We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Offer under asking price

Comments

-

We had the viewing. Put an offer in at full asking. There were 4 other viewings same day and according to estate agent who did the viewing, we are the only cash buyers so fingers crossed but suspect it might go over asking as it’s lovely house for the price.4

-

Fingers crossed that your offer is accepted Linda!linda.b_4 said:We had the viewing. Put an offer in at full asking. There were 4 other viewings same day and according to estate agent who did the viewing, we are the only cash buyers so fingers crossed but suspect it might go over asking as it’s lovely house for the price.1 -

no one knows what will happen so how about we stop throwing random numbers around?TonyTeacake said:That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.7 -

Good luck.linda.b_4 said:We had the viewing. Put an offer in at full asking. There were 4 other viewings same day and according to estate agent who did the viewing, we are the only cash buyers so fingers crossed but suspect it might go over asking as it’s lovely house for the price.1 -

So you post an article to back up your claims, but only believe the bits from it that you want to, and the rest is all rubbish

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.

Also snippets from the same article you failed to mention :I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

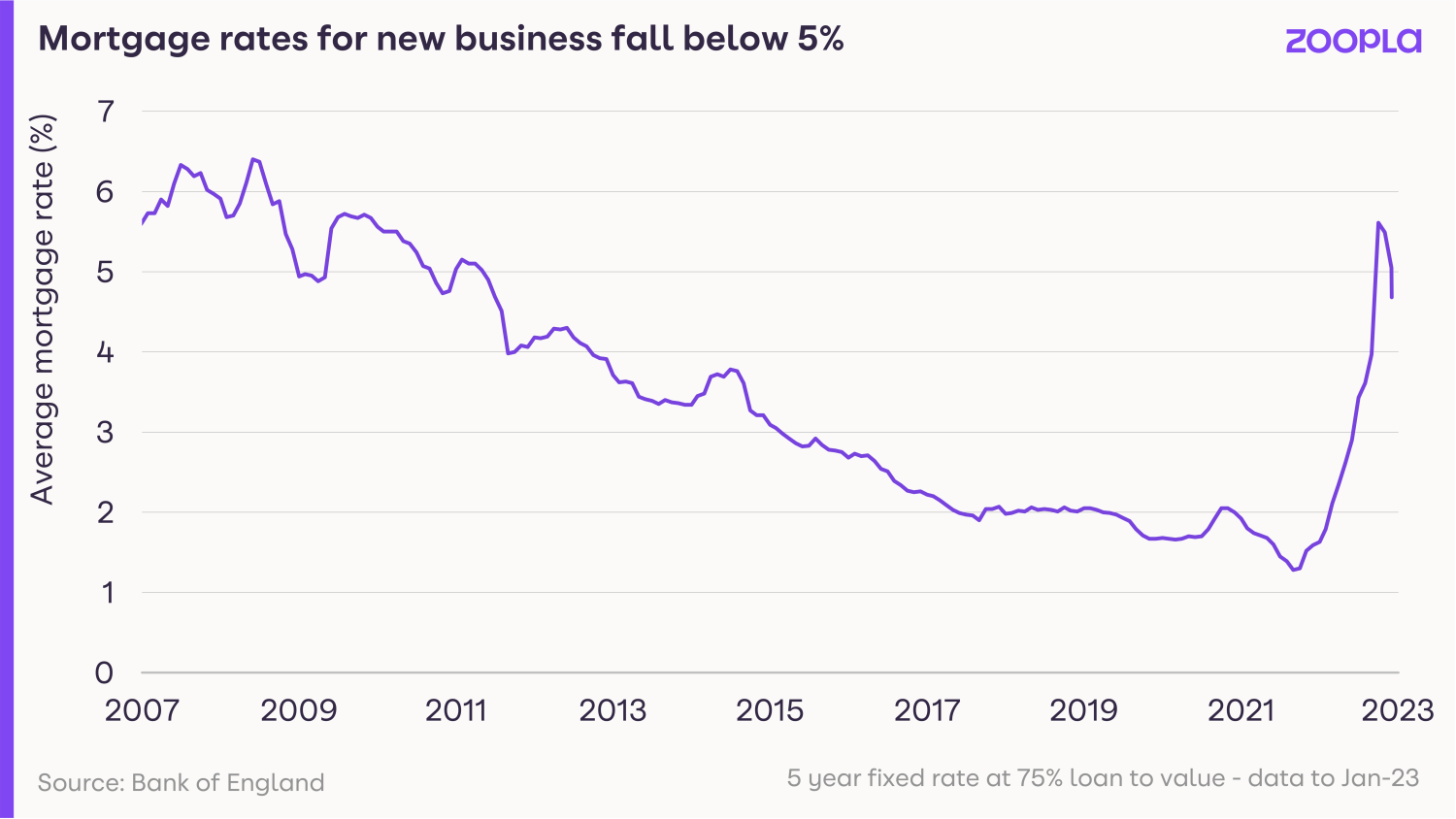

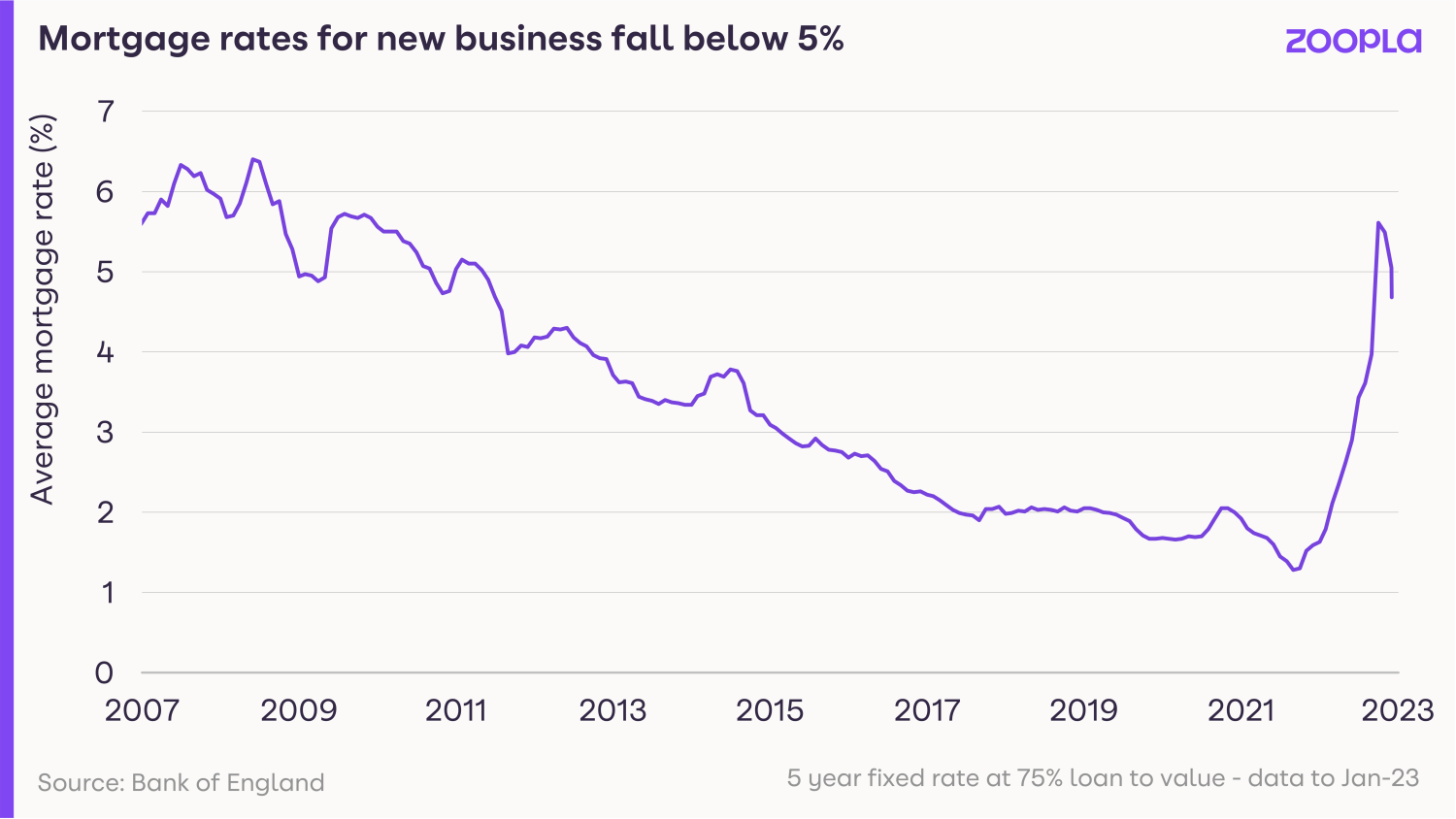

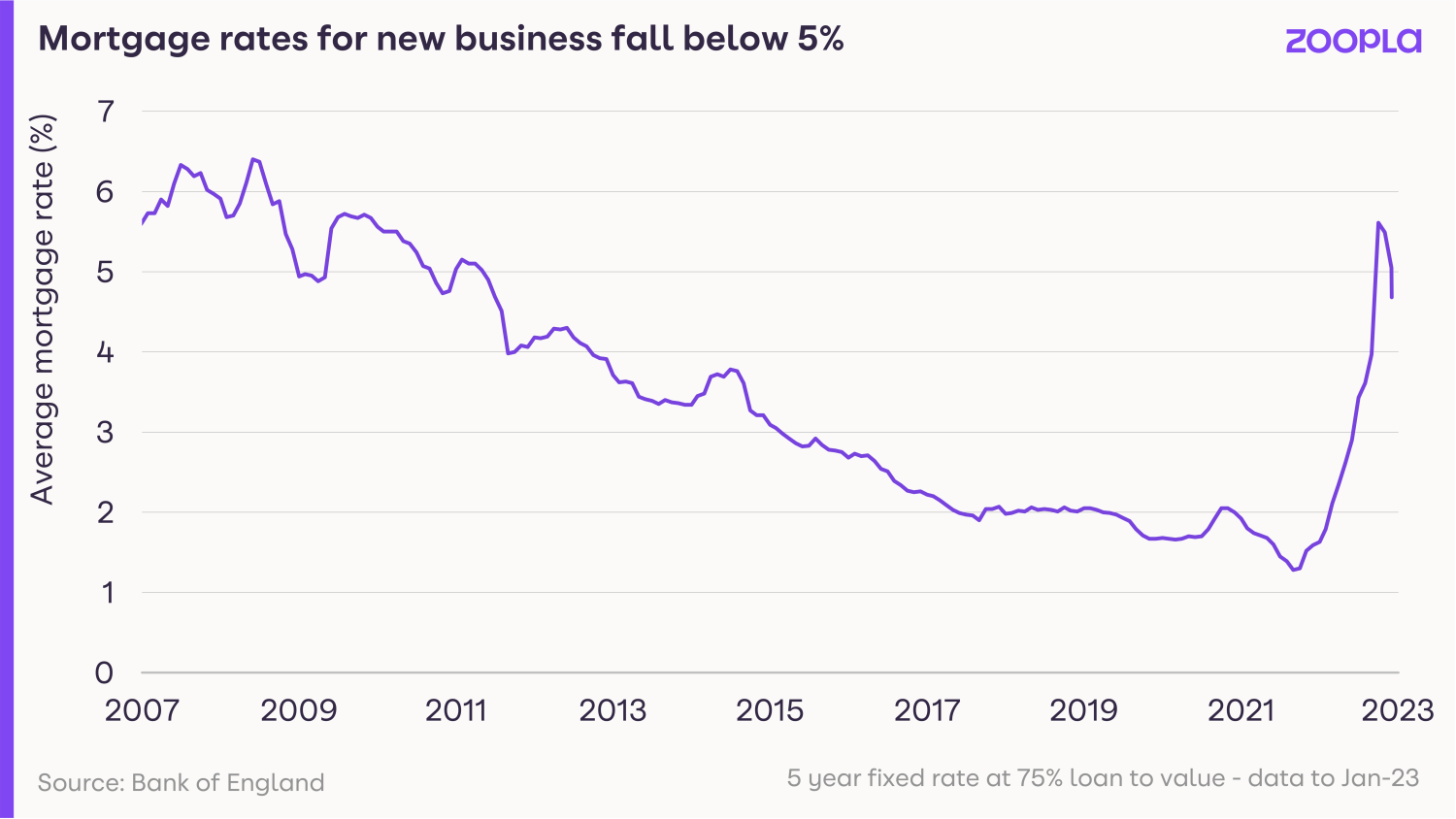

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.

Well yes, people arent going to phone the radio to say they are fine with their new rate and can easily afford it are they?

Yes, I am old enough to remember the last 'crash'. Prices dropped 14% over two years, then started to climb again. A lot of that was fuelled by the 125% mortgages they were giving out at the time ( stupid idea )2 -

TonyTeacake said:

This crash will be between 20-50% depending on where you live.mi-key said:

Also snippets from the same article you failed to mention :TonyTeacake said:RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.I've asked this before but unsurprisingly didn't get an answer... which area will see a 50% drop?As you yourself stated yesterday "please post all the facts and not just the bits you want people to hear"... or is the truth that there are no facts or reasoning and @eidand was right that you just plucked random numbers out of the air?Every generation blames the one before...

Mike + The Mechanics - The Living Years3 -

Good luck, I think offering the asking price is a good idea in this case. Hope you get it !linda.b_4 said:We had the viewing. Put an offer in at full asking. There were 4 other viewings same day and according to estate agent who did the viewing, we are the only cash buyers so fingers crossed but suspect it might go over asking as it’s lovely house for the price.1 -

Oh look, the OP has made an offer at asking price ! They must be mad considering they could wait two years and buy it for half the price ! Or perhaps they just love the house, can afford to buy it and would rather live somewhere they love than sit around for years congratulating themselves on how much money they saved by not buying it and wishing they lived somewhere else....Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.

Of course it won't drop to 50% off, and would have sold by then to someone else anyway..4 -

I'm old enough to remember the last "crash".TonyTeacake said:

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.mi-key said:

Also snippets from the same article you failed to mention :TonyTeacake said:RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.

Prices where we were dropped by around 10%, stagnated for a couple of years and then started to rise again. They were back above "pre-crash" levels within 4 years.

Would you care to share any information that backs up your claims that there will be a 20-50% crash in prices?

Do you live in a particularly deprived area where people are struggling more than most? You seem to have a very skewed view on what is happening in the economy and how it is affecting people. Certainly where we are based we are not seeing any of the things you claim to be happening right now.3 -

TonyTeacake said:

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.I am old enough to remember the last crash, I wasn't looking to sell or buy at the time, had a house with a tiny £21000 mortgage on it, so really didn't pay attention to it. I am also old enough to remember interest rates at 15%, great times for me, I had £60000 in the Chelsea building society in Lewisham for a year at least and when I took in my passbook to be updated, I had a nice £9000 given to me, which more than made up for the higher mortgage payments.Could you please tell me more about this crash please, I am inbetween properties at the moment and the areas I am struggling to buy in are around Blackheath and Greenwich, will these be any of the areas getting this big crash, I hope so, I will hang on for a little bit until you give me the heads up, cheers.Corduroy pillows are making headlines! Back home in London now after 27years wait! Duvet know it's Christmas, not original, it's a cover.5

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards