We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

pfpf said:curious. @4.6% why wont it be a "ToTP"? does it break a rule to be included?From 1st post: "Note: Generally, I don't rank 'aggregators'."As mentioned in prior discussion, the safeguarding arrangement means that customers may need to pay admin cost that would normally be covered by FSCS, should the aggregator fail. So it is not a risk free arrangement. Some aggregators have separate Client Money permission, allowing full FSCS protection, but Snoop apparently doesn't.3

-

masonic said:Savings accounts do not generally allow a negative balance at all, and providers can be on shaky ground where they put an account into negative balance.Has there ever been an instance where this occurs and if so on what grounds.The closest I've ever heard of to this is where withdrawals incur a say 90 day penalty and if you close the account in less than 90 days you get back less than you deposited but that isn't the same as a negative balance.

0 -

It would not normally occur, as any fee would need to be paid in advance or taken from a credit balance. Could happen if for example an incentive paid up front was clawed back, but the savings provider would have limited recourse in those scenarios. Savings accounts are set up so that there isn't scope for charges to go unpaid.1spiral said:masonic said:Savings accounts do not generally allow a negative balance at all, and providers can be on shaky ground where they put an account into negative balance.Has there ever been an instance where this occurs and if so on what grounds.The closest I've ever heard of to this is where withdrawals incur a say 90 day penalty and if you close the account in less than 90 days you get back less than you deposited but that isn't the same as a negative balance.1 -

I have 2 Coventry Building Society Accounts which have a negative balance, both under £2. It was when I closed a couple of accounts with a closure penalty. Instead of deducting the penalty from the amount they sent me the full amount and left the accounts with negative balance. It was over 1 year ago and they haven't asked me to clear the negative balance1spiral said:masonic said:Savings accounts do not generally allow a negative balance at all, and providers can be on shaky ground where they put an account into negative balance.Has there ever been an instance where this occurs and if so on what grounds.The closest I've ever heard of to this is where withdrawals incur a say 90 day penalty and if you close the account in less than 90 days you get back less than you deposited but that isn't the same as a negative balance.2 -

Having those accounts sitting in my spreadsheet would be just so annoying. It's the negativityness, I've loads of zero or £1 balances and that's just fine but (£1).... in a column of positive numbers....it's not natural.Malchester said:

I have 2 Coventry Building Society Accounts which have a negative balance, both under £2. It was when I closed a couple of accounts with a closure penalty. Instead of deducting the penalty from the amount they sent me the full amount and left the accounts with negative balance. It was over 1 year ago and they haven't asked me to clear the negative balance2 -

Does this mean you only allow integer balances in all your accounts? ;-)flaneurs_lobster said:Having those accounts sitting in my spreadsheet would be just so annoying. It's the negativityness, I've loads of zero or £1 balances and that's just fine but (£1).... in a column of positive numbers....it's not natural.Malchester said:

I have 2 Coventry Building Society Accounts which have a negative balance, both under £2. It was when I closed a couple of accounts with a closure penalty. Instead of deducting the penalty from the amount they sent me the full amount and left the accounts with negative balance. It was over 1 year ago and they haven't asked me to clear the negative balance1 -

Don't get a job as an accountant.flaneurs_lobster said:Having those accounts sitting in my spreadsheet would be just so annoying. It's the negativityness, I've loads of zero or £1 balances and that's just fine but (£1).... in a column of positive numbers....it's not natural.Malchester said:

I have 2 Coventry Building Society Accounts which have a negative balance, both under £2. It was when I closed a couple of accounts with a closure penalty. Instead of deducting the penalty from the amount they sent me the full amount and left the accounts with negative balance. It was over 1 year ago and they haven't asked me to clear the negative balance3 -

West Brom Building Society 4 access saver (issue 2) paying 4.65% AER is no longer availableI came, I saw, I melted5

-

Actually it does, probably bad practice but it looks neater. Not sure I'd describe my spreadsheets as "accounts", more lists of balances.Does this mean you only allow integer balances in all your accounts? ;-)

P60 numbers etc are recorded with pence. Never needed to report these numbers, doesn't SA ignore pennies?0 -

ircE said:Hope everyone had a good bank holiday weekend.

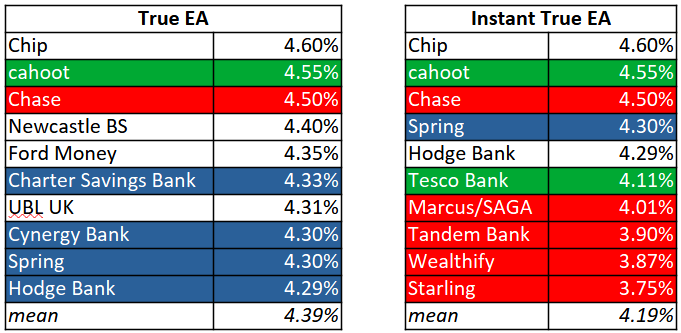

True EA accounts are easy access savings accounts which can be opened, and the headline interest rate earned, with a minimum of up to £10. They allow for unlimited withdrawals. Accounts limited to smaller balances, fee-charging accounts, and accounts only available on savings platforms are excluded. Instant True EA accounts are those True EA accounts which advertise immediate transfer times 24/7. Highlighted entries show changes in the interest rate since last time: red for falls, green for rises, and blue for new entries to the respective table.As previously discussed I've raised the threshold for minimum balances to £10 and this time that's led to Spring, a platform for Paragon Bank, springing onto the scorecard.For new customers, Chip is now the best account across the board, and cahoot's latest Simple Saver takes the lead for everyone else.Does the True EA accounts listed do weekend withdrawals?I assume they do, just not instant.2

True EA accounts are easy access savings accounts which can be opened, and the headline interest rate earned, with a minimum of up to £10. They allow for unlimited withdrawals. Accounts limited to smaller balances, fee-charging accounts, and accounts only available on savings platforms are excluded. Instant True EA accounts are those True EA accounts which advertise immediate transfer times 24/7. Highlighted entries show changes in the interest rate since last time: red for falls, green for rises, and blue for new entries to the respective table.As previously discussed I've raised the threshold for minimum balances to £10 and this time that's led to Spring, a platform for Paragon Bank, springing onto the scorecard.For new customers, Chip is now the best account across the board, and cahoot's latest Simple Saver takes the lead for everyone else.Does the True EA accounts listed do weekend withdrawals?I assume they do, just not instant.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards