We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

General Discussion and Whimsical Banter

Comments

-

You must have been living under a rock, this is the new norm, oh, don't get ill, caus you will have something really to complain about...talexuser said:What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.

0 -

I thought this was interesting from an AJ Bell survey via This is Money on ISAs:"... only 34 per cent of respondents realised that savings interest in an Isa is tax-free, while a mere 27 per cent were aware that capital gains are tax-free."There are 20 million ISA holders so potentially 5.4-6.8 million people who don't know what the main purpose of the vehicle is...!I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.2

-

talexuser said:What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.Not the highest ever.see http://taxhistory.co.uk/National Insurance rates.htm for NI andhttps://resource.download.wjec.co.uk/vtc/2015-16/15-16_20/unit7/TaxRates73-90_resource.pdf for income tax.For example, basic rate income tax in 1978-79 was 33%, while NI for employees was 6.5%.As against 20% basic (England) plus 12% NI now.2

-

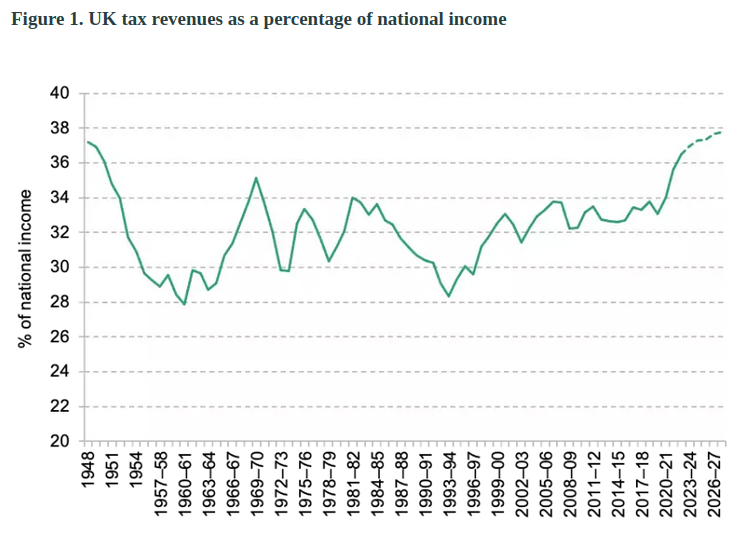

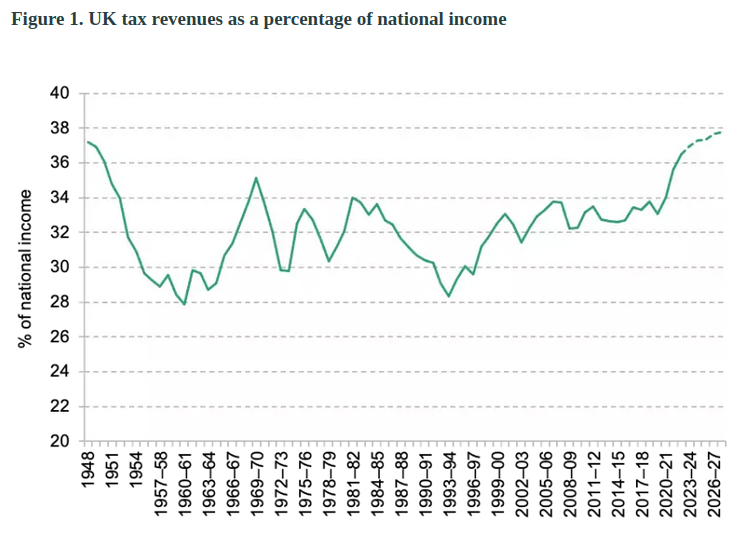

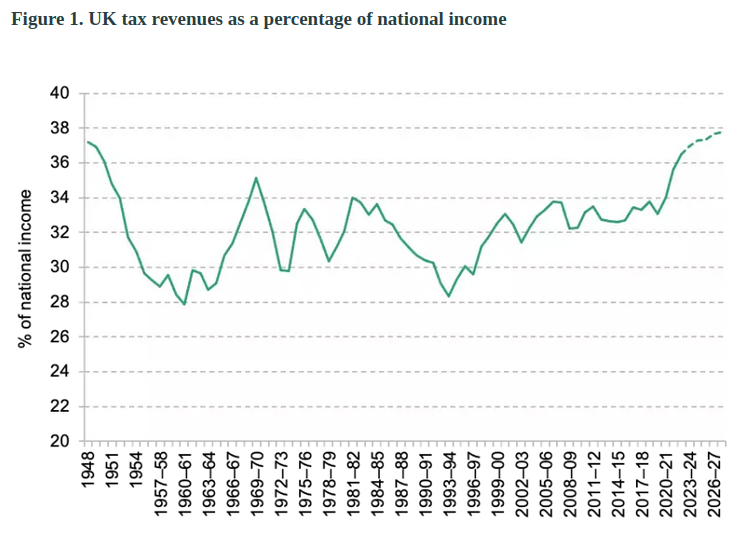

LHW99 said:talexuser said:What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.Not the highest ever.see http://taxhistory.co.uk/National Insurance rates.htm for NI andhttps://resource.download.wjec.co.uk/vtc/2015-16/15-16_20/unit7/TaxRates73-90_resource.pdf for income tax.For example, basic rate income tax in 1978-79 was 33%, while NI for employees was 6.5%.As against 20% basic (England) plus 12% NI now.You need to take into account not only the individual rates, but proportion of the income that was taxed at each rate. Fiscal drag is the sinister way of increasing the tax burden without the majority realising it. The IFS have done the heavy lifting here: https://ifs.org.uk/articles/will-be-biggest-tax-raising-parliament-record

6 -

Two issues with that conclusion:ircE said:I thought this was interesting from an AJ Bell survey via This is Money on ISAs:"... only 34 per cent of respondents realised that savings interest in an Isa is tax-free, while a mere 27 per cent were aware that capital gains are tax-free."There are 20 million ISA holders so potentially 5.4-6.8 million people who don't know what the main purpose of the vehicle is...!- You've reversed the logic - if 34% know that interest is tax-free, then 66% don't!

- The 20 million ISA holders are far more likely to know the benefits of ISAs than the rest of the population, so the ignorant proportions shouldn't be applied to the ISA holders, unless they formed the survey population?

2 -

Ah correct on both counts! My bad for speed reading/calculating!eskbanker said:

Two issues with that conclusion:ircE said:I thought this was interesting from an AJ Bell survey via This is Money on ISAs:"... only 34 per cent of respondents realised that savings interest in an Isa is tax-free, while a mere 27 per cent were aware that capital gains are tax-free."There are 20 million ISA holders so potentially 5.4-6.8 million people who don't know what the main purpose of the vehicle is...!- You've reversed the logic - if 34% know that interest is tax-free, then 66% don't!

- The 20 million ISA holders are far more likely to know the benefits of ISAs than the rest of the population, so the ignorant proportions shouldn't be applied to the ISA holders, unless they formed the survey population?

I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.1 -

masonic said:LHW99 said:talexuser said:What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.Not the highest ever.see http://taxhistory.co.uk/National Insurance rates.htm for NI andhttps://resource.download.wjec.co.uk/vtc/2015-16/15-16_20/unit7/TaxRates73-90_resource.pdf for income tax.For example, basic rate income tax in 1978-79 was 33%, while NI for employees was 6.5%.As against 20% basic (England) plus 12% NI now.You need to take into account not only the individual rates, but proportion of the income that was taxed at each rate. Fiscal drag is the sinister way of increasing the tax burden without the majority realising it. The IFS have done the heavy lifting here: https://ifs.org.uk/articles/will-be-biggest-tax-raising-parliament-record

That's interesting, but is (I think) showing total take from all tax sources. It states in the article, that the "tax revenues" they discuss include Corporation tax and the energy profits levy as well as the changes in personal taxation (and possibly other things?).I was trying to show what an individual basic rate taxpayer would suffer, which is only indirectly affected (if at all) by either of those two things..I accept that higher income individuals are suffering disproportionately, due to factors such as the HICBC as well as the freezing of allowance bands - which perhaps is the correct thing, depending on how you would prefer tax-raising powers to be targeted.Nevertheless, a person earning within the basic rate band currently suffers an overall lower total income tax / NI % rate than (in the example I gave) someone in the basic rate band in 1978-9.Undoubtedly other taxes have to be paid, such as VAT on certain things which may be more or less avoidable by choice, but personal income taxation at basic rate is not at its highest ever.2

That's interesting, but is (I think) showing total take from all tax sources. It states in the article, that the "tax revenues" they discuss include Corporation tax and the energy profits levy as well as the changes in personal taxation (and possibly other things?).I was trying to show what an individual basic rate taxpayer would suffer, which is only indirectly affected (if at all) by either of those two things..I accept that higher income individuals are suffering disproportionately, due to factors such as the HICBC as well as the freezing of allowance bands - which perhaps is the correct thing, depending on how you would prefer tax-raising powers to be targeted.Nevertheless, a person earning within the basic rate band currently suffers an overall lower total income tax / NI % rate than (in the example I gave) someone in the basic rate band in 1978-9.Undoubtedly other taxes have to be paid, such as VAT on certain things which may be more or less avoidable by choice, but personal income taxation at basic rate is not at its highest ever.2 -

Yes, although I'd argue that the total tax take against total income is probably the better proxy of what a government might have in its coffers with which to deliver public services (which I think was the underlying point @talexuser was making). What your figures do show is that taxation is considerably more progressive now than in the 70s, where there was no escape for those on the lowest incomes.LHW99 said:masonic said:LHW99 said:talexuser said:What I can't get round is paying the highest tax ever, yet getting the worst public services ever. Something has gone seriously wrong.Not the highest ever.see http://taxhistory.co.uk/National Insurance rates.htm for NI andhttps://resource.download.wjec.co.uk/vtc/2015-16/15-16_20/unit7/TaxRates73-90_resource.pdf for income tax.For example, basic rate income tax in 1978-79 was 33%, while NI for employees was 6.5%.As against 20% basic (England) plus 12% NI now.You need to take into account not only the individual rates, but proportion of the income that was taxed at each rate. Fiscal drag is the sinister way of increasing the tax burden without the majority realising it. The IFS have done the heavy lifting here: https://ifs.org.uk/articles/will-be-biggest-tax-raising-parliament-record That's interesting, but is (I think) showing total take from all tax sources. It states in the article, that the "tax revenues" they discuss include Corporation tax and the energy profits levy as well as the changes in personal taxation (and possibly other things?).I was trying to show what an individual basic rate taxpayer would suffer, which is only indirectly affected (if at all) by either of those two things..I accept that higher income individuals are suffering disproportionately, due to factors such as the HICBC as well as the freezing of allowance bands - which perhaps is the correct thing, depending on how you would prefer tax-raising powers to be targeted.Nevertheless, a person earning within the basic rate band currently suffers an overall lower total income tax / NI % rate than (in the example I gave) someone in the basic rate band in 1978-9.Undoubtedly other taxes have to be paid, such as VAT on certain things which may be more or less avoidable by choice, but personal income taxation at basic rate is not at its highest ever.

That's interesting, but is (I think) showing total take from all tax sources. It states in the article, that the "tax revenues" they discuss include Corporation tax and the energy profits levy as well as the changes in personal taxation (and possibly other things?).I was trying to show what an individual basic rate taxpayer would suffer, which is only indirectly affected (if at all) by either of those two things..I accept that higher income individuals are suffering disproportionately, due to factors such as the HICBC as well as the freezing of allowance bands - which perhaps is the correct thing, depending on how you would prefer tax-raising powers to be targeted.Nevertheless, a person earning within the basic rate band currently suffers an overall lower total income tax / NI % rate than (in the example I gave) someone in the basic rate band in 1978-9.Undoubtedly other taxes have to be paid, such as VAT on certain things which may be more or less avoidable by choice, but personal income taxation at basic rate is not at its highest ever.

2 -

Interesting conversation about tax. Even more interesting, that it isn't as high as many might think when compared internationally.

Here some sources to broaden the conversation a bit.

https://www.oecd.org/tax/tax-policy/taxing-wages-brochure.pdf

https://www.oecd.org/tax/tax-policy/taxing-wages-united-kingdom.pdf

https://obr.uk/box/the-uks-tax-burden-in-historical-and-international-context/

In my opinion, revenue generated isn't too high nor too low compared to transfers received. E.g. compare UK state pension with Austria, the UK state pension is a joke but if not much goes into the pot you are limited with what can get paid out.

Or, unemployment payments UK vs. Germany. In Germany, although a rather complicated system so a more simplified statement here, the payment is max 67% of the previous net salary and is paid, depending on age, for 12 and up to 24 months. You needed to be in full time employment for minimum 12 months within the last 30 months to be eligible, if not other transfers and sums, generally lower, are granted.

As with most governments/countries, raising funds is rather "easy", efficient allocation of funds, keeping sunk cost, basically wasting money, to a minimum, is the far more complicated task to achieve.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards