue 12) was due to be reduced to 4.25% on 1/9.

Yet it's still showing 4.50% when I log in and all the other Skipton reductions on 1/9 have occurred as expected.

Comments?

2 -

On similar note, I have entry in my spreadsheet that Skipton Member Bonus Saver Issue 2 was due to be reduced from 5% to 4.75% on 1 Sept 25. Today when I log in, it still shows as 5%. I noticed this after transferring £3k out. Ofcourse I transferred it all back in!schiff said:Skipton

I've got a clear note that the interest rate on the Bonus Saver (Issue 12) was due to be reduced to 4.25% on 1/9.

Yet it's still showing 4.50% when I log in and all the other Skipton reductions on 1/9 have occurred as expected.

Comments?

Any inkling what is the date of interest rate reduction?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards