We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

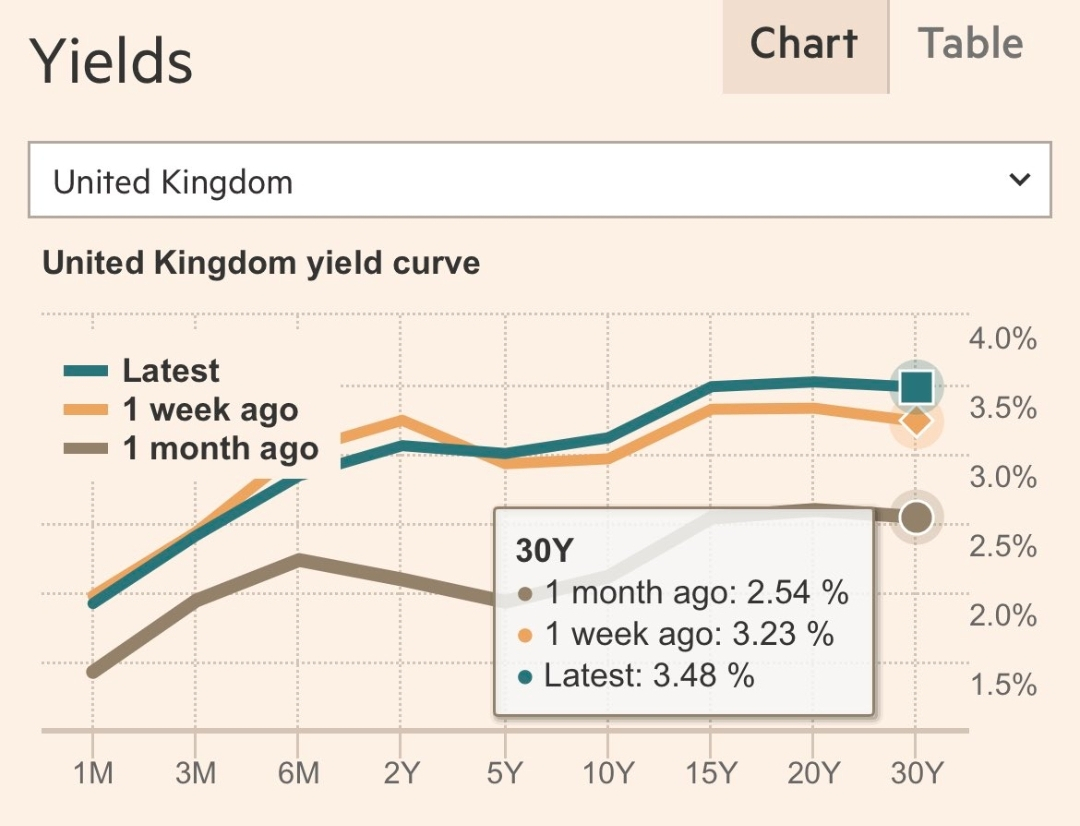

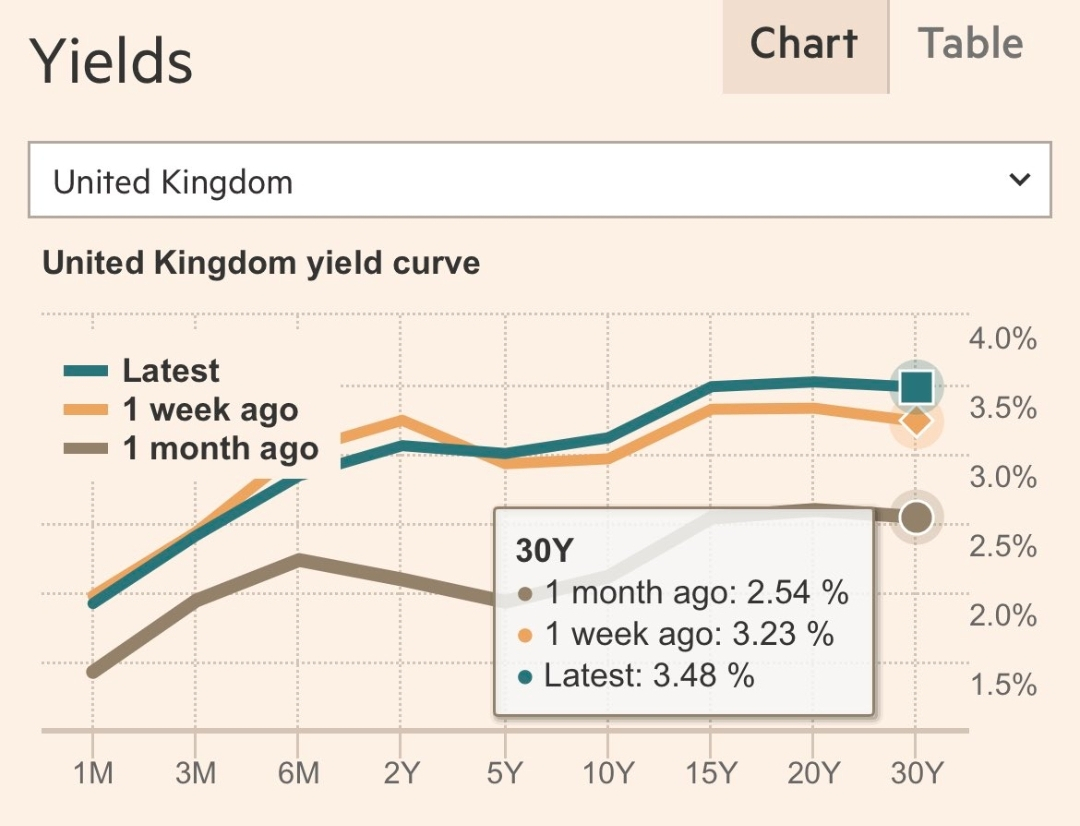

That graph is actually quite interesting. I am holding some long-dated Gilts - T45, which is 3.5% 2045. Last week, they dropped below par, which is what you would expect from the graph above. Traditionally the drop in Gilts would have been balanced by a rise in stocks, and vice versa but that of course is not the case at present.Type_45 said:I'm sure someone will be along shortly to tell us how bullish this chart is for stocks... 0

0 -

Type_45 said:I'm sure someone will be along shortly to tell us how bullish this chart is for stocks...

Can you explain what the graph is showing - it seems to be saying the yield curve is no-longer inverted. That's a good sign right?

0 -

It shows that low risk investors are probably due some more pain, thanks to the Truss tax. Lending tens of billions of pounds to energy companies while simultaneously trying to reduce taxation means this money will have to be borrowed on the gilt markets, which will push down prices, increase yields and weaken the pound. This will prolong and exacerbate high inflation, even if it reduces the size of the short-term peak.

3 -

masonic said:It shows that low risk investors are probably due some more pain, thanks to the Truss tax. Lending tens of billions of pounds to energy companies while simultaneously trying to reduce taxation means this money will have to be borrowed on the gilt markets, which will push down prices, increase yields and weaken the pound. This will prolong and exacerbate high inflation, even if it reduces the size of the short-term peak.

So commodity prices, such as gold, will increase in value relative to GDP and are therefore a hedge?0 -

Type_45 said:

So commodity prices, such as gold, will increase in value relative to GDP and are therefore a hedge?masonic said:It shows that low risk investors are probably due some more pain, thanks to the Truss tax. Lending tens of billions of pounds to energy companies while simultaneously trying to reduce taxation means this money will have to be borrowed on the gilt markets, which will push down prices, increase yields and weaken the pound. This will prolong and exacerbate high inflation, even if it reduces the size of the short-term peak.All non-sterling assets will protect an investor from a devaluing pound, but but obviously have the potential to fluctuate in value themselves. Gold is currently priced above its long term average, so there is plenty of scope for it to fall, as it has done over the last 6 months in USD. In GBP it has held up in value, but hasn't grown, and was an inferior investment to cash. Commodities are going to be highly sensitive to world events, which are not looking quite as glum now as they did in the recent past.When your own currency is being turned into an emerging market currency, the traditional thing to do is get exposure to the global reserve currency, and the use of a short dated US treasuries or TIPS fund is an option. Or just hang in there in cash and wait to pick up some equities at an 80% discount within the next few months.3 -

How much lower ? It's still SP 500 at 3650 the line in the sand. From my last post and the tea leaves I suggested it was nearing oversold around 3950 in the daily timeframe. Those same momentum indicators are showing signs of a rally , SP currently 4050 , and CPI figures out in the US Tuesday. Will they come in lower than last month ? If they do then there's a potential move higher on this news. It's what everybody wants lower inflation. Freight costs lower and Commodity Index lower.

FcDGN_tXgAEl3Mt (564×403) (twimg.com)

How much longer will this bear market go on for? - Page 62 — MoneySavingExpert Forum

$SPX | SharpCharts | StockCharts.com

August 31st

image_thumb_3.png (605×642) (equityclock.com)

9th September

image_thumb_3.png (605×642) (equityclock.com)

Earnings forecasts trimmed which will be a big hurdle . Now below $220 from $240. If SP was to rally to 4400 which is only points away then 4400/220 indicates forward P/E of 20.

Earnings-Estimates-Through-2023-082422.jpg (879×541) (realinvestmentadvice.com)

History suggests it's a bit high.

FcNi_o3XEAE9AX2 (564×372) (twimg.com)

Under the bonnet shows many sectors slowing and the main driver Energy as expected.

FcU4GkjXwAgkH7L (900×652) (twimg.com)

2 -

How much longer will this thread go on for

5

5 -

I am 80% certain the thread will either end suddenly or continue, I just don't know when. But you have been warned.11

-

There's been a thread of this type running more or less continually for the last several years at least. The people promoting the view come and go, each certain that this time it's different. There will always be a range of views among a large group of people. Anyone treated to the delightfully extreme views expressed in certain other threads over the weekend will find this one rather bland. I'm sure all of us look forward to reflecting on the views expressed here after welcoming in the new year 2023. Not long to go now.

1 -

Just to join in with the short term nature of some of the posts made in this thread, my investments are all doing pretty well over this last week so I guess the crash is over.

Overall I'm pretty happy with overall recent performance.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards