We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

DrCarrie's adventures in saving to be a mortgage-free wannabe

DrCarrie

Posts: 937 Forumite

Hello, all new friends and old?

I am here for a new adventure, and to document my adventures. To notice new obstacles and turn them into paths.

I have never been a saver. I am 50 and have never been a saver. I have been a spender. I have cleared my debts 3 times and spent significant windfalls. I have had 2 mortgages and now I rent (£895 pcm). I paid off the last of my credit cards (bar £25, which will go out as a DD mid-December). I am now ready to get back to securing my future and living a life with fun and frolics in the cheap seats.

I have cleared 21K in debt in 26 months, it's been an adventure in ongoing spending less and earning more over that time. Learned a lot of lessons about what I want and what I need. I use the 50/30/20 rules for guide for my budget but my wants are 10% and my saving is 40% of my salary. There are lots of adjustments on this along the way. I am wanting to get 20K in the savings coffers for a new home - in the Midlands (currently in Brighton), and 1K in the EF.

I have secured an overtime rate and so I am hoping that I will be able to add a fair bit on top of the 37% of my salary going into the deposit pot (with 3% of my salary going to the EF).

Part of my adventures are always about food, I used to be a chef, and I am taking on a new challenge of 30 different plants a week...Tim Spector style. A new book is out, not bought it yet. Other adventures will be learning from the boards, making good use of my Season ticket when I have one, and my Network railcard. Airing myself out daily and generally doing things with not much money, or that are planned for.

I am going to track the small wins and add them to the deposit fund. Like my round-ups and sweeps at the end of the month. Starting next month.

😇😀😇

I am here for a new adventure, and to document my adventures. To notice new obstacles and turn them into paths.

I have never been a saver. I am 50 and have never been a saver. I have been a spender. I have cleared my debts 3 times and spent significant windfalls. I have had 2 mortgages and now I rent (£895 pcm). I paid off the last of my credit cards (bar £25, which will go out as a DD mid-December). I am now ready to get back to securing my future and living a life with fun and frolics in the cheap seats.

I have cleared 21K in debt in 26 months, it's been an adventure in ongoing spending less and earning more over that time. Learned a lot of lessons about what I want and what I need. I use the 50/30/20 rules for guide for my budget but my wants are 10% and my saving is 40% of my salary. There are lots of adjustments on this along the way. I am wanting to get 20K in the savings coffers for a new home - in the Midlands (currently in Brighton), and 1K in the EF.

I have secured an overtime rate and so I am hoping that I will be able to add a fair bit on top of the 37% of my salary going into the deposit pot (with 3% of my salary going to the EF).

Part of my adventures are always about food, I used to be a chef, and I am taking on a new challenge of 30 different plants a week...Tim Spector style. A new book is out, not bought it yet. Other adventures will be learning from the boards, making good use of my Season ticket when I have one, and my Network railcard. Airing myself out daily and generally doing things with not much money, or that are planned for.

I am going to track the small wins and add them to the deposit fund. Like my round-ups and sweeps at the end of the month. Starting next month.

😇😀😇

Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)

9

Comments

-

Good luck

CRx4 -

Thank you, CR, for the luck, and for stopping by.

I had an email from the energy company, telling me my statements are ready, so I had a look - very much in credit (and they put the £66 in my bank account). My usage is down by 55% on the Gas, and 23% on the Electricity, compared to the same quarter last year. I have minded bing purposefully careful, but not obsessive.

Feel a bit more secure in the knowledge of having a good cushion for the next quarter, likely to be the most expensive.

I was going to buy an electric throw, but I have decided to just have a duvet and blankets with a hot water bottle when I am on the sofa, and at my desk, if need be.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)3 -

I think having a diary is so useful to keep on track and celebrate the small and big wins, especially as mortgages and house deposits are such big beasts.. I certainly have made and spent a fortune in the past so this new frugal me needs fellow MSE'ers to keep on track as I live in London so need a HUGE deposit.

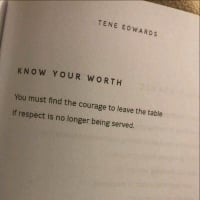

I am going to buy a heated throw as they also look fabulous but the faux fur one I want is sold out in Argos and as I have £40 of Nectar points I want to use against it, I am being incredibly self disciplined and not buying it from elsewhere.DON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest4 -

Good luck on your journey.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £171.3K Equity 36.55%

2) £2.6K Net savings after CCs 10/10/25

3) Mortgage neutral by 06/30 (AVC £30.9K + Lump Sums DB £4.6K + (25% of SIPP 1.25K) = 35.5/£127.5K target 27.8% 14/11/25

(If took bigger lump sum = 62K or 48.6%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.1K updated 14/11/253 -

Thank you @savingholmes for wishing me luck and stopping by. @LadyWithAPlan - that sucks about the heated throw being out of stock. Hope they return soon, so you can snuggle. After being really poorly a the beginning of the week (when I was on leave), I am a bit more lively. Got some batch cooking on the go. Done a small amount of Christmas shopping and went to where I thought the mobile shop was to change my contract, to find it had disappeared along with several other shops in the shopping centre including Lakeland plastics. Money seems to be falling out of my Christmas and food pots at the rate of Knots!Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)4 -

Here is my first weekly check in for this journey! - the clock started on the 1st.

NSD = 1

Tilly Tidy = 80p

Round ups = £1.52

Fun and Frolics in the cheap seats - enjoying an autumnal walk

Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)6 -

Ha ha, love this idea 😀!DrCarrie said:Fun and Frolics in the cheap seatsMortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!5 -

Happy shiny new diary

I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

Lou~ Debt free Wanabe No 55 DF 03/14.**Credit card debt free 30/06/10~** MFW. Finally mortgage free O2/ 2021****

"A large income is the best recipe for happiness I ever heard of" Jane Austen in Mansfield Park.

***Fall down seven times,stand up eight*** ~~Japanese proverb. ***Keep plodding*** Out of debt, out of danger. ***Be the difference.***

One debt remaining. Home improvement loan.5 -

Thank you @beanielou

Weekly check-in 5-11th- Tilly Tidy = 14p

- Round ups = £1.16

- NSD's = 5

Fun and Frolics in the cheap seats

- Appreciating the views from the train on the early morning commute

- Glorious full moon

- Walking to a fancy baker and getting bread, walking back along the seashore/prom

- Getting lovely salad stuff from a farmer's market stall in the park

- Haircut – great fun chatting with my hairdresser

- Free yoga class – as an introduction to the studio, I liked it

- Off to the cinema later, no ticket required, as I am still using the free tickets from my membership

Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)5 -

Lots of luck in your new diary xJan 18 Joint debts 35,213

Mortgage Jan 18- 77224 nov 25- just over 64k

June 25 Debts in my name were £5170. Now 7150 (Nov 25)4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards