We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Hanley Economic Building Society BRANCH SAVER

Comments

-

Same here but I think they mean page 3 of https://thehanley.co.uk/wp-content/uploads/2023/05/Savings-Product-Guide-September-2021-v10-0523.pdfHHUK said:... Please can anyone point me to something I may have missed in the booklet, or to a relevant link? Thanks.1 -

Thank you, that's most helpful. The estimated return leaves something to be desired though - 'Based on the current interest rate, if you deposited £1,000 in this account, after 12 months you would have £1,004.25' !Cold_comfort said:

Same here but I think they mean page 3 of [the Savings Product Guide]HHUK said:... Please can anyone point me to something I may have missed in the booklet, or to a relevant link? Thanks.

0 -

Hmmm - online payments I've made into this account have proceeded as expected up until now, but a large online payment I made just after 5pm yesterday is still not showing, despite the T&Cs saying it should have been credited this morning. I've just chased this up via secure message.

The date that payments will be to be credited to your account will be the date that we receive the cleared funds. Cut-off times apply for receipt of an Electronic Payment:- Payments received by us before 3pm on a Working Day, will be credited to your account and will be available to withdraw immediately, as soon as we receive it;

- Payments received after 3pm on a Working Day or on a non-Working Day, will be credited to your account and will be available to withdraw at the start of the next Working Day (subject to our Normal Business Hours).

0 -

The money was credited to my account this morning so, in reality, it looks like online payments made after normal banking hours on a working day can potentially take up to 2 working days to appear.refluxer said:Hmmm - online payments I've made into this account have proceeded as expected up until now, but a large online payment I made just after 5pm yesterday is still not showing, despite the T&Cs saying it should have been credited this morning. I've just chased this up via secure message.

The date that payments will be to be credited to your account will be the date that we receive the cleared funds. Cut-off times apply for receipt of an Electronic Payment:- Payments received by us before 3pm on a Working Day, will be credited to your account and will be available to withdraw immediately, as soon as we receive it;

- Payments received after 3pm on a Working Day or on a non-Working Day, will be credited to your account and will be available to withdraw at the start of the next Working Day (subject to our Normal Business Hours).

As eluded to in a previous post, there is obviously a delay between an online payment being made and it actually being received (and processed) by them. In my case, presumably a payment made at 5pm wasn't received/processed until after 3pm the following day and therefore wasn't credited until the subsequent morning.

With that in mind, I'd recommend making online payments into this account as early as possible (probably in the morning) during a working day (Monday to Thursday) if you want them to appear the following morning, as all my previous payments into this account followed this pattern.2 -

Is interest paid annually on 31 August for this account?0

-

FP wthdrawals are limited to £10k. >£10k can be withdrawn electronically but is by CHAPS and incurs a £25 fee. Cheque withdrawals are available for any amount up to the limit specified in the KID (£70k max, from memory)

0 -

Where did you get this info from, out of interest ? According to the Branch Saver terms, withdrawals can only be made from that account in a branch or by posting off your passbook to them and are limited to cash or cheque only. This was also reinforced by HEBS staff to a previous poster (either in this thread or elsewhere) who asked about the possibility of faster payment withdrawals. Online access to this account is limited to checking the balance only, unfortunately.drphila said:FP wthdrawals are limited to £10k. >£10k can be withdrawn electronically but is by CHAPS and incurs a £25 fee.

This is the withdrawal info from the Branch Saver product info in the guide linked to above...

Can I withdraw money?

You can withdraw once per calendar month without penalty up to £500 in cash and £70,000 by cheque on demand from our branches or by sending us your written instructions. Larger cash sums up to £5,000 are available by giving at least 24 hours notice. Cheque withdrawals over £70,000 can be obtained from our Registered Office. All other withdrawals are subject to 30 days loss of interest on the amount withdrawn. Following any withdrawals £1,000 should remain in the account.

0 -

FPs can be done but must be requested by post/in branch like with cheques etc.refluxer said:

Where did you get this info from, out of interest ? According to the Branch Saver terms, withdrawals can only be made from that account in a branch or by posting off your passbook to them and are limited to cash or cheque only. This was also reinforced by HEBS staff to a previous poster (either in this thread or elsewhere) who asked about the possibility of faster payment withdrawals. Online access to this account is limited to checking the balance only, unfortunately.drphila said:FP wthdrawals are limited to £10k. >£10k can be withdrawn electronically but is by CHAPS and incurs a £25 fee.

This is the withdrawal info from the Branch Saver product info in the guide linked to above...

Can I withdraw money?

You can withdraw once per calendar month without penalty up to £500 in cash and £70,000 by cheque on demand from our branches or by sending us your written instructions. Larger cash sums up to £5,000 are available by giving at least 24 hours notice. Cheque withdrawals over £70,000 can be obtained from our Registered Office. All other withdrawals are subject to 30 days loss of interest on the amount withdrawn. Following any withdrawals £1,000 should remain in the account.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

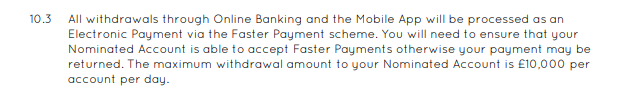

Yes - I'd spotted that but because online and app withdrawals aren't possible from the Branch Saver, then that section of the general T&Cs won't apply.Bridlington1 said:

I don't think the summary box gave any faster payment limit but section 10.3 of the general terms and conditions says this:refluxer said:

Where did you get this info from, out of interest ? According to the Branch Saver terms, withdrawals can only be made from that account in a branch or by posting off your passbook to them and are limited to cash or cheque only. This was also reinforced by HEBS staff to a previous poster (either in this thread or elsewhere) who asked about the possibility of faster payment withdrawals. Online access to this account is limited to checking the balance only, unfortunately.drphila said:FP wthdrawals are limited to £10k. >£10k can be withdrawn electronically but is by CHAPS and incurs a £25 fee.

This is the withdrawal info from the Branch Saver product info in the guide linked to above...

Can I withdraw money?

You can withdraw once per calendar month without penalty up to £500 in cash and £70,000 by cheque on demand from our branches or by sending us your written instructions. Larger cash sums up to £5,000 are available by giving at least 24 hours notice. Cheque withdrawals over £70,000 can be obtained from our Registered Office. All other withdrawals are subject to 30 days loss of interest on the amount withdrawn. Following any withdrawals £1,000 should remain in the account. 1

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards