We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Offer under asking price

Comments

-

Well done and congratulations.linda.b_4 said:Thanks to everyone wishing me luck. It’s worked as our offer has been accepted!Happy with the price and don’t intend moving for quite a few years. If the value drops then so will the price of the onward purchase. Renting has got us into the area we want to live but we are ready to have a home where we can do as we please re home improvements. We can’t even hang curtains or pictures in this rental.

Cheers again all.1 -

Best of luck!£216 saved 24 October 20141

-

Congratulations 👏linda.b_4 said:Thanks to everyone wishing me luck. It’s worked as our offer has been accepted!Happy with the price and don’t intend moving for quite a few years. If the value drops then so will the price of the onward purchase. Renting has got us into the area we want to live but we are ready to have a home where we can do as we please re home improvements. We can’t even hang curtains or pictures in this rental.

Cheers again all.MFW 2026 #50: £3,583.49/£25,00007/03/25: Mortgage: £67,000.00

Mortgage:

16/01/26: £56,794.25

02/01/26: £60,223.17

12/08/25: Mortgage: £62,500.00

12/06/25: Mortgage: £65,000.00

18/01/25: Mortgage: £68,500.14

27/12/24: Mortgage: £69,278.38

Savings: £20,0001 -

Great news, hope it all goes smoothly and you are happy there for many years to comelinda.b_4 said:Thanks to everyone wishing me luck. It’s worked as our offer has been accepted!Happy with the price and don’t intend moving for quite a few years. If the value drops then so will the price of the onward purchase. Renting has got us into the area we want to live but we are ready to have a home where we can do as we please re home improvements. We can’t even hang curtains or pictures in this rental.

Cheers again all.1 -

Brilliant news. Hope the sale goes through smoothly for you.1

-

Interesting, do they mention the crucial difference between then and now, or is it just a bit of fun so people can follow the lines?Aberdeenangarse said:

Daily Telegraph have a tracker.arthurdick said:TonyTeacake said:

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates. This is what happens when people overpay for houses and interest rates go up.

Oh and I nearly forgot to mention we have rampant inflation which we didn't have 2 years ago.

Not sure how old you are but the previous crashes took at least 2 years or more before we seen the bottom of the market. This crash will be between 20-50% depending on where you live.I am old enough to remember the last crash, I wasn't looking to sell or buy at the time, had a house with a tiny £21000 mortgage on it, so really didn't pay attention to it. I am also old enough to remember interest rates at 15%, great times for me, I had £60000 in the Chelsea building society in Lewisham for a year at least and when I took in my passbook to be updated, I had a nice £9000 given to me, which more than made up for the higher mortgage payments.Could you please tell me more about this crash please, I am inbetween properties at the moment and the areas I am struggling to buy in are around Blackheath and Greenwich, will these be any of the areas getting this big crash, I hope so, I will hang on for a little bit until you give me the heads up, cheers.

https://www.telegraph.co.uk/money/house-prices-data-tool-forecast-interest-rates-markets/ 1

1 -

That`s right, but 18 months ago no one would have rung in to say they can`t.jimbog said:

Not surprising. Only those who can't would have rung in to say they they can't?TonyTeacake said:

That's funny as I was listening to LBC radio last week and they where inadated with calls from people whose mortgages where up for renewal and they couldn't afford the new rates.mi-key said:

Also snippets from the same article you failed to mention :TonyTeacake said:RelievedSheff said:

He will be disappointed by newssuch as this then:mi-key said:

Once again crashy comes in with their completely imaginary data, desperately hoping it means the market is crashing..

The 100k figure is well out of date now, and as the thread is about offering under asking, and you went in 40% under asking I assume you fully encourage the OP to do the same, not necessarily at such a high % though?

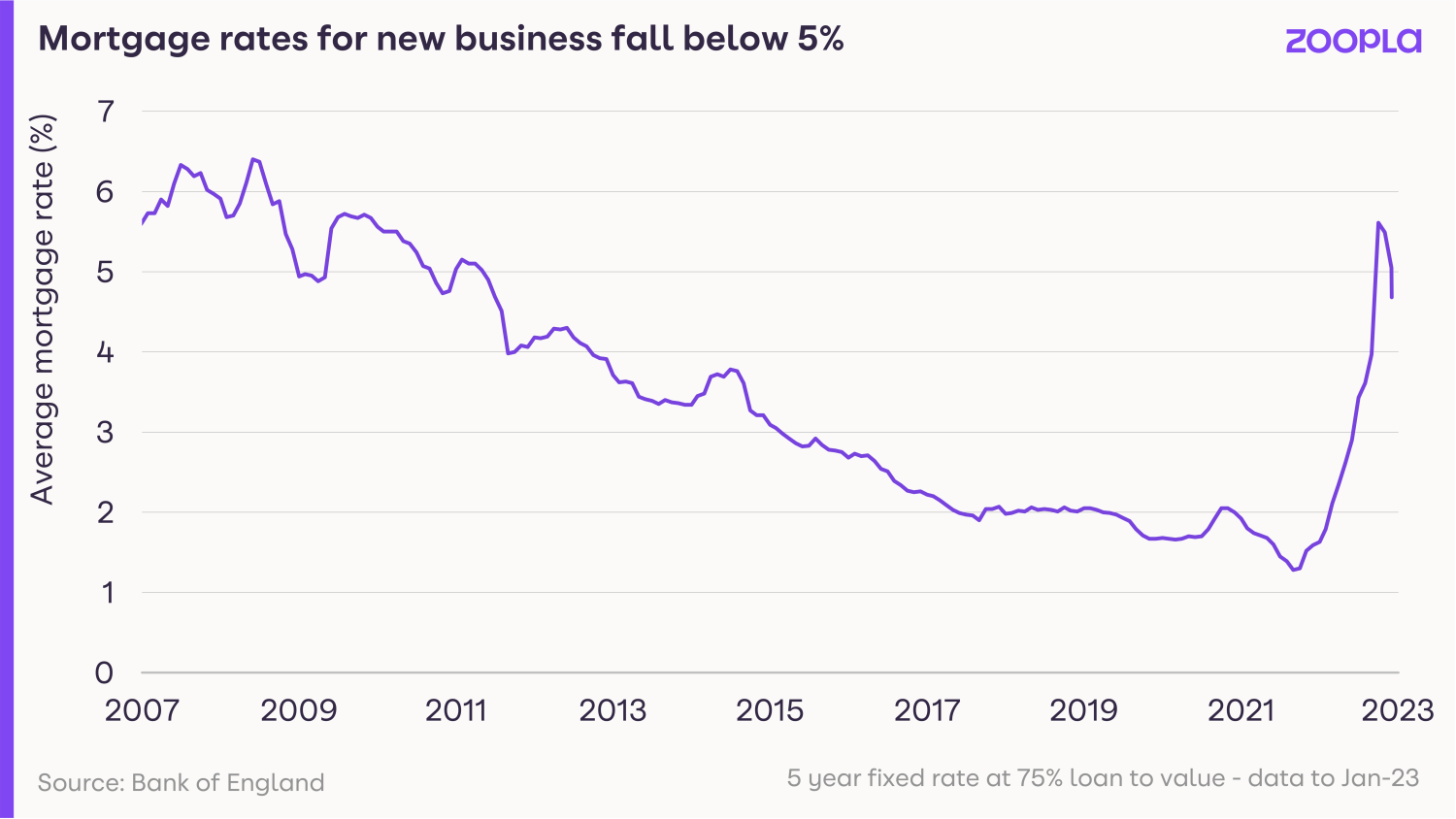

https://www.zoopla.co.uk/discover/property-news/mortgage-rates-fall-below-4-for-lower-loan-to-value-mortgages/I wouldn't get to excited by the Zoopla article has interest rates are still over double to what they where over 12 months ago.

Here is a snippet from the article.Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.0 -

What a teacake.TonyTeacake said:

I have taken a snapshot of the screen with you saying "It is currently 10.1% but will drop to around 5-6% if not lower in the next month or so when current high energy and fuel prices hit the 12 months mark and drop off the calculation."RelievedSheff said:The current rate of inflation is a blip. This time last year inflation was 5.5%. It is currently 10.1% but will drop to around 5-6% if not lower in the next month or so when current high energy and fuel prices hit the 12 months mark and drop off the calculation.

By the end of the year inflation will be lower still. Current forecasts are around 4-4.5%.

One year of high inflation is hardly sustained inflation. It is just a blip and is the same as is being played out across the world right now.

Would you care to show any evidence of these mass "lay-offs" that you keep banging on about. Government figures seem completely at odds with what you claim:

https://commonslibrary.parliament.uk/research-briefings/cbp-9366/0 -

Do you need a lender`s valuation or are you going with cash?linda.b_4 said:Thanks to everyone wishing me luck. It’s worked as our offer has been accepted!Happy with the price and don’t intend moving for quite a few years. If the value drops then so will the price of the onward purchase. Renting has got us into the area we want to live but we are ready to have a home where we can do as we please re home improvements. We can’t even hang curtains or pictures in this rental.

Cheers again all.0 -

I bet you are great fun at dinner parties...

To sum it up with inflation proving to be sticky we can expect more interest rate hikes this year which is only going to affect the affordability of people buying houses even more. It looks like this crash has already started and I expect YOY average drops for 2023 to be around 10-15% with further drops going into 2024.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards