We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

New fresh diary for 2023!

Comments

-

@FootyFanDan - my DH was 40 when we got our first mortgage so it is doable. We just couldn't afford it before that and overpaying wasn't an option due to our earnings until the final couple of years so we only actually paid it off about 4 months before he retired! With hindsight I would have been making lots of small payments like I did when I retired 4 years before DH just by rounding down the bank account every day.

Good luck to anyone looking to buy.

2 -

Ah yes, I don’t expect it to be a walk in the park. Hence why I want to sit down and do some research on it. Oh agreed! Houses here are in the lower end of our budget but we don’t want to live where we currently do. I’ve been renting this place for 8 years and a year of that was alone, don’t get me wrong we’ve done it all out but we’re in a terraced house which is fine but as soon as you walk out there’s the road. We want a small driveway and definitely need a garden because of the dogs.MrFrugalFever said:

Hi Jade,BlueJ94 said:Evening all,

so myself and OH want to eventually buy a house together which is great! I just need to get my head into the game of saving saving saving!! I’m going to do some research about buying a house it won’t be until another 2 years or so! So that’s basically how I’m gonna spend the rest of my evening

Buying a house is absolutely the right thing to do (IMO of course 😁). I am on that journey now and to be truthful, it’s been a hard slog. There are various help to buy schemes but where the housing market has boomed like there’s no tomorrow a deposit required is now generally in the region of £20-30k minimum. That’s nearly two years at £1k saving a month alone! Not to mention all the fees to go with it!

I’m using the LISA route with Moneybox and max that out per year to get the £1k gov bonus and it means I can’t really touch it unless an absolute emergency (you get heavily penalised for withdrawals for any purpose other than first time house purchase or retirement). I am very fortunate to be able to save more than £1k a month so my deposit will be more than 10% but it has still taken me 18 months so far and a further 10 months minimum to go!

Also, don’t forget your defaults and arrangements to pay will still be visible up to 6 years from the first date they defaulted or an ATP was set up so that could delay things slightly.

What sort of property are you looking for?Oh, I think I’ve heard of that. I’ll have to sit down and read about what I can open to start saving. OH is self employed aswell so he gets paid per job. He probably earns more than me! So hopefully we can save for a deposit a bit quicker. Obviously I’m not expecting miracles

yep, I know that unfortunately but that’s life eh! Hopefully once they’ve seen I’ve been able to pay it off and become better with credit management it won’t be too long of a delay!Well, we’re 100% staying away from a new build. OH works on enough of them fixing them to say nope to that already. We want something that we can put our own stamp on, OH wants something we can move into but also do up as we move in if that makes sense? Me? I don’t mind as long as it has a garden and a drive I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;*update pending as I've no idea*

Time to start a fresh. — MoneySavingExpert Forum

Time to start a Fresh part 2, 2022! — MoneySavingExpert Forum

New fresh diary for 2023! — MoneySavingExpert Forum

https://forums.moneysavingexpert.com/discussion/6494873/fresh-diary-for-2024#latest

https://forums.moneysavingexpert.com/discussion/6577209/fresh-diary-for-2025/p1?new=11 -

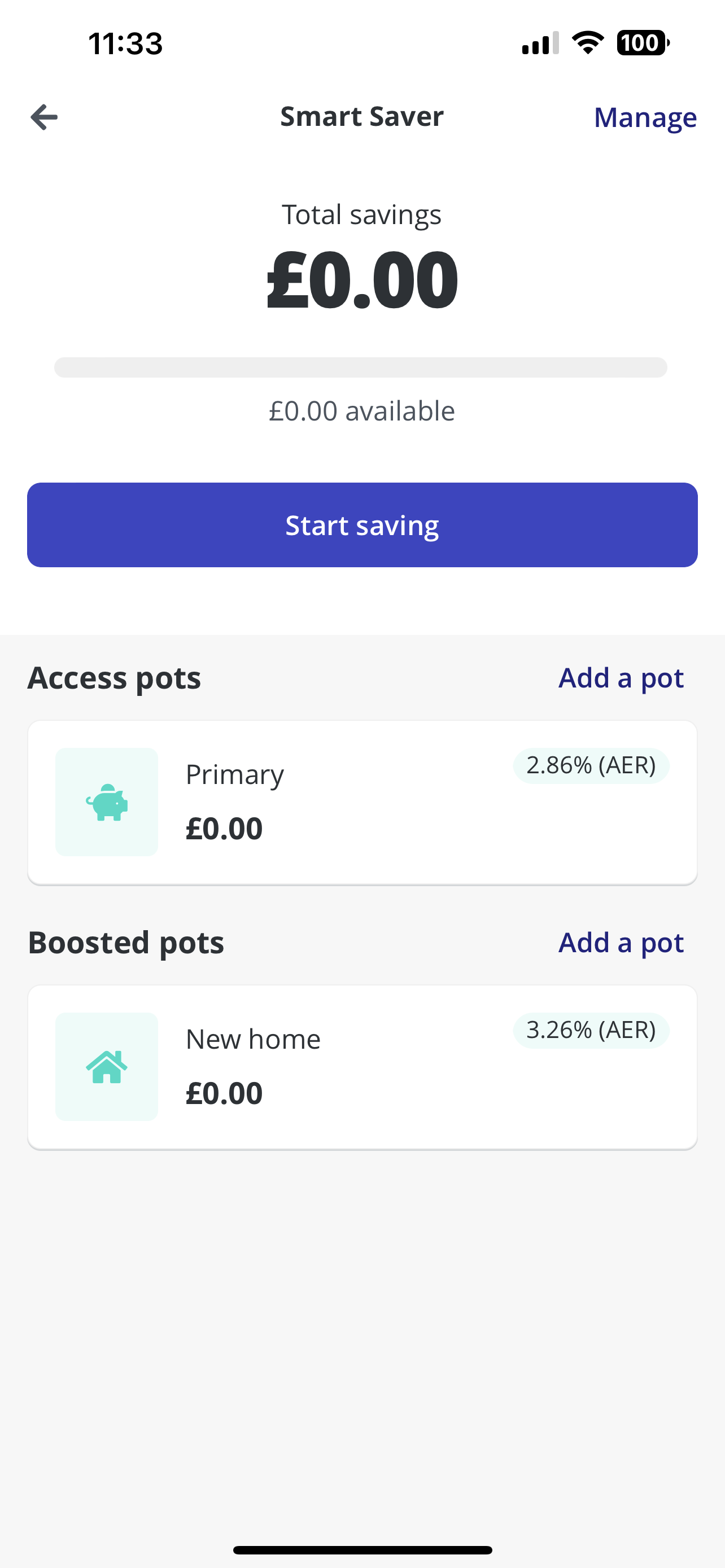

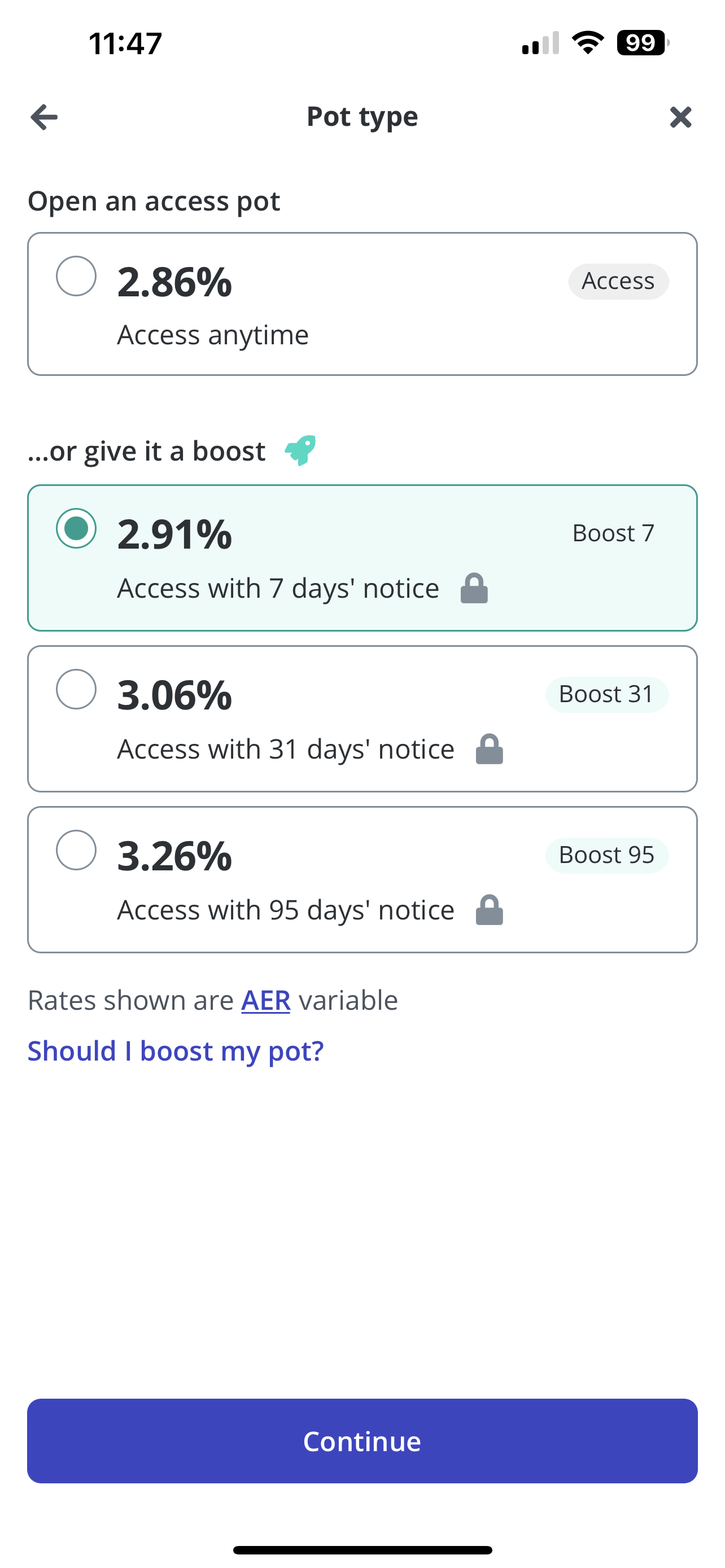

Morning all!So, I just checked my Zopa app and they do savings accounts. See below; so I’ve opened up a booster pot which basically means if I wanted anything from the pot I have to give them 95 days notice to take it back out! I’ve set automatic payments to go into my savings each month!

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;*update pending as I've no idea*

Time to start a fresh. — MoneySavingExpert Forum

Time to start a Fresh part 2, 2022! — MoneySavingExpert Forum

New fresh diary for 2023! — MoneySavingExpert Forum

https://forums.moneysavingexpert.com/discussion/6494873/fresh-diary-for-2024#latest

https://forums.moneysavingexpert.com/discussion/6577209/fresh-diary-for-2025/p1?new=11 -

I use Zopa as my primary savings App, after a few transfers it’s about 20 minute’s for deposit and withdraw times. I also have a CC with them at £5k limit for zero fees overseas spending.

So far all good, they’ve been pretty good at reacting quickly to BoE BR rate increases too.

I too don’t wish to purchase a new build!!!If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing1 -

I have my NatWest saver account but I never save anything into it, I need to check the interest on it. I have a CC with them aswell, I stands are £200 out of £500 but my aim it so pay that off at the end of this month because I’ll get my full pay which works out at £1800 and my over time pay from last month!I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;*update pending as I've no idea*

Time to start a fresh. — MoneySavingExpert Forum

Time to start a Fresh part 2, 2022! — MoneySavingExpert Forum

New fresh diary for 2023! — MoneySavingExpert Forum

https://forums.moneysavingexpert.com/discussion/6494873/fresh-diary-for-2024#latest

https://forums.moneysavingexpert.com/discussion/6577209/fresh-diary-for-2025/p1?new=10 -

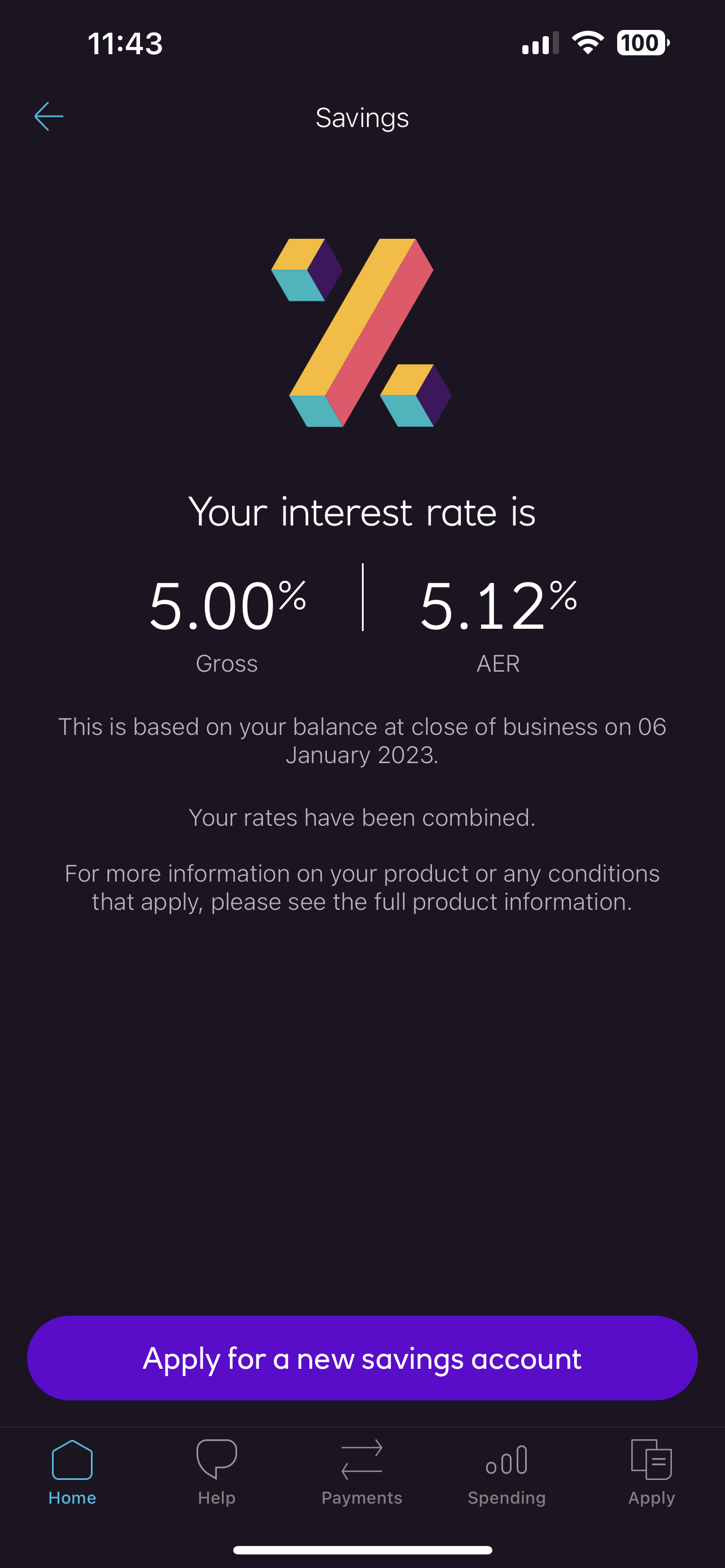

It’s higher than I thought actually

It’s higher than I thought actually

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;*update pending as I've no idea*

Time to start a fresh. — MoneySavingExpert Forum

Time to start a Fresh part 2, 2022! — MoneySavingExpert Forum

New fresh diary for 2023! — MoneySavingExpert Forum

https://forums.moneysavingexpert.com/discussion/6494873/fresh-diary-for-2024#latest

https://forums.moneysavingexpert.com/discussion/6577209/fresh-diary-for-2025/p1?new=11 -

95 days notice?! I think I need to sit and think about what I'm doing with my budget as locking away money for a long time (like my long term savings/emergency fund) would be good. As that's a good savings rate on the boosted one you have for Zopa and both rates are better than my Chase accounts.Debt Free Diary:- The Mental Debt Struggle

(Original Debt on 15/07/2016 was £33,056.76) 🙈 but Debt Free on 09/02/2025 🎉

2025 SAVINGS: Emergency Fund (£604.30/£5,000) 12.09% saved

2025 CHALLENGES: #16 Sealed Pot Challenge ~ 18 || #9 50 Envelope Challenge 22/501 -

The NatWest digital saver is 5% up to £5,000 with max £150 monthly deposit so well worth doing! I do the max monthly. The 5% was originally on £1k limit but December they increased it so now aiming for the £5k but at £150pm it’ll take a while!

If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing2 -

Yep there’s 3 options, depends on how long you want it locked awayKeedie said:95 days notice?! I think I need to sit and think about what I'm doing with my budget as locking away money for a long time (like my long term savings/emergency fund) would be good. As that's a good savings rate on the boosted one you have for Zopa and both rates are better than my Chase accounts. I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;*update pending as I've no idea*

Time to start a fresh. — MoneySavingExpert Forum

Time to start a Fresh part 2, 2022! — MoneySavingExpert Forum

New fresh diary for 2023! — MoneySavingExpert Forum

https://forums.moneysavingexpert.com/discussion/6494873/fresh-diary-for-2024#latest

https://forums.moneysavingexpert.com/discussion/6577209/fresh-diary-for-2025/p1?new=11 -

One thing I will say is try not to do too much as invariably it doesn’t really work or pay off in my experience. Two or three savings goals is ideal and will make a difference!If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards