We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Offer under asking price

Comments

-

Is it? What's the average number of monthly property transactions over the last 12 months?Sarah1Mitty2 said:

The 100k figure is well out of date now,MobileSaver said:

The "cost of living crisis" has been going on for well over a year yet on average 100,000 properties are still being bought and sold every single month in the UK... remind me again which one of us is so out of touch with the real world?TonyTeacake said:OMG you are so out of touch with the real world. Plenty of wealth where I live in Cheshire but this doesn't reflect the rest of the UK.

How wrong you are. I've no plans to buy or sell property any time soon, it makes no difference to me whether prices rise or fall.TonyTeacake said:It seems to me you can't stand the fact house prices are falling.

You are confusing me with another poster - I've never said either of those things.TonyTeacake said:

I remember you saying last year inflation will be a minor blip and the war in Ukraine won't last. ... How wrong you where Sarah1Mitty2 said:you went in 40% under asking I assume you fully encourage the OP to do the sameNo, not at all. I encourage the OP to essentially ignore the asking price to start with and simply work out based on comparables what the property is worth to them.If that figure is below the seller's "offers over" price as confirmed by the EA then I'd just move on and not waste anyone's time. If that "worth to the OP" figure is higher than the seller's asking price then I'd start a pro-active negotiation to reach a mutually agreeable deal.The approach trumpeted by certain posters here of automatically offering a fixed percentage below asking is frankly laughable and it's very telling that most of the people proposing such absurdities are the same ones complaining they can't get a good deal...

Sarah1Mitty2 said:you went in 40% under asking I assume you fully encourage the OP to do the sameNo, not at all. I encourage the OP to essentially ignore the asking price to start with and simply work out based on comparables what the property is worth to them.If that figure is below the seller's "offers over" price as confirmed by the EA then I'd just move on and not waste anyone's time. If that "worth to the OP" figure is higher than the seller's asking price then I'd start a pro-active negotiation to reach a mutually agreeable deal.The approach trumpeted by certain posters here of automatically offering a fixed percentage below asking is frankly laughable and it's very telling that most of the people proposing such absurdities are the same ones complaining they can't get a good deal...

Every generation blames the one before...

Mike + The Mechanics - The Living Years1 -

Just looking locally, there are some houses that were new build 10 years ago. £200k initial sale, now on for £300k. No way wages have kept up with that.1

-

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?1 -

How much are comparable new builds in the area though?[Deleted User] said:Just looking locally, there are some houses that were new build 10 years ago. £200k initial sale, now on for £300k. No way wages have kept up with that.0 -

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/

2 -

[Deleted User] said:Just looking locally, there are some houses that were new build 10 years ago. £200k initial sale, now on for £300k. No way wages have kept up with that.I'm sure you're right but so what? Indeed I'm sure wages haven't kept up with lots of things in recent times but it is what it is.If lamb steaks are too expensive at Tesco then you can either

- Buy a cheaper product, or

- Compromise financially elsewhere so you can afford what you want, or

- Refuse to buy until the the price comes back down and go without in the meantime

Every generation blames the one before...

Mike + The Mechanics - The Living Years1 - Buy a cheaper product, or

-

Where I live prices have nearly doubled in the last ten years. In the last 40 years I’ve accumulated £1.5m worth of properties for little over £150k outlay. If prices drop 10% - 20% in the next couple of years, as I think they could, it’s no skin off my nose! Wages are irrelevant, it’s affordability which counts.[Deleted User] said:Just looking locally, there are some houses that were new build 10 years ago. £200k initial sale, now on for £300k. No way wages have kept up with that.2 -

RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

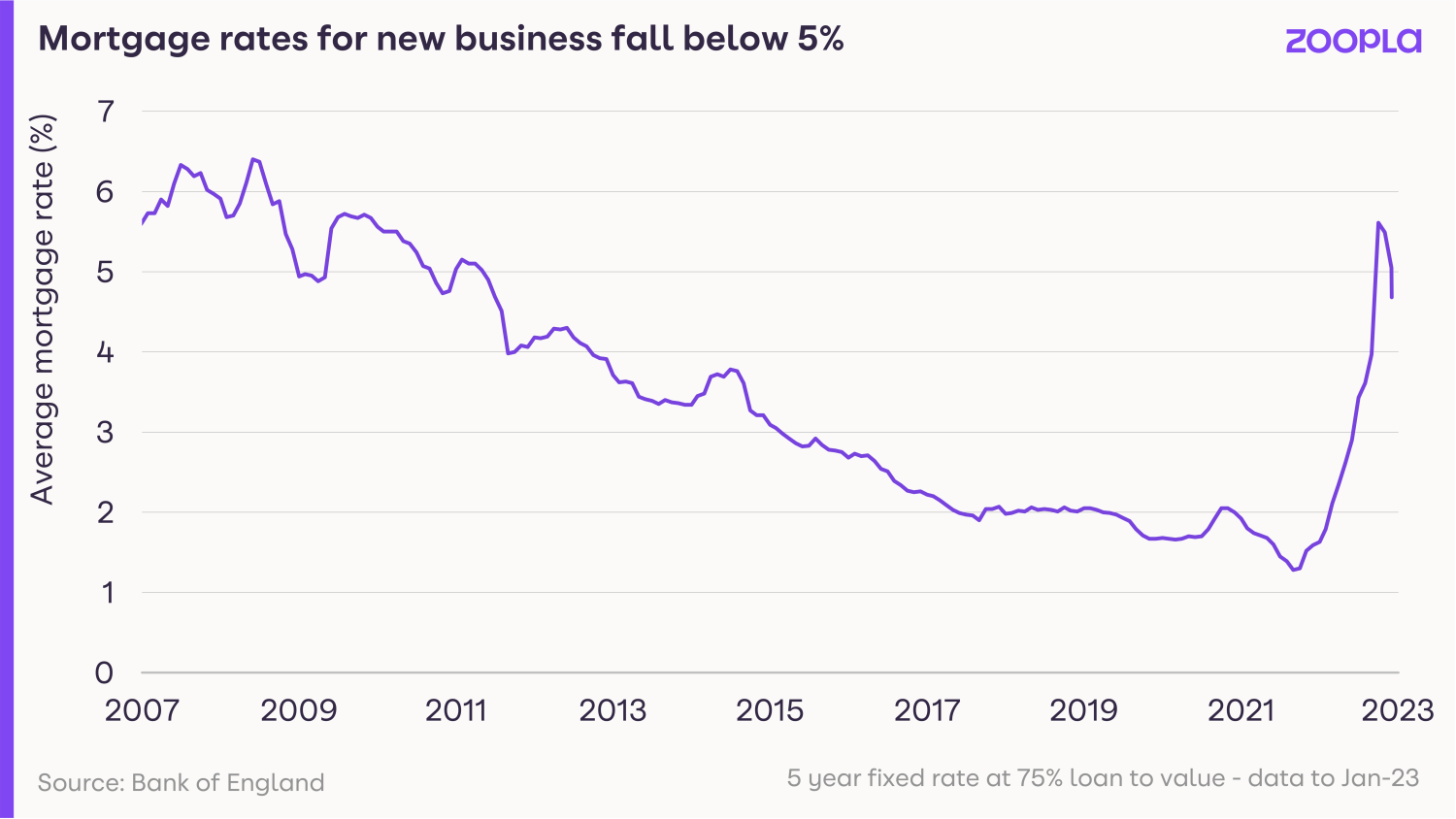

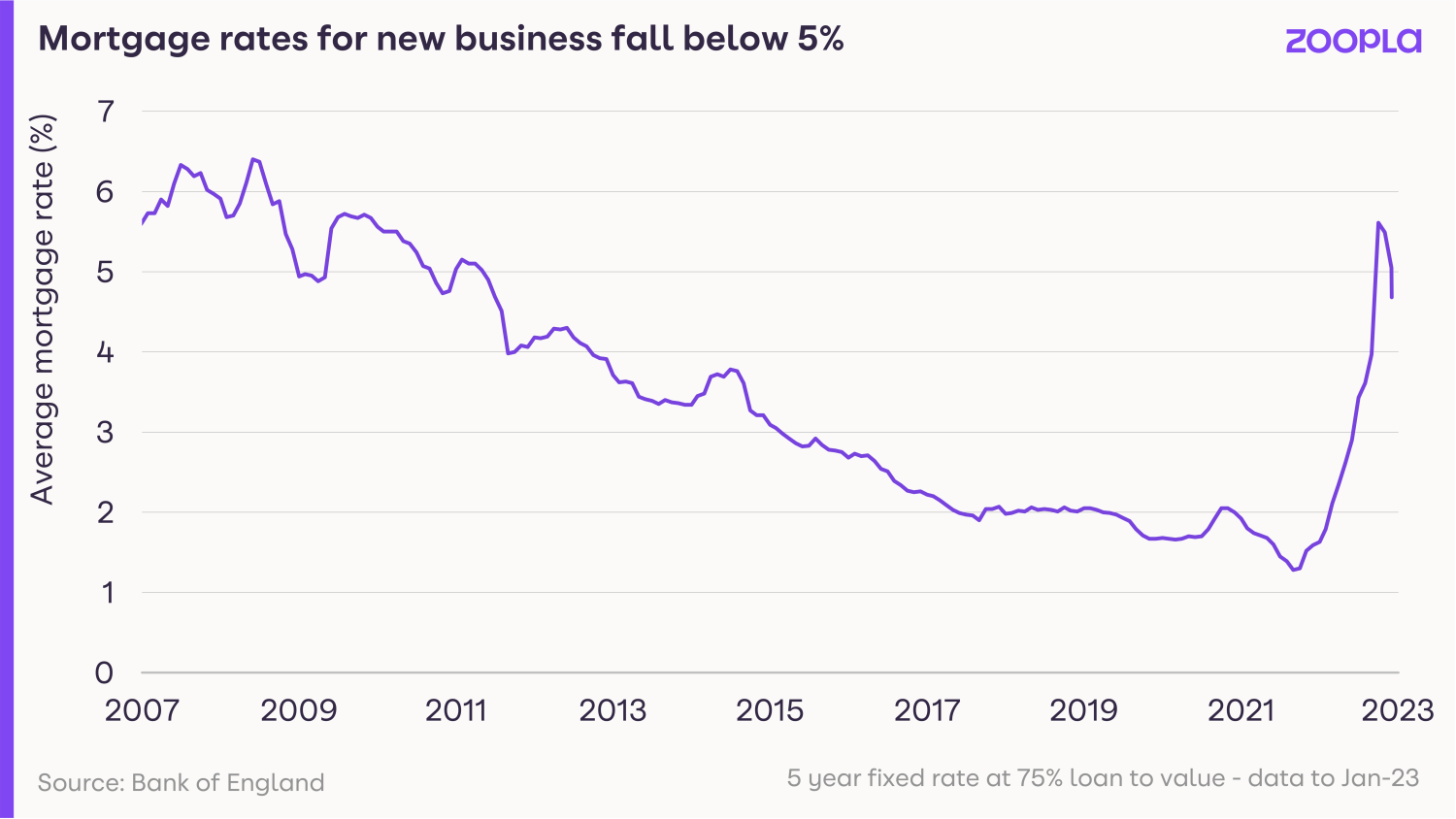

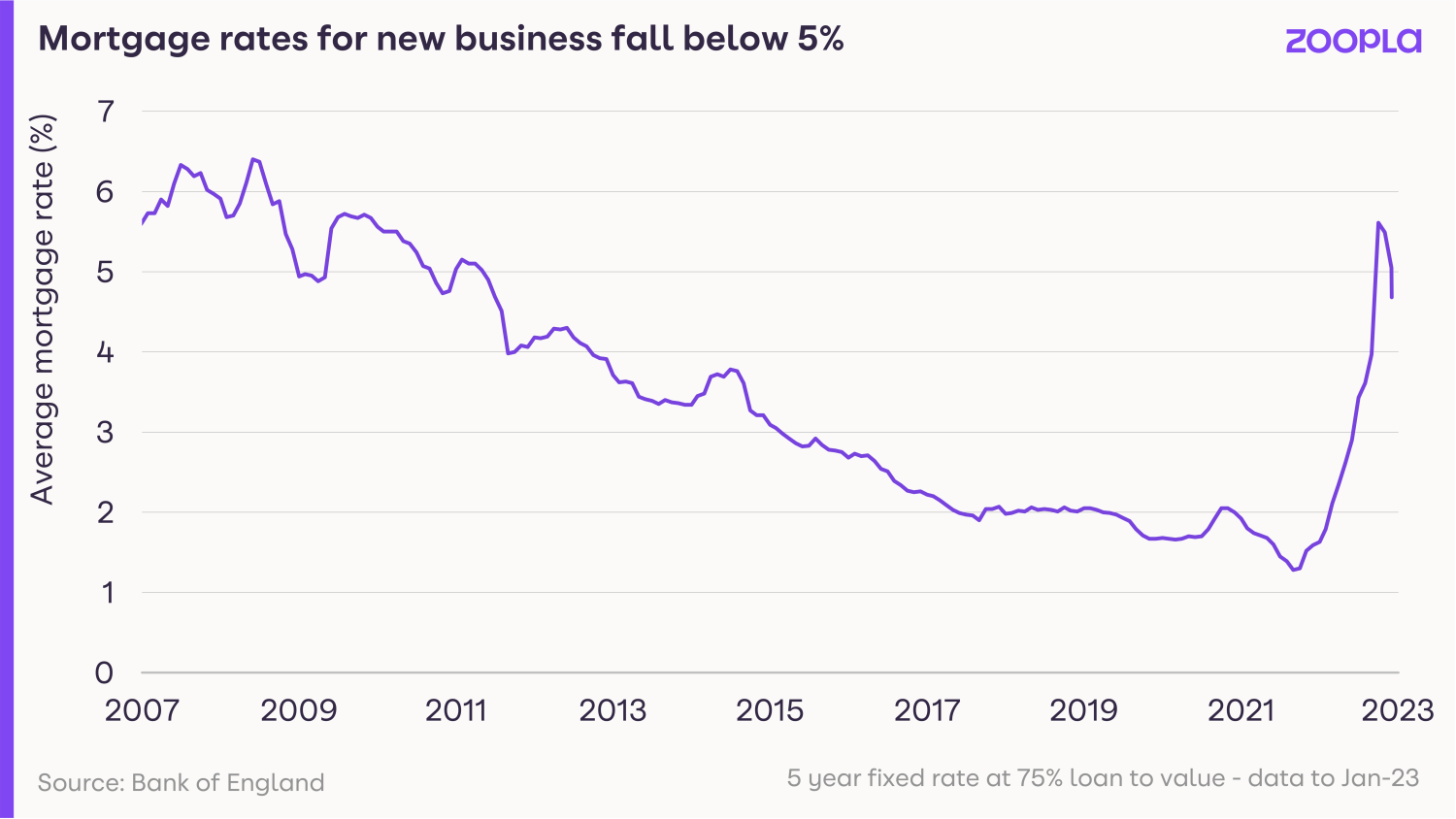

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

0

0 -

Also snippets from the same article you failed to mention :TonyTeacake said:RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.

4 -

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.mi-key said:

Also snippets from the same article you failed to mention :TonyTeacake said:RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards