We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

General Discussion and Whimsical Banter

Comments

-

It’s not that simple though - and the steps are less for anyone in employment because you pay NI as well as Income Tax, which drops.talexuser said:

I think the original Beveridge philosophy was that everyone should pay something in to get something out. I agree that low tax maybe 5 or 10% should be at the very bottom of the scale, even if benefits in some circumstances have to give back more for the very poor. The supposed inefficiency of circulating money through the tax system might encourage more social cohesion - and less division if millions of voters at the bottom have no axe to grind in tax cut arguments because they don't pay. Our large step from 0 to 20 to 40 seems to me to be counter productive incentive wise, do other countries have more progresive policies? I suppose the trouble is we have become a low wage economy.gt94sss2 said:I would argue that perhaps the basic 12570 tax free allowance is too high. We need more citizens who pay into the tax system over their lifetime rather than being net recipients12570-50270/yr you pay 32% (30% from 6Jan) = 20% Income tax + 12% NI.50270-100,000 you pay 42% = 40% + 2%.So the step is more like 10% (12% from Jan).But we have these stupid high marginal rate speed bumps between 50-60k if you have children and 100,000-125,140 when you lose the personal allowance. The former depends on #kids but you can be worse off at 60k than at 50k (if you have 7+ kids) but even at more normal numbers 3 kids and you get a 71% marginal rate. So you go from 0% > 32% > 71% > 42% > 62% > 47%. Honestly this creates a whole load of perverse incentives and in many cases (eg senior doctors) where some refuse extra work/days because it’s not worth it.3 -

82.4% if you are paying graduate tax.cwep2 said:But we have these stupid high marginal rate speed bumps between 50-60k if you have children and 100,000-125,140 when you lose the personal allowance. The former depends on #kids but you can be worse off at 60k than at 50k (if you have 7+ kids) but even at more normal numbers 3 kids and you get a 71% marginal rate.

13.8% Employer's NI

40.0% Higher Rate Income Tax

29.0% High Income Child Benefit Tax Charge

9% Graduate Tax

2% Employee's NI

...comes out at 82.4% marginal tax. (It isn't a simple addition of the tax rates because income taxes #2-#5 are applied on the net amount after income tax #1 is taken off.)

From each according to their ability!

Six kids for a graduate tax payer is enough to make them worse off by working more. 53.8% High Income Child Benefit Charge results in a total tax rate of 104%.

On the positive side, you get tax relief at 104% if you pay into a pension instead

.3 -

Those look like log tables.pecunianonolet said:The UK income tax system is very simple.

Want a very progressive system nobody really understands than move to Germany. Below table for singles, if you are married it is very different again.

https://einkommensteuertabellen.finanz-tools.de/downloads/grundtabelle-2023.pdf0 -

Well, the tables go in 1€ steps so slightly extreme. So, if you are in a position where you get a raise it could very quickly bump you up and you actually have less net due to the wage rise. As it is very progressive very small changes can have a significant effect as there are so many cliffs.Ocelot said:

Those look like log tables.pecunianonolet said:The UK income tax system is very simple.

Want a very progressive system nobody really understands than move to Germany. Below table for singles, if you are married it is very different again.

https://einkommensteuertabellen.finanz-tools.de/downloads/grundtabelle-2023.pdf

Now you add into the mix that different tax classes exist, all with different free allowances, married couples can, based on their income decide if they both take class 4 (when income is equal) or decide between a 3 and 5 mix, as class 3 has the highest free allowance. Now add into the mix that married couples have a similar table as above, but with different numbers. If there are now children the free allowances change again and that can be allocated again.

https://www.expatrio.com/living-germany/finance-germany/german-tax-system

During the 2005 general election campaign an attempt was made to heavily simplify the system by adding Prof Dr Paul Kirchhof to the campaign team of the conservative party (CDU) of Angela Merkel.

https://en.wikipedia.org/wiki/Paul_Kirchhof

The proposal would have simplified the system drastically and would have abolished the so many exceptions around and removed a lot of bureaucracy. However, there was a lot of criticism and skepticism if the system would bring enough revenue to finance all expenditure, of which social care is the largest proportion in the annual budget until today.

https://www.diw.de/de/diw_01.c.449592.de/publikationen/weekly_reports/2005_32_1/fundamental_reform_of_income_tax__in_how_far_can_the_assessment_basis_be_broadened_and_tax_law_simplified.html

It was eventually rejected as the majority of the electorate deemed it being of social injustice, especially because of higher earners paying proportionally less compared to the existing system. It was imho overlooked that at the other spectrum a fair amount of people would have their tax free allowance raised. The middle class would have needed to carry the main burden.

In my opinion, the autumn budget would have been an opportunity to reform the tax system in a way that especially those on lower incomes have to carry less of the burden due to fiscal drag. Cashing in billions due to fiscal drag and now giving a small percentage back in the form of a NI decrease, hoping the story can be sold as "we are the party cutting taxes" is just astonishing, when the triple lock is kept, which is good. Less funding in NI by increasing spending doesn't work. It is a shame and inhuman that someone having worked the entire life is getting merely £900 in state pension. Too much to die for and too little to live for.

I would have instead tried to focus on increasing the tax free allowance to £15k, would have added another let's say 7.5% step between 15k and the 35k median wage and kept the rest unchanged for now (proper calculation would need to be done of course).

My priority would then be to reduce debt much further and quicker as debt interest is nothing else as a deferred tax of the future. You need funds to invest in projects delivering a ROI over time, e.g fighting climate change, infrastructure projects, education, etc. Funing consumption with debt is suicidal and just plain stupid.

I would then limit the debt to GDP ratio to 70% with an option to deviate from this only by exception by declaring a crisis, e.g. war, pandemic, etc. That would need to have a 2/3 majority in the commons and lords (or ideally a more democratic and term limited replacement of the lords).

I would try to raise further money not by introducing new taxes and playing tricks, I would focus on enforcing existing law and closing loopholes and reduce sunk cost due to bureaucracy and inefficient processes.1 -

It is so much better now, previous UI was very outdated.ircE said:Newbury BS's website has got a bit of a makeover. They'll ask you to confirm some details next time you log in.0 -

HSBC down causing havoc. Can't make certain transfers to building societies with pay in deadlines and it's Friday. Super frustrating not being able to access funds on payday.

I hope they compensate well for the complaint I will raise.

https://www.bbc.co.uk/news/technology-67514068

3 -

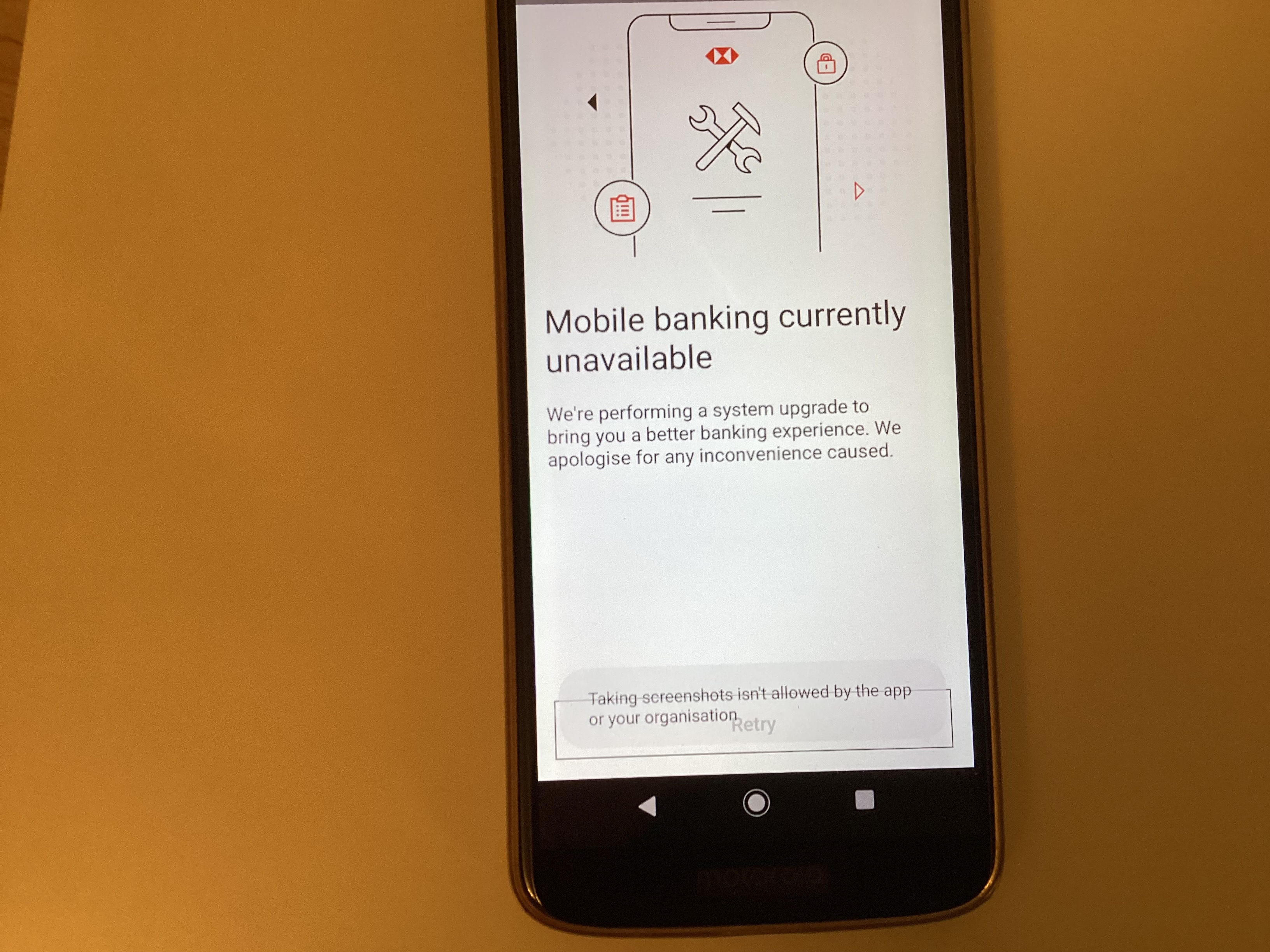

The fumiest thing is they've tried to disguise it as a system upgrade on the mobile app. On one of the busiest days of the year during banking hours? They must think people are stupid.pecunianonolet said:HSBC down causing havoc. Can't make certain transfers to building societies with pay in deadlines and it's Friday. Super frustrating not being able to access funds on payday.

I hope they compensate well for the complaint I will raise.

https://www.bbc.co.uk/news/technology-675140684 -

Just tried to log in and got the system upgrade message. Apparently it is to make mobile banking even better for us.Swipe said:

The fumiest thing is they've tried to disguise it as a system upgrade on the mobile app. On one of the busiest days of the year during banking hours? They must think people are stupid.pecunianonolet said:HSBC down causing havoc. Can't make certain transfers to building societies with pay in deadlines and it's Friday. Super frustrating not being able to access funds on payday.

I hope they compensate well for the complaint I will raise.

https://www.bbc.co.uk/news/technology-67514068

Tried again to get a screenshot and was annoyed when I successfully logged in and saw all of my accounts displaying correctly.

Edit. I just tried again and got the system update message. Tried to screenshot it but the app didn't allow it.

0 -

What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.7

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards